AzmanL

Investment Rundown

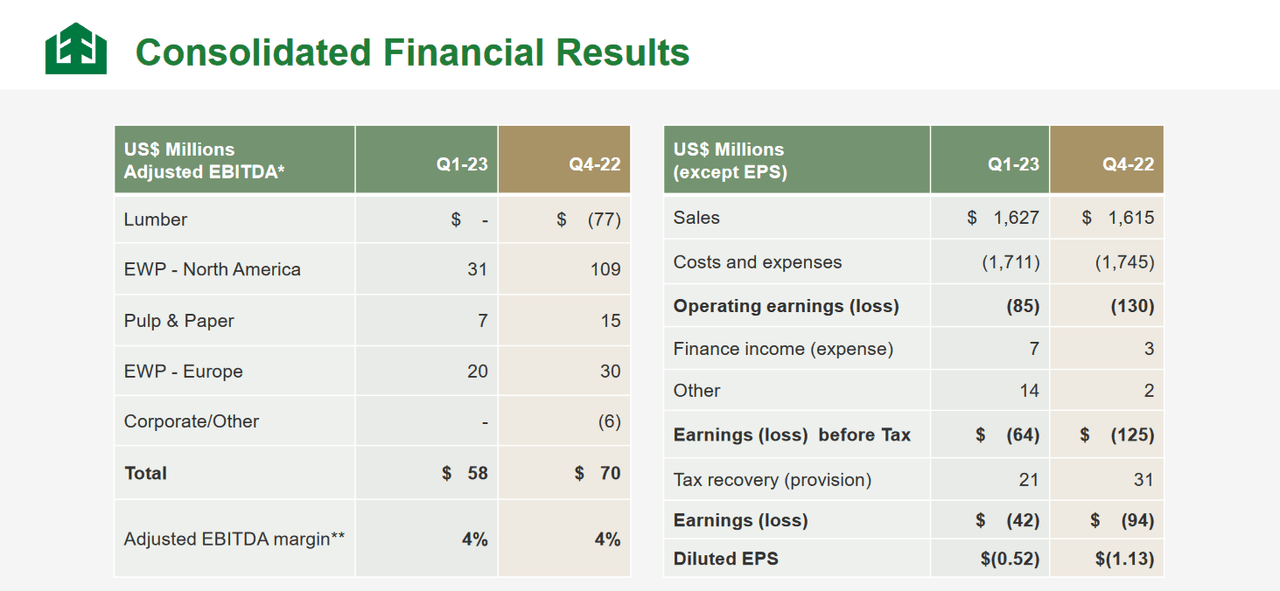

West Fraser Timber Co. Ltd. (NYSE:WFG) has had a very difficult start to the year as lacking demand was clearly shown in many key markets. The bottom line was negative and the EPS was indeed up being $(0.52) for the quarter. Luckily, there seem to be some improvements on a QoQ basis. Back in Q4 2022, the net loss was $94 million instead.

Higher mortgage rates are putting pressure on the residential construction market as lower buildings are being planned. This lowers demand for WFG and we end up with quarterly results like we have just seen here. This hasn’t stopped the share price though from going ballistic the last month, up nearly 30%. This has just introduced more downside risk in my opinion and a buy case just doesn’t seem feasible here. A hold rating will be my view on WFG right now.

Company Segments

West Fraser has been operating for a long time, founded back in 1955. It has grown into a very diversified wood products company that engages mostly in the manufacturing and selling of lumber. They are heavily dependent on market prices and demand to turn a profit. The prices of lumber have been significantly decreasing over the last few months, resulting in a difficult market for WFG to operate in.

In the line of offerings from WFG, they have lumber from spruce, pine, fir, and southern yellow pine. But also treated wood products, often used for building out porches, and plywood and fiberboard panels used for a variety of different applications.

