Good Friday night to all of you right here on r/shares! I hope everybody on this sub made out fairly properly out there this previous week, and are prepared for the brand new buying and selling week forward. 🙂

Right here is every little thing you have to know to get you prepared for the buying and selling week starting June sixth, 2022.

The inventory market might attempt to regain its footing within the subsequent few classes, at the same time as a recent inflation report looms giant on the finish of the week.

Shares struggled to maneuver ahead previously week. With Friday’s sell-off, the most important indexes closed out the four-day interval with losses. That was disappointing to traders in search of the same upside to the week earlier than Memorial Day throughout which the S&P 500 gained about 6.5%.

Liz Ann Sonders, Charles Schwab chief funding strategist, mentioned the market’s late Might surge was doubtless the setup for extra promoting.

“The kind of rally like we noticed final week and a few of what it contained appears a bit extra typical of bear market rallies,” she mentioned. “I nonetheless suppose you’re more likely to get countertrend pops in among the extra speculative areas of the market. … However I believe very decidedly the low high quality commerce is within the rearview mirror. I believe to do nicely on this setting it’s a must to be worth minded. Not worth indexes, however valuation minded.”

Whereas the S&P 500 briefly dipped right into a bear market on Might 20, it has not closed with a 20% decline from its excessive. Nevertheless, Sonders mentioned the present state of affairs is the equal of a bear market, based mostly on the sharp declines in particular person shares.

Sonders doesn’t but see indicators that may point out shares might flip greater, although she says there’s scope for extra sharp rallies.

“I believe the sentiment setting is just not universally bearish sufficient but,” she mentioned. She mentioned sentiment and behavioral measures want to indicate extremes.

Inflation peak?

Within the coming week, the financial calendar is comparatively mild. Shopper worth index and client sentiment — each launched on Friday — are an important reviews.

Might’s CPI is anticipated to be simply barely cooler than April, and a few economists expect it might affirm that inflation has peaked. Artwork Hogan, chief market strategist at Nationwide Securities, mentioned year-over-year headline inflation is anticipated at 8.2%, slightly below April’s 8.3% tempo.

“If CPI is available in at or close to consensus, I believe traders might really feel higher,” he mentioned. Hogan mentioned the market’s late Might breakout helped sentiment, regardless that shares backtracked previously week. “Buyers are in a extra constructive place, and that may carry by way of if CPI is wherever close to consensus or higher,” he mentioned.

Headline inflation, together with meals and vitality, was working at 8.5% in March, and the hope is that CPI will ease from right here to half that stage by year-end, Hogan mentioned.

Diane Swonk, chief economist at Grant Thornton, mentioned CPI will probably be affected by the bounce in gasoline costs in Might. Used automotive costs and meals prices may be elements, she added.

“Everybody’s hoping for this peak inflation, however it might be extra elusive and fewer of a peak than individuals would really like it to be,” Swonk mentioned.

Cleveland Fed President Loretta Mester mentioned Friday that she doesn’t see sufficient proof inflation has peaked, and he or she is on board with a number of half level fee hikes to fight it. Fed officers are in a quiet interval within the coming week, forward of their assembly June 14.

Schwab’s Sonders mentioned the market could also be involved within the quick time period about whether or not inflation has peaked.

“However it’s not simply whether or not we’re on the peak. It’s the pace at which we come down off that peak and in the end to what stage,” she mentioned. “Is the [Federal Reserve] on a mission to get inflation all the way down to the two% goal? Or are they going to really feel comfy with a 3% stage. … To me, it’s the place does the aircraft land? Is the runway at the next elevation than it was pre-pandemic?”

With the CPI Friday, merchants say there’s not a lot for the market to latch onto forward of that report.

“You’ve got a complete week of worth motion, and as of proper now, the worth motion appears ‘glass half empty,’” mentioned Scott Redler, companion with T3live.com.

Redler, who follows short-term technicals, mentioned he’s watching to see if the S&P 500 holds assist at 4,073 and 4,000 beneath that. If not, it might drop again to its latest low of three,810.

The S&P 500 closed Friday at 4,108, down 1.6% on the day and 1.2% for the week.

