Printed on July 14th, 2022 by Quinn Mohammed

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value over $360 billion, as of the top of the 2022 first quarter.

Berkshire Hathaway’s portfolio is stuffed with high quality shares. You possibly can comply with Warren Buffett shares to search out picks for your portfolio. That’s as a result of Buffett (and different institutional buyers) are required to periodically present their holdings in a 13F Submitting.

You possibly can see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink under:

Notice: 13F submitting efficiency is totally different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of March thirty first, 2022, Buffett’s Berkshire Hathaway owned 315,400 shares of Procter & Gamble for a market worth of $48.2 million. Procter & Gamble represents about 0.1% of Berkshire Hathaway’s funding portfolio. This marks it as one of many smallest positions within the portfolio.

This text will analyze the patron staples firm in better element.

Enterprise Overview

Procter & Gamble is a client merchandise big that sells its merchandise in additional than 180 nations and generates over $76 billion in annual gross sales. A few of its core manufacturers embody Gillette, Tide, Charmin, Crest, Pampers, Febreze, Head & Shoulders, Bounty, Oral-B, and lots of extra.

P&G is a mega-cap inventory with a market capitalization of roughly $350 billion.

P&G has undergone large portfolio restructuring over the previous few years, as the corporate bought off a substantial share of its client manufacturers. The corporate has diminished the variety of manufacturers in its portfolio from round 170 to about 65.

On April 20th, 2022, Procter & Gamble launched Q3 fiscal yr 2022 outcomes. For the quarter, the corporate generated $19.4 billion in internet gross sales, a 7% improve in comparison with Q3 2021.

This end result was led by development throughout the board. The corporate’s 5 reporting segments – Magnificence, Grooming, Well being Care, Material & Residence Care, and Child, Female & Household Care – posted will increase of two%, 3%, 13%, 7%, and seven%, respectively.

Supply: Investor Presentation

Internet earnings equaled $3.37 billion or $1.33 per share in comparison with $3.25 billion or $1.26 per share in Q3 2021. On an adjusted foundation, core earnings-per-share elevated 6% year-over-year, to $1.33.

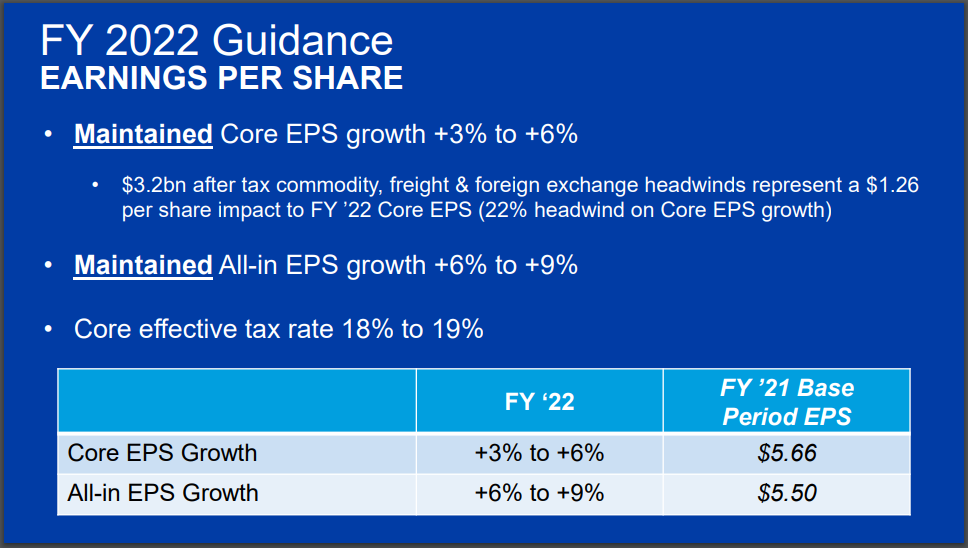

Procter & Gamble additionally upgraded its fiscal 2022 gross sales estimate from earlier steering of three% to 4%, to revised steering of 4% to five% development. The corporate anticipates 3% to six% core earnings-per-share development from final yr.

Supply: Investor Presentation

We estimate that Procter & Gamble can generate $5.90 in earnings-per-share for the fiscal 2022 yr.

