tdub303/E+ through Getty Photos

Writer’s be aware: This text was launched to CEF/ETF Earnings Laboratory members on June twenty first, 2022. Please examine newest information earlier than investing.

The Weekly Closed-Finish Fund Roundup can be put out at the beginning of every week to summarize latest value actions in closed-end fund [CEF] sectors within the final week, in addition to to spotlight lately concluded or upcoming company actions on CEFs, corresponding to tender provides. Knowledge is taken from the shut of Friday, June tenth, 2022.

Weekly efficiency roundup

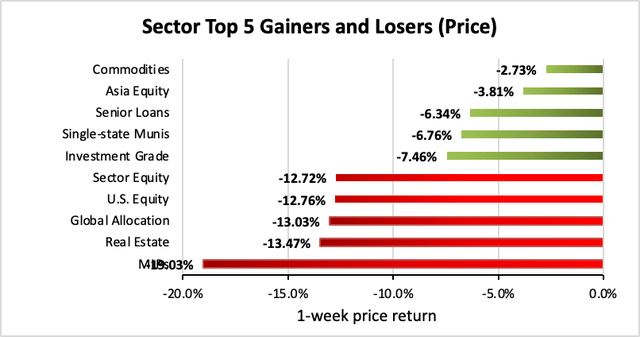

The bear market has arrived! 0 out of 23 sectors had been constructive on value (down from 1 final week) and the typical value return was -9.59% (down from -2.13% final week). The lead gainer was Commodities (-2.73%) whereas MLPs lagged (-19.03%).

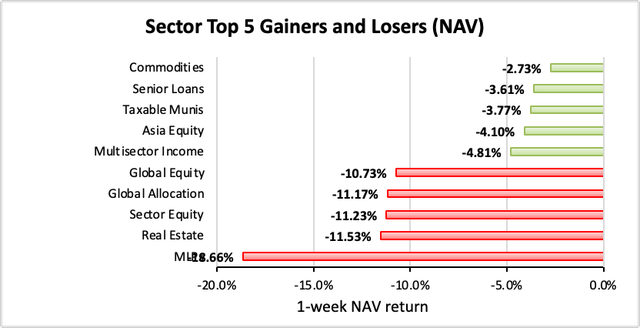

0 out of 23 sectors had been constructive on NAV (identical as final week), whereas the typical NAV return was -9.59% (down from -2.32% final week). The highest sector by NAV was Commodities (-2.73%) whereas the weakest sector by NAV was MLPs (-18.66%).

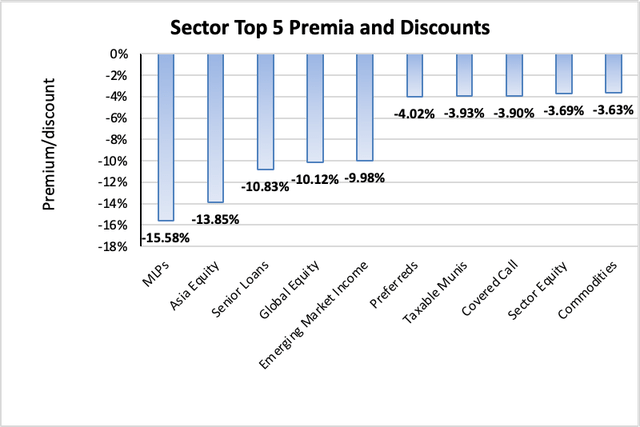

The sector with the best premium was Commodities (-3.63%), whereas the sector with the widest low cost is MLPs (-15.58%). The typical sector low cost is -7.53% (down from -4.94% final week).

