PM Pictures

“Frequent sense is seeing issues as they’re; and doing issues as they must be.” – Harriet Beecher Stowe

My View of Wall Road

The pendulum swings again to the Micro from the Macro because the official begin to the 2Q24 earnings season has begun. Buyers have witnessed a weaker macro backdrop unfold, however it hasn’t mattered. The S&P notched its thirty seventh file excessive this yr, whereas the NASDAQ Composite has recorded 25 new highs.

Earnings and upgraded earnings revisions are the explanation, and we all know that usually trumps most of the “considerations.” So, the following 5-6 weeks will present a glimpse into how firms and shoppers navigate the expansion slowdown. It appears we all the time say the identical factor round earnings season.

These outcomes will probably be key as to whether shares can keep elevated and maybe construct on their current positive aspects, OR we lastly get a pullback better than 2%.”

Consensus expectations for S&P 500 earnings are for them to climb 9.5% year-over-year in 2Q24-the fourth consecutive improve and the quickest tempo since 4Q21. Regardless of some slowing within the economic system, firms recorded their fifteenth consecutive constructive quarter of gross sales development, rising (+4.5%) at their quickest tempo since 4Q22. Let’s not overlook that margins ought to stay above their 10-year common (10.8%) for the 14th consecutive quarter and broaden to the highest degree (12.4%) since 4Q21.

Margins (www.factset.com)

The first cause for the stable outcomes is the present low company tax construction, which retains multinationals aggressive in international markets.

Extra importantly, if earnings beat by even a contact, 2Q24 earnings development might simply find yourself with a double-digit acquire; market valuations are on the highest degree since 2021, so earnings will have to be the catalyst to drive the market greater, as the present valuations have already priced in a lot of the excellent news. Nonetheless, permit me so as to add some clarification to that assertion. As famous final week, the ahead PE for the S&P 500 is 21, however the PE for the median inventory is 17. Buyers, together with myself, have a portfolio stuffed with numerous “median” shares, and if we see the market broaden out, that’s the place the following set of positive aspects will probably be made.

One other constructive is the anticipated broadening of the earnings image. Seven out of the 11 sectors are anticipated to put up constructive EPS development. Undoubtedly, EPS development will probably be led by tech-related sectors, with communication companies (+22% YoY) and information tech (+16% YoY) anticipated to ship the perfect earnings development. Megacap earnings (MAGS) are anticipated to sluggish however nonetheless ought to be round a 30% YoY tempo. The numerous distinction is that the S&P 500 ex. (MAGS) will begin contributing to S&P 500 earnings development to the tune of about 6%-7%. That can come from Healthcare (XLV) and Power (XLE) – two of my favored sectors going ahead. Three heavyweights within the sector, UnitedHealth (UNH), Johnson & Johnson (JNJ), and Abbott Labs (ABT), got here by way of with constructive outcomes.

If forecasts are anyplace close to right, this may improve the reversion to the imply commerce, broadening the marketplace for traders.

It is one factor for the businesses to report a stable Q2. How the market reacts to stated earnings is one other story. Since analysts have ramped up forecasts coming into this season, it makes for a difficult setup for firms to beat their earnings forecast solidly. I anticipate the upper earnings bar to drive up volatility. With exuberant expectations, firms that disappoint or supply tepid steering are apt to be punished. The S&P has had one 5% pullback this yr (usually, three 4%-5% pullbacks happen in any given yr), so regardless of all the excellent news on the earnings entrance, I would not be stunned if we get a “promote on the information” occasion.

Backside line: Buyers ought to know by now the market has a thoughts of its personal, and nothing ought to be taken without any consideration.

Earnings

Drive Inventory Costs

Earnings studies are ramping up considerably, with a complete market cap of $12.3 trillion in S&P 1500 members (359 shares) hitting the tape final week and one other $21.6 trillion (555 shares) the next week.

Alphabet (GOOGL) and Tesla (TSLA) had been the primary mega-caps to report on Tuesday (7/23). Alphabet posted a stable however not overwhelming quarter, whereas Tesla disenchanted traders. Alphabet offered off on an honest report, and if that development continues, will probably be tough for the general market to push greater.

