RichVintage/E+ via Getty Images

It finally looks like the AI boom in investor buying of semiconductor equities is ready to roll over into a stretch of selling. Why? Sure, valuations and pricing have been reaching for ever higher extremes since last summer. My bearish view is an unexpected rise in inflation and interest rates into the summer will blow a hole into the falling-rate rationale supporting the gigantic upmove in Big Tech and semiconductor share prices since October.

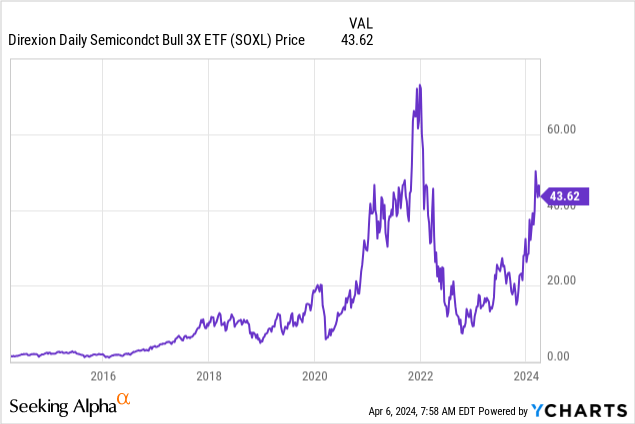

So, if a painful correction of -20% to a crash of -50% is next for the leading semiconductor names the rest of 2024, I would absolutely avoid the Direxion Daily Semiconductor 3x Bull ETF (NYSEARCA:SOXL). We could be entering a prolonged period like 2022, where the daily rebalance and compounding features work against holders, as fund expenses and swap contract costs pile up. A deep selloff in the Big Tech sector, especially the top AI-frenzy semi names, may initially give investors huge losses in SOXL’s 300% long design, while making the math for a rebound back to unchanged pricing levels very difficult years into the future.

YCharts – SOXL, Weekly Price Changes, 10 Years

Rotten Valuation Backdrop

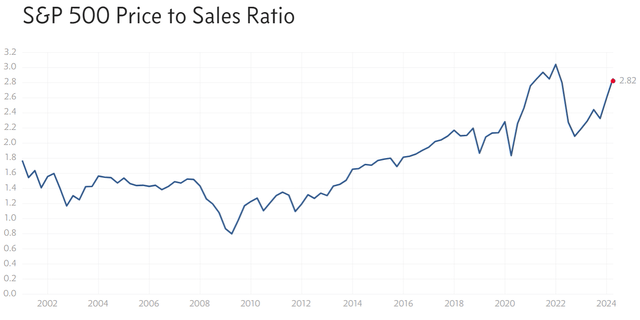

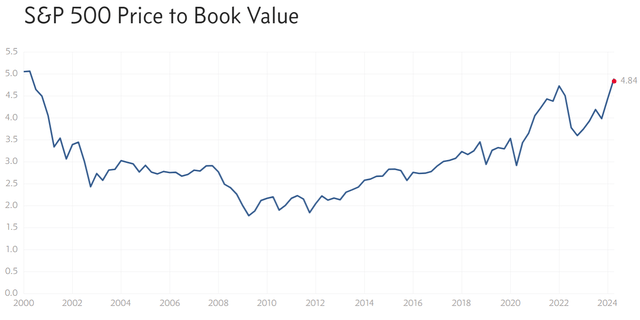

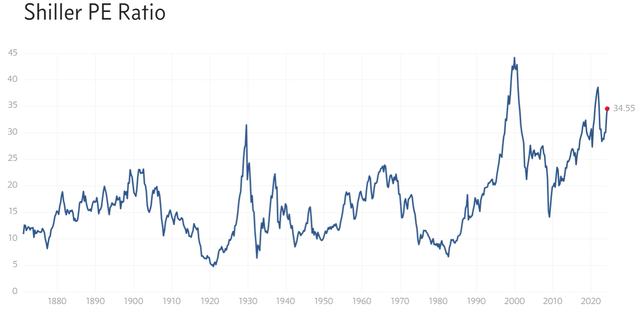

The entire U.S. stock market (as measured by the S&P 500 index) is now priced near record price to sales and book value multiples, on top of one of the worst setups in the famous long-term Shiller CAPE ratio (reviewing 10-year trends).

