Jonathan Raa | Nurphoto | Getty Images

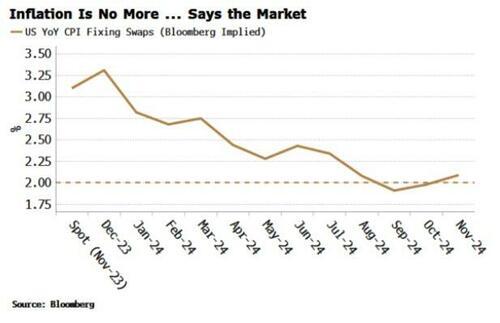

The bitcoin exchange-traded funds launching Thursday after the SEC’s long-awaited approval come at a wide variety of price points, with signs that a fee war is already underway.

The Bitwise Bitcoin ETF (BITB) has the lowest expense ratio of all the new bitcoin funds, at 0.20%. Several other funds are close behind, including the Ark 21Shares Bitcoin ETF (ARKB) at 0.21% and the iShares Bitcoin Trust (IBIT) at 0.25%.

The Bitwise fund also has a temporary waiver that will eliminate the fee entirely for six months on the first $1 billion of assets. Other proposed funds have similar waivers, meaning early adopters of the bitcoin ETFs will have little or zero management cost for a brief time.

Bitcoin ETF fee comparison

| Fund | Ticker | Fee |

|---|---|---|

| Bitwise Bitcoin ETF | BITB | 0.20%* |

| Ark 21Shares Bitcoin ETF | ARKB | 0.21%* |

| Fidelity Wise Origin Bitcoin Fund | FBTC | 0.25%* |

| iShares Bitcoin Trust | IBIT | 0.25%* |

| Valkyrie Bitcoin Fund | BRRR | 0.25%* |

| VanEck Bitcoin Trust | HODL | 0.25% |

| Franklin Bitcoin ETF | EZBC | 0.29% |

| WisdomTree Bitcoin Fund | BTCW | 0.30%* |

| Invesco Galaxy Bitcoin ETF | BTCO | 0.39%* |

| Hashdex Bitcoin ETF | DEFI | 0.94% |

| Grayscale Bitcoin Trust | GBTC | 1.5% |

Source: SEC filings; * indicates temporary waiver for part or all of the management fee

The fees for bitcoin funds are higher than many broad stock index funds, with the SPDR S&P 500 ETF Trust (SPY) charging less than 0.10%. But the pricing is in line with or even below the biggest commodity funds, as SPDR Gold Shares (GLD) and the United States Oil Fund (USO) charge 0.40% and 0.60%, respectively.

Fund managers make money by charging fees on the assets under management. ETF fees have been trending lower over time, and some asset managers have shown a willingness to run a new fund at a loss in order to attract more assets and maximize revenue long term. The fees are taken out of a fund’s asset pool, and investors are not billed individually.

The low prices before the launch show that the battle to lower fees is already in effect for crypto funds. For example, Ark-21Shares, Valkyrie, Invesco-Galaxy and others had shown higher fees initially but lowered them in subsequent filings. Even Bitwise dropped its proposed fee to 0.20% from 0.24%, which was already the lowest of the initial batch.

“I think the level of competition was maybe higher than expected. I think there were a couple of issuers like Ark for example that signaled potentially higher fees, and once the rubber sort of met the road, they all came in pretty low,” said Bryan Armour, director of passive strategies research for North America at Morningstar.

Much cheaper than options before

The fees will be a big change from the other bitcoin fund options already on the market. For example, BITO has an expense ratio of 0.95%, while the previously over-the-counter Grayscale Bitcoin Trust (GBTC) charged 2%.

“I think it’s great for investors, especially in the vein of what’s currently available in the market,” Armour added.

Grayscale is cutting its fee on GBTC as part of the conversion of that product to an ETF, but only to 1.5%. That is the highest of any fund slated to launch by a wide margin.

The fund’s 10-year track record and existing size of about $29 billion could give it an advantage over new entrants. The high fee could also be a bet that current GBTC shareholders are not willing to sell their shares and move to a cheaper fund because that could create a tax bill that could offset the benefits of the lower fees.

“We believe the product’s management fee reflects its value, as investors and the broader capital markets will benefit from GBTC’s large asset base, strong liquidity, and ten-year track record,” Edward McGee, Grayscale CFO, said in a statement.

Other crypto-focused asset managers are also charging a relative premium. The second-highest published fee is from the Hashdex Bitcoin ETF (DEFI), which is a strategy change of an existing bitcoin futures fund, at 0.94%. Valkyrie was planning to charge 0.49% for its fund BRRR, though it dropped the fee to 0.25% just before launch. Valkyrie is also offering a temporary fee waiver.

Grayscale CEO Michael Sonnenshein said Thursday on CNBC’s “Squawk Box” that his firm’s experience in dealing with crypto helped to justify the higher price point.

“We’re a crypto specialist. We’ve weathered all different types of speed bumps and advancements within the crypto ecosystem. For a lot of these asset managers and issuers, this is the first time they’re going to be dealing with the complexities that go into running these types of products,” Sonnenshein said.

Don’t miss these stories from CNBC PRO: