When actual property traders hear “reasonably priced money circulation cities,” they could consider Detroit or Cleveland. However I feel one in every of the greatest money circulation cities in America proper now could be Indianapolis.

This graph reveals every metro’s job development:

Whereas Detroit (blue line) could have extra jobs, it truly hasn’t but recovered from the job losses it suffered from the pandemic. And neither has Cleveland (crimson line). However Indianapolis (inexperienced line) is truly rising its variety of jobs at a comparatively spectacular price.

In keeping with BLS.gov, the typical job development throughout all MSAs over the previous 5 years was 4.2%, whereas Indianapolis skilled 9.1% development (the best was St. George, Utah, at 21.9%, and the second-highest was Austin, Texas, at 20.4%).

However I used to be curious: Of all of the Rust Belt cities, why does Indianapolis have the best job development?

What’s Driving Development in Indianapolis?

It seems this reply was tougher than I believed to seek out, just because there isn’t only one reply. The financial system is comparatively robust and numerous. Whereas technically the highest focus of jobs is in transportation and logistics (13.4%), different sectors have seen a slight uptick in jobs added, comparable to monetary actions and building, in addition to robust development in training and well being providers and a class titled skilled and enterprise providers, which may mainly be thought of as common white-collar jobs.

The one sector that’s shrinking is the info class, which may also be regarded as software program engineering jobs.

If we ignore the lack of “smooth tech” jobs, Indy has had wholesome job development in nearly each different sector. As a result of this development is so numerous, I can’t pinpoint it to anybody motive, apart from my private opinion that “the financial system seems to be numerous sufficient.”

There are schools there (and close by is very regarded Purdue College), which can be serving to to entice companies because of the educated workforce.

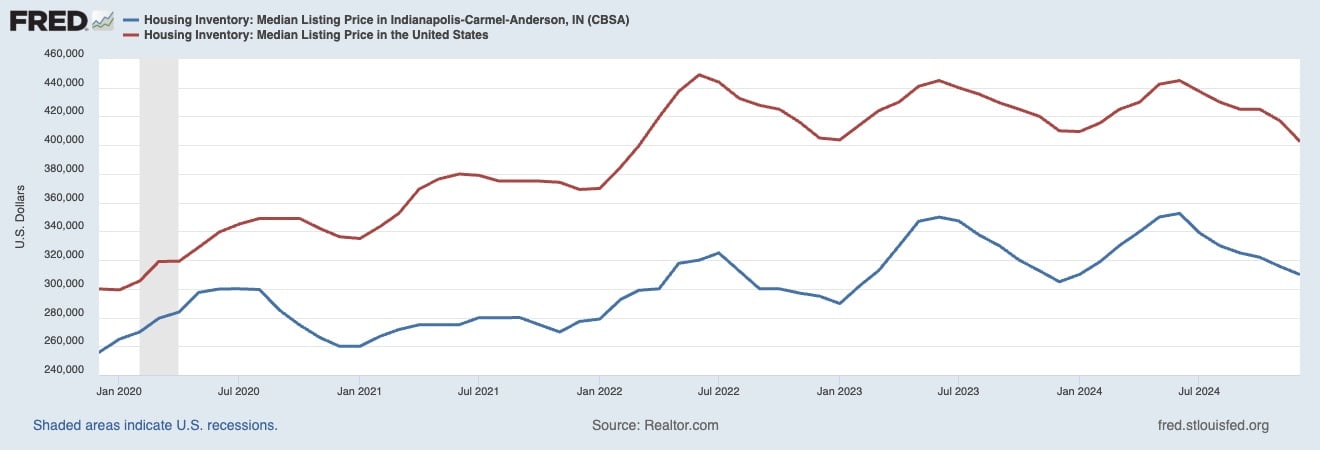

Indy additionally stays one of many final reasonably priced “rising cities,” with a median home value of simply $309,900 (about 23% cheaper than the nationwide median of $402,502), in line with Realtor.com.