The subsequent mega caps won’t be for one more week. Microsoft (MSFT) will launch its outcomes on Tuesday (7/30), adopted by Meta (META) on Wednesday (7/31) and Apple (AAPL), and Amazon (AMZN) the day after (8/1). The next week will see an enormous drop off in large-cap shares reporting, however the slate will nonetheless have a lot of shares (over 300), together with the following closest names to getting into the trillion-dollar market cap membership. The final of the mega caps, NVIDIA (NVDA), will not report till late August.

The Fed

Fed Fund futures have priced in a 100% likelihood that the Fed will reduce rates of interest in September. On condition that this rally has priced in that eventuality, it leaves the market very susceptible. First, as a result of it is priced in, there’s a good likelihood will probably be a sell-the-news occasion. Secondly, if the Fed doesn’t reduce charges as anticipated, the selloff will most likely be much more vital. Subsequently, the likelihood {that a} fee reduce in September will convey a loud cheer and constructive market response is VERY LOW.

I will observe that retail gross sales simply beat consensus estimates, and whereas the forecasts preserve bouncing round, the primary learn on Q2 GDP got here in at 2.8%. That’s the newest knowledge; if the Fed is data-dependent, present rates of interest are NOT proscribing the economic system.

The Buying and selling Week

Regardless of the foremost political occasions of the weekend (Biden out, Harris in), the fairness market appears undeterred. Nonetheless, the distinction within the underlying worth motion was notable. Monday was a reversion of the reversion, translation- it was again to Know-how. MAGS suffered an honest dip within the prior week, and the “assumed” bounce occurred right this moment. All the main indices had been greater, and the small caps rallied alongside large-cap tech for the primary time shortly. The scorecard; DJIA + 0.32%, NASDAQ +1.58%, Russell 2000 +1.66%.

WTI closed again beneath $80 ($79.95) whereas the greenback was combined.

In contrast to Monday’s explosive upside session, apart from the “small caps,” Tuesday was a “yawner.” The S&P 500 traded in a slim 16-point vary, closing at 5555, flat on the day. The identical may very well be stated for the NASDAQ and DJIA, however the star of the day was the small caps (IWM), including one other 1% to Monday’s positive aspects.

Wednesday was a “Tech Wreck”. It was a poor session for all of the indices, posting extreme losses on the day, because the Magnificent 7 ETF (MAGS) dropped 5.5%. The S&P gapped decrease on the open and confronted promoting stress all through the day, shedding 2.3%. The scorecard: DJIA -1.1%, NASDAQ -3.5%, and Russell 2000 -1.6%. Healthcare was the lone shiny spot, including 0.83% throughout this yr’s worst market session.

Given the buying and selling motion witnessed on Thursday, I needed to change the tone of my routine every day updates for shoppers. The NASDAQ, NASDAQ 100, and the S&P all suffered breakdowns within the morning, whereas the Russell small caps had been initially up 1%. Rallies ensued, bringing the Large Three indices again into the inexperienced. The S&P rallied to a degree the place it clawed again half of the prior day’s 2% loss, then offered off once more, closing with a 14-point (-0.37%) loss. The NASDAQ Composite and NASDAQ 100 by no means recovered from their breakdown standing, though their losses had been pared. In the meantime, the Russell 2000 small caps prolonged their positive aspects to 1.2% on the shut.

The “Sentiment” winds modified once more on Friday as what was perceived as a benign PCE inflation report supplied the catalyst for a shopping for spree. All the indices moved greater. Nonetheless, the 1.1% acquire within the S&P wasn’t sufficient to push the index into the inexperienced for the week. It was the identical for the NASDAQ Composite as each indices prolonged their weekly shedding streaks to 2.

On the flip aspect, the DJIA posted its fourth consecutive week of positive aspects, whereas the Russell 2000 (IWM) made it three straight weeks within the inexperienced.

It’s a story of two completely different markets loaded with uncertainty.

