Published on January 2nd, 2023 by Samuel Smith

Generating reliable and growing passive income from a portfolio of dividend stocks is probably the best possible all-around way to invest for long-term wealth. This approach enjoys true passivity and access to the easy diversification benefits of publicly traded securities while also liberating the investor from the emotional roller coaster that the short-term volatility of public markets provides.

Instead of frantically praying that stocks will not crash and in the process ruin your retirement dreams, dividend growth investors can kick back, relax, and enjoy the fruits of their growing passive income machine without ever needing to touch the principal, regardless of whether they are still working or are already in retirement.

Investors looking for growing passive income can turn to the Dividend Aristocrats, an elite group of 65 S&P 500 stocks with 25+ years of consecutive dividend increases.

We have compiled a list of all 65 Dividend Aristocrats, along with relevant financial metrics like dividend yield and P/E ratios. You can download the full list of Dividend Aristocrats by clicking on the link below:

Source: Image Source

Two Questions Every Dividend Investor Should Ask

That said, building a truly reliable and consistently growing passive income stream is harder than it sounds. There are plenty of attractive looking stocks out there that promise to provide juicy income yields only to soon turn into devastating yield traps that destroy investor capital while also slashing or even eliminating their dividend. As a result, the two most important questions an investor should ask when building a passive income stream through dividend stocks are:

(1) how sustainable are the current dividends paid out by a given stock

(2) what is the growth potential for those dividends?

If the current dividends are not sustainable, the passive income stream is nearly useless because investors will not be able to rely on it and might as well invest in growth stocks. Additionally, if the passive income stream does not grow on a per share basis moving forward, its purchasing power is highly vulnerable to the negative effects of inflation.

Why The Dividend Payout Ratio Is So Important

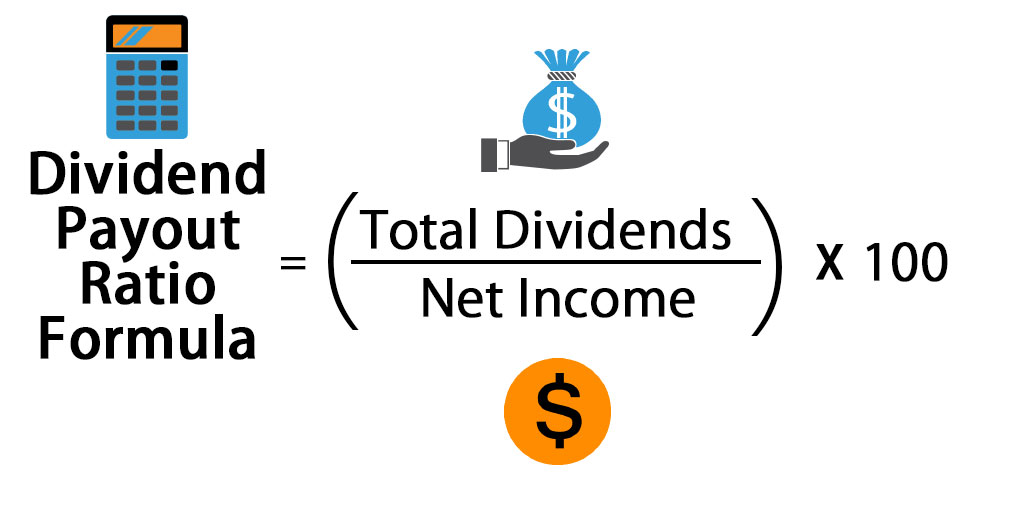

The best single metric for gaining insight into the answer to these questions is the dividend payout ratio. It shows how much of a margin there is between a company’s earnings (or other relevant metric such as funds from operation, adjusted funds from operation, free cash flow, distributable cash flow, cash available for distribution, etc.) and what it pays out to shareholders via dividends.

Source: Image Source

If the payout ratio is 100%, that means that all a company’s earnings are used to pay the dividend, leaving no wiggle room for if/when some future macro or micro economic event causes the company’s earnings to decline and no longer cover the dividend. It also means that the company has no retained earnings with which it can pursue other avenues to grow the intrinsic value of the company through actions like debt reduction, share repurchases, or growth investments, thereby increasing dividend paying capacity long-term. The dividend payout ratio is such a powerful metric because it shows how much:

• margin of safety the current dividend payout has

• capacity the company has to grow the dividend within its current earnings power

• retained earnings the company can use to drive further long-term dividend growth

How To Determine A Good Dividend Payout Ratio

With all that said, the two aforementioned most important questions for dividend investors to ask can be boiled down into a single question:

“What is a good dividend payout ratio?”

