volodyar

Introduction

Who doesn’t love a business model built around recurring spend? Investors have proven time and time again to love these sorts of business models. Whether it is SaaS or a consumer staples good that is frequently repurchased, like razors or detergent, recurring revenue is simply preferred compared to lumpy, hard-to-predict inflows.

In today’s article, I’ll explore one such company whose business model revolves around recurring consumption; specifically, today, we will examine West Pharmaceutical Services, Inc. (NYSE:WST).

West is a mid-cap-sized business that supplies consumable medical goods to the pharmaceutical and life sciences industries. They supply things like vials for injectable medications/vaccines and other highly customized plastic packaging related to drug delivery.

Apart from infrequent spikes (COVID-19, for example), demand for these sorts of products has historically been remarkably consistent, growing slowly year after year as health science breakthroughs and an aging global population have been long-term tailwinds.

It’s a strategy that’s worked out very well for the firm and investors alike.

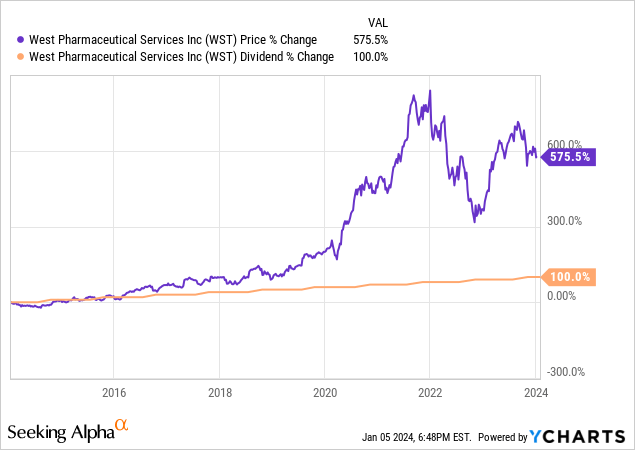

Over the past 10 years, its share price has increased by 575%, and its dividend paid per share has exactly doubled. Things are even more impressive over the long term: the share price has increased by nearly 10,000% since 1984, and the company has raised the dividend every year for 30 years straight, making it one of the rare few dividend aristocrats.

In today’s article, we’ll explore West’s business, recent developments, performance and valuation versus its peers, and much more.

Context

In 1923, a man by the name of Herman West started West Pharmaceutical Services, Inc. in Philadelphia, marking the start of a one-of-a-kind journey. At first, the company’s focus was on manufacturing rubber items for pharmaceutical use, like dental grinding wheels and various types of stoppers.

Then, a significant breakthrough came during World War II; working with Eli Lilly and the U.S. government, West developed a special stopper for penicillin vials, which was vital for both military and civilian healthcare. This development played a critical role in the war, especially for the Allies, which benefited from this advancement.

After that earlier success, over the coming years, West expanded its operations worldwide. Starting with new locations across the United States, the company then moved into Latin America in 1952, South America in 1957, Europe in 1968, and Asia in 1983. In 1973, an important step was taken when West partnered with Japan’s Daikyo Seiko, and later on in 2019, making an additional investment gaining a 49% stake in the company and enhancing its global reach.

West has had an incredible impact on the world.

By 2022, West had a significant impact on healthcare around the world, producing almost 47 billion components. This growth, fueled by constant innovation and expansion, has positioned West as a leader in creating and delivering injectable medicines globally.

The Impact of COVID-19

The COVID-19 pandemic has brought unprecedented challenges and opportunities to companies in the life sciences sector, including West, a key supplier to the industry.

The outbreak severely disrupted the pharma and medtech R&D landscape, deeply impacting companies operationally and financially. These disruptions were multi-faceted, affecting clinical trials, lab operations, and overall productivity due to remote working and reduced lab capacities.

According to a report by McKinsey, more than 90% of companies implemented emergency procedures, and the majority experienced significant trial disruptions, with R&D labs operating at less than 50% capacity. This operational upheaval presented a complex scenario for West.

However, the pandemic also created an intense demand for medical products, pulling forward demand in an unprecedented manner. West rose to this challenge by rapidly scaling up the production of essential medical products.