The Economic system

Q2 GDP grew at a 2.8% tempo, significantly better than anticipated, and is up from the 1.4% in Q1. Private consumption rose to a 2.3% tempo from 1.5%, with spending on items rising 2.5% from the prior 2.3% drop. Authorities consumption was up 3.1% from 1.8%.

The Fed’s favourite gauge of inflation – PCE, got here in above forecast month over month, rising 0.2% vs. the 0/1% forecast. CORE PCE additionally stays “sticky,” reported at 2.6% yearly in comparison with the anticipated 2.5%. Analysts dubbed it “inconsequential.”

Inflation is waning, however it’s not “useless.” Mixed with the not too long ago reported Q2 2.8% GDP print, the case for reducing rates of interest would not seem like as crystal clear as many wish to consider. The chants for fee cuts develop louder, however will they show to be untimely and incorrect? Keep Tuned.

Manufacturing

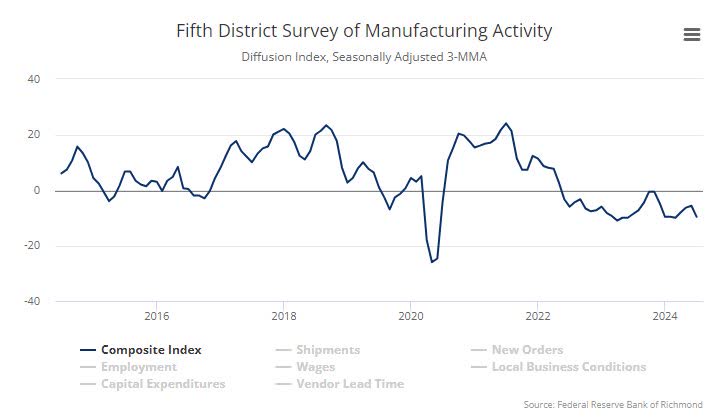

Richmond Fed’s manufacturing dropped 7 factors to -17 in July, disappointing expectations, after falling 8 factors to -10 in June. That is the bottom since Could 2020. The index has not been in constructive territory for the reason that print in October.

Richmond Fed (www.richmondfed.org/region_communities/regional_data_analysis/surveys/manufacturing)

It has been in damaging territory each month since Could 2022, apart from final September and October. Declines had been broad-based.

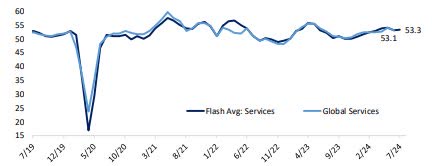

US Flash PMI knowledge:

Companies broaden, Manufacturing contracts.

Composite Output Index at 55.0 (June: 54.8). 27-month excessive.

Companies Enterprise Exercise Index at 56.0 (June: 55.3). 28-month excessive.

Manufacturing Output Index(4) at 49.5 (June: 52.1). 6-month low.

Flash US Manufacturing PMI(3) at 49.5 (June: 51.6). 7-month low.

Housing

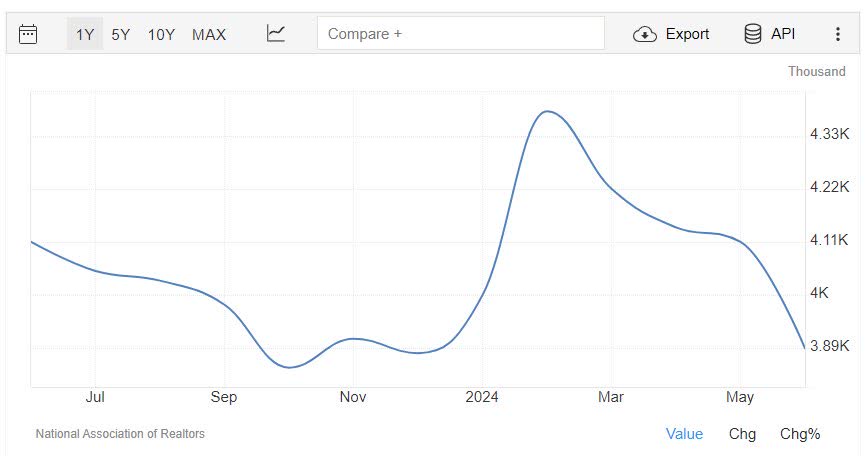

Present residence gross sales declined 5.4% to three.89 million in June, beneath forecast and the weakest since February. This follows the 0.7% slide in Could to 4.11 million in Could. The month’s provide of houses rose to 4.1 after growing to three.7 within the prior report.

