Revealed on June twenty eighth, 2022 by Felix Martinez

Berkshire Hathaway (BRK.B) has an fairness funding portfolio value greater than $360 billion as of the top of the 2022 first quarter.

Berkshire Hathaway’s portfolio is stuffed with high quality shares. You’ll be able to ‘cheat’ from Warren Buffett shares to search out picks for your portfolio. That’s as a result of Buffett (and different institutional traders) are required to periodically present their holdings in a 13F Submitting.

You’ll be able to see all Warren Buffett shares (together with related monetary metrics like dividend yields and price-to-earnings ratios) by clicking on the hyperlink beneath:

Be aware: 13F submitting efficiency is completely different than fund efficiency. See how we calculate 13F submitting efficiency right here.

As of March 31, 2022, Buffett’s Berkshire Hathaway owned simply over 151.6 million shares of American Specific Firm (AXP) for a market worth exceeding $22.16 billion. American Specific Firm presently constitutes a bit over 7.3% of Berkshire Hathaway’s funding portfolio.

This text will analyze this client finance firm in higher element.

Enterprise Overview

American Specific is a globally built-in funds firm that operates within the following enterprise items: US Card Providers, Worldwide Shopper and Community Providers, World Business Providers, and World Service provider Providers. American Specific was based in 1850 and is headquartered in New York, NY.

The corporate presently has a market capitalization of $110.1 billion. AXP has been rising its dividend for 9 consecutive years from 2012 to 2020. Nevertheless, it has paid the identical dividend for 2 and a half years. Thus dropping its nine-year streak, it lately elevated its dividend by 20% in March 2022 and now has a low dividend yield of 1.42%.

On April 22, 2022, the corporate reported first-quarter outcomes for Fiscal 12 months (FY)2022. Income beats estimates by $70 million to $11.73 billion. This represents a year-over-year improve of 29.5%. Reported Q1 GAAP EPS of $2.73 per share additionally beats estimates by $0.28.

The corporate reported a internet revenue of $2.1 billion, or $2.73 per share, in comparison with a internet revenue of $2.2 billion, or $2.74 per share, a 12 months in the past. This represents a lower of 4,5% and 0.4%, respectively.

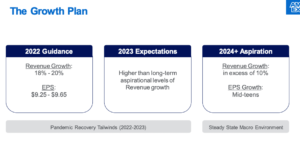

Total, the corporate administration was proud of the quarter outcomes and is reaffirming the corporate’s full-year steerage of 18 -20% income progress and earnings per share between $9.25 and $9.65 per share.

Supply: Investor Presentation

Development Prospects

The corporate operates as a closed-loop community for funds. Which means American Specific points the bank card to the patron, operates the cost community, and establishes a direct relationship with the service provider. A closed-loop community permits American Specific to seize the whole financial revenue from a single bank card cost.

So so long as the corporate can enroll new clients, it will assist with progress for the highest and backside traces.

Supply: Investor Presentation

The corporate expects to develop income by 18-20% in 2022 in comparison with 2021. In addition they count on earnings to be between $9.25 and $9.65. The mid-point could be $9.45 per share. This is able to signify a lower of 5.7%. That is okay, as the corporate grew earnings from 2020 to 2021 by 166%.

Supply: Investor Presentation

Aggressive Benefits & Recession Efficiency

Its sturdy model and world attain function aggressive benefits. The corporate generates most of its income from low cost income and card charges, with noninterest revenue making up roughly 80% of its income. In distinction, different bank card issuers sometimes rely on internet curiosity revenue. Not being as reliant on curiosity revenue advantages American Specific to construct a stable aggressive place in bank cards for high-income people and companies. Each teams are much less prone to carry giant excellent balances on their playing cards.

The corporate didn’t carry out effectively through the Nice Recession of 2008-2009, and it didn’t carry out effectively through the COVID-19 pandemic. For instance, through the Nice Recession, the corporate’s earnings dropped 24% in 2008 and 40% in 2009. Nevertheless, the corporate didn’t reduce the dividend. As an alternative, the corporate froze the dividend however continued to pay it out.

Durning COVID-19, earnings drop 53% from 2019 to the top of 2020. Once more, luckily, the corporate was capable of proceed to pay its dividend. Nevertheless, in addition they froze their dividend for 2020 and 2021. The corporate lately introduced a dividend improve of 20% in March 2022.

Valuation & Anticipated Returns

The corporate is buying and selling fingers presently with a PE ratio of 14.5X earnings. Over the previous ten years, the corporate has averaged a PE of 15.4X earnings. Thus, the inventory seems to be to be barely undervalued at as we speak’s value.

The present dividend yield can also be increased than the corporate’s five-year common of 1.35%. Thus, one other indicator is that the inventory is barely undervalued.

We count on earnings will develop 7% yearly for the subsequent 5 years. Thus, with a slight valuation tailwind, and a stable earnings progress of seven%, we see that the corporate can generate 10-13% in complete return for the subsequent 5 years yearly.

Ultimate Ideas

Bank card firm American Specific is a high quality identify that mixes constant earnings and dividend progress with a recession efficiency that was a lot better than a lot of its friends. Its sturdy model and world attain function aggressive benefits. We consider that American Specific will produce stable earnings-per-share progress through the coming years because the financial system and the corporate get better from the coronavirus aftereffect. Thus, we fee the inventory a purchase on the present value.

Different Dividend Lists

Worth investing is a priceless course of to mix with dividend investing. The next lists comprise many extra high-quality dividend shares:

Thanks for studying this text. Please ship any suggestions, corrections, or inquiries to [email protected].