Fly View Productions

One of many issues that I like most about analyzing corporations is having the ability to improve them. With only a few exceptions, there aren’t any corporations that I do not wish to see succeed. One enterprise that I really feel that is getting near deserving of an improve is Webster Monetary Company (NYSE:WBS). You see, again in late January of this 12 months, I downgraded the agency from a “purchase” to a “maintain.” This downgrade got here after shares spiked 41% since my preliminary ranking on the corporate. For context, the S&P 500 rose by solely 10.8% over that very same window of time. However after such a transfer increased, shares didn’t appear to supply a lot in the way in which of appreciation.

Since that point, the inventory truly carried out worse than I anticipated. Whereas the S&P 500 is up one other 12.5%, shares of Webster Monetary have plunged 6.3%. This drop was possible pushed by a few components. For starters, when administration introduced monetary outcomes masking the primary quarter of the 2024 fiscal 12 months, they revealed deposits that have been a bit decrease than they have been the prior quarter. Along with this, a contraction of the corporate’s web curiosity margin introduced web curiosity revenue and web income down 12 months over 12 months. That is a part of the explanation why, regardless of shares getting cheaper, I am not able to improve the agency simply but, though shares are cheaper than many comparable establishments.

Assessing the ache

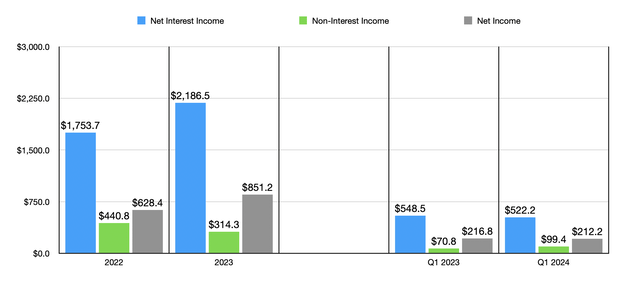

Once I final wrote about Webster Monetary in January, we had information masking via the top of 2023. However now, outcomes lengthen via the primary quarter of this 12 months. Due to this, my emphasis on the corporate and its monetary situation will focus on first quarter figures. Throughout that point, web curiosity revenue for the establishment got here in a bit weak, totaling $522.2 million in comparison with the $548.5 million reported one 12 months earlier. The massive driver behind this was a decline within the agency’s web curiosity margin from 3.66% to three.35%. Why all the businesses benefited from an increase within the efficient rate of interest on its curiosity incomes property, that enhance was solely from 5.08% to five.59%. By comparability, the weighted common rate of interest on its interest-bearing liabilities popped up from 1.52% to 2.39%. This was largely the results of the financial institution being pressured to extend how a lot it pays depositors from 1.11% on an annualized foundation to 2.23%.

Creator – SEC EDGAR Knowledge

Whereas web curiosity revenue suffered, the agency did profit when it got here to non-interest revenue. Though there have been different components as properly, this enchancment from $70.8 million to $99.4 million was largely the results of a decline in losses on funding securities from $16.7 million final 12 months to $9.8 million this 12 months, and from a surge in different revenue from $5.8 million to simply shy of $33 million. The opposite revenue enhance was largely pushed by an $11.7 million web acquire on the sale of mortgage servicing rights, in addition to different issues like extra proceeds from financial institution owned life insurance coverage insurance policies, increased revenue from rate of interest by-product actions, and an increase in payment revenue related to its acquisition of Ametros earlier this 12 months. For context, that enterprise introduced with it 24,000 members and $804 million in property beneath custody.

Creator – SEC EDGAR Knowledge

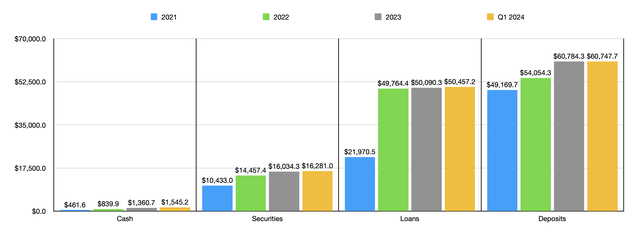

Regardless of the development in non-interest revenue, web income nonetheless managed to fall from $216.8 million to $212.2 million. This wasn’t the one weak spot for the corporate. The worth of deposits as of the top of the newest quarter got here in at $60.75 billion. That is a slight lower from the $60.78 billion reported on the finish of 2023. Happily, that is nonetheless properly above the $54.05 billion that the corporate reported for 2022. As deposits fell, the worth of loans on the corporate’s books inched up, rising from $50.09 billion to $50.46 billion. The worth of securities, in the meantime, managed to rise from $16.03 billion on the finish of 2023 to $16.28 billion within the first quarter of this 12 months.

