Scott Olson

Yesterday’s reaction to Walmart’s (NYSE:WMT) Q3 earnings report is an example of why market neophytes are unnerved by share price gyrations. In one fell swoop, the stock gave up over half of the year-to-date gains.

In the current environment, Walmart’s business model is a double-edged sword. Inflation is forcing consumers to devote a large portion of their paychecks to groceries. That means your average Walmart customer is spending less on high margin merchandise like apparel, home furnishings and electronics.

However, Walmart is also the go-to place to save money. Consequently, WMT is picking up market share.

The company also has a number of initiatives designed to drive growth, and this quarter’s results provide insights into how the company is faring on several fronts.

Dissecting Q3 Results

Walmart’s Q3 2024 results beat consensus on the top and bottom line. Adjusted EPS of $1.53 beat by $0.01. Revenue, up 5.2% year over year, hit $160.8 billion, topping analysts’ estimates by $2.26 billion.

Gross profit of 24% rose 32 basis points over the comparable quarter. FCF of $4.3 billion was also up 19.4% year over year.

Walmart’s operating margin fell by 30 basis points. Management blamed increased wages, costs associated with store remodels, and an unfavorable sales mix for the decline.

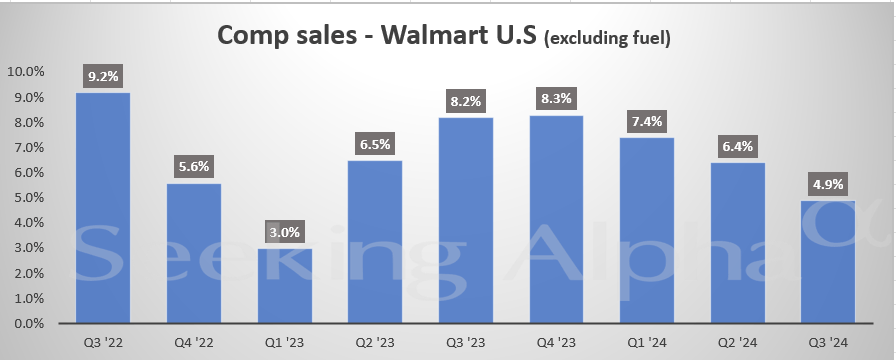

Comparable sales for Walmart’s U.S. stores excluding fuel increased 4.9% year over year, well ahead of analysts’ 3.9% forecast. Comparable sales of groceries increased at a mid single digit rate, and health and wellness surged by a high-teens percentage. However, sales of general merchandise fell by single digits.

Seeking Alpha

A strong positive can be found in Walmart U.S. e-commerce sales. Up 24%, WMT has now recorded six consecutive quarters of double-digit percentage e-commerce sales growth.

The firm’s advertising business also reported revenue growth of 26%, and store-to-home delivery costs fell 15%.

Grocery saw a mid-single-digit percentage increase in sales, and management noted “strong share gains in both units and dollars.”

Sam’s Club memberships hit a record level, and international sales were up 9.4% in Mexico, 5.3% in Canada, and 18.6% in China.

Management now guides for net sales growth in a range of 5.0% to 5.5%, a 1% increase from last quarters estimates. Adjusted EPS is expected to land in a range of $6.40 to $6.48.

Both metrics are below analysts’ estimates for 5.61% sales growth and EPS of $6.50 for FY 2024. This likely accounts for the 8% plus fall in share valuation that hit the stock the day of the earnings call.

Potential Growth Drivers

Walmart has several avenues to increase growth including advertising, e-commerce, marketplace fees, financial services, and healthcare services, to name a few.

Toward the end of 2020, the company launched Walmart+, a subscription service designed to compete against Amazon Prime. At a price of $98/year, Walmart’s service undercut Amazon Prime’s $139 price.

Available throughout the US, Walmart+ offers a variety of perks including unlimited, same-day delivery, fuel discounts, and Paramount’s streaming service. Membership income was up 7.2% this quarter and is projected to grow 10.4% this year to over 29 million users. Perhaps more importantly from an investor’s perspective, Walmart+ serves to cement customer relationships.

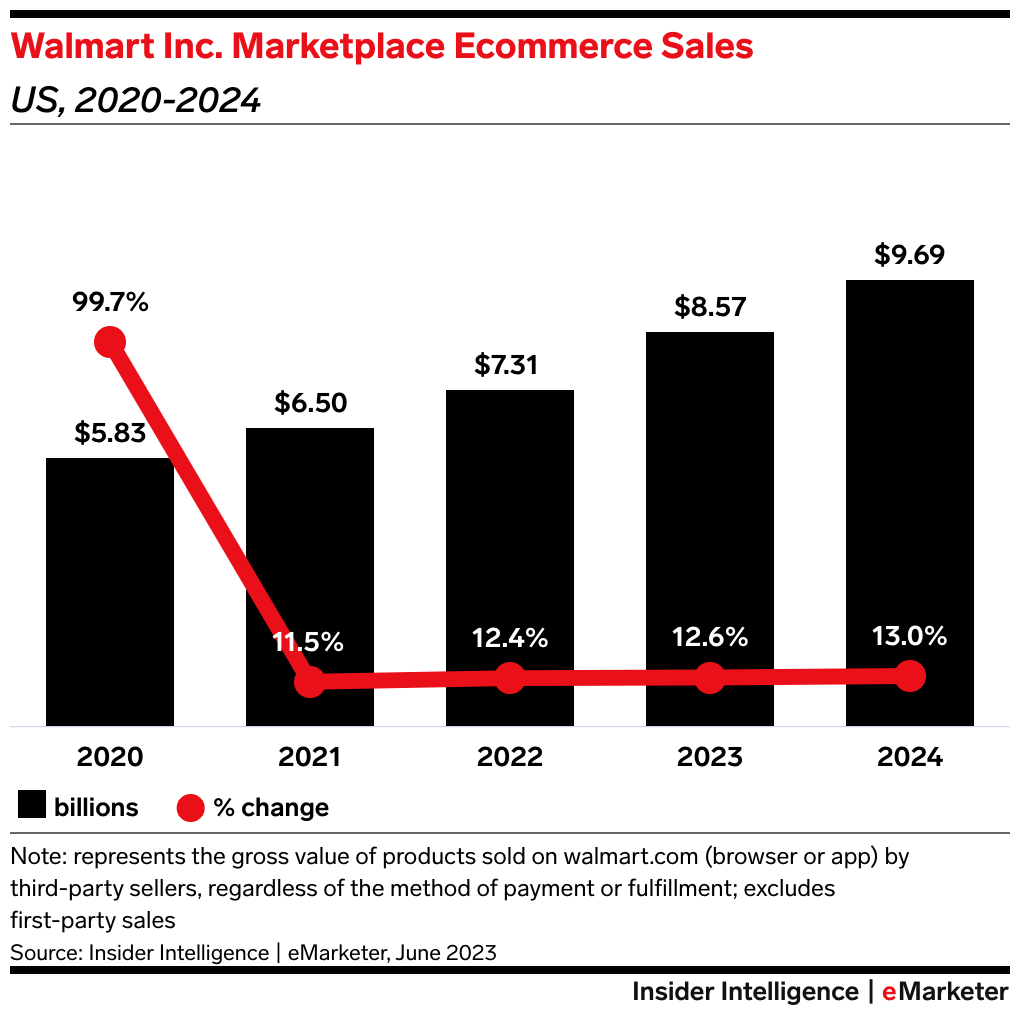

Walmart’s Marketplace is still in its infancy. Providing a platform for third-party sellers to list items on Walmart.com, the service already boasts over 400 million SKUs, an increase from 35 million SKUs in 2017.

Insider Intelligence / eMarketer

Walmart’s e-commerce offerings have grown considerably over the years. Rising from a 4.9% share of total revenues in fiscal year 2019, e-commerce contributed 6.3 % in FY 2020, 11.6% in FY 2021, 12.2% in FY 2022, 12.7% in FY 2023, and 15% of sales in the last quarter.

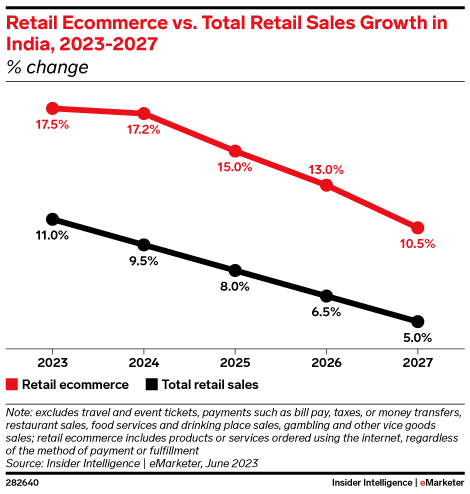

In a move that could drive significant growth, earlier this year, Walmart spent $3.5 billion to acquire the remaining shares of Flipkart, an Indian e-commerce and payment platform.

Flipkart’s Myntra is India’s largest e-commerce platform for fashion and lifestyle products. Myntra provides access to top brands for customers across India with more than 6,000 brands on its marketplace.

Insider Intelligence / eMarketer

eMarketer projects online sales will grow at double-digit rates in India until at least 2027.

The following assessment of the potential for investments in India are summed up well by this excerpt from a recent Baron Capital fund letter.

India is the new China and the fastest growing major economy in the coming decade and beyond. We believe India offers the most attractive long-term investment appeal in our universe. Economic reforms, digitization, formalization, and rising credit penetration favor the most sophisticated, best-managed, public corporations.

Walmart’s global advertising could also spur growth. That business grew approximately 35% in Q2 and 20% in Q3 and is on track to increase by 45% for the full year.

The company also has nascent initiatives in financial services designed to spur growth.

Most of these businesses offer higher margins than the brick and mortar business and serve to build strong customer relationships.

Debt, Dividend, And Valuation

Walmart’s debt is rated AA

WMT yields 1.46%. The payout ratio is 34.66%, and the 5-year dividend growth rate is 1.86%. Therefore, the dividend is safe but is growing at a paltry pace.

Walmart’s forward PEG ratio is 2.91x, versus the average over the last 5 years for that metric of 3.89x. The forward P/E is 24.41x, slightly below the 5-year average P/E of 25.62x, indicating the stock is trading at a valuation marginally better than historic norms.

Walmart currently trades for $156.27 per share. The average 12-month price target of the 30 analysts following the company is $178.79. The average price target of the 3 analysts that rated the stock since Q3 earnings were released is $182.66.

Walmart owns approximately 86% of its stores including the Sam’s Clubs locations. The firm has $18.1billion remaining in the share repurchase program.

Is Walmart A Buy, Sell, Or Hold?

One big positive for Walmart is that it is simply too big to fail. I’m not using the term in the sense of how US banks are viewed. Rather, the company’s sheer size provides advantages that allow it to compete with any and all comers.

A means to illustrate this scale advantage lies in the firm’s advertising costs. In FY 2022, WMT spent $4.1 billion in advertising as opposed to $1.5 billion spent by Target (TGT). Despite outspending its retail rival by a near three-to-one margin, Walmart only devoted 0.7% of sales to advertising versus Target’s 1.3% of sales.

Another way to put Walmart’s scale into perspective is to note that the company’s share of the U.S. grocery market is greater than the combined share of the four next largest grocery channel retailers combined: Kroger (KR), Costco (COST), Target (TGT), and Albertsons (ACI).

Unfortunately, there is a negative aspect to Walmart’s size in that it takes tremendous growth to move the stock. With 4,700 locations and a Walmart and/or Sam’s Club store within 10 miles of 90% of the population, there appears to be little room for the company’s physical expansion in the US.

With a P/E ratio that is only slightly below the average for that metric over the last five years, I don’t view the stock as trading at an appealing valuation. I I’ll add that as an investor that focuses on dividends, the 1.46% yield and the 5-year dividend growth rate of 1.86% are unappealing.

With all of this in mind, I rate WMT as a HOLD.