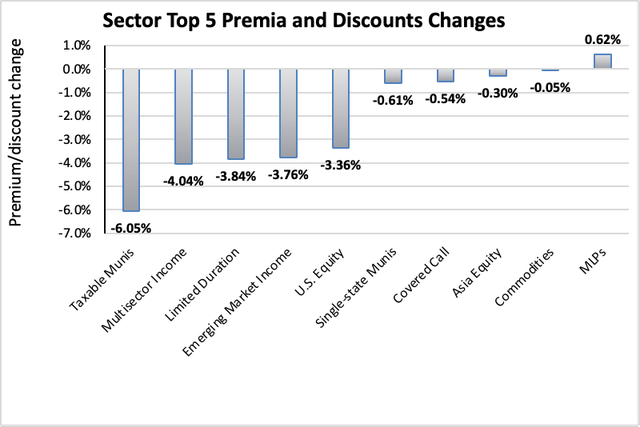

The sector with the best premium/low cost enhance was MLPs (+0.62%), whereas Taxable Munis (-6.05%) confirmed the bottom premium/low cost decline. The typical change in premium/low cost was -1.92% (down from +0.67% final week).

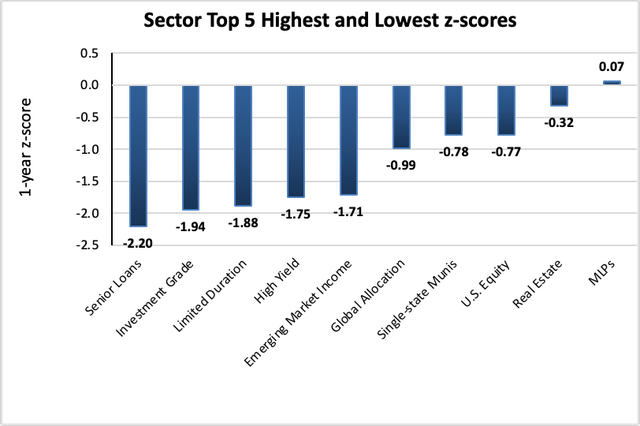

The sector with the best common 1-year z-score is MLPs (+0.07), whereas the sector with the bottom common 1-year z-score is Senior Loans (-2.20). The typical z-score is -1.25 (down from -0.38 final week).

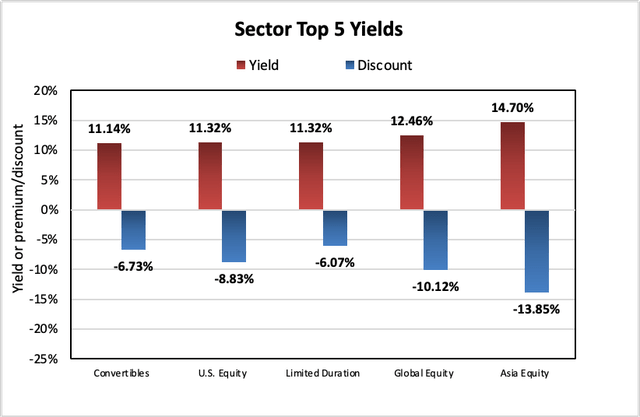

The sectors with the best yields are Asia Fairness (14.70%), World Fairness (12.46%), and Restricted Period (11.32%). Reductions are included for comparability. The typical sector yield is +8.84% (up from +8.13% final week).

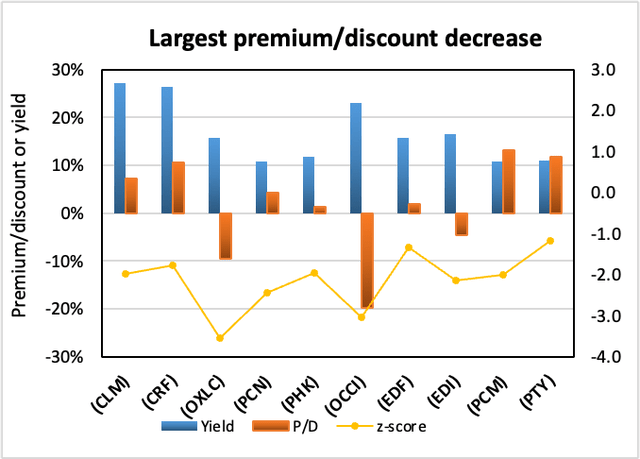

Particular person CEFs which have undergone a big lower in premium/low cost worth over the previous week, coupled optionally with an rising NAV pattern, a detrimental z-score, and/or are buying and selling at a reduction, are potential purchase candidates.

