gsheldon

The Hershey Company (NYSE:HSY), together with its subsidiaries, engages in the manufacture and sale of confectionery products and pantry items in the United States and internationally.

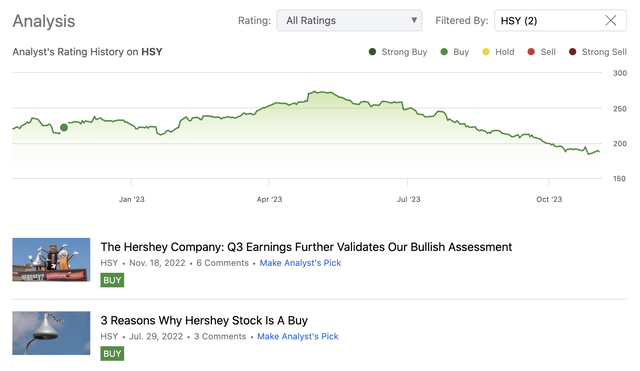

We have started coverage on the firm in mid-2022, with a buy rating, and we have maintained our bullish view up till now. As our last writing about the company has been about a year ago, we decided to revisit the firm to assess whether our previously established arguments for a buy rating are still valid.

Our primary reasons for the buy rating have been:

1.) Strong financial performance in 2022, relatively unaffected by poor consumer sentiment.

2.) Attractive valuation and dividends.

Analysis history (Author)

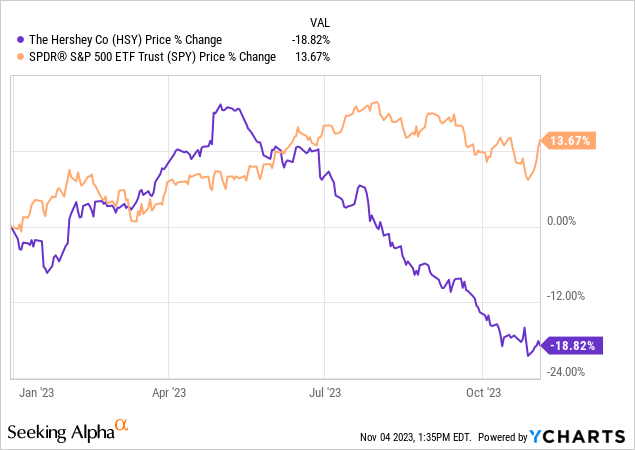

Also, as the firm’s market value has declined substantially year to date, we are going to discuss whether this could be an attractive opportunity to buy the dip.

To start off our discussion, we will first look at HSY’s latest earnings report.

Earnings

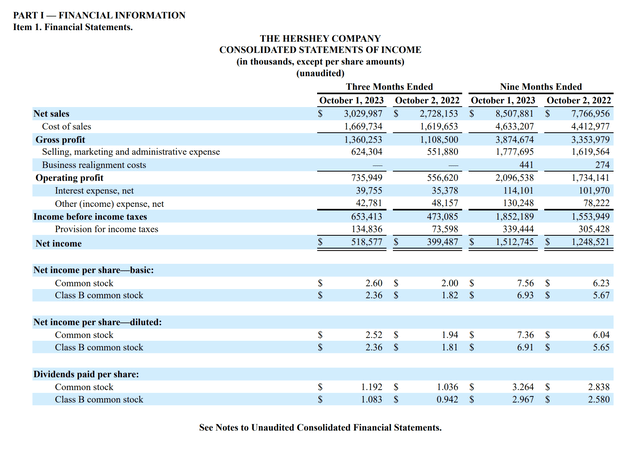

In the third quarter of 2023, HSY has reported net sales of more than $3 billion, representing a more than 11% increase compared to the same period in the prior year. Organic sales growth on a constant currency basis came in at 10.7%. Reported net income has increased by almost 30% year-over-year, reaching as much as $518.6 million.

