jetcityimage

Amid renewed investor confidence in tech stocks this year, many of last year’s laggards have enjoyed dramatic rebound swings since January. As investors look to position their portfolios for the remainder of the year, one question is critical: do fundamentals justify these rallies?

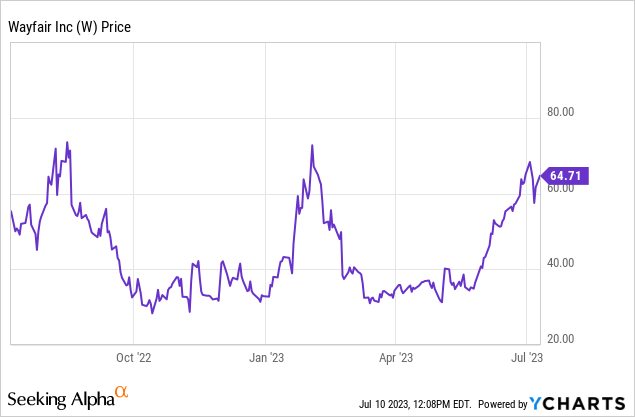

In the case of Wayfair (NYSE:W), I think the answer is no. The furniture e-commerce company has been dealing with a demand “hangover” after its pandemic-era pop, and its investments in inventory and capacity have soured. And despite y/y declines in revenue and active customers, shares of Wayfair have pumped up nearly 2x so far this year.

I was neutral on Wayfair when it was trading in the $30-$40 range, but after observing this year’s rally which did not come with a material improvement in top-line trends, I’ve become much more skeptical and am now bearish on the name.

The key risk investors have to monitor is this: Wayfair is a company that relies largely on economies of scale. As much as it is an e-commerce play, it’s also a logistics and operations business that depends on scale to move incredibly bulky goods throughout the country. The company was really only able to eke out meaningful profitability when demand spiked during the pandemic. What investors need to be looking out for is if Wayfair has plausible drivers to get back to pandemic-era revenue levels (in late 2020, revenue nearly doubled to a >$4 billion quarterly clip).

Without confidence in Wayfair’s ability to do this, I’m comfortable moving to the sidelines here.

With housing demand down, we shouldn’t be surprised that Wayfair’s demand is struggling as well

Home goods companies saw elevated demand during the pandemic for a simple reason: so many people were packing bags and leaving to other parts of the country, enabled by remote work as well as cheap interest rates to seek more space in suburban areas and away from dense cities. Naturally, demand for furniture spiked as people sought to set up new homes.

Now, with most companies mandating at least a hybrid work arrangement and with schools fully back in session, that outward sprawl has slowed – driven in no small part as well by much higher mortgage interest rates that has sapped real estate transactions. Amid this backdrop, it’s not difficult to understand why people aren’t buying new furniture.

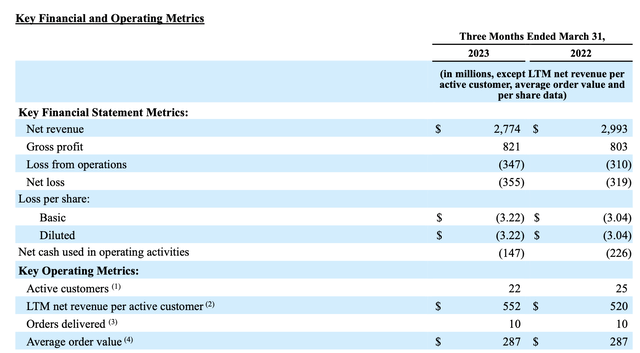

In Wayfair’s March quarter which the company reported in early May, the company posted a -7% y/y decline in revenue to $2.77 billion. The company’s count of active customers, defined as a person who has made a purchase on one of Wayfair’s sites within the past twelve months, also declined -15% y/y to 21.7 million. Order frequency also stalled, as the average customer ordered only 1.81 times over the past twelve months versus 1.87 times in the prior-year period.

Wayfair key metrics (Wayfair Q1 earnings release)

Niraj Shah, Wayfair’s CEO, noted on the Q1 earnings call that traffic “remains challenged” and that the company is embarking on a more aggressive promotional calendar to try to combat the downside in demand trends:

Our category, in particular, has been impacted more than others with sales first turning down in March of 2022 and now contracting approximately 20% year-over-year according to many of the sources we follow. While traffic remains challenged, our conversion levels have held steady and our work on nailing the basics and driving customer and supplier loyalty is leading to sustained market share growth.