Multipl.com – S&P 500 Price to Sales, Since 2001 Multipl.com – S&P 500 Price to Sales, Since 2000 Multipl.com – S&P 500 Price to Sales, Since 1872

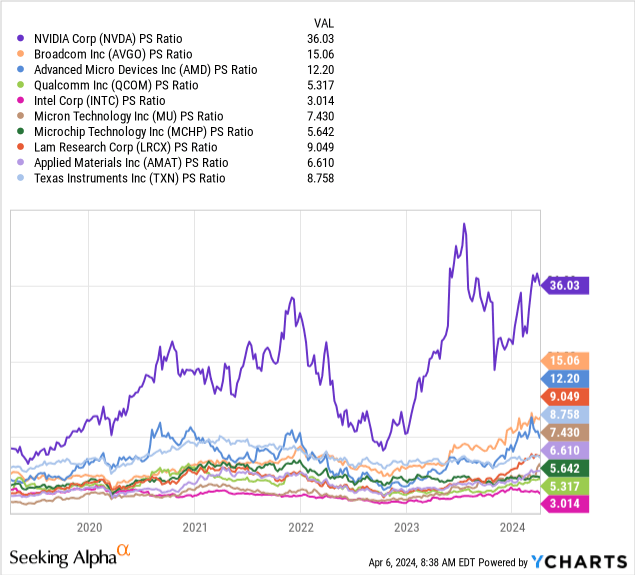

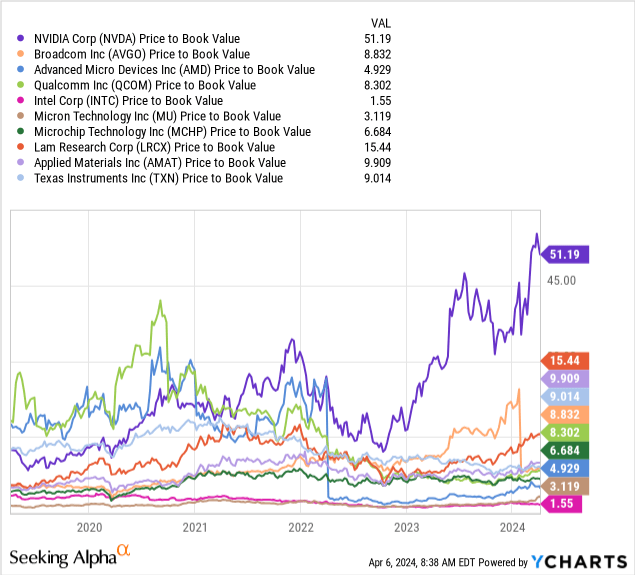

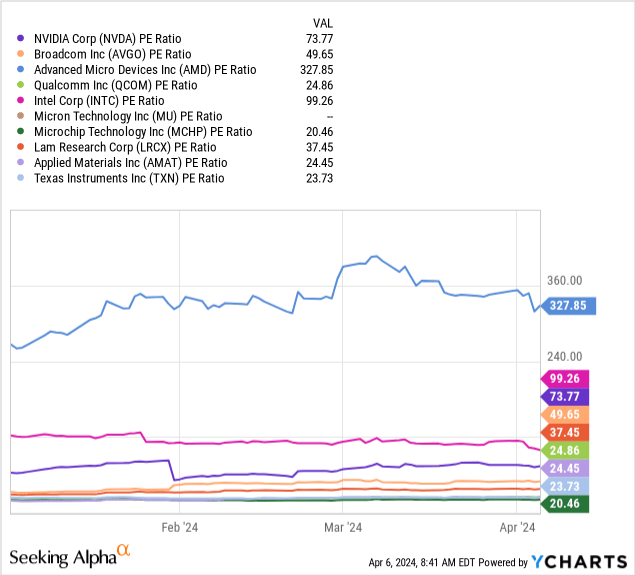

More bad news, the main semiconductor-company holdings of SOXL are sitting at even higher valuations. Reviewing some of the highest-weighted positions in SOXL, it’s easy to understand the underlying valuation picture is quite stretched for new buyers today. I am including NVIDIA (NVDA), Broadcom (AVGO), Advanced Micro Devices (AMD), Qualcomm (QCOM), Intel (INTC), Micron (MU), Microchip Technology (MCHP), Lam Research (LAM), Applied Materials (AMAT), and Texas Instruments (TXN) in my charts. This group represents around 50% of the underlying index weighting used by SOXL.

