bjdlzx

Coterra Vitality (NYSE:CTRA) not too long ago reported a bullish quarter. Administration even raised manufacturing steerage. But the inventory efficiency is one thing else fully. A lot of the trade is within the doghouse. So, the query stays if that is a kind of that will get better to steer the trade (or will it proceed to lag?). What many don’t understand is that even after the merger, that is primarily two separate firms below one umbrella. What was once Cabot is a money move subsidiary that can be utilized to discover lots of acreage that the opposite firm Cimarex delivered to the merger. A lot of the Cimarex acreage was thought (on the time) to supply the potential for a much more beneficial liquids income than was the case for the Cabot acreage. Nonetheless, Mr. Market at all times compares and appears to see if each penny is accounted for.

Pure Gasoline Costs

Pure gasoline costs are positively weak and dry gasoline manufacturing has been declining. It’s only a matter of time earlier than the surplus pure gasoline in storage will get to a stage the place pure gasoline costs start to get better. Aiding the pure gasoline state of affairs is a good quantity of exporting capability that comes on-line this fiscal yr and subsequent fiscal yr.

Nonetheless, the market seems to be at costs obtained.

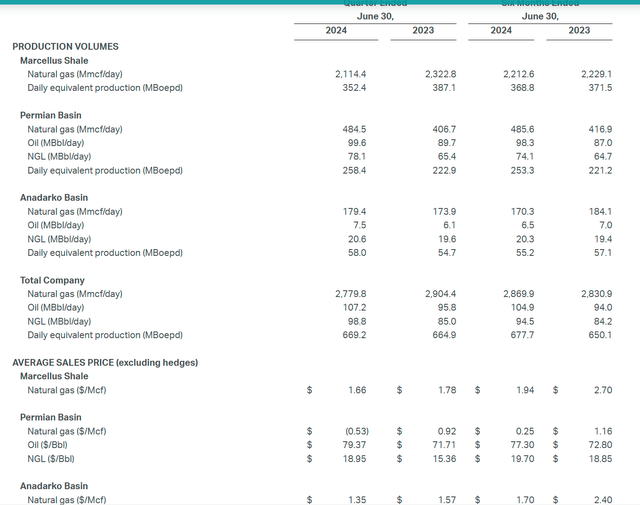

Coterra Vitality Manufacturing And Commodity Costs Acquired Abstract (Coterra Vitality Second Quarter 2024, Earnings Press Launch)

Now the oil costs look cheap (or at the least “in there”). However the Marcellus pure gasoline value obtained has lengthy been a problem for Cabot. Cabot has been recognized to depend on the acreage to supply good outcomes after which largely keep away from the difficulty of constructing extra money on pure gasoline costs.

The reason being that administration by no means put a lot, if any effort, into getting the pure gasoline out of the oversupplied Marcellus space. Afterall, if earnings have been already good and shareholders have been completely satisfied, then why trouble?

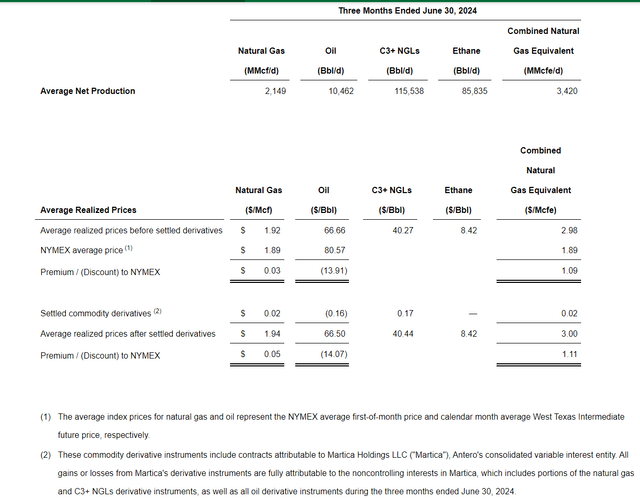

Antero Assets Costs Acquired

Many have famous nice margins and different options. However within the commodities enterprise, each penny is essential. There are completely different gross sales phrases on account of when possession is taken of the pure gasoline by the vendor that may account for some pricing variations. However there’s additionally a distinction in costs obtained by getting the pure gasoline to a stronger priced market.

Antero Assets Abstract Of Second Quarter 2024 Costs Acquired (Antero Assets Second Quarter 2024, Earnings Press Launch)

Typically talking, pure gasoline transportation will not be all that a lot when in comparison with the worth of pure gasoline. Antero Assets (AR) administration has lengthy devoted themselves to getting the most effective value for his or her manufacturing so long as the web quantity is bigger than the worth obtained within the Marcellus Basin. As proven above, in comparison with the worth that Coterra is incomes for its pure gasoline, that may be very more likely to be the case. This administration has lengthy had the selection to promote within the Marcellus Basin or elsewhere and has lengthy chosen to promote elsewhere.

In an trade the place each penny counts, the distinction in what the 2 firms obtain for pure gasoline exhibits lots of potential pennies for Coterra to gather.

It must also be saved in thoughts that web earnings and money move are fractions of income. Due to this fact, each additional little bit that administration can get flows via to shareholders. Due to this fact, it’s a must to ask your self if “ok” is all you need as a shareholder or if you’d like each final penny you will get.

