This article is an on-site version of our Disrupted Times newsletter. Sign up here to get the newsletter sent straight to your inbox three times a week

Today’s top stories

China is changing tack and taking “golden shares” in tech giants such as Alibaba and Tencent instead of doling out heavy fines and imposing sanctions in regulatory crackdowns. The change of approach means the Communist party can remain involved in the businesses, particularly the content they broadcast to millions of Chinese people.

There was some welcome good news today for the UK economy, which grew unexpectedly in November by 0.1 per cent, boosted by football fans’ spending during the World Cup and bucking forecasts of a contraction. However, in the three months to November the economy shrank 0.3 per cent as inflation and rising borrowing costs hit businesses and households, highlighted by data showing mortgage costs rising to the highest proportion of income since the financial crisis.

In the latest manifestation of the crypto crisis, 20 per cent of jobs are being cut at Crypto.com. The collapse of Bahamas-based crypto exchange FTX has sparked fresh debate in the EU about whether its regulation of digital assets could protect the public against similar crises. The trial of FTX’s founder Sam Bankman-Fried is a big test for Wall Street’s top cop Damian Williams.

For up-to-the-minute news updates, visit our live blog

Good evening,

Wall Street banks may have enjoyed a golden period of late thanks to interest rate rises but, as fourth-quarter reporting season gets under way, signs are growing that there could be a reckoning in 2023.

Banks have been able to charge borrowers more for loans without raising the rates they pay depositors by as much, boosting their net interest income — the difference in what they pay on deposits and what they earn from loans and other assets. But with US Federal Reserve windfalls likely coming to an end, some are looking to cut costs and lay off staff.

The standout example so far is Goldman Sachs, which has announced “brutal” job cuts and embarked on its biggest cost-cutting drive since the global financial crisis. Ahead of results next Tuesday, it revealed today that its new fintech unit had notched up $3bn in losses since 2020.

Today’s flurry of Q4 statements painted a mixed picture of the sector, with some results better than analysts had expected.

JPMorgan Chase, the largest US lender, reported a better than anticipated 6 per cent rise in net income to $11bn or $3.57 per share, helped by a gain of almost $1bn from the sale of its shares in Visa. But, in what analysts called a “warning shot for the entire industry”, its caution that net interest income for 2023 would be lower than expected sent its shares downwards.

Bank of America’s net income also increased more than expected, hitting $7.1bn or 85 cents a share, boosted by a stellar performance from its lending business.

Profits at Wells Fargo however fell by half after being hit by multibillion dollar fines for mismanagement of mortgages, car loans and bank accounts. Net income was $2.9bn, including $3.3bn of operating losses. Earnings were 67 cents a share and total revenue fell to $19.6bn from $20.9bn last year. America’s fourth-biggest bank by assets is pulling back from the home loans industry it once dominated.

Citigroup profits fell by more than a fifth as investment banking slowed, but net income of $2.5bn or $1.16 a share was in line with analysts’ estimates. The bank is in the middle of a costly restructuring programme, following scrutiny from regulators and years of underperformance.

Morgan Stanley, whose business, like Goldman’s, skews more towards investment banking, trading and asset management, also reports next Tuesday, but has already announced the departure of CEO contender Jonathan Pruzan.

This year could also be a tough one for asset managers as they cut costs and make tough decisions about where to invest.

In an internal memo seen by the FT, BlackRock’s chief executive Larry Fink said “negative markets had a substantial impact” on its results, hitting revenues and profits in an operating environment “unlike anything we’ve seen in decades”. The world’s largest asset manager plans to axe 500 jobs or 2.5 per cent of its global workforce of almost 20,000 people. Assets under management dropped from a record $10tn a year ago to $8.6tn, while revenues fell by 15 per cent to $4.3bn.

Need to know: UK and Europe economy

Sweden’s state-owned mining company LKAB said it had discovered Europe’s largest deposit of rare earth metals north of the Arctic Circle in the province of Lapland. The find could give a huge boost to the transition to green energy and reduce dependence on China.

The green transition is exposing differences between the Fed and the European Central Bank on whether to take an active role in tackling climate change. Read our explainer.

Meanwhile, Brussels has greenwashing in its sights after finding half of the environmental claims used to advertise products in the EU are misleading or unfounded. The FT editorial board said the EU’s pioneering carbon border tax was a step forward but could be tricky to implement.