Creator – SEC EDGAR Knowledge

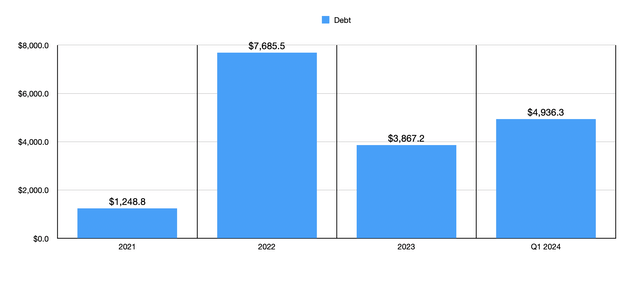

There are different metrics that traders ought to be listening to as properly. For instance, we’d like solely have a look at money on the corporate’s steadiness sheet. Money and money equivalents got here in at $1.55 billion in the newest quarter. Sadly, that is down considerably from the $1.72 billion reported one quarter earlier. This comes at a time when debt elevated from $3.87 billion to $4.94 billion. Happily, that debt determine continues to be beneath the $9.94 billion that debt peaked at in the course of the first quarter of 2023. That point corresponded with the banking disaster that riled the economic system. Many establishments within the banking sector purposely elevated their debt balances with a view to be sure that they’d loads of money available. Webster Monetary was no exception to this.

Creator – SEC EDGAR Knowledge

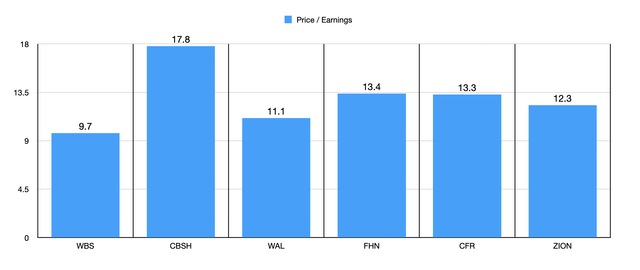

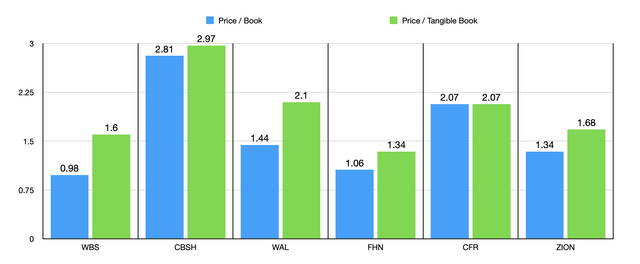

On the subject of valuing the corporate, I am happy to say that the inventory does now look attractively priced. Utilizing 2023 web income, we find yourself with a value to earnings a number of of 9.7. That is down from the ten.3 that the corporate was buying and selling at after I downgraded it earlier this 12 months. Within the chart above, you may see how this stacks up towards 5 related corporations. Once I wrote concerning the firm earlier this 12 months, 4 of the 5 I in contrast it to have been buying and selling at multiples decrease than it was. Now, Webster Monetary is the most affordable of the six corporations. Within the subsequent chart beneath, I did the identical factor utilizing each the value to ebook a number of and the value to tangible ebook a number of of all corporations. From a value to ebook perspective, shares are the most affordable of the group. And in relation to the value to tangible ebook method, solely one of many 5 corporations is cheaper than it’s. This compares to 2 of the 5 on a value to ebook foundation and three of the 5 on a value to tangible ebook foundation after I final wrote concerning the firm in January.

Creator – SEC EDGAR Knowledge

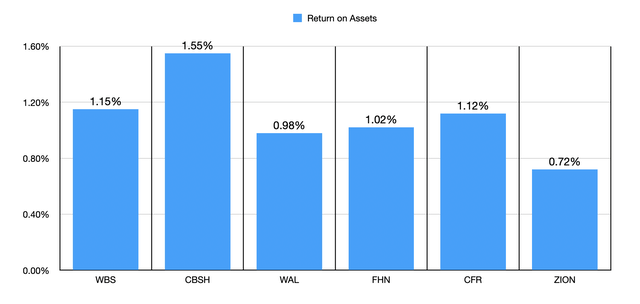

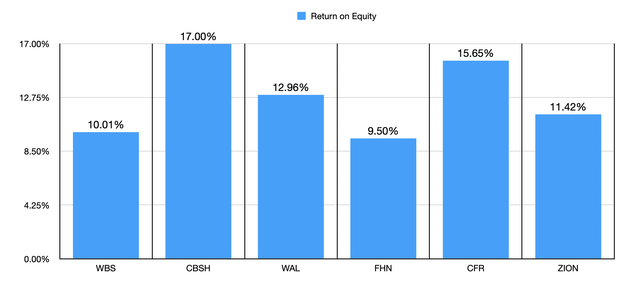

On the subject of asset high quality, the image is reasonably blended. Within the first chart beneath, you may see the return on property for our candidate, in addition to for the 5 corporations I’m evaluating it to. 4 of the 5 rank decrease than Webster Monetary’s 1.15% studying. However within the subsequent chart, you may see the return on fairness for every of the companies. With a studying of 10.01%, Webster Monetary ended up being decrease than all however one of many 5 corporations. This does create a reasonably blended image. However to me, how low-cost shares are is extra vital right now.

Creator – SEC EDGAR Knowledge

Creator – SEC EDGAR Knowledge

Takeaway

Basically talking, Webster Monetary won’t be doing the perfect. Income and income are falling. There was some contraction in deposits, loans, and money. Debt has additionally risen. Nonetheless, the corporate appears to be the next high quality prospect on a return on asset foundation. Shares are additionally comparatively low-cost utilizing every of the three metrics on this article. It is also value noting that uninsured deposit publicity is a bit increased than I would love it to be at 34.1%. That compares to the 30% most threshold that I usually favor. All mixed, this paints an image to me of a agency that is not but prepared for an improve, however that would warrant one if shares proceed to say no.