I watch the news channels, but mostly for entertainment. Many years ago, I learned that markets disclose more useful information than talking heads.

I had that realization in the 1990s while serving in the Air Force where I had the chance to visit the Middle East and South Korea as tensions rose in those regions.

At first, I attended the intelligence briefings thinking officials must know everything. But I quickly grasped that there was a lot of guesswork in their analysis. (To note, methods are better now than they were then, and I’m sure the analysis has improved.)

Back then, there seemed to be a bias toward escalation. Almost everything seemed like hostile intent.

I was also a trader at that time and watched markets from those locations. There was often a disconnect between the news presented and how prices moved. If there was going to be war in the Middle East, I expected oil prices to rise. When they fell, I believed the issues could be resolved peacefully.

But news and prices don’t always move together in that way, and there’s a simple reason for that. Large firms devote staggering amounts of resources to researching the markets. They risk billions of dollars based on their analysis. They won’t always be right, but they tend to have more insight into the gravity of the situation than the news. If large firms were nervous about war, we’d certainly see oil prices rise.

I thought about this on Saturday morning. We woke to the news that there was a potential coup underway in Russia. Wagner Group tanks were pushing toward Moscow instead of Kyiv. These are well-trained mercenary forces that threatened Russian President Vladimir Putin’s hold on the Kremlin.

Within hours, the danger passed. Wagner’s chief, Yevgeny Prigozhin, announced that he wanted to avoid bloodshed. He was heading to exile. His troops were heading back to Ukraine.

Analysts are still trying to make sense of Prigozhin’s actions. If it was an attempt to overthrow Putin, he didn’t have the support he needed from other officials. Some speculate it was planned to give Putin a reason to purge his enemies from government.

All the speculation is interesting. But the market is saying it wasn’t much of anything.

Stock markets tend to make large moves during coups. Turkey provides a recent example.

A Coup That Shook Global Markets

In July 2016, the armed forces moved against President Recep Erdoğan. The coup attempt lasted two days. Hundreds were killed. When Erdoğan repelled the attack, he arrested tens of thousands of plotters and potential plotters.

The unrest started on July 15, a Friday, just as the stock market was closing. iShares MSCI Turkey ETF (Nasdaq: TUR) plunged almost 9% when trading opened the next Monday. TUR fell 16.8% before bottoming later in the week.

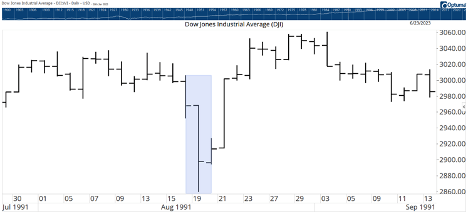

Russia, actually the former Soviet Union, also offers an example of the market’s reaction to a coup. In August 1991, hardline Communists seized control of the Kremlin. Under the Soviet Union, there was no stock market. So we need to look at how traders in other countries responded to the news.

That coup shook global stock markets. The Dow Jones Industrial Average dropped 4.6% in two days as traders assessed the situation.

Large moves are expected around events like that. Unexpected news isn’t priced into markets.

Traders need to act quickly to move prices to a new level based on the events. We see this pattern after earnings are released. Analysts update their fundamental models based on the news, and traders push prices up or down to reflect those changes.

Now, let’s look at how traders handled this weekend’s coup.

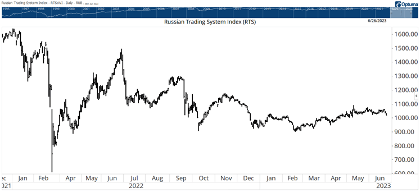

The Russian Trading System Index (RTS) is shown in the chart below. It’s a local currency index of Russian stocks, so it reflects how Russian traders reacted.

RTS fell about 3%, less than the move seen in previous coups. The reaction also seems especially muted compared to the sell-off in response to the war in Ukraine.

The market isn’t always right. But it does a good job showing the trend of important events. Its verdict is that we shouldn’t expect any changes in Russia in the short term.

Regards, Michael CarrEditor, Precision Profits

Michael CarrEditor, Precision Profits

Fed Chairman Jerome Powell fired a warning shot at Wall Street.

On Wednesday, at the European Central Bank Forum on Central Banking, he effectively told investors not to assume he was loosening policy any time soon.

However, Powell was quick to throw a wet blanket on the prospect of getting more sporadic rate hikes, following the “pause” in June.

When he was asked whether the Fed would raise rates every other meeting, Powell replied:

“We have not made a decision to go to that. It may work out that way. It may not work out that way. But I wouldn’t take, you know, moving at consecutive meetings off the table at all.”

There’s a word for this. It’s called “jawboning.” Powell is hoping that he can affect policy by simply hinting at it, without actually having to do anything.

Does Jawboning Work?

Well, I’d argue that Fed’s jawboning lost its potency once Wall Street discovered the “Greenspan put,” named after former Fed Chairman Alan Greenspan.

Greenspan set an awful precedent of rushing to the rescue with a flood of liquidity at the first hint of stress.

Now, whenever a Fed chair threatens to go “nuclear,” and uber restrictive, investors generally shrug it off. They know that as soon as things get ugly, the Fed will simply reverse course and reflood the capital markets with fresh liquidity.

Powell also did himself no favors by suggesting that inflation wouldn’t be hitting his 2% target this year, or even next year. That tells us they’re really not all that committed to slaying inflation.

So it seems that Powell is huffing and puffing and threatening to blow the house down, but no one is taking it seriously.

It would make more sense for Powell to come out forcefully now, and make an effort to break inflation before we get yet another stock bubble. Because that’s exactly what’s happening today…

You know that I’m wildly bullish on artificial intelligence and its coming impact on our economy. But today, we’re seeing investors piling into a small core of mega-cap tech stocks, with no consideration of price, just on the idea that they will benefit from AI.

That’s no way to run a stock portfolio.

Again, I’m bullish on AI. Wildly bullish on AI. But I’m not going to simply buy Nvidia and hope for the best. That’s not a strategy.

If you want to invest in the AI space intelligently, watch Ian King’s latest webinar breaking down the best investment opportunities this industry has to offer. He also reveals his #1 AI stock to buy.

And if you’re interested in how AI can be used to help you trade smarter and more efficiently, check out what Mike Carr is doing in his Trade Room. He’s working on integrating this technology into his trading strategy.

Regards,

Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge