Alex Potemkin/E+ via Getty Images

Warner Bros. Discovery, Inc. (NASDAQ:WBD) reported Q2 2023 earnings results last week, missing on both top and bottom lines; we remain hold-rated on the stock. We’re more constructive on WBD’s position after the company launched combined max streaming this quarter, merging HBO content with unscripted hits from Discovery networks. Still, we think the company will continue to face churn in efforts to grow its subscriber base and gain profitability in 2023, and we don’t think the turnaround moment is here yet. Hence, we continue to be cautious about WBD’s near-term growth prospects and recommend investors stay on the sidelines.

Regarding ad revenue, our expectations of softer ad spending in March have played out this quarter, and we expect macro headwinds to continue pressuring the ad revenue into 2024. Management touched on the ad spending situation on the earnings call, noting:

“While the overall advertising market remains soft, we see the streaming and advertising opportunity well positioned to benefit from secular tailwinds over the long term.”

We agree that ad spending will rebound more meaningfully in 2024, but don’t see significant ad revenue growth in 2023.

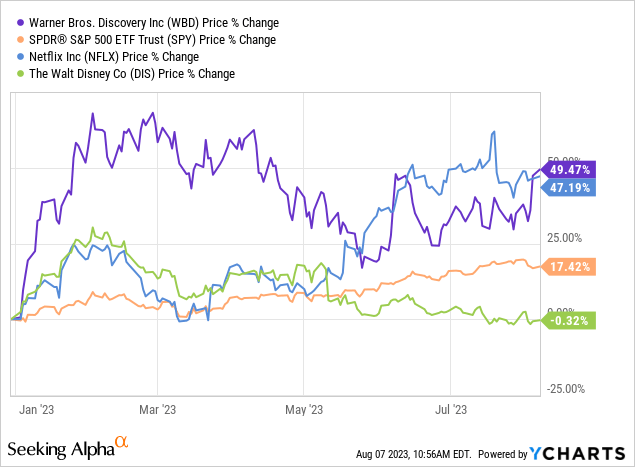

The stock is relatively flat since our hold-rating in mid-March, underperforming the S&P 500 (SP500) by around 15%. YTD, the stock is up an impressive 48%, outperforming the S&P 500 by approximately 30%. We now expect the YTD outperformance to moderate and don’t see meaningful revenue growth in the near-term as macro weakness continues to weigh on ad firm budgets and consumer spending in the back end of the year.

Breakdown of revenue growth

The company reported GAAP EPS of -$0.51, missing by $0.10, and revenue of $10.36B, up 5.4% Y/Y but missing estimates by $80M. Revenue grew Y/Y but saw a sequential decline from $10.7B last quarter. WBD has three core segments: Studios, Networks, and Direct-to-Customer or DTC. The bulk of revenues is derived from the networks segment, with revenue of $5.8M this quarter, down 5% Y/Y but up from $5.6M in 1Q23. Studios revenue was down 24% Y/Y and down 18.7% sequentially. WBD’s longer-term growth catalyst, DTC, achieved revenue of $2.7M, up 14% Y/Y and up sequentially from $2.5M last quarter, but reported subscriber loss of 1.8M, which management attributed to a subscriber switch to combined max subscription.

We think WBD’s risk-reward profile is becoming increasingly favorable, but we don’t believe the turnaround moment is here yet.

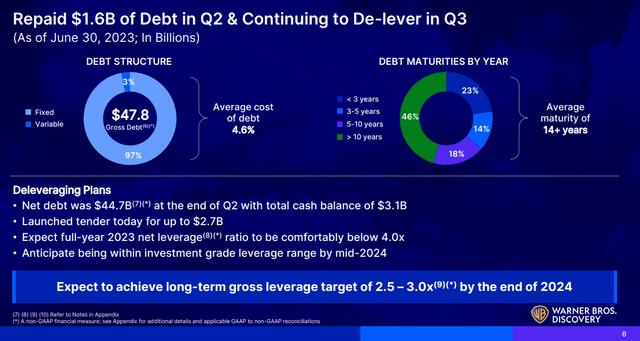

Debt still is an issue

We’re more constructive on WBD finding its footing in the media and entertainment industry after Warner Media’s spinoff by AT&T (T) with Discovery Inc last year. We’re seeing the company reducing debt built up from the 2022 merger this quarter; the company said it repaid $1.6B in debt and announced a tender offer to pay down around $2.7B more. Despite positive efforts, WBD ended the quarter with $44.7B in net debt and $3.1B in cash on hand versus 1Q23, in which the company ended the quarter with $49.5B in gross debt and $2.6B in cash on hand.