Need to know: Global economy

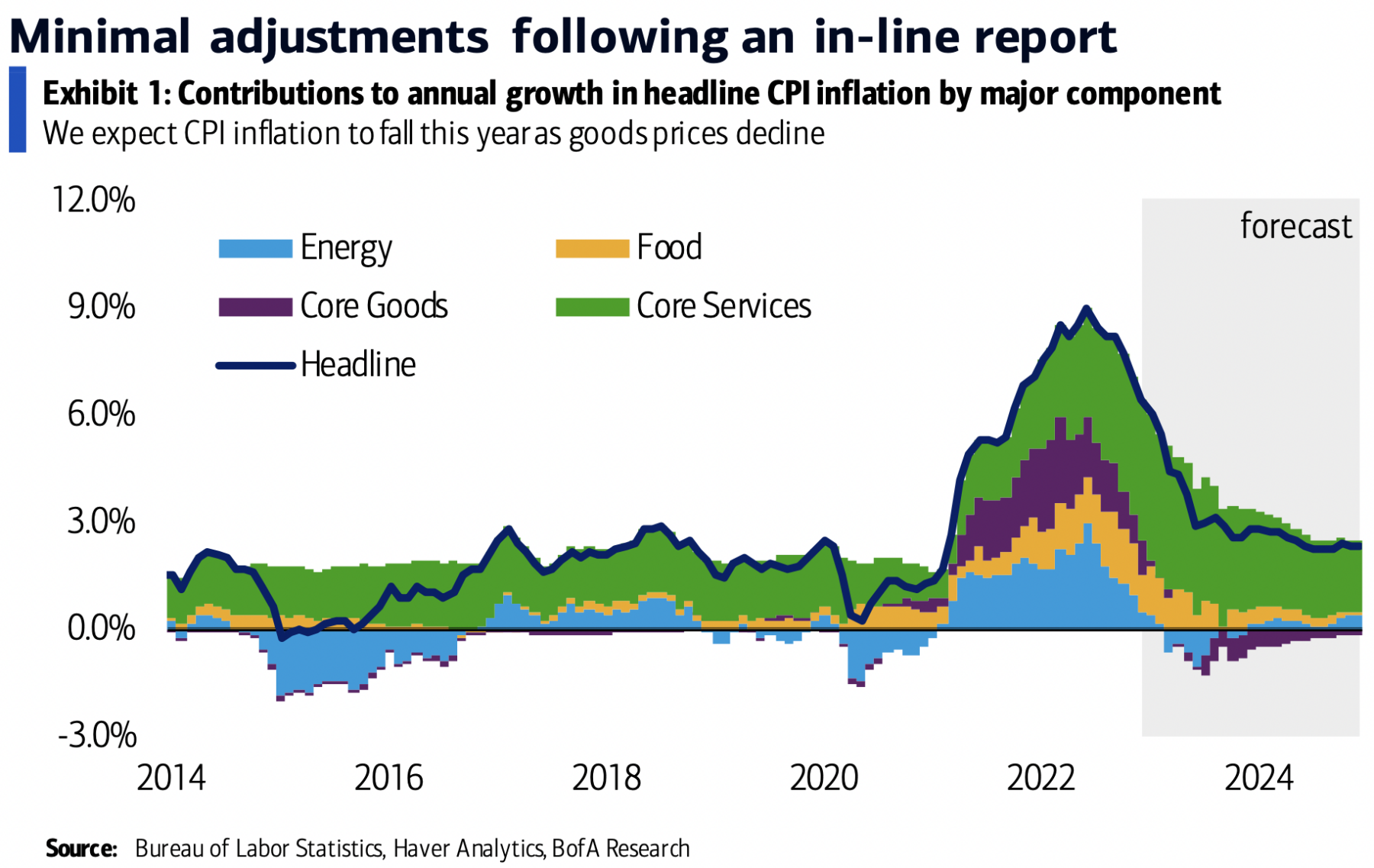

US inflation fell to 6.5 per cent in December, the lowest level in more than a year. The drop paves the way for the Fed to ease up on its programme of interest rate rises by switching to increases of 0.25 per cent. The easing in inflation is also helping consumer sentiment start to tick upwards.

Chinese exports had their sharpest fall in three years in December, according to official data. Full-year gross domestic product figures on Tuesday are expected to miss a 5.5 per cent target that was already the lowest such figure in decades.