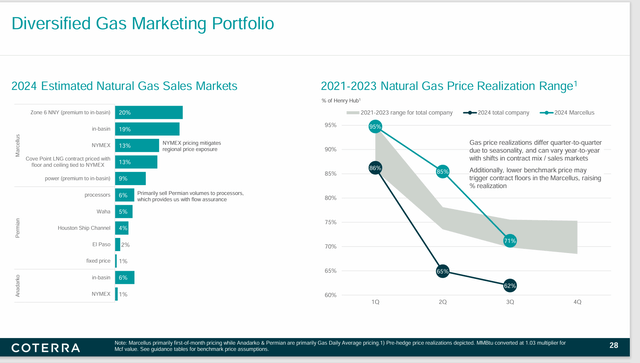

Firm Gross sales Profile

Certain sufficient, administration admits to promoting some gasoline within the basin mixed with some energy gross sales which can be at a premium to the basin value. Nonetheless, the issue with that “premium” assertion is that the Marcellus Basin costs are usually at a reduction to simply about any cheap benchmark chosen. That begs the query of “the true premium” in comparison with some benchmarks that others use.

Coterra Pure Gasoline Costs Acquired (Coterra Vitality Second Quarter 2024, Earnings Convention Name Slides)

This firm is now massive sufficient, that frankly, these reductions proven above much more seemingly belong to smaller operators. Hopefully the corporate has taken measures to learn from the climbing capacity of North America to export pure gasoline.

Antero Assets, in distinction, often notes that none of its manufacturing is ever bought throughout the basin. In truth, administration has been criticized for sustaining “additional” transportation capability for which many thought the corporate would lose cash. But quarters hold going by the place that pricing premium normally exceeds practically each producer within the basin by greater than the quantity it takes to keep up transportation selections.

Now, the corporate seems to be heading in the direction of an export coverage for the foreseeable future as a result of that’s the place the fixed premium is. Right here, with Coterra, that low cost takes away from hard-earned manufacturing worth.

What Can Occur

At any time when there’s a state of affairs the place administration settles for “ok” there’s a market inefficiency that’s more likely to be corrected additional time. Now the method is “messy” in that it might occur tomorrow or lengthy into the long run. But it surely normally will occur.

The case of Exxon Mobil (XOM) buying Pioneer (PXD) might be a wonderful instance. Immediately Exxon Mobil figured there have been efficiencies to be gained as Pioneer Assets administration had lengthy been recognized to accept “ok”. Pioneer had a number of the greatest leases within the Permian. Due to this fact, good outcomes have been assured even when administration didn’t go for “each final dime”.

However upon acquisition, each within the presentation and later throughout a number of convention calls, administration at the least implied significantly better nicely efficiencies lie forward which implied higher manufacturing. Exxon Mobil additionally has a present program underway to get much more out of Permian wells via secondary restoration sooner or later.

What’s now coming to the forefront is that whereas Pioneer shareholders positively had a passable return, there was clearly a good quantity of enchancment accessible that there was no drive to attain for shareholders as a result of present outcomes made shareholders completely satisfied.

One other instance was the Rice Brothers’ battle to win management of EQT (EQT) again in 2019. Poor operational outcomes have been a key focus of the battle. The most recent acquisition of Equitrans Midstream (ETRN) was each to get extra pure gasoline out of the basin for a greater value whereas touting that the corporate breakeven might drop as a lot as 25% (give or take) because of the acquisition. This continues a historical past that started with the Rice Brothers on the helm of the corporate, of dropping firm breakeven prices. This leads to a much more worthwhile firm now than was the case earlier than they took over.

Abstract

Coterra Vitality has lots going for it. However the obvious concentrate on oil has missed a good revenue alternative within the type of pure gasoline costs generated. The commodity enterprise is such that each final penny of potential revenue is essential. That requires a element oriented and pushed administration. There are indicators right here that this administration at the least partly doesn’t meet that goal.

When that occurs, the market typically assigns a long-term low cost as a result of a “ok” perspective is related to extra future challenges {that a} detail-oriented and pushed administration is predicted to uncover earlier than it turns into an issue.

Some have lengthy speculated, for instance, that EQT was headed in the direction of a way more tough fiscal yr 2020 than what really occurred. There are comparable speculations about what the Pioneer earnings might have been with an Exxon Mobil administration perspective.

Administration performs an essential a part of a inventory value analysis and the potential for overlooking future points is a good a part of that inventory analysis. Due to this fact, for me that is at greatest a maintain as a result of I’m a agency believer in detail-oriented and pushed administration.

This administration might nicely find yourself benefitting from the approaching pure gasoline value restoration. But it surely seems clear that it may gain advantage much more.

The web site exhibits a complete return of about 70% for the reason that final article was written again in July 2021. From that point interval ahead, the EQT return (for instance) was comparable. However now EQT administration states that the newest acquisition (which dropped the inventory value quickly) will drop the corporate breakeven by a large quantity. Coterra has actually nothing of that significance going ahead. Each are more likely to profit from the approaching pure gasoline value restoration. However EQT seems to learn each from the pricing restoration and considerably decrease prices sooner or later.

Dangers

Any upstream operation could have publicity to risky and low visibility future commodity costs. A extreme and sustained downturn of these costs might end in a really completely different future than what was implied above.

The lack of key personnel might set again the corporate’s future plans materially.

This firm is diversified by working in a lot of basins with the potential to enter nonetheless extra basins sooner or later. That reduces the danger of a know-how enchancment that switches the situation of the low-cost basin.

Moreover, know-how advances that periodically sweep the trade can lead to an unfavorable change within the firm aggressive place. Maintaining with the newest advances in addition to having acreage that takes benefit of these advances might be fairly a job for any administration.