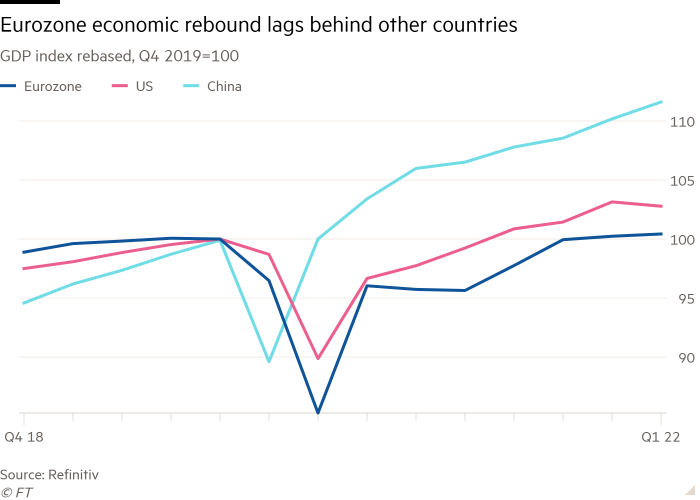

Weaker than anticipated European progress, a stalling US and considerations concerning the Chinese language economic system have raised the prospect of a world downturn pushed by surging inflation and the Ukraine struggle.

New information on Friday confirmed that the Russian invasion is weighing on Europe’s economic system, pushing up vitality and meals costs, worsening provide bottlenecks for producers in addition to sapping enterprise and client confidence.

The disappointing information got here a day after the US introduced that its economic system suffered an sudden 0.4 per cent quarterly contraction, whereas worries concerning the affect of extreme Covid-19 lockdowns in China induced the steepest month-to-month fall within the renminbi on document.

The Chinese language foreign money has fallen 4.2 per cent this month to about Rmb6.6 per greenback, the most important drop for the reason that finish of its US greenback peg, which was in place from 1994 to 2005. The autumn is bigger than a one-off devaluation by the Chinese language central financial institution in 2015 that rattled world markets and a tumble in 2018 throughout the US-China commerce struggle underneath the Trump administration.

Economists stated the mix of weak world progress, hovering commodity costs and a collection of anticipated rate of interest rises by western central banks — together with an unusually giant 0.5 share level hike by the US Federal Reserve that would come subsequent week — would spell bother for the worldwide economic system.

“The world is in actually dangerous form,” stated Erik Nielsen, chief economics adviser at UniCredit. “Notably in Europe, the place we’ve got entered stagflation now.” He predicted that the eurozone was heading for a “double whammy” of an financial downturn and rising borrowing prices because the European Central Financial institution was more likely to increase rates of interest as early as July.

Gross home product within the 19 nations that share the euro grew 0.2 per cent within the first three months of the yr, in contrast with 0.3 per cent within the earlier quarter, Eurostat stated on Friday. Economists polled by Reuters had on common forecast progress within the bloc to stay secure.

France’s economic system stagnated within the first quarter, whereas Italian output contracted. The Spanish economic system additionally misplaced tempo. Germany was the one one of many 4 greatest EU economies to beat expectations, because it posted meagre progress of 0.2 per cent from the earlier three months.

“We’re seeing peak stagflationary fears now and that is giving us a actuality verify on the actual prices of the struggle,” stated Ludovic Subran, chief economist at Allianz, including that he feared a “recessionary tightening” of financial coverage by the ECB within the coming months.

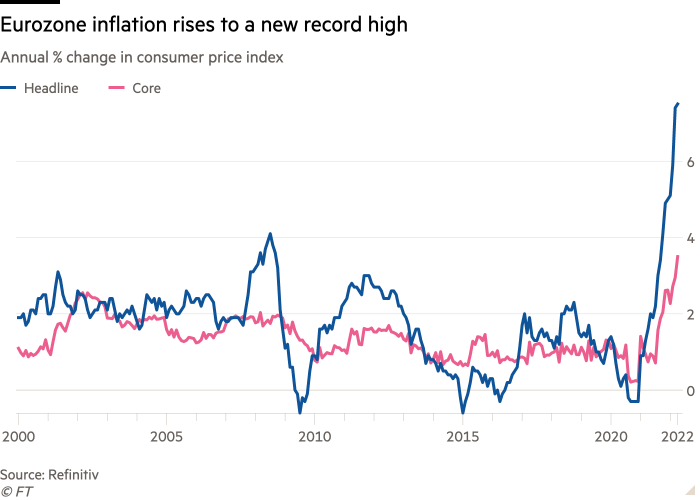

Inflation within the eurozone was 7.5 per cent within the yr to April, up from a document excessive of seven.4 per cent within the earlier month. Power costs rose 38 per cent, whereas unprocessed meals costs jumped 9.2 per cent. Core inflation, excluding vitality and gasoline, elevated to three.5 per cent from 2.9 per cent.

The information present worth pressures persevering with to construct within the eurozone, lifting inflation additional above the ECB’s 2 per cent goal and triggering requires it to speed up the reversal of ultra-loose financial coverage.

“For the ECB, the continued — albeit slowing — financial progress signifies that it’s more likely to act sooner somewhat than later,” stated Bert Colijn, an economist at ING. He forecasted that the central financial institution might increase rates of interest in July if the financial outlook doesn’t worsen, whereas including “that’s an enormous if”.

Philip Lane, chief economist on the ECB, stated on Friday there was “nonetheless quite a lot of momentum within the restoration”. He stated the depreciation of the euro, which this week hit a brand new five-year low towards the greenback, would push up the central financial institution’s subsequent inflation forecasts due in June. “Inflation may be very excessive and that does carry its personal threat of momentum,” he informed Bloomberg.

Russia’s invasion of Ukraine has clouded the outlook for European economies. Economists are involved that an escalation of western sanctions on Moscow dangers resulting in shortages of oil and fuel that might hit business arduous and ship vitality costs even increased, eroding family earnings and additional denting client and enterprise confidence. Russia has already lower off fuel provides to Poland and Bulgaria.

Hovering client costs, continued pandemic restrictions and the fallout from the Ukraine struggle all took their toll on financial exercise within the first three months of this yr. Italy’s economic system was the worst performer, shrinking 0.2 per cent, whereas Spain’s progress slowed essentially the most to 0.3 per cent. The strongest performers have been Portugal and Austria, the place output expanded by 2.6 and a pair of.5 per cent respectively.

Germany’s 0.2 per cent rise in first-quarter GDP marked a rebound from a 0.3 per cent contraction within the earlier quarter, that means Europe’s largest economic system prevented a technical recession, outlined as two consecutive quarters of detrimental progress.