IMF chief Kristalina Georgieva warned that global growth would “bottom out” this year before speeding up in 2024. Georgieva, who said last week that a third of the global economy would tip into a recession this year, maintained that a worldwide downturn could still be avoided.

Emerging market governments have raised more than $40bn on international bond markets so far this year, as signs grow that inflation in the US and the eurozone has peaked and hopes arise that China will benefit from its reopening.

Need to know: business

One of the biggest US proxy fights for years was sparked by activist investor Nelson Peltz trying to force his way on to the board of Walt Disney after it declined to make him a director. The battle pits Peltz against CEO Bob Iger and new chair Mark Parker, a Nike veteran.

Saudi Aramco, the world’s biggest crude producer, is doubling down on oil production, even as the world looks to phase out fossil fuels. Our Big Read explains its strategy. Green campaigners meanwhile have seen red over the appointment of Abu Dhabi’s oil chief as president of the COP28 climate summit.

British Gas owner Centrica cemented its position as one of the big winners from the surge in energy prices as it predicted an eightfold rise in earnings.

Taiwan’s TSMC, the world’s largest manufacturer of chips, reported strong earnings in the fourth quarter but cautioned that 2023 would only produce “slight growth” because of the industry downturn.

Science round-up

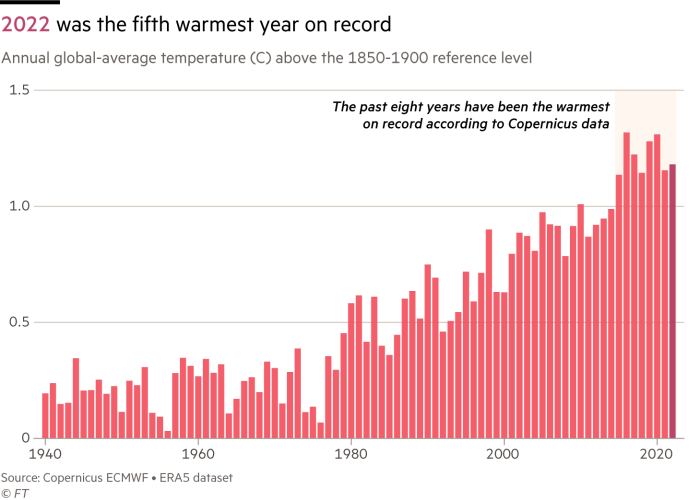

Last year was the fifth warmest on record with average temperatures nearly 1.2C above pre-industrial trends. Copernicus, the EU’s earth observation programme, also said that concentrations of polluting greenhouse gases carbon dioxide and methane had reached their highest points in the satellite record.

Scientists are researching the effects of climate change on the wavy jet stream that has fuelled record warmth in Europe and torrential rain and snow in the western US.

The hype around quantum computing generated by recent research from China is receding over its lack of practical uses, writes US west coast editor Richard Waters. Quantum computing is harder than herding kittens is the view of innovation editor John Thornhill.

Machine learning used to help discover new medical treatments could however be more promising. Covid vaccine maker BioNTech has bought UK AI start-up InstaDeep for £562mn.

US regulators approved a drug that could help the world’s 50mn sufferers of Alzheimer’s by slowing the rate of cognitive decline. Lecanemab is one of the first new treatments in decades but comes at a high cost: $26,500 per year. Commentator Anjana Ahuja cautions that it may end up representing a triumph of hope over evidence.

Positive early trial results for CanSinoBio’s mRNA Covid vaccine could help China as it grapples with soaring case rates and hospitalisations.

Some good news

Uganda has declared the end of an Ebola outbreak four months after the first case was confirmed, thanks to the “magic bullet” of community action.

Something for the weekend

The FT Weekend interactive crossword will be published here on Saturday, but in the meantime why not have a go with today’s cryptic crossword?

Interactive crosswords on the FT app

Subscribers can now solve the FT’s Daily Cryptic, Polymath and FT Weekend crosswords on the iOS and Android apps

Recommended newsletters

Working it — Discover the big ideas shaping today’s workplaces with a weekly newsletter from work & careers editor Isabel Berwick. Sign up here

The Climate Graphic: Explained — Understanding the most important climate data of the week. Sign up here

Thanks for reading Disrupted Times. If this newsletter has been forwarded to you, please sign up here to receive future issues. And please share your feedback with us at [email protected]. Thank you