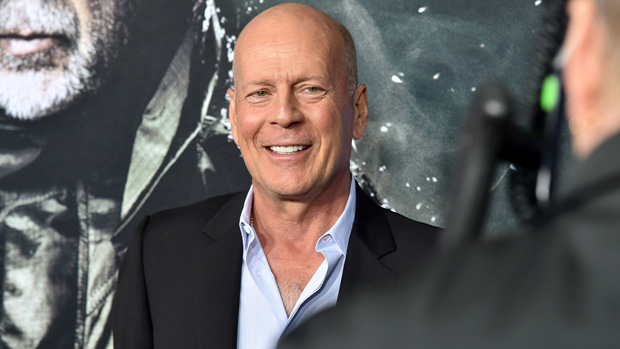

Single-family properties in a residential neighborhood in San Marcos, Texas.

Jordan Vonderhaar | Bloomberg | Getty Photos

After flatlining the week earlier than, mortgage demand rose final week, regardless of mortgage charges rising for the fourth straight week. Complete utility quantity climbed 1.7% in contrast with the earlier week, in response to the Mortgage Bankers Affiliation’s seasonally adjusted index.

The typical contract rate of interest for 30-year fixed-rate mortgages with conforming mortgage balances ($766,550 or much less) elevated to six.90% from 6.86%, with factors rising to 0.70 from 0.60 (together with the origination payment) for loans with a 20% down cost. That was the best degree since July.

Purposes for a mortgage to buy a house rose 2% for the week however had been 1% decrease than the identical week one 12 months in the past. Buy demand was pushed by typical and FHA loans, with FHA buy functions seeing a 7% enhance.

“For-sale stock has loosened in some markets and a few potential consumers have been in a position to reap the benefits of rising provide and decrease FHA charges which had been down barely compared to the conforming 30-year fastened price,” mentioned Joel Kan, an MBA economist, in a launch.

Purposes to refinance a house mortgage rose 2% for the week and had been 43% greater than the identical week one 12 months in the past. Demand was pushed by a ten% enhance in VA functions.

Mortgage charges are about flat to date this week, in response to a separate survey from Mortgage Information Day by day. They moved greater Monday however then fell Tuesday on information that the U.S. licensed Ukraine to make use of long-range missiles to assault Russia, which then formally modified its doctrine on the usage of nuclear weapons. Bond yields dipped in a so-called flight to security by traders.

“The advance in mortgage charges was wholly underwhelming relative to the information headlines — possible as a result of it’s miles from the primary such risk from Russia, or as a result of merchants are skeptical that anybody desires to push any of the pink buttons on the ‘mutually assured destruction’ machine,” wrote Matthew Graham, chief working officer at Mortgage Information Day by day.