“Merchants are dropping religion in attempting to place extra threat on to catch extra of an oversold bounce, or a bear market bounce. They’d virtually not need to be concerned as a result of there’s too many potholes,” mentioned Scott Redler, companion with T3Live.com.

Redler mentioned Tesla CEO Elon Musk soured sentiment, after reviews that Musk advised Tesla executives he had a “tremendous unhealthy feeling” concerning the economic system and desires to chop 10% of Tesla’s workforce. The feedback adopted intently on a comment from JPMorgan CEO Jamie Dimon that he’s getting ready for an financial hurricane.

“You may’t have the poster little one of threat saying they’re going to cut back their headcount by 10%. In the event that they’re alleged to have a a number of for development, they usually scale back the headcount, then one thing has to provide with valuation,” Redler mentioned. Tesla shares fell 9% Friday.

Earnings warnings

Whereas there are few earnings reviews within the coming week, Hogan mentioned firms might observe Microsoft’s lead and difficulty warnings. Microsoft lowered its steering on revenues, citing an unfavorable forex influence. Salesforce additionally lowered income steering as a result of forex.

“Buyers are a minimum of wanting by way of that. Not less than, it’s not a requirement difficulty. They’re specializing in the upper greenback and what it would do to multinationals,” he mentioned.

Campbell Soup and Brown-Forman, the maker of Jack Daniel’s, report quarterly outcomes Wednesday. Signet Jewelers and DocuSign submit earnings Thursday.

Sonders mentioned weakening earnings and revenue margin outlooks might set off one other leg down for the market.

“We had the valuation re-rating by advantage of the weak point out there, however we haven’t but seen the weak point in ahead expectations in earnings,” she mentioned.

Sonders mentioned the market rallies want to indicate higher breadth, that means a excessive share of shares climbing collectively, earlier than it begins to show.

One other signal she is watching is the put/name ratio, which might should be the next stage to replicate extra pessimism. This ratio is used as a contrarian indicator. It’s a measure of the variety of put to name choices. Put choices guess that inventory costs decline and a excessive quantity would recommend very adverse sentiment out there.

This previous week noticed the next strikes within the S&P:

S&P Sectors for this previous week:

Main Indices for this previous week:

Main Futures Markets as of Friday’s shut:

Financial Calendar for the Week Forward:

Proportion Adjustments for the Main Indices, WTD, MTD, QTD, YTD as of Friday’s shut:

S&P Sectors for the Previous Week:

Main Indices Pullback/Correction Ranges as of Friday’s shut:

Main Indices Rally Ranges as of Friday’s shut:

Most Anticipated Earnings Releases for this week:

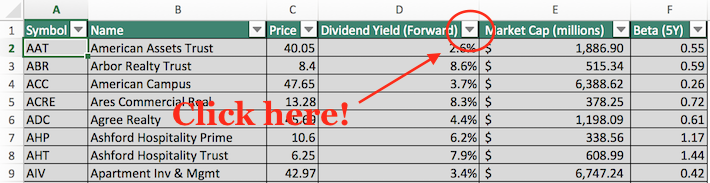

(CLICK HERE FOR THE CHART!)

(T.B.A. THIS WEEKEND.)

Listed here are the upcoming IPO’s for this week:

Friday’s Inventory Analyst Upgrades & Downgrades:

Will There Be A June Swoon? Perhaps, However Perhaps Not

After a late month rally, we will say goodbye to the month of Might, which now opens the door to June. Right here’s the unhealthy information, June is traditionally a weak month and it’s really the worst month of the 12 months throughout a midterm 12 months, down 1.8% on common.

As proven within the LPL Chart of the Day, the excellent news although is the previous 10 years, it has been a stable month, up 1.4% on common to rank because the fourth finest month. However the previous 20 years it has been weak (solely September has been worse) and since 1950 solely August, February, and September had been worse.

“June has one thing for everybody, as it’s little doubt a really weak month traditionally, however the previous decade it has been sturdy,” defined LPL Monetary Chief Market Strategist Ryan Detrick. “Nonetheless, after the large bounce in late Might, we wouldn’t be shocked in any respect if this latest energy continued into a possible summer time rally.”

