Customers stroll by way of the King of Prussia Mall, as world markets brace for a success to commerce and progress attributable to U.S. President Donald Trump’s determination to impose import tariffs on dozens of nations, in King of Prussia, Pennsylvania, U.S., April 3, 2025.

Rachel Wisniewski | Reuters

America, initially of 2025, is a story of two shoppers.

Decrease-income earners are reining of their transactions to deal with necessities, whereas the rich proceed to spend freely on perks together with eating out and luxurious journey, based on first-quarter outcomes from U.S. bank card lenders.

As nervousness from the opening salvos of President Donald Trump’s commerce insurance policies rippled by way of the nation in current months, traders and economists have questioned whether or not declines in shopper sentiment would spill into the true economic system. There are some early indicators of stress amongst those that are already extra economically susceptible.

For example, at Synchrony, which offers retailer playing cards for retail manufacturers together with Lowe’s and T.J. Maxx, spending fell 4% within the first three months of the yr, the corporate mentioned final week.

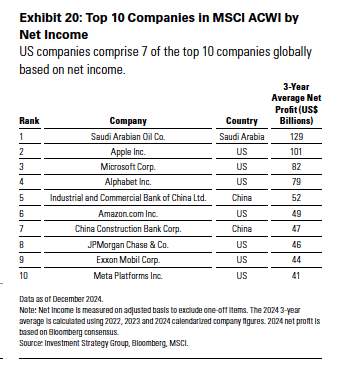

That compares to a 6% spending bounce at American Specific and an analogous rise at JPMorgan Chase, each of which cater to wealthier customers with increased credit score scores than Synchrony. AmEx mentioned its clients spent 7% extra on eating and 11% extra on first-class and enterprise class airfare than a yr earlier.

Whereas the “shopper continues to be in fairly good condition” general, they’re “being selective round how they spend,” Synchrony CEO Brian Doubles instructed analysts on April 22.

Decrease-income card customers specifically “began tapering their spend a few yr in the past,” pulling again on discretionary and large ticket bills as inflation ate into their shopping for energy, Doubles mentioned.

Falling behind

Extra People had been already falling into debt whereas utilizing their bank cards within the fourth quarter. The share of bank card customers making solely minimal month-to-month funds rose to 11.1%, the best stage in 12 years, in accordance Federal Reserve Financial institution of Philadelphia knowledge launched this month.

However to this point, bank card lenders catering to wealthier clients have been insulated from considerations about how tariffs, inflation and a doable recession later this yr might affect shopper spending.

“It is truthful to say that the excessive finish has held up higher, and the low finish has pulled again extra,” Brian Foran, a Truist analyst overlaying banks, mentioned in an e mail. “It has been a typical theme each talking to bank card corporations, and listening to from most of my colleagues overlaying shopper and retail.”

The break up was additionally seen at Citigroup, a serious participant within the credit score trade. Whereas spending within the division that gives playing cards for retailers fell 5% within the quarter, plastic that carries the financial institution’s personal model — a cohort with increased credit score scores — noticed spending rise 3%.

Each Citigroup and Bread Monetary, one other supplier of retailer and co-branded playing cards like Synchrony, mentioned that shopper habits shifted towards necessities and away from journey and leisure on concern that tariffs would increase costs for some items.

The dynamic boosts spending now, but it surely might imply weaker demand sooner or later.

“Customers are shopping for extra electronics, dwelling furnishing, auto components,” Bread CFO Perry Beberman mentioned final week.

Individuals are “attempting to determine, are they nonetheless going to purchase that large TV or are they going to make another selections if inflation comes by way of at a number of the charges they might,” Beberman mentioned. “That is the true wildcard right here.”