What can also be fascinating is that many of the development is happening within the outer suburbs of Indy, whereas the core metropolis has truly misplaced inhabitants. This text from Axios reveals the inhabitants development (or loss) by county intimately. I heard one demographer name this the “donut impact,” the place folks depart the interior metropolis for the outer ring of suburbs.

The Broader Indianapolis Market

The Indianapolis metro is made up of a group of counties, every with their personal cities. Marion County sits on the middle, and its geographical space is sort of similar to Indianapolis’s metropolis bounds. One might approximate “Indianapolis = Marion County.”

When trying on the map, try the outer suburbs. These have been steadily rising in inhabitants, and it seems the “path of progress” is occurring alongside the north and northeast corridors of the area (Carmel, Fishers, Westfield, and Noblesville). After all, different areas are seeing development as effectively.

I needed to listen to what a boots-on-the-ground skilled thought concerning the totally different markets, so I reached out to a neighborhood property supervisor, Edwin Watson, from Triple E Realty & Property Administration. Right here’s what he needed to say:

“As an energetic investor, actual property agent, and property administration proprietor for practically 25 years, I’ve seen areas regulate significantly. [Picking a market] really is determined by your total targets as an investor.

If you are in search of optimistic money circulation, the Indianapolis market gives better alternative than its surrounding areas, like Fishers and Carmel. This is solely as a result of the upper gross sales worth in these areas (Fishers and Carmel) do not proportionally correlate with the residence’s rental values.

What the investor loses in money circulation, they make up in total appreciation, as houses within the Fishers and Carmel market have a tendency to understand at a a lot steadier price. We coach our traders to have a mix inside their portfolio to give you the chance to trip the highs and lows as they arrive.”

I additionally requested Watson what he considered a few of the less-popular markets that aren’t as well-known:

“I am a fan of Lebanon for long-term buy-and-hold, with the Eli Lilly mission coming that method, in addition to Anderson, Indiana. Anderson is a spot the place you’ll be able to doubtlessly buy extra fix-and-flips or buy-and-holds as a result of it has not been as flooded with traders over the previous 10 years.”

For these curious, very thrilling issues are occurring close to Lebanon on the LEAP Innovation District.

The Underlying Fundamentals of the Broader Indy Market

I additionally needed to check out the underlying metrics of the cities inside the Indianapolis MSA. With so many components to take into consideration, like inhabitants development, median value, and emptiness charges, I made a decision to give my very own weights to every metric, then rank every metropolis primarily based on these metrics alone.

Greenfield (east of the town) seems to have a superb mixture of various components, together with strong inhabitants development (11%), an reasonably priced median value ($205,000), an appropriate proportion of renters (38%), and a comparatively excessive median revenue ($75,000). Like Westfield and Noblesville, it’s a bit of additional out from downtown, the metropolis’s core financial middle. However all the things is relative; it’s solely a 30-to-40-minute drive, providing a barely longer commute to jobs if you’d wish to stay outdoors the town.

Greenwood (south of the town) has very comparable metrics to Greenfield. Plainfield (west) appears prefer it has comparable metrics as effectively, however there’s a massive warehouse district and a close-by jail.

Carmel (north of the town) gives many monetary providers and insurance coverage jobs within the space, and has a excessive median revenue ($134,000). Anybody on the lookout for appreciation could wish to take into account this market.

In abstract, Greenfield and Greenwood could also be good “combined” markets, which supply acceptable money circulation and optimistic (however not nice) appreciation, whereas Carmel could supply wonderful appreciation (however a decrease rent-to-price ratio).

However are there any particular person neighborhoods inside Indianapolis correct that could be good for traders?