Present Dwelling Gross sales (www.nar.realtor/research-and-statistics/housing-statistics/existing-home-sales)

The median gross sales worth climbed to a file excessive of $426,900 after rising to $417,230.

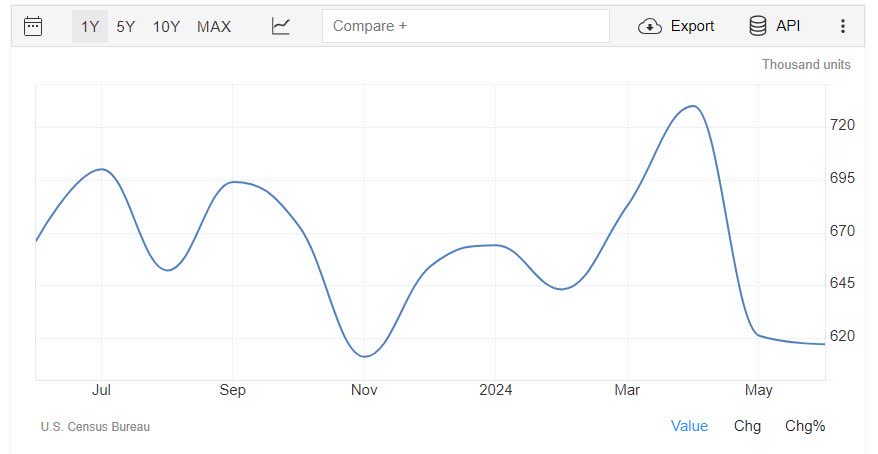

New residence gross sales fell per June knowledge launched yesterday. Complete gross sales volumes fell 0.6% MoM versus a 3.4% MoM acquire forecast by economists. Inventories proceed to rise with the very best absolute degree of inventories for the reason that post-subprime bubble unwound.

New Dwelling Gross sales (www.census.gov/building/nrs/present/index.html)

Regardless of rising stock/gross sales ratios, the median new residence spends little or no time in the marketplace, suggesting loads of latent demand. New houses are extra reasonably priced than current ones.

International Scene

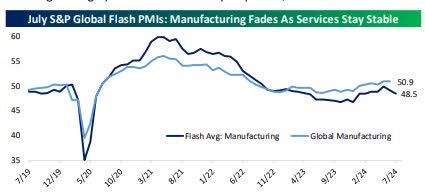

Flash PMIs: S&P International launched flash PMI Manufacturing knowledge from 7 economies in a single day, comprising roughly 85% of whole month-to-month responses; outcomes had been combined.

International PMIs (www.bespokepremium.com)

Whereas manufacturing exercise fell sharply, suggesting an finish to the current acceleration globally, companies exercise was extra secure.

German PMI (www.bespokepremium.com)

Of significance, German manufacturing PMI lagged that of the Eurozone for the twenty sixth straight month, the worst run since at the very least 2008 and a robust indication of Germany’s financial underperformance during the last couple of years.

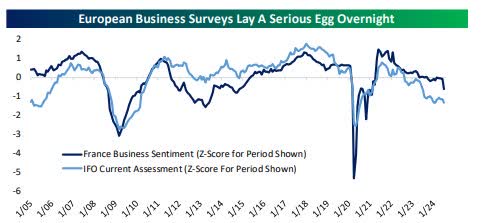

Sentiment Information from France, Germany, and the UK plunged. The INSEE surveys of French companies confirmed a deterioration in sentiment.

Euro Sentiment (www.bespokepremium.com)

IFO’s survey of German companies that missed estimates confirmed a weaker outcome, and manufacturing costs plunged, as reported to the Council of British Trade.

