marchmeena29/iStock through Getty Photographs

Past any doubt, some of the iconic manufacturers on the planet is WD-40, which is produced by WD-40 Firm (NASDAQ:WDFC). This product, which serves as a lubricant, rust preventative, penetrant, and moisture displacer, is virtually ubiquitous throughout houses, garages, and companies nationwide. The agency additionally has a rising presence abroad. In latest months, as a result of underperformance on its backside line, mixed with the truth that shares have been already buying and selling at lofty ranges, shares of the enterprise have suffered to a point. There isn’t any denying that that is painful for buyers at the moment. And the very fact of the matter is that, even after factoring in a possible restoration for the enterprise, shares do look quite lofty. However for a way top quality the enterprise is, the corporate would not look to be a very dangerous prospect, nor does it seem to supply important upside. On the finish of the day, it in all probability is only a ‘maintain’ alternative for long-term buyers.

WD-40’s latest efficiency is blended

The final time I wrote about WD-40 Firm was in an article revealed in December of 2021. At the moment, I referred to as the corporate a superb agency for long-term buyers. Having stated that, I acknowledged that shares have been extremely expensive and there was a considerable threat of underperformance relative to the marketplace for an prolonged time period due to the multiples shares are buying and selling at. I have a tendency to put a excessive worth on high quality firms with important model enchantment and which have demonstrated sturdy efficiency over an prolonged time period. This led me to price the corporate a ‘maintain’ at the moment. Sadly, since then, shares of the enterprise haven’t carried out notably properly. Even because the S&P 500 has generated a lack of 1%, shares of WD-40 Firm have resulted in a decline of 24.5%.

The issue right here stems from the truth that expensive firms can drop in worth even when basic efficiency is appropriate. In some methods, efficiency for WD-40 Firm since publication of that article has been fairly constructive, whereas different efficiency has been disappointing. On the constructive aspect, as an example, we want solely take a look at income. For the primary quarter of the corporate’s 2022 fiscal 12 months, the one quarter for which information is now out there that was not out there once I final wrote concerning the agency, the enterprise generated income of $134.75 million. That represents a rise of 8.2% over the $124.56 million generated one 12 months earlier.

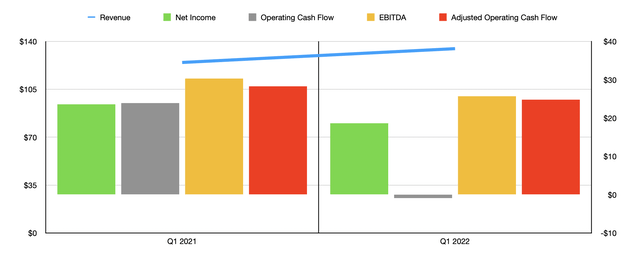

Creator – SEC EDGAR Knowledge

Throughout this era, the corporate noticed notably enticing progress within the Asia-Pacific area. Gross sales there surged by 33.8%, taking the corporate’s publicity to the area up from 12% a 12 months earlier to fifteen% now. By comparability, extra established markets just like the Americas and the EMEA (Europe, Center East, and Africa), reported smaller will increase of simply 3.9% and 5.1%, respectively. It is also price noting that for the whole 2022 fiscal 12 months, administration does have excessive expectations for the corporate. They at present anticipate income of between $522 million and $547 million. On the midpoint, this means a year-over-year progress price of 9.5%.

Though income progress for the corporate stays strong, the identical can’t be stated of profitability. Web revenue within the first quarter of the 12 months got here in at $18.56 million. That is down from the $23.62 million the corporate generated within the first quarter of its 2021 fiscal 12 months. This was not the one profitability metric that suffered. Working money stream dropped from $23.92 million to damaging $0.95 million, whereas this determine, if we exclude adjustments in working capital, would have declined from $28.35 million to $24.75 million. And at last, EBITDA for the enterprise dropped from $30.27 million to $25.72 million. These declines for the corporate don’t look good when you think about that income elevated for 4 of the previous 5 years, whereas money flows and EBITDA adopted swimsuit.

In response to administration, the corporate has skilled ache related to provide chain points and inflation. So despite the fact that gross sales are rising, the agency is experiencing margin contraction. The excellent news is that administration expects this to be extraordinarily non permanent. At the moment, the forecast for web revenue is for it to come back in at between $71.7 million and $73.6 million, with a midpoint of $72.65 million. That will suggest a year-over-year progress price of simply 3.4%, however at the very least it could be constructive.