Listed here are three causes for optimism. First, after the massive positive factors final week, the 7 week dropping streak for the S&P 500 Index is lastly over. There had been solely three prior 7 week dropping streaks and twice (1970 and 1980) noticed the S&P 500 up greater than 33% a 12 months later. On the opposite facet although, the returns in 2001 weren’t excellent as 9/11 and the recession damage returns.

Second, the S&P 500 corrected 18.7% earlier than the rally final week, which may very well be a very good factor as taking a look at earlier corrections between 10-20% confirmed positive factors of almost 25% on common a 12 months later and almost 40% two years later.

Lastly, large positive factors just like the 6.6% achieve for the S&P 500 final week are often an amazing signal for the bulls. Listed here are all of the occasions it has gained greater than 6% in every week (since 1950) and the longer term returns are very sturdy. Up 12.5% on common six months later and almost 22% a 12 months in a while common is one thing that would have most bulls smiling after the tough begin to 2022.

2022 has been a tough 12 months for many traders, however we do see higher occasions forward. Final week’s backside and rally may very well be the beginning of brighter skies forward for traders.

Greatest Vitality Names See Document Strikes

The Vitality sector has been on an absolute tear over the pandemic interval with a 273% achieve for the reason that pandemic lows in March 2020. Through the general market downturn of the previous a number of months, it’s the solely cyclical sector to have managed to retain its uptrend because it has rallied over 60% 12 months thus far in comparison with a 13% decline for the S&P 500. Looking by way of our Chart Scanner device, there’s not an excessive amount of variation within the charts of large-cap Vitality shares with sturdy uptrends throughout the board and lots of new multi-year highs in consequence. Looking at two of the most important members who account for almost three-quarters of a trillion {dollars} in market cap, Exxon Mobil (XOM) and Chevron (CVX) are good examples. CVX has reached new all-time highs following its meteoric rise over the previous couple of years whereas XOM has recovered many of the previous decade’s declines. Moreover, we’d notice that XOM has traditionally tended to be a lot bigger than CVX, however the pandemic and the next rally over the previous couple of years have introduced the 2 shares’ market caps rather more intently consistent with each other.

Each long-standing staples of the Vitality sector, XOM and CVX are additionally notable in that they’re each dividend aristocrats (a gaggle of shares which have now raised their dividend yearly for 25 or extra consecutive years). Which means on high of huge capital positive factors, traders have additionally been rewarded handsomely with dividends. Even after these huge rallies, CVX nonetheless yields 3.25% and XOM pays a good higher 3.67%. Taking this under consideration, the two-year runs together with dividends that these shares have been on are in contrast to something noticed since a minimum of the early Eighties. Given the report two-year run we have seen within the Vitality area, it is powerful to get tremendous bullish on this space of the market now. Keep in mind, we noticed an explosive transfer greater like this for different areas of the market earlier on within the post-pandemic period (suppose meme shares, SPACs, excessive development, and so forth.), however as soon as the tide turned in late 2021, the draw back reversal was simply as excessive. Vitality shares have fully totally different basic threat profiles than aggressively valued Tech shares, and in the end their efficiency is generally tied to the worth of oil. That being mentioned, investor psychology and herd mentality work the identical whatever the asset class.

Sentiment Swings Again to Optimism

Sentiment has taken a giant swing greater throughout surveys this week because the S&P 500 has skilled some upside imply reversion. The weekly AAII sentiment survey has seen bullish sentiment rebound from a sub-20% studying all the best way again as much as 32%. Relative to the historic common of 37.84%, that studying continues to indicate a depressed stage of optimism for particular person traders, however it’s the strongest studying for the reason that week of March twenty fourth. As for the 12.2 share level bounce in bullish sentiment week over week, it was the most important one week achieve for the reason that week of October 14th of final 12 months when it rose 12.4 share factors.

As bullish sentiment surged, there was an enormous 16.4 share level drop in bearish sentiment. That was the most important one week decline within the studying on pessimism since July 15, 2010 when it fell 19.27 share factors. Now at 37.1%, bearish sentiment is on the lowest stage for the reason that finish of March.

Such a big decline in bearish sentiment in just one week has just about been exceptional within the submit Monetary Disaster years. Once more, July 2010 was the final time bears fell by a minimum of 15 share factors and earlier than that there are solely about two dozen different occurrences with out one other occasion within the earlier three months. Whereas it was a giant decline, bearish sentiment stays pretty elevated at 37.1%, however that’s inline with most different occurrences for the reason that mid 2000s whereas bearish sentiment was usually decrease from the occurrences earlier than 2005.