The Greatest Neighborhoods for Traders Inside Indianapolis

As a result of Indianapolis has many various neighborhoods, I thought it could be greatest to get an opinion from one other boots-on-the-ground skilled. So I reached out to investor-friendly actual property agent Peter Stewart. Listed here are the neighborhoods he thought traders ought to know extra about:

The Outdated Southside

The OSS is a small pocket neighborhood that abuts the south facet of downtown Indianapolis and the west facet of the very talked-about Bates-Hendricks neighborhoods. It’s an up-and-coming space that’s following the identical path we noticed with areas like Fountain Sq. and Bates-Hendricks.

We’re beginning to see a superb quantity of latest building there and a ton of transformed houses. The world is a mixture of single-family houses and residential multifamily for essentially the most half. There are a couple of smaller condo buildings scattered round too.

Professionals:

- Location: It is positioned simply south of downtown, and you may stroll to Lucas Oil Stadium from the north facet of the neighborhood. Indy’s downtown has undergone a large transformation over the previous 25 years, going from a scary place that you simply solely go to in the event you work there, to a world-class vacation spot. This is inflicting all of the areas close to downtown to expertise a ton of revitalization.

- Price: As a result of the realm remains to be up-and-coming and is not well-known like some different comparable places (Fountain Sq., for instance), the value factors are a bit decrease right here.

- Methods: As a result of location and the revitalization, you’ll be able to do nearly each technique right here: long-/short-/medium-term leases, flips, BRRRRs, growth, and many others.

- Appreciation and money circulation: That is an space the place you will get a mixture of money circulation and appreciation, and often it is one or the opposite.

Cons:

- Observe report: The neighborhood has solely been bettering over the previous 4 to 5 years, so that they do not have a protracted monitor report in comparison with different areas (like Fountain Sq.: 20 years).

- Practice tracks: There are two prepare tracks that run alongside the neighborhood—one on the E facet that runs N/S, and one on the S finish that runs E/W—so relying on the place you’re within the neighborhood, you’ll be able to usually see/hear the trains.

- Revitalization combine: As a result of it has not been revitalizing for that lengthy, there are nonetheless an honest quantity of run-down houses sprinkled round, so some blocks simply aren’t that engaging but.

Butler-Tarkington

The BT neighborhood is a really fascinating space situated on the N facet of Indianapolis, about 4 miles north of downtown. What’s fascinating is that it is a mixture of old-school, established A lessons and up-and-coming C/B lessons.

It’s residence to Butler School, which is a small non-public faculty that has a fantastic campus crammed with limestone buildings. It is usually residence to Hinkle Fieldhouse, which is fairly well-known and was designated a Nationwide Historic Landmark. The governor’s mansion can also be situated on this neighborhood.

The north facet of the neighborhood has been A category for a really very long time, and there are lots of costly houses there ($500,000 to $800,000+). The south facet was traditionally C class, however over the previous 5 to seven years, it has turned a nook and actually began to enhance. I’ve been seeing extra new builds and lots of flips, costs rising, and many others. Immediately, I take into account the S finish to be B class.

Professionals:

- Location: It’s positioned on the N facet of city, proper within the middle close to two main thoroughfares (thirty eighth St and Meridian St), so you will get anyplace on the town in about quarter-hour. Inside 5 minutes, you’ll be able to get to Broad Ripple, the Artwork Museum (Newfields), the Kids’s Museum, the State Fairgrounds, the Monon Path, and extra. It is usually proper subsequent to the Meridian-Kessler neighborhood, which is one of the well-known and established neighborhoods in Indianapolis (A category, numerous $1 million+ houses).

- Methods: As a result of location, faculty, and value factors, you’ll be able to do each technique right here: long-/medium-/short-term leases, flips, BRRRRs, growth, pupil housing, lease by the room, and many others.

- Appreciation and money circulation: That is an space the place you will get a mixture of money circulation and appreciation.

- Stability: Though the southern finish of the neighborhood is transitioning a bit, total, it is a very well-known space that is surrounded by different very well-known neighborhoods, all of which assist contribute to the steadiness of costs right here.