On the 5-year charts below, you can review the median averages for both price to sales and book value are now in the 8x multiple range, far above S&P 500 readings.

YCharts – Major Semiconductor Stocks, Price to Sales, 5 Years YCharts – Major Semiconductor Stocks, Price to Book Value, 5 Years

In addition, the median average of 37x for trailing price to earnings is quite a distance above the prevailing S&P 500 P/E of 27x today.

YCharts – Major Semiconductor Stocks, Price to Trailing Earnings, 3 Months

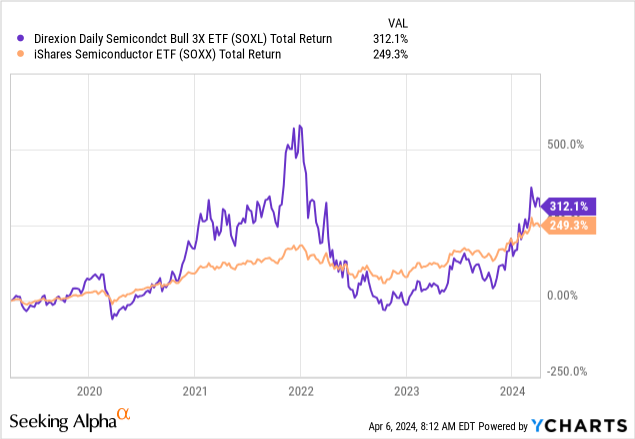

SOXL is priced using the NYSE Semiconductor Index (ICESEMIT), a rules-based, modified float-adjusted market capitalization-weighted index that tracks the performance of the 30 largest U.S. listed semiconductor companies. It is slightly different than the Philadelphia Semiconductor Index, but returns in SOXL tend to closely mimic price changes in this more commonly traded and referenced index. The iShares Semiconductor ETF (SOXX) acts as the nearest SOXL cousin for a 100% long product.

Over time, extra costs to create its 3x leverage through swaps with major banks/brokers, wild price swings in the sector hurting rebalance results, a relatively high 0.76% in management expense per year, and little to no cash dividend payouts (the current yield is 0.39% annually), have made it difficult for SOXL to keep up with SOXX. Of course, oversized gains in the sector during the last five years have helped SOXL to outperform to a minor degree.

YCharts – 3x SOXL vs. 1x SOXX, Total Returns, 5 Years

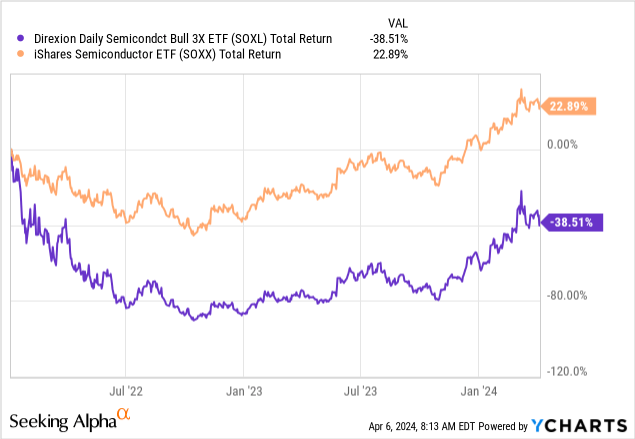

The worst news for new buyers in April 2024 is getting in AFTER a spike in price over the preceding year or two “does” reduce the odds of future investment success dramatically. Those buying at the late 2021 peak in semiconductors are still waiting to get back to break even! If you have the stomach to lose -90% of your investment like January to October 2022, be my guest. Something similar could be approaching for SOXL owners the rest of 2024, as large losses multiplied by a factor of 3x could prove catastrophic for bulls.

YCharts – 3x SOXL vs. 1x SOXX, Total Returns, Since January 2022

Why Am I Bearish?

