Klaus Vedfelt/DigitalVision by way of Getty Photos

In my final article on Western Alliance (NYSE:WAL), I highlighted my optimistic view on this financial institution’s 2024, and it turned out to be right: because the publication of the article, WAL has outperformed the S&P500 by about 22%.

After the current Q2 2024, I reaffirm my purchase ranking regardless of the robust uptrend in current months. There are extra development drivers that may result in additional value appreciation, together with a P/TBV per share that’s nonetheless fairly low in comparison with historic values.

Highlights Q2 2024

The explanation I’ve been so overbalanced within the title is as a result of I imagine that this Q2 2024 was extremely constructive in additional methods than one. The mortgage portfolio grew regardless of the difficult macroeconomic setting; non-interest-bearing deposits elevated once more, producing a consequent enchancment in profitability; mortgage high quality stays excessive, as do capital ratios web of unrealized losses from AFS securities.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

Beginning with the previous, the mortgage portfolio elevated by $1.7 billion from the earlier quarter and $4.60 billion year-over-year. Nearly all of the expansion may be attributed to C&I loans, up $1.94 billion from the earlier quarter and $5.03 billion year-over-year. On the identical time, essentially the most distressed section is Residential & Shopper, down $179 million on a quarterly foundation and $577 million on an annual foundation.

So, primarily based on this information, it appears that evidently households are disinclined to originate mortgages, whereas companies are nonetheless in a position to gas demand for credit score. In reality, though unemployment charges are rising, the economic system stays resilient and companies don’t but appear to be struggling an excessive amount of with excessive rates of interest. This development is prone to proceed within the coming months, making C&I loans an more and more necessary part since CRE loans will stay flat:

I believe what you possibly can count on for the remainder of the 12 months is to see steady downward motion in our residential mortgage portfolio as you noticed this quarter. I believe you will discover CRE total will likely be comparatively flat. We’ll search for alternatives to finance. We do like pockets of financing within the building land and improvement, most notably, we have all the time talked about this, our lot banking section will present alternative. However the quick reply, I assume, is that principally it’ll are available C&I, observe financing, warehouse lending are the 2 areas which can be going to cleared the path.

CEO Kenneth Vecchione, convention name Q2 2024.

In different phrases, we will count on the mortgage portfolio to proceed to develop, however it is going to be pushed primarily by C&I loans. Particularly, by 2024 administration expects a mortgage portfolio of $54.80 billion, up $500 million from earlier steering.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

By way of mortgage high quality, WAL is among the many banks with fewer issues on this respect. As you possibly can see on this picture, the Cumulative Web Cost-Offs/Common Nonperforming Loans ratio is decrease than many friends and the 3-Yr Median.

Actually, having ¾ of the portfolio depending on particular person companies or enterprises is an allocation that exposes WAL to some threat, particularly within the occasion of an financial downturn. This can be a issue to think about, though now the scenario is strong.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

As for deposits, there’s excellent news right here as nicely. On a quarterly foundation, they elevated by $4 billion, pushed primarily by non-interest-bearing deposits, +$3.10 billion. Such a rise generated a discount within the common value of liabilities, from 2.82% to 2.79%.

As well as, steering was additionally seen upward for deposits: +$14 billion over 2023 versus +$11 billion beforehand.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

General, the advance in deposits mixed with the advance in loans (each when it comes to quantity and yield) resulted in a rise in each web curiosity earnings and web curiosity margin. The previous achieved an enchancment of $57.70 million over the earlier quarter, the latter by 3 foundation factors.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

In accordance with the up to date steering, web curiosity earnings is predicted to rise between 9% and 14% (5%-10% beforehand) and the online curiosity margin will likely be roughly round 360 foundation factors on the finish of the 12 months.

These outcomes have happy traders, and I, personally, imagine there are grounds for additional enchancment within the subsequent quarter. Demand for C&I remains to be excessive and administration might have been too conservative. Additionally, WAL’s Mortgage to Deposit ratio is simply 79%, so there’s ample room to situation new loans.

Amongst different issues, with such an quantity of deposits available, administration might resolve to deal with high quality relatively than amount sooner or later, letting costly CDs steadily expire with out refinancing them. This course of, mixed with an additional improve in non-interest-bearing deposits, would give an additional enhance to the online curiosity margin.

In different phrases, I imagine the circumstances are in place for WAL to take advantage of out of the present macroeconomic setting.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

In all this, it shouldn’t be forgotten that WAL is a well-capitalized financial institution. Based mostly on CET1 adjusted for AOCI, WAL is near reaching the seventy fifth percentile. On this case, its power isn’t having a securities portfolio with massive unrealized losses.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

As you possibly can see, the yield of 4.87% is kind of near the present Fed Funds Fee.

Conclusion

WAL is a strong financial institution that skilled important development in loans and deposits within the final quarter. As well as, profitability has additionally improved, as has the 2024 steering. The market has reacted favorably to this, and I imagine there’s nonetheless room for additional enchancment.

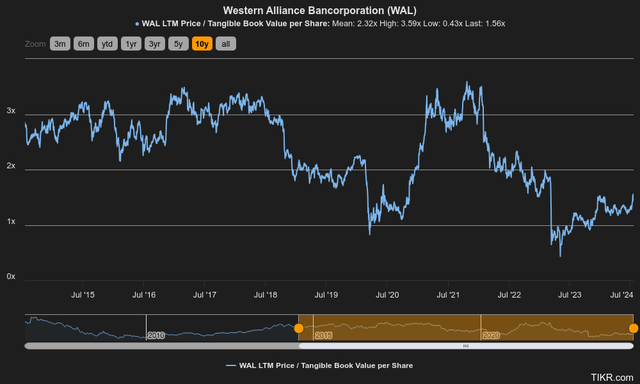

TIKR

The worth per share has gone up lots not too long ago, however primarily based on the P/TBV per share, there’s nonetheless a large margin earlier than the 10-year common of two.32x is reached. Personally, I’d not be stunned if 2x is reached within the subsequent few months, which might suggest a value per share of $98.54.

To assume that this financial institution was buying and selling at solely $18 slightly over a 12 months in the past is really mind-blowing and hints at how dynamic the banking sector is. Expectations can change in a short time, which is why I believe it’s vital to observe the evolution of the macroeconomic setting. If the unemployment price doesn’t cease its development, the honest worth of $98.54 could also be a very optimistic value.

Western Alliance Bancorporation (WAL) Q2 2024 Earnings Name

Lastly, from a long-term perspective, WAL has confirmed to be a superb funding to this point: it has vastly outperformed the peer median. The previous can’t give us certainty in regards to the future, however it may assist us in our funding decisions. A financial institution that will increase TBV per share by 595% since 2013 signifies that it has been nicely managed, and bodes nicely for its future.