Revealed on August 5th, 2022 by Josh Arnold

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value greater than $360 billion, as of the tip of the primary quarter of 2022, making it one of many largest traders on this planet.

Berkshire Hathaway’s portfolio is crammed with high-quality shares, and usually ones which have steady earnings profiles, and pay dividends. Nevertheless, lately, Buffett has confirmed prepared to go exterior the standard checklist of firms for Berkshire to purchase. Certainly, the corporate now owns some high-growth names, together with tech shares, which Buffett famously eschewed for many years.

You’ll be able to study from Warren Buffett’s inventory picks to search out ones to your personal private portfolio. That’s as a result of Buffett (and different institutional traders) are required to periodically present their holdings in a 13F Submitting.

You’ll be able to see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Word: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of March thirty first, 2022, Berkshire owned over six million shares of Snowflake (SNOW), for a market worth approaching a billion {dollars}. That makes Berkshire a ~2% proprietor of Snowflake, though the place is simply 0.3% of the corporate’s complete fairness funding portfolio.

On this article, we’ll study the enterprise of Snowflake, in addition to its future progress prospects and anticipated complete returns in what’s a really uncommon inventory decide for Buffett.

Enterprise Overview

Snowflake is a cloud-based knowledge platform that’s based mostly within the US, however has a listing of worldwide prospects. The corporate’s platform permits prospects to consolidate knowledge right into a single supply that has a number of advantages. First, it takes numerous knowledge sources and combines them into one place that’s a lot simpler for purchasers to navigate. Second, it permits prospects to then use the info to drive insights, construct data-driven functions, and share knowledge throughout groups and companies in methods they may not with out the consolidated supply of knowledge.

Supply: Investor presentation, web page 13

As we are able to see on this illustration, the thought of the platform is to take disparate knowledge sources and functions and mix them right into a single supply, making insights, predictions, and monetization far simpler. Snowflake goals to resolve the age-old enterprise downside of groups and functions being housed in silos within the group, and seeks to mix them for better knowledge effectivity.

Snowflake was based in 2012, ought to generate about $2 billion in income this yr, and trades with a market cap of $51 billion.

The corporate’s most up-to-date earnings report was launched on Might 25th, 2022, for fiscal Q1 outcomes. Outcomes have been combined as income beat estimates by $9 million, hovering 84% year-over-year to $422 million. Nevertheless, the corporate posted a much bigger than anticipated loss at 53 cents per share.

