Do you remember your first time using the internet?

The big bulky “box” on your desk that made that sound I’ll never forget when it was connecting. (Here it is if you want to step back in time for a second.)

All of a sudden, the world was online and at your fingertips.

It changed everything.

Web 1.0 in the mid-1990s brought us web browsers like Netscape on those giant brick-like computers… Web 2.0 in the 2000s gave us blogging, Twitter and YouTube.

Now we’re entering a new era.

Web 3.0 (or Web3): A more “decentralized” version of the internet that wouldn’t be controlled by Big Tech companies like Facebook and Google.

(AKA: The companies you give your personal information to.)

Instead, Web 3.0 will be backed by blockchain technology, the building blocks of cryptocurrency.

This is what will make it decentralized, and why the idea of Web3 is so tightly linked to crypto.

Even the term “Web3” was coined by a co-founder of Ethereum (ETH), Gavin Wood. But that’s not the only connection Ethereum has to the Web3 project.

In today’s video, we break down what this new version of the internet may have in store…

And the #1 way to invest in a Web 3.0 future:

(Or read the transcript here.)

Hot Topics in Today’s Video:

- Reader Question: “Are there any publicly traded companies focused on fusion-generated energy?” [1:00]

- Market News: The S&P 500’s first 100 days of trading bodes very well for its stocks this year. (Plus, more on the debt ceiling debacle, and three key economic releases for this week.) [3:25]

- World of Crypto: Bitcoin’s biggest conference of the year just finished in Miami. (And signups have already started for bitcoin2024 in Nashville.) How bitcoin is becoming more “Ethereum-like.” [11:10]

- Mega Trend: We’re entering a new era of the internet: from Web 2.0 to Web 3.0. Here’s the latest in Web3 developments. [14:35]

- Investing Opportunity: Why these three cryptos are paving the way for Web3 (and why you should invest in them). [21:00]

- To find out more about why crypto is at a turning point in its evolution, check out my free webinar here!

Survey Results: Spot the AI

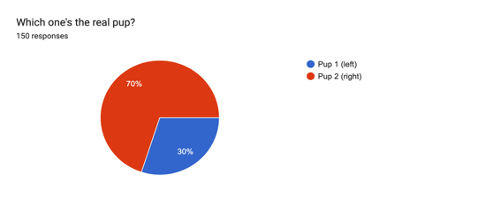

We asked you if you could tell us which pup was real and which one was created by artificial intelligence in this picture:

Without further ado, here are the results!

Most of you got it right! Pup 1 is the AI and pup 2 is the real deal.

If you have any questions about artificial intelligence, cryptos like Ethereum and how to invest in these spaces — let us know at [email protected].

See you soon,

Ian KingEditor, Strategic Fortunes

Ian KingEditor, Strategic Fortunes

I’ll be straight with you.

I have no idea how this debt ceiling fiasco ends.

It will end, of that I’m certain. It’s ridiculous to imagine that the world’s largest economy will simply choose to not pay its debts, devil may care.

But at the same time, it’s not so hard to believe that politics will have us stumble into default, even if it’s a short one.

Think about it.

Speaker of the House Kevin McCarthy has a razor-thin majority in the House of Representatives, and he is not loved by the Democrats … or his own party, for that matter.

It took 15 rounds of voting for him to eventually get the Speaker job. The Democrats have no incentive to do him any favors, and if he loses even five Republican votes, he won’t be able to get approval for any deal he manages to make with President Biden.

If it looks like he’s giving too much away to Biden, he’ll lose the right flank of his party … and likely his job as Speaker of the House.

So essentially, he’s incentivized (for better or worse) to drive a hard bargain that the Democrats will have a hard time accepting.

Meanwhile, we’re a year away from an election. The Democrats are well aware of this, and of the fact that they can’t be seen as weak.

This is particularly true of Biden. If he makes a deal that involves cutting the funding for the programs he sees as his legacy … he’ll be out of a job in 2024.

All of it comes to this: There is a very real chance that we can end up stumbling into default … due to the pursuit of narrowly self-interested job security.

When Politics Effects Economy

Both Republicans and Democrats are bought and sold by their donors.

Their donors are not going to be happy if we default (or even nearly do). Because a default will, of course, cause market volatility.

Our elected leaders are idiots, but they are smart enough to know who pays them. So while I don’t think a default is likely, it is possible. We need to prepare for that possibility.

I wouldn’t recommend selling everything and going into “bunker mode” with your rations. But I think it makes sense to keep a little extra cash on hand, and perhaps, to unwind lower-conviction holdings.

Even if the U.S. doesn’t go into default, this experience should make it abundantly clear that having investments outside of the traditional financial system makes sense.

Ian mentioned that he believes Ethereum, the second-largest crypto, could eventually evolve into the world’s new reserve currency.

In my opinion, investing in crypto is a no-brainer move to make.

Having exposure to precious metals like gold also makes sense. I personally have some gold coins that I keep locked in a bank safe deposit box. It’s not a massive percentage of my portfolio, but it’s big enough to serve its purpose as a hedge.

And finally, owning a little real estate overseas is a good way of getting cash out of the financial system — and into an asset class that has historically beaten inflation. It’s also produced massively on tax-advantaged income.

Yesterday, I sat down with international real estate investor Ronan McMahon. As always, he was full of great investment ideas. His latest is a beachfront community next door to Mexico’s Playa del Carmen.

Watch the episode below!

Regards, Charles SizemoreChief Editor, The Banyan Edge

Charles SizemoreChief Editor, The Banyan Edge