Californians may be dealing with new taxes, once more.

Waves have been stirred final week when Assemblymember Chris Ward (D-San Diego) launched the California Hypothesis Act (AB 1771).

The invoice is the Meeting’s newest try and curb rising housing prices and bludgeon investor income. If handed, the Act would add an extra 25% tax on the capital acquire from the sale or change of residential properties inside three years of its preliminary buy.

In different phrases, California lawmakers try to disincentivize investor exercise within the state’s housing market. But, the invoice’s language can even have an effect on the normal home-owner, together with probably the most susceptible.

An Overview of the California Hypothesis Act

The California Hypothesis Act carries the next provisions:

- Owners could be taxed as much as 25% on capital acquire in the event that they promote their residence inside three years of buy.

- The tax applies to all “Certified Taxpayers”.

- Applies to most residential properties with few exemptions.

- First-time homebuyers and reasonably priced housing items are exempted.

- Properties offered inside three years are topic to a 25% tax. After three years, the speed declines by 5% every year till seven years have handed.

- Collected taxes could be put in the direction of neighborhood funding, with 30% designated for reasonably priced housing.

- If handed with a 2/3 vote within the Meeting, the invoice would develop into regulation on January 1, 2023.

What’s The Story Behind It?

California’s housing market is notoriously costly. San Francisco normally charts at primary for the most costly actual property market within the U.S. State tax charges are additionally among the many highest within the nation.

AB 1771’s intention is to decrease residence costs by stopping buyers from making the most of the market with money affords. In response to the invoice’s sponsor, Chris Ward, the Act will dissuade institutional buyers who purchase up houses with money and flip them at inflated costs quickly after.

“We’ve heard of individuals entering into their first residence getting beat by money affords,” Ward stated at a information convention. “When buyers fall out of the shopping for pool, that may give common residence patrons an opportunity to purchase a house,”

For Ward, costs are a significant downside. As a consultant of San Diego, traditionally one of many extra reasonably priced spots in California, he’s overseen skyrocketing actual property appreciation that’s put San Diego on par with San Francisco, a voting concern that doesn’t bode effectively for him.

Sadly for Ward, his invoice is being confronted with vital opposition.

In response to detractors, the primary concern dealing with California’s actual property disaster is the extreme lack of housing provide. Demand has been by way of the tough over the previous few years and provide has been exceptionally sluggish in catching up.

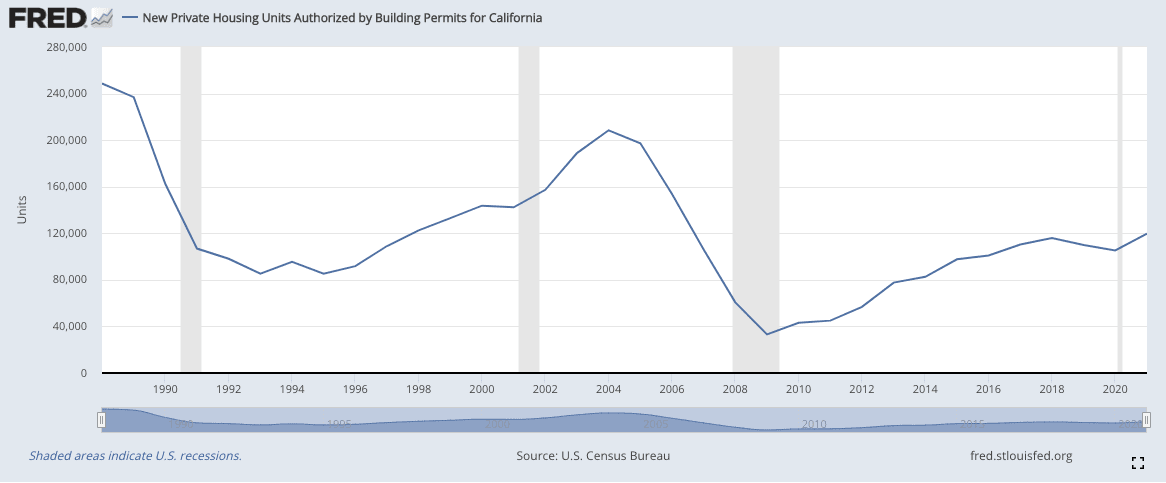

California housing begins in 2021 totaled about 120,000. That’s a slight uptick from 2020, however proper on par with the final 4 or so years. It’s means down from 2004 or 1988 ranges although, the place whole items rose effectively above 200,000. The state can also be beneath its development targets, which is focused to fall round 180,000 items per yr.

In essence, California is brief a number of million housing items and continues to be not on observe to satisfy demand. This, paired with excessive tax charges, has created a catastrophically overpriced market, locking out hundreds of thousands and placing an infinite quantity of strain on low-income and first-time patrons.

In reality, many actual property consultants are declaring that the Act would seemingly exacerbate the stock disaster.

“California has a significant affordability disaster. Sadly, this invoice would tax most householders and buyers alike, resulting in an excellent worse lack of stock, one of many main causes for housing value escalation. We imagine that is well-meaning laws with vital unintended penalties,” stated Nema Daghbandan, Companion at Geraci LLP, the Basic Counsel for the American Affiliation of Personal Lenders.

A number one concern with the invoice is that it applies to all certified taxpayers. Until you’re on active-duty navy service or deceased, you’re thought of a professional taxpayer. If you happen to have been to promote your property inside a seven-year interval, then you’ll be subjected to the tax, investor or not.

The argument, in fact, is that the majority Californians don’t promote their houses that rapidly, which is true. As an example, residents of Los Angeles are likely to preserve their houses for a median size of about 16 years.

Nevertheless, it begs the query of whether or not it’s an infringement of the property rights of sellers? Let’s say you purchased a house in Los Angeles in 2020 however have been simply supplied a implausible job in San Francisco. The catch is that you must relocate.

Must you be taxed as much as 25% for needing to maneuver? A joint assertion by a number of California actual property commerce associations, together with the California Affiliation of REALTORS®, says completely not.

“In response to the Neighbor 2020-2021 American Migration Report, over 20% of these surveyed said they deliberate to maneuver based mostly on job adjustments, monetary challenges, or extra area necessities. Below AB 1771, property house owners with a rising household looking for to maneuver into a bigger residence, downsizing because of the job lack of one of many occupants, and even those that should relocate to behave as a caregiver for a liked one who turned in poor health could be harshly penalized for merely needing to maneuver” the letter said.

The assertion continued to scorn the invoice, citing important information that means buyers who paid with money solely made up 3.8% of all transactions in 2021. It additionally ensured to deal with the invoice’s major reasoning, which is to decrease costs.

“Additional, [the bill] does nothing to make sure that first-time or different homebuyers are assured entry to houses, nor does it create extra housing alternatives. Relatively, the invoice will trigger unintended penalties for the market by decreasing the variety of houses obtainable on the market. In January 2022, new residence listings continued to drop by the double digits – with listings declining from 13,301 in January 2021 to only shy of 10,000 in December 2021. The discount in listings could be exacerbated by this invoice because it incentivizes buyers to truly maintain on to their properties longer and would power owners who have to promote to attend – additional miserable California’s possession housing provide.”

Closing Ideas

Total, the California Hypothesis Act is a mindless try and curb housing costs and can seemingly trigger extra hurt than good to the true property market.

By focusing on all certified taxpayers as an alternative of buyers particularly, it’s onerous to see this invoice as something greater than a authorities cash seize off the backs of extremely valued houses.

We’ll preserve you up to date on additional developments.