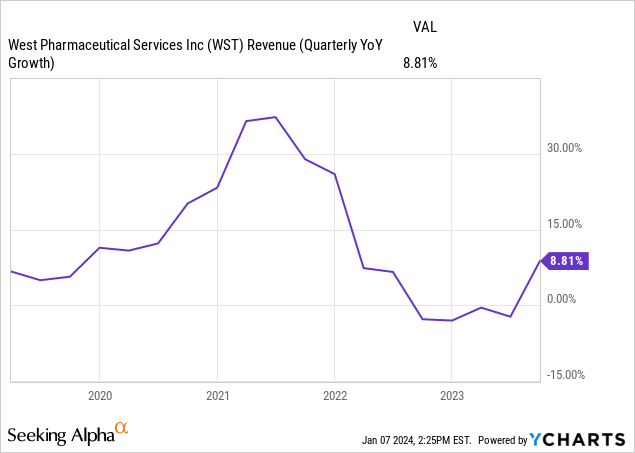

This response not only helped meet the urgent needs of patients and clinicians but also resulted in impressive financial returns for shareholders, noting the rapid spike in revenue growth in late 2020-2021. This success story illustrates West’s agility and resilience in adapting to and capitalizing on sudden market changes.

Post-crisis, the demand has somewhat softened, reflecting a shift in the immediate urgency that characterized the pandemic’s peak. Despite this, the experience has likely set a new precedent in the life sciences industry. Companies like West have learned the importance of agility and innovation in responding to global health crises.

Financial Performance vs. Peers

Now that we’ve discussed the company’s history and recent events impacting its long-term strategy, let’s shift our attention to its financial performance in comparison to its peers to add further color. Today, I’ll be comparing West to Mettler-Toledo International Inc. (MTD), Waters Corporation (WAT), Danaher Corporation (DHR), and Thermo Fisher Scientific Inc. (TMO). Side note, I recently wrote a deep dive article on Danaher, which you can find here.

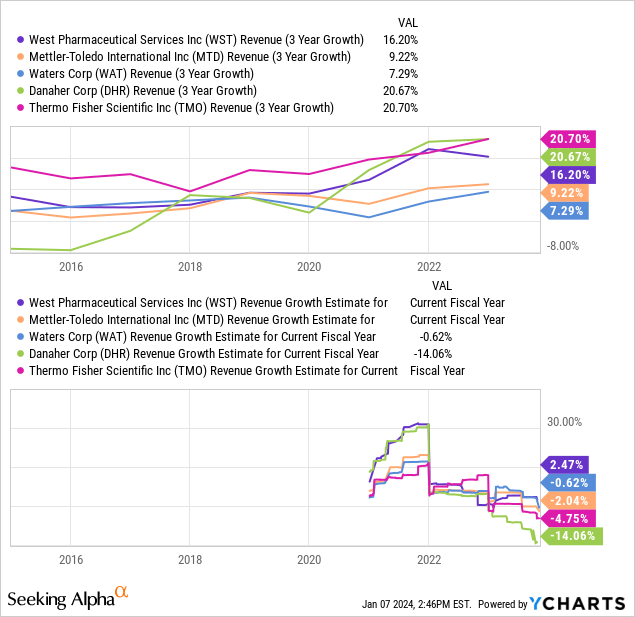

Revenue Growth

Rather than look at just one quarter or one year, the chart above shows 2 metrics: revenue growth over the last 3 years, as well as forward expectations for the current fiscal year. By company, Thermo Fisher, a giant in life sciences, grew the fastest over the past decade or so, having routinely increased revenues by roughly 20% over each 3-year period. Danaher, another large life sciences player, is up around the same level, too, after having improved its growth rates following a number of spinouts of slower-growing businesses.

But West, despite being much smaller and having a more simplistic range of products, is not far behind at 16.2% growth over the past 3 years. Looking forward, West is the only one of the groups forecasted to have positive revenue growth for the current fiscal year according to data from YCharts.

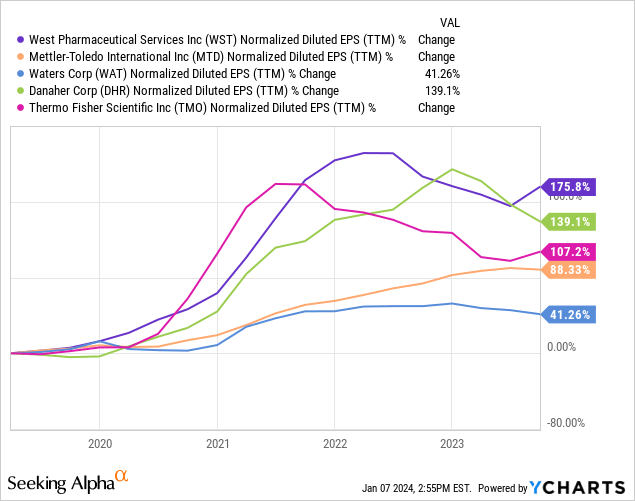

EPS Growth

Looking back over the past 5 years, at 176% growth, West grew its earnings faster than any of its peers. As you can see in the chart above, earnings spiked around 2021-2022 but tapered off as demand slowed post-covid. For some of these businesses, the cool-down has been sharp; Thermo Fisher is a good example of this. And yet, for others, the cooldown has been much more tempered or non-existent: Mettler-Toledo and West.

