f9photos/iStock via Getty Images

In November 2019, members of our global equity team traveled to India to meet with management teams of more than 80 companies, gathering insights on India’s economic potential, growth drivers, and consumer demand across many different sectors. The team concluded that India’s evolution into an organized economy is still in progress and there are unique opportunities to capture alpha.

After our trip, the COVID-19 pandemic upended the global economy. For India, the pandemic led to a severe economic contraction. But following a third wave of COVID-19 infections in 2021, economic activity picked back up as consumer demand for goods and services increased. The key question is:

Would India’s governmental reforms and advancements in digital infrastructure help sustain optimism?

To check in on India’s economic growth, our team traveled back to India in the fall of 2022 and met with public and private companies, industry experts, and venture capital investors. And we found that while COVID-19 impacted near-term developments in India, key sectors are standing out, offering compelling investment opportunities. Here are five emerging trends to watch.

Expanding Digital Infrastructure with the India Stack

My colleague Jay Kannan, a global research analyst and whose research efforts focus on technology, believes that digital infrastructure in India is driven by the penetration of smartphones and the availability of low-cost data, which was enabled by Reliance Jio providing low-cost wireless services beginning in 2016.

Over the past decade, the Indian government has pushed the creation of the “India Stack,” a series of free public digital goods that enable a digital economy for those who have historically been outside the formal economy.

The India Stack has several layers. First, there’s a base layer of identity that includes biometrics identification. This expanded to a payments layer, which allowed for greater financial inclusion though bank accounts, direct benefit transfer, and peer-to-peer (P2P) payments. The emerging layers today are focused on the Open Network for Digital Commerce (ONDC) digital infrastructure, with new services connecting to allow private companies to tap in and use the existing infrastructure for identity verification and payments.

The net impact of the India Stack is that street vendors are now more likely to be inside the formal economy, accepting digital payments for goods, and can now use those sales as a verification of income for credit access.

The expansion of digital infrastructure, combined with the pandemic (which increased remote work globally), also led to more outsourcing to India. India essentially became the office of the world as corporations became more comfortable with work being performed outside of the office.

Historically, this global offshoring model was primarily used for managed tech services such as networking, servers, and on-premise enterprise resource planning (ERP) implementation. Now, outsourced work includes knowledge-based, higher-value-add services, including digital transformation efforts such as software engineering and data analytics. This work not only leads to cost efficiencies but also incremental revenue generation.

From Biscuits and Toothbrushes to Luxury Goods: A Tale of Two Indias

Rising incomes have tended to translate to increased consumption levels. As people make more money, they spend more money. In addition, strong gross domestic product (GDP) growth, as we have recently seen in India, can lead to rising incomes and booming consumption.

But where incremental spending goes is mostly dependent on current levels of income, says my colleague global research analyst Michael Patchen, whose primary research focuses on the consumer sector. India’s GDP, measured by the purchasing power parity (PPP), is about $2,000, and there’s a high level of inequality. This relates to the idea of “two Indias.”

While overall income levels in India have risen, there is still a large disparity between the highest earners and the average Indian. By income, the top 10% of Indian people earn more than 50% of the country’s total GDP. Much of the population is still low-income by global standards, and most incremental consumption goes toward products lower on the pyramid.

Thus, when a person makes a few dollars a day, those dollars are likely to go toward necessities, such as food products. Only a small portion of the population is at the income level where incremental dollars go to “luxuries,” such as fast-food, sportswear, or other discretionary categories.

That’s why our biggest overweights in India’s consumer sector are consumer staples companies. We see fewer opportunities in branded sneakers and more opportunities in basic consumables.

Examples of our current positioning include India’s largest soft drink distributors, a western snack company with a strong portfolio of brands and an extensive distribution network, and India’s leading household goods and food products company.

Is Solar the Future?

India is a sun-rich country. According to my colleague global research analyst Ben Loss, as solar energy continues to become more competitive, it can help reduce India’s need to import oil and natural gas.

Solar energy also reduces the need to burn coal, wood, and other high emission fuels, which has a direct impact on people’s health and causes climate and environmental concerns.

Ben, whose research focuses on the energy sector, says that greater investment in renewable power can also facilitate low-cost loans for other projects in India. But large-scale renewable projects will likely encounter similar challenges to traditional infrastructure investments.

As a result, India will likely focus more on residential and light commercial projects (which include smaller-scale businesses, such as banks, restaurants, and small shopping centers) and industrial solar projects.

