Today and tomorrow the Federal Reserve will hold its 7th Federal Open Market Committee meeting of the year. It is given that we will see a 75-basis point increase Wednesday, but what gets said about the meeting on December 13-14 is even more important. The hopes are the Fed indicates a slower pace of rate increases, perhaps as low as 50 basis points in December.

Arguably, even that is too much.

The FOMC’s ability to impact consumers and inflation has proven mixed so far. Goods prices have been falling while Service prices have been stickier. Perhaps the reason is the 2020s form of inflation differs so radically from historical parallels. A unique combination of pandemic fiscal stimulus plus massive supply chain snarls has created a perfect storm. Hence, the current circumstances do not lend themselves to an easy fix.

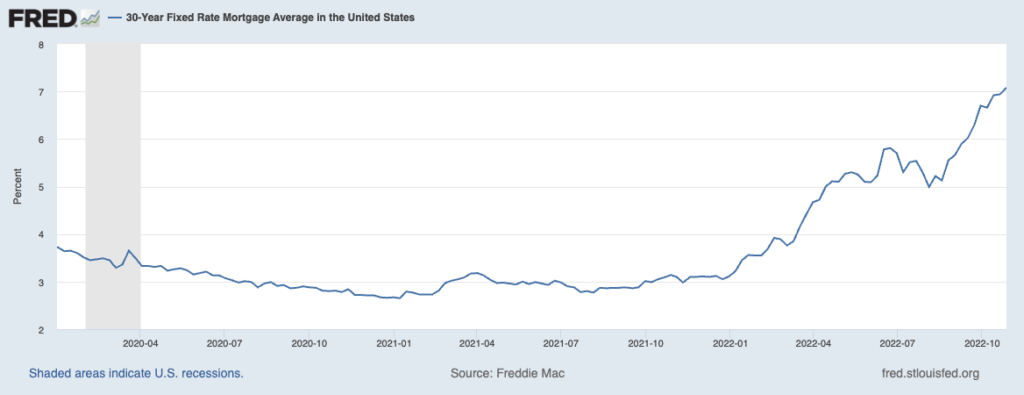

But that does not mean the Fed’s actions won’t have long-term consequences for the economy. Consider the chart above: It shows the 40-year downtrend in 30-Year Fixed Rate mortgages to have been decisively broken. In January 2021, those mortgages were as low as 2.65%; today they are over 7%. So far, it has led to a collapse in home buyer traffic. It is already crimping homebuyers dramatically.

But not all home buyers: About 25% of homes purchased nationally are bought for cash; it’s closer to 50% in places like Manhattan. And that was under normal, pre-pandemic circumstances. Today, it is closer to a third nationwide. As you might surmise, cash purchases tend to be the more expensive homes purchased by the wealthiest buyers; when more modest middle-class homes get purchased for all cash, it tends to be by large investors.

Which is par for the course for the Federal Reserve. The massive wealth gap expansion we saw in the post-GFC era was driven in large part by the Fed. Instead of running the banks through restructuring, they were kept alive through the policy of ZIRP. Making the cost of capital practically nothing had all sorts of ramifications, not the least of which was to make risk assets – stocks bonds real estate, etc. – worth appreciably more. ZIRP and QE made the wealthy wealthier.

As I have said before, once the emergency ends, so too should rates at emergency levels. That was evident in 2021 (perhaps even late 2020). The post-pandemic inflation would eventually work itself out as supplies come online and the fiscal stimulus wore off.

But that is not what we have happening today: The FOMC, having lowered rates to zero and kept them there too long, is now committing the opposite mistake of raising them too quickly and to levels that are too high.

And while we know the FOIMC rates are below official CPI levels, we also know that CPI is like all models – an imperfect depiction of reality. It reports price increases with a very distinct lag and has trouble managing rapidly rising or falling home prices.

Regardless, the FOMC seems to believe that middle-class purchases of homes and automobiles are where they can best strangle inflation. This is needlessly damaging at best, and ineffective at worst.

Jerome Powell should know better…

30-Year Fixed Mortgage Rates, 2020-Present

Previously:

How the Fed Causes (Model) Inflation (October 25, 2022)

Collapse in Prospective Home Buyer Traffic (October 18, 2022)

Why Is the Fed Always Late to the Party? (October 7, 2022)

Who Is to Blame for Inflation, 1-15 (June 28, 2022)

How Everybody Miscalculated Housing Demand (July 29, 2021)