Development Prospects

Following P&G’s restructuring, the corporate is now a extra agile and versatile group with improved development prospects. Whereas P&G divested low-margin companies with restricted development potential, it held on to its core client manufacturers resembling Tide, Charmin, Pampers, Gillette, and Crest.

With the principle focus now on the corporate’s strongest and most worthwhile manufacturers, P&G can profit from decrease prices and better margins.

Margin growth is a vital element of P&G’s earnings development technique. P&G’s cost-cutting actions have raised its working margins into the highest of its peer group.

P&G acquired billions of {dollars} from its quite a few asset gross sales, and a portion of that went to inventory buybacks. These buybacks have additionally boosted P&G’s earnings-per-share over time.

Procter & Gamble may proceed rising via acquisitions. One such instance is the acquisition of Merck’s world client well being enterprise in 2018. The acquisition included 10 core manufacturers in nutritional vitamins, dietary dietary supplements, and different over-the-counter (OTC) merchandise.

The worldwide OTC market is predicted to develop within the mid-single digits yearly via 2025, which P&G ought to profit from.

We undertaking that the corporate can proceed to develop earnings per share by about 4.0% yearly via 2027.

Aggressive Benefits & Recession Efficiency

P&G has a number of aggressive benefits. The primary and predominant benefit is its unbelievable model portfolio. The corporate has a number of category-leading manufacturers resembling Crest, Tide, Gillette, Bounty, Febreze, Outdated Spice, Pampers, and lots of extra. P&G owns a number of manufacturers that generate $1 billion or extra in annual gross sales. The corporate’s core manufacturers promote top quality merchandise that buyers are keen to pay a premium for.

To maintain its aggressive place, P&G invests closely in promoting and analysis & improvement. Annually, the corporate invests billions extra in R&D. These investments are a aggressive benefit for P&G. R&D generates product innovation, whereas promoting helps market new merchandise and achieve market share.

P&G’s aggressive benefits afford the corporate continued profitability, even throughout financial downturns. Earnings held up very properly in the course of the Nice Recession:

- 2007 earnings-per-share of $3.04

- 2008 earnings-per-share of $3.64 (19.7% improve)

- 2009 earnings-per-share of $3.58 (-1.6% decline)

- 2010 earnings-per-share of $3.53 (-1.4% decline)

P&G confirmed energy in 2008, with nearly 20% earnings development. Then, earnings fell solely barely within the subsequent two years. This needs to be thought-about a powerful efficiency in one of many worst financial downturns up to now a number of many years.

Moreover, P&G carried out very properly via the coronavirus pandemic. In reality, P&G has grown its earnings-per-share to new data all through the whole ordeal to-date.

P&G is a recession-resistant enterprise. Folks want paper towels, toothpaste, razors, and different P&G merchandise, whatever the financial local weather.

Valuation & Anticipated Returns

Shares of Procter & Gamble have traded for a mean price-to-earnings a number of of round 20. Shares at the moment are buying and selling above this common, which signifies that shares could possibly be overvalued on the present 24.7 instances earnings.

Our truthful worth estimate for Procter & Gamble inventory is 20.0 instances earnings. If this proves right, the inventory will incur a -4.1% annualized drag in its returns via 2027.

Shares of Procter & Gamble at present yield 2.5%, which is under its common yield of three.1%. On a dividend yield foundation, P&G shares appear to be buying and selling above truthful worth.

Placing all of it collectively, the mix of valuation modifications, EPS development, and dividends produces complete anticipated returns of two.4% per yr over the subsequent 5 years. This makes Procter & Gamble a promote.

The present dividend payout is sufficiently coated by earnings, with room to develop. Primarily based on anticipated fiscal 2022 earnings, P&G has a payout ratio of 62%. We anticipate continued low-to-mid single-digit dividend will increase within the years to come back.

Last Ideas

P&G is a constituent of each the Dividend Aristocrats and Dividend Kings lists. The corporate has elevated its dividend for 66 years, proving that it may possibly climate a slew of financial storms and nonetheless come out the opposite aspect stronger.

P&G has the model energy, aggressive benefits, and profitability to take care of its regular and annual dividend will increase over the long run.

As a result of present overvaluation within the share worth, it might be higher to attend for a extra favorable entry level.

Different Dividend Lists

Worth investing is a useful course of to mix with dividend investing. The next lists include many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].