Revenue

Income statement (HSY)

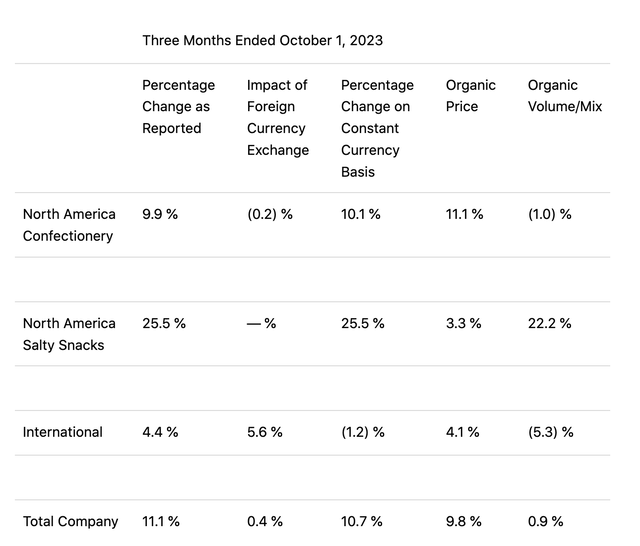

The increase in sales has been driven primarily by price increases, however volume has also contributed.

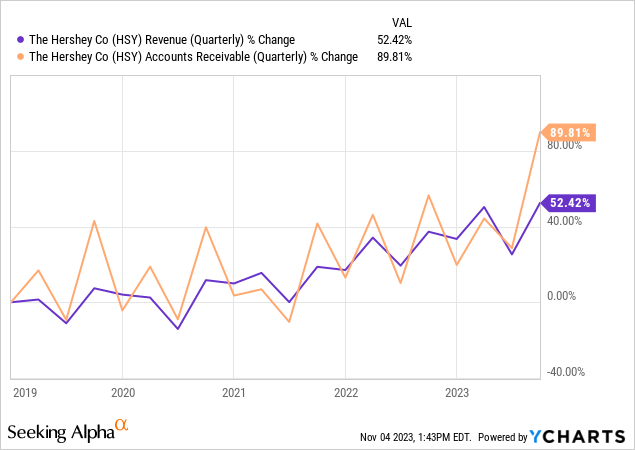

The following chart shows how HSY’s revenue growth has developed over the past five years. We can see that despite the pandemic and the challenging macroeconomic and geopolitical environment, the company has managed to keep the demand high for its products and consistently improve its sales.

We would like to highlight here that although accounts receivable have been historically fluctuating around the revenue figure, in the previous quarter accounts receivable have grown at a much faster than revenue. We think it might be an indication that HSY is potentially inflating its sales figures by pulling demand forward from future periods. It is definitely crucial to keep an eye on this development in the coming quarters. Ideally, we would like to see revenue growth catching up with accounts receivable growth.

Furthermore, we need to highlight that sales have not only increased in North America, but also internationally. Particular attention should be paid to the salty snacks segment, which has had by far the fastest growth.

Sales by segment (HSY)

Looking forward, we believe that the robust revenue growth is important indication that HSY’s customer base shows a high degree of loyalty that enables the firm to successfully expand. This may be an important competitive advantage.

Profitability

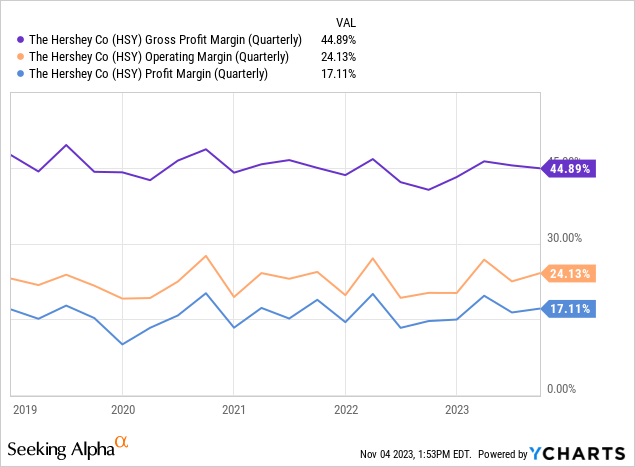

Not only the revenue growth has been impressive, but also the development of the profitability measures year-over-year. The reported growth margin has reached almost 45%, representing a 4.3% expansion compared to the prior year. Price realization and productivity have been the main reasons for the margin expansion, however their positive impacts have been dampened by the elevated commodity, overhead and manufacturing related expenses.