The following image outlines WBD’s net debt as of 2Q23.

WBD 2Q23 earnings presentation

The company slashed more than 16% on total costs and expenses to $11.26B. We think WBD is on the right track to profitability but expect it’ll be a bumpy road, and we don’t expect the stock to see meaningful financial outperformance in 2H23. The struggle for profitability within the media and entertainment industry, specifically the streaming business, has been highlighted by Disney (DIS) and Netflix (NFLX) over the past year; and we believe both stocks have a head start over WBD. Granted, we expect next quarter’s earnings to see sequential growth due to the WBD and Mattel (MAT) Barbie movie already making history with $1B at the box office barely three weeks post release. Still, we don’t think it will offset weakness in 2H23.

The following graph outlines WBD’s YTD performance against DIS, NFLX, and the S&P 500.

YCharts

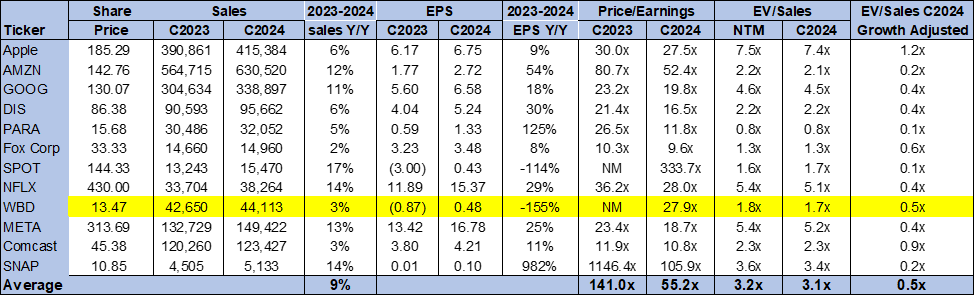

Valuation

WBD is trading well below the peer group average, but we don’t recommend investors buy the stock on weakness just yet. On a P/E basis, the stock is trading at 27.9x C2024 EPS $0.48 compared to the peer group average of 55.2x. The stock is trading at 1.7x EV/C2024 Sales, versus the peer group average of 3.1x. We don’t see favorable entry points into the stock.

The following chart outlines WBD’s valuation against the peer group.

TSP

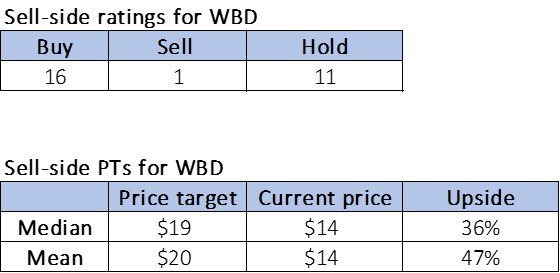

Word on Wall Street

Wall Street doesn’t share our bearish sentiment on the stock. Of the 28 analysts covering the stock, 16 are buy-rated, one is sell-rated, and the remaining are hold-rated. The stock is currently priced at $14. The median sell-side rating is $19, while the mean is $20, with a potential 36-47% upside.

The following charts outline WBD’s sell-side ratings and price-targets.

TSP

What to do with the stock

We remain hold-rated on Warner Bros. Discovery, Inc. post Q2, 2023 earnings results. We expect an upside in Q3 due to high traction for the blockbuster movie Barbie, but continue to expect the company to be under pressure in the back end of the year due to macro headwinds, and don’t expect Barbie to fully offset the weakness. We will continue to monitor how WBD performs and works down debt to improve profitability. In the meantime, we recommend investors stay on the sidelines.