Cons:

- Worth factors: As a result of that is an space that has a mixture of A/B class properties, the value factors are excessive sufficient to the place it’s arduous to money circulation when doing long-term leases (until you do Part 8), and to money circulation, you actually want a residential multifamily property (two to 4 items). SFRs more than likely won’t money circulation when doing an LTR technique.

- Location: A part of the SW facet of the neighborhood abuts the Crown Hill Cemetery. Whereas the cemetery may be very good and has some well-known folks buried in it, it may also be an enormous turnoff for some consumers/renters as effectively.

- Multifamily combine: The world is predominately crammed with SFRs. Two-to-four items do exist right here, however they’re few and much between. We see a a lot greater focus of two to 4 items within the C-class places just like the close to eastside.

Riverside

This neighborhood is a well-liked up-and-coming space situated simply NW of downtown Indianapolis. It is a small, historic neighborhood that’s primarily made up of older bungalow-style houses constructed within the early 1900s. Traditionally, it is been on the tough facet, however over the previous 5 years or so, it has turned a nook and is filled with investor exercise.

Like different up-and-coming places, we’re seeing lots of new builds and flips, and costs are rising. It is taken into account to be a C+ location. You could find money circulation right here, and there’s a good likelihood for appreciation as the realm continues to enhance.

Professionals:

- Location: It sits on the NW facet of downtown, and proximity to downtown is vital for traders. Downtown is driving a ton of development and growth within the surrounding areas.

- Two massive drivers for this location are the 16 Tech campus (www.16tech.com) that has the favored AMP meals corridor (https://theampindy.com/) and the proximity to the IU Well being Hospital (off sixteenth St, so it is a stone’s throw away), which is present process a $4.3 billion enlargement. There are three different massive hospitals downtown which might be not more than 5 minutes from this location (VA, Eskenazi, Riley). It is usually very near Marian College, and you will get to the Indianapolis Motor Speedway in beneath 10 minutes. Lastly, it sits subsequent to the Riverside Park and Coffin Golf Course.

- Methods: As a result of proximity to downtown and the downtown hospitals and the truth that the realm is beginning to revitalize, you are able to do nearly each technique right here. Costs are nonetheless decrease, so you are able to do long-term leases, and the proximity to the hospitals makes it an important space for furnished mid-term leases. As soon as the realm improves a bit extra, I feel it will be an ideal location for long-term leases too. It’s also possible to do growth (construct new building) and flip right here.

- Appreciation and money circulation: That is an space the place you will get a mixture of money circulation and appreciation.

Cons:

- Danger: The world nonetheless has a methods to go—it is simply beginning to revitalize. As a result of it isn’t as well-known and never as investor heavy as another places, properties can take longer to promote, and the value factors will not be fairly as excessive as some different comparable places. So, there is a little more threat whenever you make investments right here.

- Practice tracks/industrial buildings: There’s a prepare that runs N/S alongside the E fringe of the neighborhood, and alongside that monitor, there are an honest quantity of economic/industrial buildings, which detract a bit from the residential really feel of the opposite facet of the neighborhood.

Ultimate Ideas

Indianapolis is reasonably priced and rising. Whereas I additionally like Columbus, Ohio’s comparable (however not essentially higher) job development, Indiana has a decrease property tax price, making properties in Indy arguably simpler to money circulation.

The outer ring of suburbs seems to be rising at a wholesome price with strong fundamentals, comparable to Greenfield, Carmel, Fishers, and Lebanon. And there are fairly a couple of good up-and-coming neighborhoods in Indianapolis as effectively, comparable to Fountain Sq., Outdated Southside, and Butler-Tarkington. Traders might be able to discover good offers on-market in these places, relying on their technique.

Additionally, please take into accout that there could also be good offers on the market no matter whether or not a market has “good” or “unhealthy” underlying metrics. I might merely want the placement to be secure and rising in worth, which ought to theoretically enhance the speed at which my property appreciates.

Are there any different “Rust Belt/Nice Lake” cities you’d like me to cowl subsequent? Let me know within the feedback beneath.