| Fund | Ticker | P/D lower | Yield | P/D | z-score | Value change | NAV change |

| Cornerstone Strategic Worth | (CLM) | -24.34% | 27.09% | 7.23% | -2.0 | -23.71% | -6.39% |

| Cornerstone Whole Return Fund | (CRF) | -21.59% | 26.44% | 10.69% | -1.8 | -22.54% | -7.42% |

| Oxford Lane Capital Corp | (OXLC) | -16.36% | 15.73% | -9.54% | -3.5 | -15.26% | 0.00% |

| PIMCO Company & Earnings Strgy | (PCN) | -12.12% | 10.90% | 4.38% | -2.5 | -15.60% | -5.95% |

| PIMCO Excessive Earnings | (PHK) | -11.46% | 11.76% | 1.24% | -2.0 | -15.08% | -5.47% |

| OFS Credit score Firm Inc | (OCCI) | -11.24% | 23.01% | -19.85% | -3.0 | -16.51% | 0.00% |

| Virtus Stone Harbor Rising Markets Inc | (EDF) | -11.21% | 15.69% | 2.00% | -1.3 | -20.03% | -10.85% |

| Virtus Stone Harbor Emg Mkts Whole Inc | (EDI) | -9.81% | 16.47% | -4.49% | -2.1 | -19.30% | -10.67% |

| PCM Fund | (PCM) | -9.45% | 10.90% | 13.17% | -2.0 | -12.65% | -5.71% |

| PIMCO Company & Earnings Alternative Fd | (PTY) | -8.97% | 11.03% | 11.75% | -1.2 | -13.63% | -6.69% |

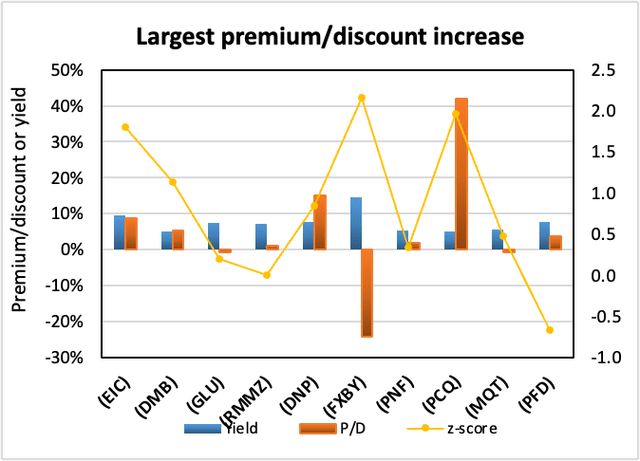

Conversely, particular person CEFs which have undergone a big enhance in premium/low cost worth up to now week, coupled optionally with a reducing NAV pattern, a constructive z-score, and/or are buying and selling at a premium, are potential promote candidates.

| Fund | Ticker | P/D enhance | Yield | P/D | z-score | Value change | NAV change |

| Eagle Level Earnings Co Inc | (EIC) | 15.06% | 9.46% | 8.79% | 1.8 | 5.04% | -9.75% |

| BNY Mellon Muni Bond Infrastructure Fund | (DMB) | 11.09% | 5.00% | 5.39% | 1.1 | 5.21% | -5.85% |

| Gabelli World Utility & Earnings | (GLU) | 9.33% | 7.49% | -0.74% | 0.2 | -6.32% | -15.10% |

| RiverNorth Handle Dur Muni Inc Fd II Inc | (RMMZ) | 8.13% | 7.18% | 1.04% | 0.0 | -0.40% | -8.83% |

