José Antonio Luque Olmedo/iStock via Getty Images

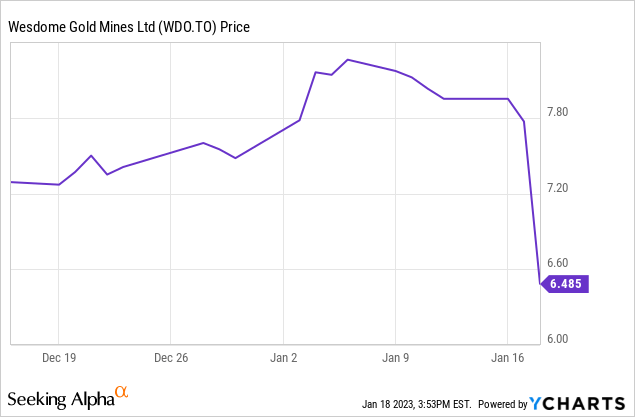

Wesdome Gold (OTCQX:WDOFF) released Q4 production results and its 2023 guidance on January 18 and the market casted its verdict in no uncertain terms. For readers wondering if this was a buying opportunity for this (former) market darling: we submit it is not.

But let’s take a step back and remember how we got here.

For the better part of the past three years, Wesdome’s storyline has revolved around bringing the Kiena mine back into production and exploiting the newly discovered high-grade A-Zone resource at this site. This restart was going to be funded internally from cash flow stemming from the company’s producing Eagle mine, where operations had been steadily improving since the appointment of Mr. Middlemiss as the CEO back in 2016.

Market confidence increased as milestone after milestone was hit, driving the share price to tickle the C$15 line on two occasions. The confidence (if not the exuberance) appeared justified as the company executed on its plan with remarkable precision and reliability, right until the home stretch. Unfortunately, first cracks started to show late last year, and with the latest news release, these cracks have deepened. Management had reassured markets when third quarter results fell short, promising to hit the already revised guidance with an outsized fourth quarter. To quote from the Q3 earnings call:

As implied by our guidance, we are expecting a big fourth quarter.

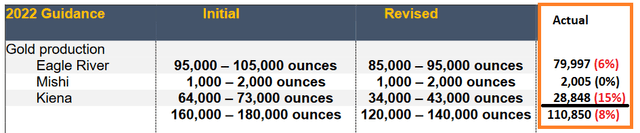

Not to happen, as it turned out. The January 18 news release confirmed what we had already foreshadowed for our subscribers: Wesdome’s production has fallen short of its revised guidance (see orange box below, percentage refers to the lower end of the guided range).

Guidance miss in numbers (company filings, author’s work)

The guidance miss at the Eagle mine was caused by the nuggety nature of the ore at the Falcon zone, and the associated difficulties in estimating the reserve and head grades. The detrimental effects of these difficulties had been mounting for most of 2023, and a promising uptick in grades during Q4 was not enough to compensate for the earlier quarters. And we don’t blame Wesdome for not trying: the company even forwent blending low-grade stockpiled ore from the Mishi pit providing an additional grade kicker.

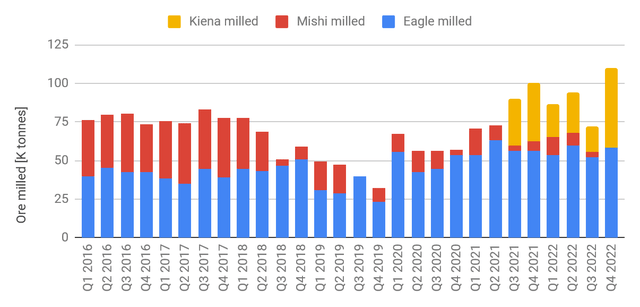

Mill performance (company filings, author’s database)

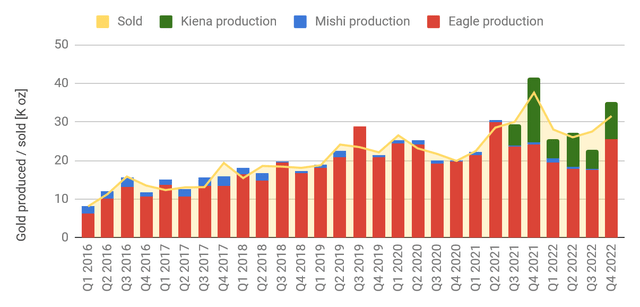

Throughput at the Eagle mine was close to the 650tpd nameplate capacity, and combined with better-than-recent grades, Q4 production at Eagle ranks as an all-time third according to our database (red bars in the chart below).

