Contrary to popular belief, stocks do not only go up.

They go up … and they go down. They go down a lot less often than they go up. But when they do, it’s usually painful.

Some people prefer to hold through the painful times where stocks go down, waiting for the up period to resume so they can make money again.

You should know by now I’m not one of those people. I’m not satisfied with waiting for stocks to do anything.

I want to make money while they go up, AND while they go down.

Here’s why I’m saying this…

So far in 2023, stocks are more or less going up. The S&P 500 is up 4% since the start of the year. That’s giving hope to the passive investor who’s itching for a new bull market.

But I implore you to understand: this is still no time to be a passive investor.

We’re in the middle of another fakeout rally that I’m confident will lead to another brutal shakeout.

I don’t want you to be a victim to the next leg down.

So listen closely to what I’m about to tell you…

Just Another Fakeout Rally

I was emailing Ian King earlier this week. He pointed out that, from 2000 to 2002, the Nasdaq had four fakeout rallies.

Anyone who bought these fakeout rallies thought the worst was over, but they were wrong. After each of these 20% rallies, there was another shakeout. The average decline in these shakeouts was 37%… pushing stock prices to new lows.

This chart shows the big fakeout rallies between 2000 and 2002…

(Source: Macrotrends)

In the first rally, a 23% fakeout was followed by a -42% shakeout.

The second fakeout rally saw a 12% run, followed by a -34% shakeout loss.

The third saw stocks gain 16%… but a -31% shakeout bust came right after.

Finally, the fourth and final fakeout rally drove stocks 31% higher — only to fall -41% in another shakeout.

As you can see, for 2 ½ years, people were duped into thinking there was a recovery. Nobody knew another shakeout was around the corner.

My research says we are in for another 2 ½-year bear market. We’re only one year into it. That means the rally we saw last week was yet another fakeout before another major shakeout.

Why will this time be like 2000, and not the three other times the Nasdaq recovered the following year?

Because market dynamics today are just like those of back then…

History Is Rhyming with the Dot-Com Crash

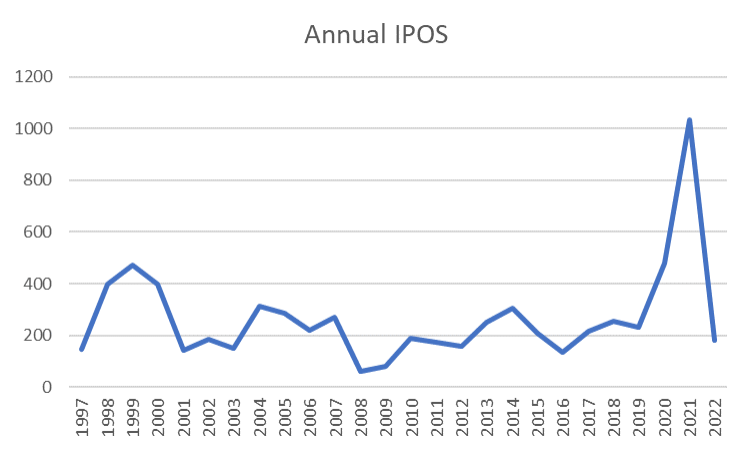

In the late 1990s. companies rushed to take advantage of the bull market through initial public offerings, or IPOs. They sold shares to the public through these IPOs.

But, think about that for a minute… Company leadership rushed to sell shares to the public as stock prices soared.

We could assume these CEOs had the best intentions and wanted individual investors to benefit from owning these great companies. But that would be much too generous.

It’s far more likely they wanted to cash out at absurdly high valuations while they could.

And they did it again in just the last few years.

The number of IPOs set a new record in 2021. The previous high was in 1999, just before the bubble popped. The 2021 high was more than double what was happening back then.

This looks a lot like history rhyming, if not outright repeating itself…

If we look back even further, we can see other similarities:

- In the 1920s, individual investors used new technology — the ticker tape and the telephone — to leave their boring job and trade the bull market from anywhere.

Dreams of fortunes made on ocean liners sailing to Europe or on the beaches of New Jersey gave people hope … then October 24, 1929 happened and the Great Depression followed.

- In the late ‘90s, it was the same thing: New technology, like the internet and online brokers, allowed people to leave their jobs and trade the bull market.

Everyone wanted the “Lifestyles of the Rich and Famous” so they rushed into the market. Then the dot-com bubble burst in 2000… the worst bear market since the Great Depression.

- It was the same song, a third verse in the 2020s.

Discussion boards like Reddit and free online trading helped people get out of their 9-5 jobs and into a bull market.

There was a brief pause due to the coronacrash in March 2020, but stocks went on a 12-month tear after that. In 2022, the market came back to reality… putting us in the bear market we’re still in today.

Another constant in the greatest bear markets is enthusiastic “smart money.”

In 2021, the amount of money flooding into venture capital funds doubled. The last time that happened was in 1999… right before the dot-com bubble.

See the theme?

Then and Now

Now, there is one big difference between those markets and now… The Federal Reserve is raising rates. That makes things even worse now than they were back then.

During the dot-com bubble burst, we were in the middle of a 40-year cycle of lower interest rates. Today, we’re in the early stages of what could be a long cycle of higher interest rates.

The Fed doesn’t have much choice. From 2009 to 2022, it pushed interest rates to zero, but economists said that was impossible to sustain. So, the Fed increased the supply of money faster than at any time in history.

Now, we’re paying for that. Inflation is higher than it’s been in 40 years. Government economists assure us there’s nothing to worry about. Inflation will be back to 2% in months, they say.

Inflation has always taken years to fight. Maybe this time is different than what we’ve seen over the past 800 years, but I doubt it.

This is why I believe we are currently in yet another fakeout rally.

Just look at history. Again:

- Then: the first leg down … a 28% drop in a matter of months (from February 2000 to May 2000).

- Now: this first leg down … a 37% drop in one year (from December 2021 to December 2022).

Traders are excited because we seem to have a bit of a recovery… up 6% in a few weeks.

Over the next few weeks, expect the market to keep on rallying as all looks good. If you want to partake in that rally, great.

But be ready for the looming shakeout. And be ready for the recession that is coming this year.

Remember, we are in a bear market in stocks, but we are not in an economic recession… yet.

My indicators tell me that could start this quarter. And that’s more bad news for investors.

On average, stocks fall 38% in a recession. And the bottom comes after economists admit we’re in a recession. We are months… probably years… away from a bottom.

After looking at all this, I have to ask again… what should make us think this time is different?

Nothing.

How can anyone dare claim that we have hit the bottom of a bear market if we haven’t even declared a recession yet?

So I’ll be taking shakeout trades over the next few months to benefit from the profitable opportunities bear markets provide. If you’d like to join me, you can get all the details here.

Regards,

Michael CarrEditor, One Trade

Michael CarrEditor, One Trade