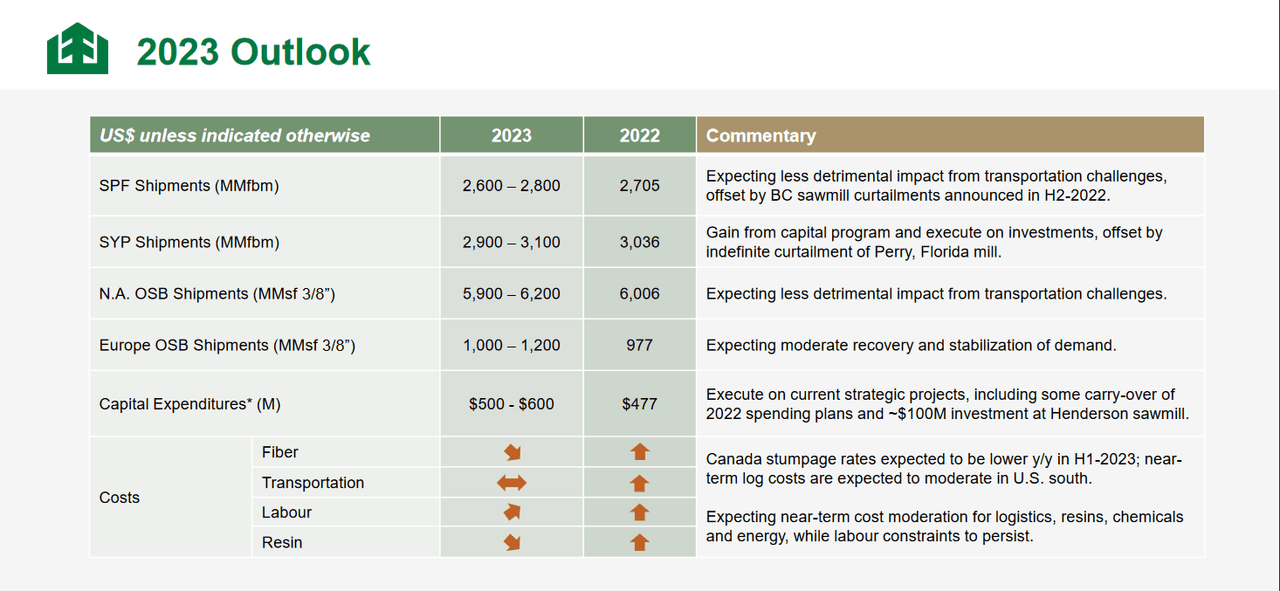

2023 Outlook (Q1 Report)

Looking ahead for the remaining part of 2023 it seems that WFG will continue facing difficulties as prices aren’t seeing any significant catalyst in the near term. Shipments are expected to see some slight growth compared to 2022, but the much less favorable pricing environment will translate to a struggling bottom line in my opinion. It seems that a surge in new home buildings could lead to a better pricing environment.

Markets They Are In

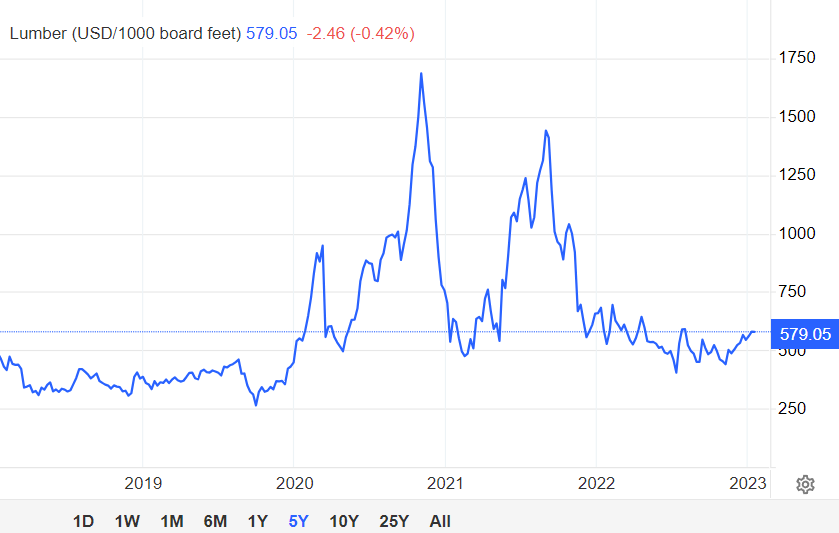

We have established that lumber prices seem to drive a lot of the results for WFG. Below we have a chart showing the price for the last few years, with some very significant spikes in both 2021 and 2022.

Lumber Price (tradingeconomics)

Going forward more activity in the residential construction market could lead to higher prices. But for that to happen more incentives for people to make those investments would be needed. Low-interest rates could make it more appealing to begin homebuilding, which would ultimately translate to more activity in the industry. Historically though, there have been natural events that have pushed up the price of lumber. In 2021 there were significant wildfires that helped push the prices up, but that seems to have been short lived, and relying on events like that to make significant profits isn’t a sound business model.

Upcoming Report

The coming report from WFG is set to be on July 27 disseminating the Q2 2023 results. I think we are likely to see a slight recovery in the bottom line as the price of lumber has been on the rise the last few months, but still, nowhere near where its previous highs were.

Earnings Results (Q1 Report)

The previous report showed that WFG was despite a tougher market climate able to at least maintain margins somewhat, but the adjusted EBITDA margin didn’t shift. The management also noted that they are still in a tough market where they need to perform well to continue to grow. The CEO Ray Ferris said the following, “As in the prior quarter, the product and geographic diversification of our European Engineered Wood Panels and Pulp & Paper segments provided positive EBITDA contributions that helped to offset some of the weakness in North American residential construction markets”. This highlights the importance that foreign markets are to WFG. When slowing demand is shown in the US, they have to rely on stronger volumes in Europe instead. But I don’t think that back and forth can always be counted on and eventually slowing demand might happen in both. This is where the risks come in when looking at WFG:

Risks

Lumber companies are currently facing a complex outlook characterized by various challenges and uncertainties. One of the significant risks they encounter is the impact of inflationary cost pressures. As the global economy recovers, there has been a surge in demand for lumber and other building materials, resulting in higher prices. These inflationary pressures can put strains on the profitability of lumber companies, affecting their margins and overall financial performance.

Another critical concern for lumber companies is labor constraints. The industry heavily relies on skilled labor for logging, sawmilling, and other essential operations. However, finding qualified workers has become more challenging in recent times, leading to potential delays in production and increased labor costs. The shortage of labor may also impact supply chains and overall efficiency within the industry.

Final Words

WFG sits in a tough position right now I think. It doesn’t present any catalyst that would ensure investors that the bottom line will see significant improvements in the coming quarters. The lumber prices are unfavorable and with lower demand in the North American market, the company will most likely continue to struggle. Besides, the earnings estimates aren’t sure enough in my opinion that we will see a reasonable valuation in 2023 or 2024. For 2024 the EPS is at $5.19, which would give it a multiple of 17. For me, the forest products industry should always be valued at a lower multiple given the lack of catalyst or significant growth they offer. They are a reliable industry where companies pass on profits to shareholders. But a 17x p/e is above where I would be comfortable paying for such a company. Instead, a multiple around 12 – 13 is far more fair. That leaves some downside risk with WFG right now that suppresses a buy thesis in my opinion. Rather, WFG makes more sense as a hold here.