The following chart shows HSY’s profit margins over the past five years. Just as revenue growth has been robust, the profitability of the firm has remained fairly stable, considering the headwinds created by the relatively poor consumer sentiment over the past years.

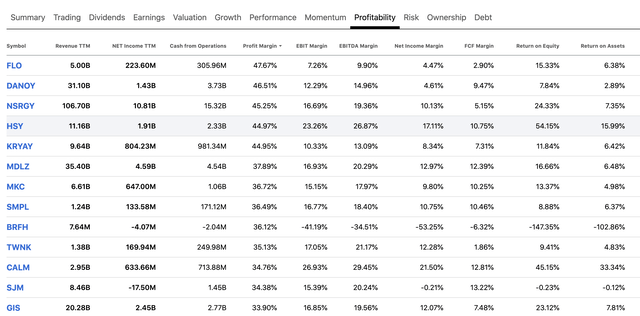

To put these figures into perspective, the following table compares a set of profitability metrics across firms in the Packaged Foods and Meats industry. We can clearly see that across most metrics, HSY ranks very high on the list.

Comparison (Seeking Alpha)

This outstanding profitability combined with stability makes HSY an attractive business, in our opinion.

Outlook

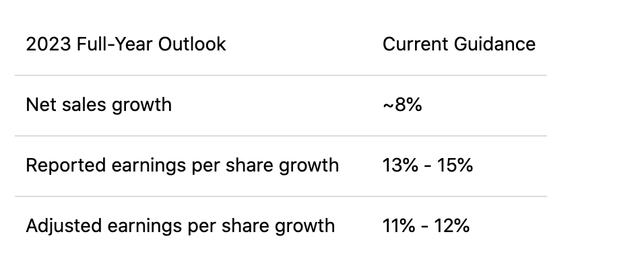

The firm has reiterated its full year outlook for 2023, expecting high single-digit revenue growth and EPS growth in the mid teens.

Guidance (HSY)

All in all, we believe that HSY has once again delivered strong quarterly results, which prove the robustness of the business and the continuing outstanding demand for the firm’s products. Looking forward, despite the challenging macroeconomic environment, we do not see significant headwinds for the company in the near term.

Return to shareholders

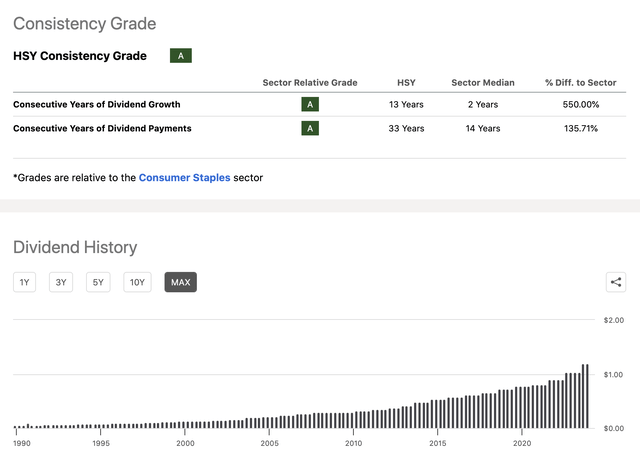

Hershey also remains attractive for dividend and dividend growth investors. The firm has remained committed to paying quarterly dividends, which is currently $1.19 per share, equivalent to an annual yield of roughly 2.5%.

Dividend history (Seeking Alpha)

Note that the firm has been paying dividends in each year of the past 33 years, and they have managed to increase the payments in each of the past 13 years.

The dividends also appear to be safe and sustainable as the cash flow from operations in the previous quarter came in at $516 million, CAPEX was $218 million, so the firm has more than enough to left to spend on dividends, which eventually accounted for $238 million.

HSY has also spend $1.1 million to repurchase stocks, however this amount was relatively negligible compared to the amount of buybacks in the prior quarters.