| DNP Choose Earnings | (DNP) | 7.93% | 7.65% | 15.18% | 0.9 | -8.53% | -13.98% |

| FOXBY CORP | (OTCPK:FXBY) | 7.80% | 14.55% | -24.24% | 2.2 | -1.08% | -11.25% |

| PIMCO NY Municipal Earnings | (PNF) | 6.99% | 5.44% | 1.98% | 0.3 | -2.42% | -9.10% |

| PIMCO CA Municipal Earnings | (PCQ) | 6.90% | 5.19% | 42.06% | 2.0 | -3.90% | -8.56% |

| BlackRock Muniyield High quality II | (MQT) | 5.43% | 5.64% | -0.78% | 0.5 | -1.37% | -6.77% |

| Flaherty & Crumrine Most well-liked Earnings | (PFD) | 5.24% | 7.66% | 3.80% | -0.7 | -0.65% | -5.65% |

Latest company actions

These are from the previous month. Any new information up to now week has a bolded date:

June 13, 2022 | Cornerstone Strategic Worth Fund, Inc. Publicizes Completion Of Rights Providing.

June 13, 2022 | Cornerstone Whole Return Fund, Inc. Publicizes Completion Of Rights Providing.

June 6, 2022 | Nuveen Municipal Closed-Finish Funds Announce Completion of Reorganization.

Might 24, 2022 | NEUBERGER BERMAN HIGH YIELD STRATEGIES FUND ANNOUNCES FINAL RESULTS OF RIGHTS OFFERING.

Upcoming company actions

These are from the previous month. Any new information up to now week has a bolded date:

Might 2, 2022 | Gabelli World Utility & Earnings Belief Publicizes Rights Providing for Widespread Shares Document Date and Abstract of Phrases.

Latest activist or different CEF information

These are from the previous month. Any new information up to now week has a bolded date:

————————————

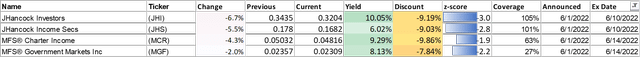

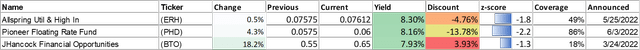

Distribution adjustments introduced this month

These are sorted in ascending order of distribution change proportion. Funds with distribution adjustments introduced this month are included. Any distribution declarations made this week are in daring. I’ve additionally added month-to-month/quarterly data in addition to yield, protection (after the increase/lower), low cost and 1-year z-score data. I’ve separated the funds into two sub-categories, cutters and boosters.

Cutters

Boosters

Technique assertion

Our purpose on the CEF/ETF Earnings Laboratory is to present constant earnings with enhanced whole returns. We obtain this by:

- (1) Figuring out probably the most worthwhile CEF and ETF alternatives.

- (2) Avoiding mismanaged or overpriced funds that may sink your portfolio.

- (3) Using our distinctive CEF rotation technique to “double compound“ your earnings.

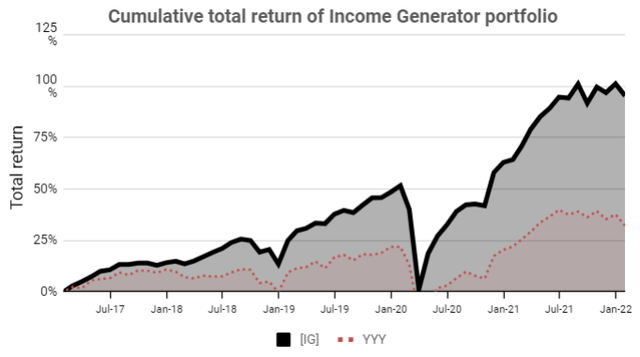

It is the mixture of those components that has allowed our Earnings Generator portfolio to massively outperform our fund-of-CEFs benchmark ETF (YYY) while offering rising earnings, too (approx. 10% CAGR).

Earnings Lab

Bear in mind, it is very easy to place collectively a high-yielding CEF portfolio, however to take action profitably is one other matter!