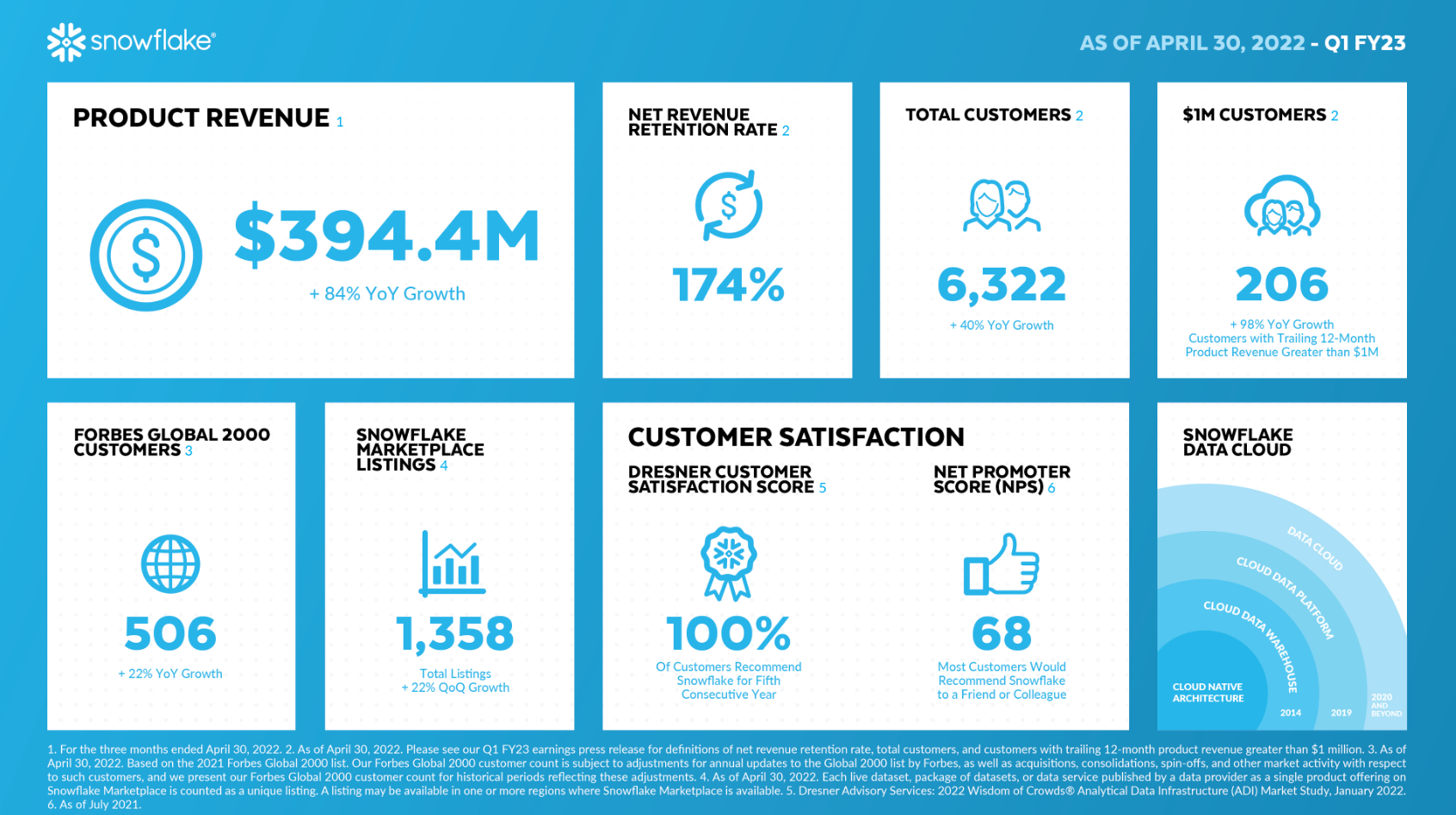

Supply: Firm Web site

Snowflake isn’t worthwhile but, so traders are inclined to deal with buyer and income progress metrics as an alternative. We will see the primary quarter noticed income practically double year-over-year, as complete prospects have been up 40%. As well as, Snowflake doubled the variety of $1+ million annual income prospects from the prior yr interval. Lastly, Snowflake’s web income retention fee is vital given it’s constructing its enterprise out, and at 174%, it implies that not solely is Snowflake retaining all prior interval income, however is rising per-customer income by leaps and bounds.

The corporate guided for second quarter product income to be within the vary of $435 million to $440 million, which might symbolize ~72% year-over-year progress, whereas working margin is predicted to be -2% of income. For the yr, Snowflake guided for income of ~$1.9 billion, which might be up ~66%, with product gross margin of 74.5%, working margin of 1%, and adjusted free money circulate margin of 16%.

These progress values spooked traders and analysts, nevertheless, regardless of the eye-popping year-over-year good points anticipated, and shares fell following the report.

Let’s now flip our consideration to the corporate’s progress prospects, that are strong to say the least.

Progress Prospects

Snowflake’s progress previously few years has been otherworldly. Since fiscal 2019, its common income progress fee has been 113%. In different phrases, Snowflake has greater than doubled income, on common, for every of the previous 4 years. The corporate has been scaling product income extraordinarily shortly by means of each new prospects, and better per-customer income. We count on these components to proceed to contribute to income progress going ahead, however the ever-higher income base will grow to be harder to develop from.

Nonetheless, analysts at present count on Snowflake’s medium-term common income progress to be within the neighborhood of fifty% yearly.

Supply: Investor presentation, web page 70

The corporate’s long-term forecast exhibits fiscal 2029 goal income of $10 billion, which is ~5X what it must be this yr. As well as, the corporate believes it should nonetheless be rising income at ~30% yearly by then, however with working earnings of ~20% of income. These are lofty targets, however given the corporate’s progress trajectory, they give the impression of being possible.

The 2 major catalysts are the corporate’s means so as to add new prospects, which it’s doing at a really quick fee, in addition to its web income retention fee. Mixed, we expect Snowflake can hit ~50% income progress yearly for the foreseeable future, and that may really mark a large slowdown in income progress from historic ranges.

Aggressive Benefits & Recession Efficiency

Snowflake’s aggressive benefit is in its first-mover place in utilizing a cloud platform to consolidate disparate knowledge sources into one. The mega-trend of utilizing knowledge within the cloud for a wide range of functions from merchandising to cybersecurity to operational metrics is barely starting to realize steam, and Snowflake is primed to take full benefit within the years to return.

Snowflake didn’t exist the final time the US had a significant recession, however we have now to imagine its enterprise would endure. Snowflake’s prospects are enterprises of all sizes and shapes, so whereas its prospects are sticky given the immense switching value, some would inevitably be unable to proceed to pay Snowflake throughout a harsh slowdown. Snowflake doesn’t pay a dividend, and sure received’t for a really very long time to return.

Valuation & Anticipated Returns

Given Snowflake doesn’t have any earnings, and earnings received’t be significant for a while to return, we’ll use the price-to-sales ratio to evaluate worth. Shares of Snowflake have been very costly for the reason that preliminary public providing, they usually stay highly-valued immediately. Shares go for ~25X estimated fiscal 2023 gross sales, which is tremendously excessive by any measure. Nevertheless, Snowflake’s common price-to-sales ratio in its historical past as a publicly-traded firm is 60. We don’t see that worth as sustainable, nevertheless, and as an alternative assess honest worth at 8 occasions gross sales as a long-term a number of.

We count on 50% income progress for the foreseeable future, however the valuation might trigger a ~20% headwind to complete returns over time because it shrinks. These offsetting components would nonetheless imply we count on ~19% complete annual returns within the years to return. The corporate doesn’t pay a dividend so that doesn’t issue into complete returns.

Ultimate Ideas

Snowflake is a extremely uncommon inventory decide for Warren Buffett, in that it doesn’t pay a dividend, is just not worthwhile, and is a hyper-growth tech inventory. Nevertheless, the corporate is a primary mover in a mega-trend that’s more likely to persist for many years, and we see immense progress potential for Snowflake. The valuation is extraordinarily excessive, nevertheless, and can probably offset a number of the forecasted income progress. Nonetheless, with ~19% complete anticipated annual returns, Snowflake is rated a extremely speculative and unstable purchase.

Different Dividend Lists

Worth investing is a worthwhile course of to mix with dividend investing. The next lists comprise many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].