As for a way the S&P 500 has tended to do following these huge bearish sentiment shifts, the S&P 500 has usually tended to maneuver greater with outperformance versus the norm on a median foundation one week and one month out. Though once more efficiency is persistently constructive, the scale of positive factors have tended to be beneath or extra inline with the norm three, six, and twelve months out from these occurrences.

After the massive strikes in bulls and bears this week, sentiment continues to favor pessimism however to a a lot smaller diploma than latest weeks because the bull bear unfold narrowed to -5.1 factors.

Was that the Low?

Shares rallied laborious final week, because the S&P 500 Index broke a seven week dropping streak in resounding trend; its 6.6% achieve was the perfect since November 2020. That sturdy response from equities, following one of many worst begins to the 12 months ever, has many traders questioning, “Was that the low?” Whereas we’re actually open to that chance, as we speak we are going to check out why the technical image suggests volatility is more likely to stay elevated within the close to time period.

First, let’s check out the technical set-up of the S&P 500. Whereas shares have bounced decisively off necessary assist close to 3800, the index is now confronted with a number of ranges of technical resistance, together with damaged assist from the February and March lows, and the 50-day transferring common at 4270. Given shares regular collection of decrease highs and decrease lows all through 2022, it will be important for us to see proof that this pattern has turned and may maintain the next excessive.

Second, we stay skeptical that this market has actually bottomed with out the capitulatory flush often discovered at main market lows, as we mentioned in final month’s Weekly Market Commentary. Nothing in markets has to occur, however whether or not it’s put/name ratios, a stubbornly low VIX (a measure of implied market volatility based mostly on choices costs), and even simply the truth that a number of of the nongrowth sectors arguably stay rangebound from 2021 and haven’t corrected, it could be extremely uncommon for us to see such a significant market low with out real indicators of investor panic and indiscriminate promoting. Of the 5 main indicators of panic that we monitor and are sometimes discovered at main market bottoms, just one has triggered up to now this 12 months in distinction to a minimal of three which have been discovered at latest lows in March 2020, the autumn of 2015, late 2011 and the Nice Monetary Disaster in 2008-2009.

Lastly, whereas we’re inching nearer, we stay within the seasonally weak a part of the 12 months and a Might low would nonetheless be on the early facet of the typical low in a midterm 12 months. all of the midterm years going again to 1950, solely two have seen their yearly low earlier than Might 19, when the S&P 500 made its closing low two weeks in the past. We might notice although, that the depth of this correction is nearly precisely consistent with the typical mid-term 12 months pullback. And no matter once we make that backside, because the chart beneath reveals, the positive factors a 12 months after the low have been substantial with a greater than 30% common return and just one incidence falling in need of a double digit achieve.

“We’re something however market pessimists,” defined LPL Monetary Technical Market Strategist Scott Brown. “Actually, we consider there will probably be substantial alternative in shares on the opposite facet of this volatility and sure within the second half of the 12 months. Nevertheless, exterior of this latest rally, little or no about this market has modified from a technical standpoint and that makes us cautious of calling the all-clear. We consider a slight lean in direction of defensive sectors and away from the growth-oriented areas of this market nonetheless make sense”.

LPL Analysis’s Strategic and Tactical Asset Allocation Committee is most constructive on healthcare and actual property and is turning into more and more constructive on vitality. Inside development sectors, we’re most adverse on communication companies and client discretionary and likewise consider the industrials sector is more likely to underperform.

Revisiting The 50/50 Membership

Amidst the entire craziness in development/meme shares in early 2021, we took a have a look at the Russell 3000 shares that had been each 50%+ off their 52 week highs and nonetheless 50%+ above their 52 week lows to indicate among the most unstable names out there final Might. Right now, we’re revisiting that membership to indicate among the development names which have gotten hammered since final Might however have recovered considerably off of their lows lately. A lot of this craziness is resembled by way of Cathie Wooden’s ARK Innovation Fund (ARKK), which is now about 20% above its lows on 5/11 however nonetheless 67% off its 52 week excessive.