While a low dividend payout ratio is obviously better for a stock’s dividend sustainability and future growth prospects, there is also obviously a balance that needs to be struck. The lower a dividend payout ratio is, the lower its current dividend yield will be and too much retained cash may prompt management to be careless with how they allocate it, thereby destroying shareholder value over the long-term. As a result, the right payout ratio level varies considerably from stock to stock and depends largely on the company’s business model, balance sheet, and stage of development.

If a company operates in a cyclical capital-intensive industry like automobile manufacturer, it would probably be better served by keeping its payout ratio low since management will need to have extra cash to invest in continued innovation to keep up with competitors while also investing in expensive production facilities and equipment. Furthermore, given the cyclicality of the industry, free cash flow can plummet at certain points, which makes a high payout ratio imprudent. As a result, it should be no surprise to see that Toyota Motor Corp. (TM) has a 27.89% payout ratio, Ford Motor Co. (F) has a 20.08% payout ratio, and Tesla Inc. (TSLA) does not even pay a dividend.

In contrast, alternative asset managers employ very capital-light business models and generate sticky fee related earnings streams from long-dated assets under management, so they are able to return the vast majority of their earnings to shareholders via dividends. In fact, leading alternative asset managers like Blackstone (BX) and Brookfield Asset Management (BAM) have payout ratio policies of ~85% and 90%, respectively.

The same can be said for the state of a company’s balance sheet. If that company has a lot of leverage relative to its sector peers, it should generally adopt a much lower payout ratio. This is because if interest rates spike (as we have seen this past year) and/or if economic conditions deteriorate, it may have greater difficulty in servicing and/or refinancing its debt. Therefore, it could be forced to cut or even eliminate its dividend to pay down debt or pacify creditors. A recent example of this scenario is AT&T (T) which had a very impressive dividend growth track record and an attractive dividend yield, but its leverage ratio got too high, and the business was struggling to grow. As a result, management was forced to make the difficult decision to slash the dividend to conserve more cash to use for paying down debt and preserve the investment grade credit rating.

A final important consideration when evaluating whether a company has a prudent payout ratio is the company’s stage of development. When a business is early in its development and is growing rapidly, it is typically best if the company has a very low payout ratio or ideally does not even pay a dividend at all. This is because the company has numerous high returning growth opportunities to allocate capital to that will help the company scale into profitability or at the very least strengthen its long-term moat. Examples of this scenario are numerous in the technology space, including Meta (META), Amazon (AMZN), Netflix (NFLX), and Alphabet (GOOG). Each of these companies has never paid a dividend as they have invested aggressively in growth for quite some time now.

However, as they have reached maturity and their growth rates have slowed, there are signs that some or all these companies are beginning to misallocate some of their retained earnings. For example, instead of electing to pay a dividend, META has sunk billions of dollars into various virtual reality related ventures, which have yet to bear fruit for the company. NFLX has invested aggressively in new content creation and other platform enhancements instead of paying out a dividend, yet its subscriber growth seems to have peaked. AMZN has reinvested profits aggressively in building out a massive logistics empire as well as investing aggressively in electric vehicle maker Rivian Automotive (RIVN), but recently suffered steep losses after overbuilding due to demand falling short of expectations and RIVN suffering a steep decline in value as well.

In these instances, shareholder value would have been greater if management had elected to return that cash to shareholders rather than reinvesting it themselves. As a result, it is imperative for investors to ensure that a company’s dividend payout ratio policy aligns with its current stage of development.

Concluding Thoughts

As we have discussed in this article, one of the keys to unlocking the magic of dividend investing for one’s portfolio is effectively analyzing the prudence of a company’s dividend payout ratio. If it operates in a capital-intensive cyclical industry, has a heavily leveraged balance sheet, and/or is still in its high growth stage, it is best if the company pays out little to nothing in dividends.

However, if it generates stable free cash flow through the cycle, has a sound balance sheet, and has limited high return investment opportunities, it is important that the company returns most of its cash to shareholders. If management fails to employ a high payout ratio in such a scenario, returns on capital will likely plummet and significant shareholder value might even be destroyed if management allocates that capital to poor returning investments. If a company fails to match its payout ratio to its business model, balance sheet, and development stage, investor returns will undoubtedly suffer.

The following articles contain stocks with very long dividend or corporate histories, ripe for selection for dividend growth investors:

Thanks for reading this article. Please send any feedback, corrections, or questions to [email protected].