Valuation

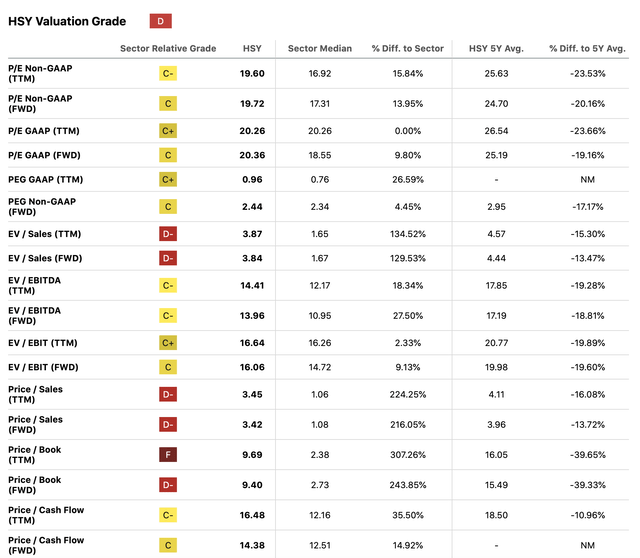

To assess, whether it is worth investing in HSY’s stock now, we have to discuss its valuation. To do so, we will be using a set of traditional multiples to see how the firm’s relative value is compared to its sector, industry and its own 5YR historic averages.

The following table shows the comparison between HSY’s current metrics, the consumer discretionary sector median and the firm’s own historic averages.

Multiples (Seeking Alpha)

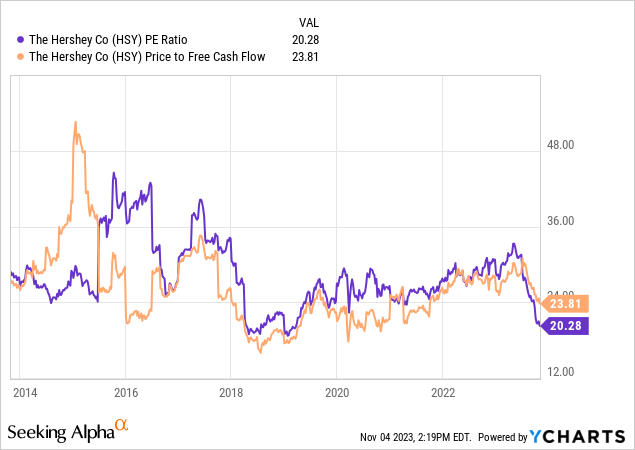

While HSY appears to be trading at a premium compared to the sector median, it is trading at a significant discount compared to its own historic valuation, across all metrics. In general, HSY has been also trading at a premium compared to the sector median. And if we take a look back at the historic valuation of the firm, we can clearly see that the current drop in share price may provide a great opportunity to acquire HSY’s shares at a relatively attractive price level.

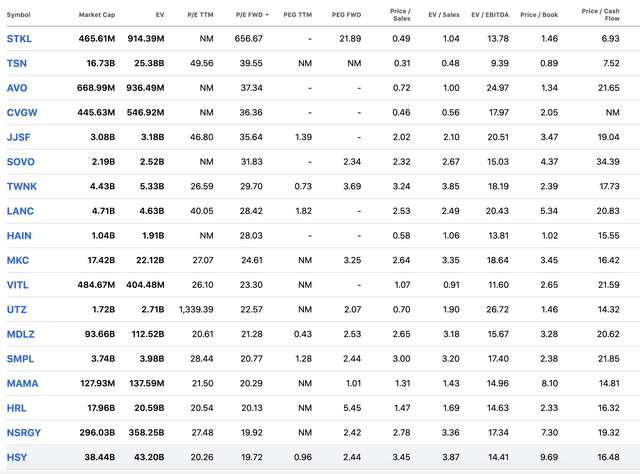

When we narrow the peer group to firms in the Packaged Foods and Meats industry, we can see that HSY’s stock is not priced at a premium at all, according to most metrics.

Comparison (Seeking Alpha)

To sum up

HSY has delivered strong quarterly results with significant increase in sales and EPS. At the same time the firm has managed to improve its profitability compared to the prior quarter.

The firm has remained committed to returning value to its shareholders in the form of dividend payments. These dividends appear to be safe and sustainable, as they are well-covered by the free cash flow.

While the stock still trades at a premium compared to the consumer discretionary sector median, we believe that compared to its industry peers and its own 5YR averages, it is actually attractively priced.

For these reasons, we reiterate our previous bullish rating.