Other beneficiaries of India’s renewable power investment range from large Indian businesses using their scale to expand into domestic polysilicon mining, solar panel manufacturing, and energy storage to a global leader in industrial automation geared toward electrification products such as solar inverters and switching.

Modernizing India’s Urban Infrastructure

India’s infrastructure has fallen behind due to an unreliable power system, significant road congestion, an inefficient railway and ports network, and a limited number of airports. The World Bank estimates that India needs to invest at least $55 billion annually into urban infrastructure to support its rapidly growing population.

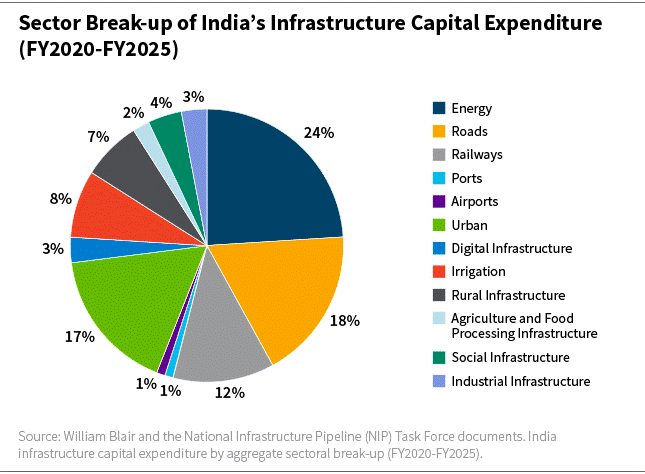

India, however, is investing heavily to modernize and expand its infrastructure, with roughly 13% and 22% infrastructure capital expenditure (capex) growth (including energy, roads, water, railways, shipping, and sanitation) built into the Union Budget of India for fiscal years 2023 and 2024, respectively.

Prime Minister Narendra Modi also instituted a National Infrastructure Pipeline (NIP) in 2019, which includes thousands of projects and is meant to drive roughly $1.8 trillion in investment from fiscal 2019 through fiscal 2025.

My colleagues on our industrials team believe these investments, along with other schemes by the government (such as production-linked incentives), will go a long way in driving private capital investment and economic growth and supporting manufacturing growth.

Structural steel tubing manufacturers, as well as an explosives manufacturer used in the extraction of minerals and India’s leading manufacturer of cables and wiring, could potentially benefit from urban infrastructure investments.

Growth Opportunities in Rural Areas

As in urban areas, rural infrastructure in India continues to be a challenge. But my industrials team colleagues also believe this presents an opportunity for companies that can address India’s infrastructure challenges.

For example, monsoon season in India requires extensive waterproofing, and the challenge becomes greater as paved roads and greater urbanization eradicates natural rainfall collection areas. The growth rate in industries, ranging from waterproofing adhesives and coatings to piping and concrete, continues to be greater than India’s GDP.

In addition, rural farming remains a primary source of income in India and improving agricultural efficiency is another strong growth trend. Investable examples include innovative agricultural chemical manufacturers and distributors.

So too is housing, with India seeking to have housing standards reach parity with developed markets.

Addressing this housing trend is India’s “Housing for All” program, which was designed to provide permanent, affordable housing with basic amenities to homeless people, and those living in temporary and dilapidated houses in rural and urban areas by 2022.

Although the government missed that target, it continues to invest heavily in this area. India’s 2023 budget includes almost $6 billion (a 66% increase) for the “Housing for All” initiative. The funds are distributed in the form of interest rate subsidies for home purchases based on annual income; as direct construction subsidies; and for additional provisions for sanitary products and utilities access.

More than 12 million projects have been sanctioned, leading to an estimated 11 million project starts and resulting in 7 million houses being completed since the program’s launch.

Potential beneficiaries of India’s housing expansion and rural infrastructure efforts include construction material providers with strong brands and companies selling paint, waterproofing materials, piping, and HVAC manufacturers.

The Case for India

In our previous report—India in 2020: Active Perspectives on India’s Evolution—we wrote that India’s economic transition “will be a messy, nonlinear process.” But that doesn’t mean there aren’t areas of investment opportunity.

From digitalization and rising consumption to solar energy and urban and rural infrastructure modernization, uncovering these opportunities requires local expertise and feet on the ground. As bottom-up asset managers, we are excited about India’s economic potential and remain focused on seeking out quality companies that create sustainable value.

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.