In the second quarter, we’re seeing improving year-over-year order trends, and we’re just coming off the back of our seventh Way Day event. At the beginning of the year, as we planned a denser promotional calendar for 2023 and we decided to try a 3-day format for Way Day.”

While heavier promotions may be able to blunt the impact of slower demand, it’ll come at risk to margins – which improved to 30% in Q1, from 27% in the prior-year quarter driven by lower logistics expenses as rates declined from pandemic era highs.

Debt and cash burn

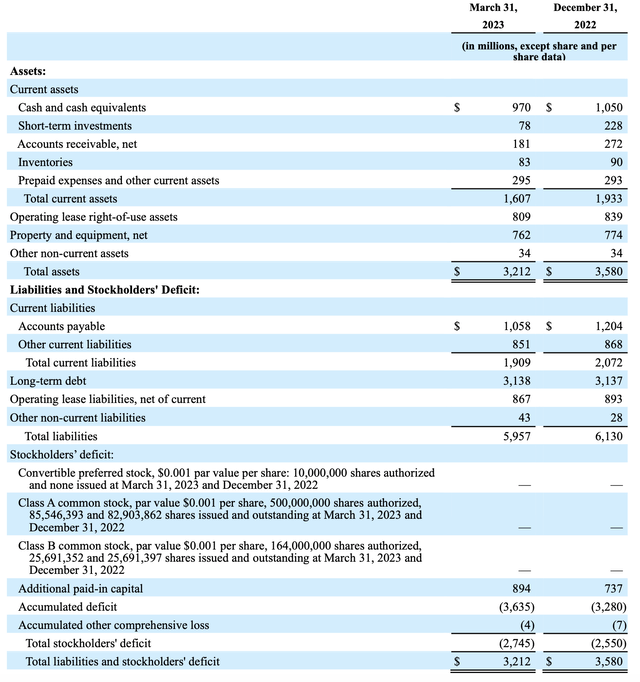

The other area we have to watch out for in Wayfair is its balance sheet. As of its March quarter, the company had only $1.04 billion of cash on its books (and very minimal $83 million in inventory), stacked on top of $3.14 billion in debt (or a net -$2.1 billion debt position).

Wayfair balance sheet (Wayfair Q1 earnings release)

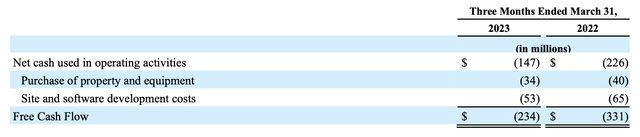

This stacks on top of quite heavy cash burn for Wayfair. In the first quarter, Wayfair’s cash burn moderated slightly to -$234 million from -$331 million in the year-ago quarter; but that’s after burning through -$1.13 billion in free cash flow in FY22.

Wayfair FCF (Wayfair Q1 earnings release)

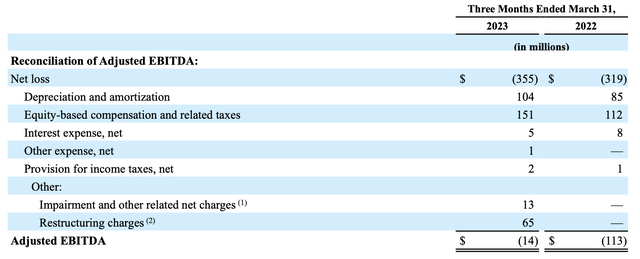

The bright side here is that Wayfair is laser-focused on cost optimization. In Q1, the company’s adjusted EBITDA losses slimmed to a near-breakeven -$14 million (from a loss roughly 8x the size in the year-ago quarter). This was driven both by the improvement in gross margins (a combination of logistics savings plus price increases passed onto customers), as well as the company’s reduction in workforce announced in January.

Wayfair adjusted EBITDA (Wayfair Q1 earnings release)

Management is guiding to adjusted EBITDA profits in Q2 in a 0.5-1.5% margin (roughly $31 million of adjusted EBITDA at the 1% midpoint, based on consensus revenue expectations of $3.08 billion for the quarter). Still, we have to ask: does this “turnaround” in profitability support Wayfair’s $2+ billion in net debt, or its $7+ billion market cap? In my view, the answer is no, and the key to bigger profit propulsion is a resurrection in revenue trends – which we have not yet seen proof of.

Key takeaways

With receding demand trends and meager profitability plans despite a quite substantial debt load, I see very few reasons to stay invested in Wayfair especially as the stock has already skyrocketed ~2x this year. Retreat to the sidelines here.