Gold output (company filings, author’s database)

Record throughput at Kiena only transformed into 9,614 ounces of gold production thanks to low grades from the currently available S-50, VC, and Martin Zones. Access to mining faces in the newly discovered A-Zone, the actual reason for re-opening the mine, has been hampered by delays in bringing the paste fill plant online. As a knock-on effect, ramp construction into the deeper and high-grade portions of this A-Zone has been hamstrung and investors will have to wait until early 2024 for the high-grade ore to reach the mill.

In fact, Q4 looks like one of the best quarters in the company’s recent history, but it would have needed a blow-out record quarter to meet guidance. Hindsight is most often 20/20, but promising such a blow-out record was perhaps not the wisest thing to do on the Q3 earnings call.

Looking Forward

Mr. Middlemiss has termed the current year a “consolidation year for the company” as 2022 experiences should allow for a better production forecast at Eagle River in general, and the Falcon zone in particular. And over at the Kiena mine, this year will be marked by mine development, with a goal of opening up the A-Zone by year’s end. In the meantime, the mill will be fed with low-grade ore from the mentioned available zones. Kiena will most likely remain free-cash-flow negative in 2023 as a result, and any free cash flow generated at Eagle River will be directed towards Kiena. However, we are doubtful about Eagle River being able to fully carry Kiena through this year and we expect some funding needs to be met by other sources.

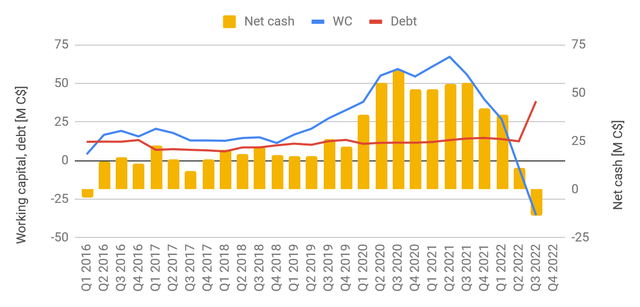

Management seems to entertain similar concerns. At the end of Q3 Wesdome’s balance had deteriorated sufficiently for management to put in place measures to ensure liquidity. An at-the-market equity program was established allowing the company to sell up to $100M common shares from treasury, and the revolving credit facility was expanded to $150M of which $40M had been drawn as of November 9 2022. These initiatives will most likely suffice to fund the remaining $45M in capex spending earmarked for 2023, and they will also provide working capital if needed as Wesdome completes the ramp into the guts of the A-Zone over the course of the year.

Balance sheet (company filings, author’s database)

Summary and Investment Thesis

Wesdome Gold has come agonizingly close to completing its ambitious plan to fund the Kiena restart organically, but has fallen flat on the home stretch — close, but unfortunately no cigar.

The balance sheet has suffered and the company has ensured liquidity by expanding its credit facility and by implementing an at-the-market program. The latter is likely to weigh on the share price, as will servicing the former.

Investors have been burned, and we suspect it will take time for market confidence to rebuild.

We see a difficult year ahead for Wesdome Gold. Investors had expected to benefit from the Kiena mine by now, yet they have just been asked to wait for at least another year. And once the Kiena mine finally reaches its potential, debt service will take priority over shareholder benefits. The share price will most likely reflect this situation, and the ATM program will be at the back of minds should it rally anyway.

We had been looking for an entry of late, but given this difficult year ahead we have decided to stay on the sidelines. The share price will most likely remain under pressure for the foreseeable future; and any further mishap will be punished by an already frustrated market. We expect better potential entry points as the year unfolds.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.