At present, there are 33 Russell 3,000 shares with a market cap of a minimum of $1 billion which might be 50%+ beneath their 52 week highs and 50%+ above their 52 week lows. These 33 shares are outlined beneath, and each single one in every of them are nonetheless beneath their 200-day transferring averages. Nevertheless, solely 12 are beneath their 50-DMAs. The common inventory on this checklist is 67.3% off its 52 week highs (median: 65.4%) and 68.9% above its 52 week low (median: 60.6%).

There are just a few notable names on this checklist, together with the new-to-market EV producer Rivian (RIVN), the famed meme inventory GameStop (GME), the Metaverse Index part Unity Software program (U), the digital platform engineering firm EPAM Software program (EPAM), and the EV charging station firm ChargePoint (CHPT). CHPT is up 63% from its lows on Might eleventh. EPAM has already doubled since its lows in March. Whereas it might not appear to be a lot when you personal the shares so much greater, these names have lately seen huge bounces off of their lows.

Lackluster June Latest 21-12 months Seasonal Chart

June recorded common losses for DJIA & S&P 500 the final 21 years. NASDAQ and Russell 2K have fared higher with modest common positive factors. Traditionally the month has opened respectably, advancing on the primary and second buying and selling days. Then shares drifted sideways and decrease into or close to adverse territory relying upon the index simply forward of mid-month. Right here the market rallied to create a pleasant mid-month bulge that rapidly evaporated and changed into losses. The brisk, submit, mid-month drop is usually adopted by a month finish rally lead by know-how and small caps.

June Worst Month of Midterm Years

During the last 51 years June has shone brighter on NASDAQ shares as a rule rating fifth finest with a 1.0% common achieve, up 29 of 51 years. This contributes to NASDAQ’s “Greatest Eight Months” which ends in June. June ranks close to the underside on the Dow Jones Industrials simply above September since 1950 with a median lack of 0.2%. S&P 500 performs equally poorly, rating ninth, however primarily flat (0.1% common achieve). Small caps additionally are likely to fare nicely in June. Russell 2000 has averaged 0.9% within the month since 1979.

In midterm years since 1950, June ranks no higher than eleventh. June is the worst DJIA, S&P 500 and Russell 1000 month in midterm years. Common losses vary from 1.5% by Russell 1000 to 1.8% from S&P 500. Of the 5 indexes, none has a profitable monitor report in June. DJIA and S&P 500 have declined greater than they’ve risen.

STOCK MARKET VIDEO: Inventory Market Evaluation Video for Week Ending June sixth, 2022

(CLICK HERE FOR THE YOUTUBE VIDEO!)

(VIDEO NOT YET POSTED.)

Listed here are essentially the most notable firms (tickers) reporting earnings on this upcoming buying and selling week ahead-

(CLICK HERE FOR NEXT WEEK’S MOST NOTABLE EARNINGS RELEASES!)

(T.B.A. THIS WEEKEND.)

Beneath are among the notable firms popping out with earnings releases this upcoming buying and selling week forward which incorporates the date/time of launch & consensus estimates courtesy of Earnings Whispers:

Monday 6.6.22 Earlier than Market Open:

Monday 6.6.22 After Market Shut:

Tuesday 6.7.22 Earlier than Market Open:

Tuesday 6.7.22 After Market Shut:

Wednesday 6.8.22 Earlier than Market Open:

Wednesday 6.8.22 After Market Shut:

Thursday 6.9.22 Earlier than Market Open:

Thursday 6.9.22 After Market Shut:

Friday 6.10.22 Earlier than Market Open:

(CLICK HERE FOR FRIDAY’S PRE-MARKET EARNINGS TIME & ESTIMATES!)

(NONE.)

Friday 6.10.22 After Market Shut:

(CLICK HERE FOR FRIDAY’S AFTER-MARKET EARNINGS TIME & ESTIMATES!)

(NONE.)

(T.B.A. THIS WEEKEND.)

(T.B.A. THIS WEEKEND.) (T.B.A. THIS WEEKEND.).

DISCUSS!

What are you all waiting for on this upcoming buying and selling week?

I hope you all have a beautiful weekend and an amazing buying and selling week forward r/shares. 🙂