Hold an eye fixed out on WD-40’s Q2 earnings

Heading into the corporate’s earnings launch, which is meant to happen on April 7th after the market closes, buyers can be sensible to maintain an eye fixed out on a few issues. Most necessary, given the disparity between the corporate’s backside line through the first quarter of this 12 months and the place administration expects income to go for the 12 months as a complete, can be earnings. At current, analysts anticipate earnings per share of $1.02. That will suggest web income of $13.97 million. To place that in perspective, it could signify a decline of 18.7% in comparison with the $17.19 million the corporate generated the identical time one 12 months earlier. Seeing the corporate outperform on this entrance might assist to push shares up and would permit buyers to acknowledge that administration would possibly very properly be proper for the 12 months. However failing to ship at the very least what analysts count on might push shares down additional.

In the case of income, the expectation from analysts is for a studying of $126.80 million. This follows the pattern the corporate reported within the first quarter of the 12 months within the respect that it could be greater than what the corporate reported final 12 months. General progress can be 13.3% over the $111.91 million the corporate achieved final 12 months. As soon as once more, the Asia-Pacific area will in all probability be a key driver of progress. However past that, we won’t actually guess as to what would possibly transpire on this entrance. As for different metrics for the corporate corresponding to money stream and EBITDA, there was no steering offered by analysts. However usually talking, these ought to observe the trajectory of earnings.

WDFC inventory remains to be expensive

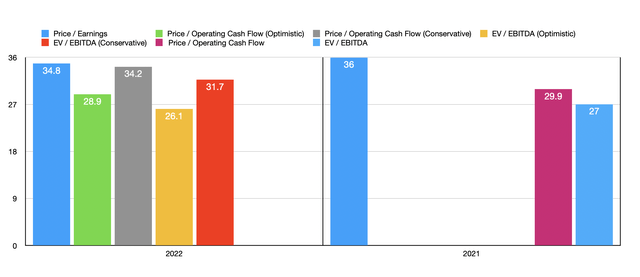

relating to valuing the corporate, I’ve determined to take a look at the corporate by way of the lens of each its 2021 12 months outcomes and what the corporate would possibly generate through the 2022 fiscal 12 months. Utilizing the agency’s 2021 outcomes, we discover that shares can be buying and selling at a worth to earnings a number of of 36. This drops to 34.8 if we assume that administration is correct of their forecasts. In the case of different profitability metrics, it is troublesome to know what the longer term holds. If we assume that working money stream and EBITDA will enhance on the similar price that earnings will, then the value to working money stream a number of needs to be 28.9, whereas the EV to EBITDA a number of needs to be 26.1. This compares to the 29.9 and 27, respectively, that the corporate is buying and selling at if we depend on the 2021 outcomes. If, nonetheless, we assume that the primary quarter of the 12 months is extra indicative of what efficiency will finally be for these metrics, then the value 2 adjusted working money stream a number of can be 34.2, whereas the EV to EBITDA a number of can be 31.7.

Creator – SEC EDGAR Knowledge

To place the pricing of the corporate into perspective, I made a decision to check it to 5 related corporations. On a price-to-earnings foundation, these firms ranged from a low of 16.1 to a excessive of 30.8. On this case, our prospect was the most costly of the group. In the meantime, utilizing the value to working money stream strategy, the vary was from 12.8 to 30.3. And utilizing the EV to EBITDA strategy, the vary was from 10.2 to 95.9. In each of those circumstances, 4 of the 5 firms have been costlier than WD-40 Firm.

| Firm | Value / Earnings | Value / Working Money Circulation | EV / EBITDA |

| WD-40 Firm | 36.0 | 29.9 | 27.0 |

| Central Backyard & Pet Firm (CENT) | 16.1 | 12.8 | 10.2 |

| The Procter & Gamble Firm (PG) | 27.5 | 22.2 | 18.8 |

| Church & Dwight (CHD) | 30.5 | 25.3 | 20.5 |

| Spectrum Manufacturers Holdings (SPB) | 30.8 | 30.3 | 95.9 |

| Colgate-Palmolive Firm (CL) | 30.3 | 19.8 | 18.6 |

Takeaway

Based mostly on the info offered, it appears to me as if shares of WD-40 Firm are nonetheless expensive. Having stated that, buyers can be unwise to underestimate a high-quality firm with such important model worth. To at the present time, I nonetheless view these elements as roughly balancing each other out. In fact, it was troublesome to know that the corporate would underperform on its backside line prefer it has. And a part of the decline is probably going a justifiable response to the drop in income and money flows. If administration can come out and present indicators of enchancment, notably on the underside line, then buyers will seemingly reward the corporate accordingly. However failure to take action might result in extra short-term ache.