The logic for selling or avoiding SOXL is the Federal Reserve appears to be stuck into tighter credit/banking policy than the markets or economy would prefer the remainder of the year. And, with investor enthusiasm sky-high again, and valuations just as extreme again as late 2021, I feel this ETF is overflowing with downside “risk.”

Friday’s (April 5th) strong U.S. employment numbers, the unexpected uptick in inflation reports for two months running in America, spiking crude oil during 2024 (+20% from January 1st), a misunderstood and ignored upturn in many food commodities since the middle of 2023, and now a leap in gold/silver as a warning shot since early March (gold at all-time highs, silver at multi-year highs), are all screaming a turn for the worse in the inflation outlook is at hand.

The bond market is starting to take notice (with steady price losses for weeks running), while the Federal Reserve seems to be just as lost on what is going on as early 2022. The “hope” that inflation is coming back down to the Fed’s 2% annual target could soon be squelched, forcing stock market investors to reevaluate how they price the high-growth technology space. My worry is 4% or 5% CPI changes by late summer, with growing odds of additional Fed rate INCREASES, could cause a monster rerating of semiconductor stocks lower for an acceptable valuation. Plus, this scenario means we have to bring the recession discussion back for later in the year, on top of injecting a new level of angst/uncertainty about the upcoming and critical November election cycle.

What I am saying is a trainwreck for SOXL could be approaching, with a decimation of price in the -80% or greater range a real possibility, on its 3x design.

Final Thoughts

Pulling all the ideas together, the Direxion Daily Semiconductor 3x Bull ETF is a security full of risk in April (bursting at the seams actually). I know it’s tempting to believe instant AI riches are part of the investment story for SOXL, after an astounding +307% price gain between the October low and March peak. But, all good things must come to an end.

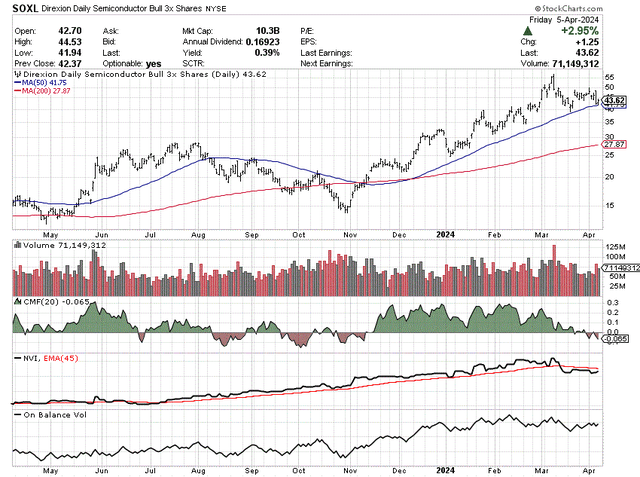

The technical chart strength of late 2023 has faded fast since March. Momentum indicators peaked months ago for this ETF, and price is getting close to breaking below its 50-day moving average for the first time since early November.

On a 1-year chart of daily trading, you can review the 20-day Chaikin Money Flow indicator has flipped into sell territory. The Negative Volume Index strength of 2023 has reversed into a bearish trend during March-April. And, On Balance Volume stats topped out in February.

StockCharts.com – SOXL, 12 Months of Daily Price & Volume Changes

My overriding concern is the U.S. semiconductor stocks are outlining a major top in early 2024. An unexpected jump in inflation and interest rates means Big Tech names are not only overvalued, but deserve a drop in valuations back toward long-term norms. If this is true, a wicked selloff in SOXL could be at hand. Then, if we do find ourselves in recession, with sliding demand for semiconductors and chips the reality of late 2024 and early 2025, SOXL could flip from one of the best investments to own last year to one of the worst performers of calendar 2024.

I rate SOXL a Sell and Avoid. For this security to rise much in price into December, we have to experience a further drop-off in inflation and interest rates without a recession appearing. At this stage, I place the odds of a goldilocks scenario at less than 25%. A recession later in the year could be as high as 75%, based on further credit crunching via higher interest rates. For the U.S. stock market, it may be a “watch out below” moment to consider.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.