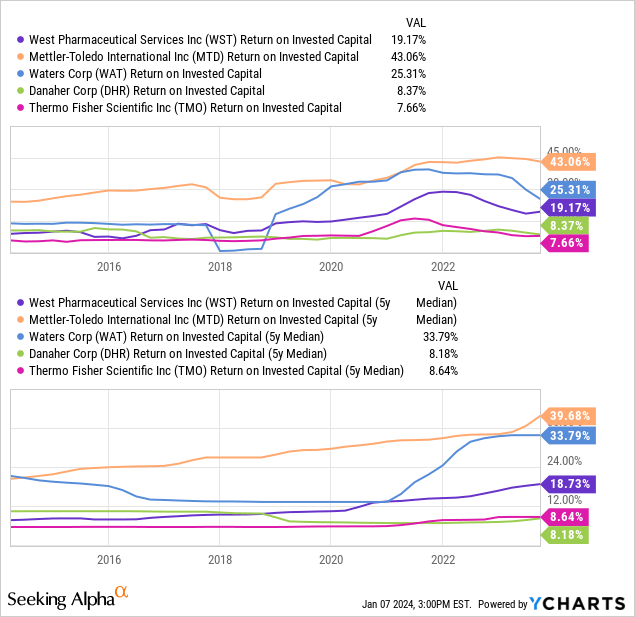

ROIC

As you can see in their EPS growth rates from the last chart, all of these companies performed well over the last 5 years. That said, I’m a big believer that over the long term, the performance of a stock will be determined by how effectively management can deploy its cash flow toward further growth, and on that metric, there is quite a bit of disparity.

Mettler-Toledo, with an average ROIC over the past 5 years of 40%, is one of the highest averages I’ve ever seen; this is incredibly impressive, and Waters, despite its slower EPS and Revenue growth, is not far behind at 34%.

West’s ROIC, while falling short of the impressive levels set by the likes of Waters and Mettler-Toledo, is nothing to balk at. Its average returns on invested capital over the last 5 years come out at 18%; this is much higher than the average company.

Danaher and Thermo Fisher lag behind with returns on capital less than 10%.

Valuation and Conclusion

| Company | Current Stock Price | EPS 2024 Est. | 2024 P/E |

| WST | $339 | $8.79 | 38.6 |

| MTD | $1,132 | $39.44 | 28.7 |

| WAT | $305 | $12.00 | 25.4 |

| TMO | $531 | $22.03 | 24.1 |

| DHR | $230 | $7.80 | 29.5 |

| Average PE (excl. West) | 26.9 |

Analyst Expectation Source: Yahoo Finance

West’s financial performance has been impressive, yet a notable downside lies in its valuation. With a forward PE ratio of 38.6, considerably higher than the industry average of 26.9 (excluding West), it’s clear that West is valued more expensively compared to its peers. This high valuation, despite reflecting strong market confidence and solid financial results, could be seen as a potential risk or drawback for investors, especially when compared to more moderately valued companies like MTD, WAT, TMO, and DHR in the same sector.

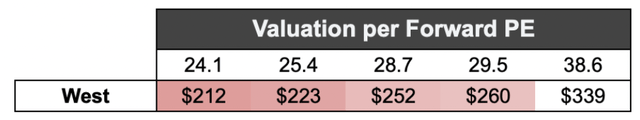

Created by Author using Analyst Expectations from Yahoo Finance

While West’s business model demonstrates remarkable resilience, having withstood global upheavals like world wars and pandemics, the primary risk for investors currently stems from its high valuation. With a P/E ratio significantly above the industry average, this aspect of West’s profile presents a contrast to its otherwise stable and proven business approach. Investors, while appreciative of the company’s consistent performance and durability, must carefully consider this valuation aspect, as it represents a significant downside in an otherwise robust investment narrative. The table above illustrates the downside potential if the company were to experience a multiple contraction.

Ultimately, West Pharmaceutical Services showcases a remarkable history of growth and impressive returns on capital, highlighting its strength in the industry. Despite this, its elevated valuation presents a notable concern. Balancing these aspects – a proven track record against a high valuation – leads to my neutral stance. As much as I would like to add to my position, at these levels, I cannot do so.

Consequently, I rate West Pharmaceutical Services a “Hold.”