Political Scene

In a historic transfer, President Biden introduced Sunday that he’s not working for reelection, although he plans to serve the rest of his time period. The president endorsed VP Harris, who’s at the moment the presumptive Democratic candidate for president of the US.

Whereas it’s nonetheless early, VP Harris is seen as sustaining a established order coverage platform relating to taxes, inexperienced vitality funding, EV mandates, ESG, vitality provide constraints, and so forth. In essence, Biden 2.0. This indicators that the 2 platforms stay diametrically opposed.

Macroeconomy

This part presents a collection of points that won’t essentially affect the market right this moment however can pose issues for the MACRO scene.

The announcement that the administration has determined to alter presidential candidates provides loads of uncertainty to the political scenario. We will solely hope that within the days/weeks forward, we begin to get readability on points. One does should marvel if current proposals like “lease management” may have any endurance. Hopefully, we are going to quickly discover out the place presidential candidate Harris stands on the problems.

Maybe Ms. Harris will come to appreciate that the plan to cap rents at 5% will do extra hurt than good. It should additionally hurt affordability. The proposal comes chock stuffed with threats to the property homeowners who will watch their prices rise however be pressured to cap their earnings. If you need much less of one thing, regulate it or tax it. Capping rents removes the motivation to BUILD and ADD extra models which is able to accomplish the duty of conserving lease below management. Examine after examine and customary sense proceed to help the notion that offer and demand rule. Cripple the owner and the owner has no possibility however to go away extra properties in disrepair.

The NAHB issued an opposition to a different short-sighted proposal that assaults the golden goose-the property proprietor.

Hire management in any type is dangerous for housing and the administration’s tax plan to cap rents at 5% on current multifamily constructions will worsen the housing affordability disaster by discouraging builders from constructing new rental housing models at a time when the nation is experiencing a shortfall of 1.5 million housing models. These lease caps would additionally damage current tenants – those who the they’re attempting to assist – as a result of homeowners and builders can be unable to cowl rising prices if rents are mounted. Main economists and quite a few research through the years agree that lease management would irritate affordability issues by exacerbating the housing scarcity in America.

“If this administration is severe about desirous to decrease prices for renters, its insurance policies ought to concentrate on growing the rental housing provide. The most effective technique to attain this purpose on the tax entrance is to strengthen the Low-Revenue Housing Tax Credit score, which is the perfect device to finance the manufacturing of reasonably priced rental housing. NAHB has developed a 10-point plan to deal with the affordability disaster that requires increasing the LIHTC, decreasing rules that stall multifamily improvement initiatives and adopting affordable and cost-effective constructing codes. These commonsense options will increase multifamily housing manufacturing and make renting extra reasonably priced.”

Hopefully, this lame-duck proposal might by no means see the sunshine of day in Congress. Nonetheless, if the present administration candidate picks it up, it would bode poorly for the housing business and assist nobody.

Harriet Beecher Stowe’s opening quote, “frequent sense,” rang true within the 1800s however is being ignored right this moment.

Earnings

The Savvy Investor market retains all members updated with the most recent EPS outcomes, which we use to uncover the market’s hidden gems.

The Day by day chart of the S&P 500 (SPY)

This week’s market motion was marked by one thing we’ve not seen a lot of this yr – volatility. Breakdowns adopted by intraday rallies, then late-day selloffs. That mid-week motion was adopted by a 1.5% rally within the S&P 500 to shut out the buying and selling week.

S&P 500 (www.freestockcharts.com)

That left the S&P again above an honest help degree, including extra confusion about what may come subsequent.

Funding Backdrop

An In-depth evaluate of the market dynamics is reserved for members of the Savvy Investor companies.

THANKS to all of the readers who contribute to this discussion board to make these articles a greater expertise.

These FREE articles assist help the SA platform. They supply info that speaks to Each the MACRO and the short-term scenario. With a various viewers, there isn’t a manner for any writer to get particular until they’re merely highlighting ONE inventory, ETF, and so forth. Subsequently, detailed evaluation, recommendation, and suggestions are reserved for members of my service providing on the platform.

SA verifies the knowledge right here; hyperlinks are supplied as supporting documentation in virtually each case. If anybody can level out a remark in any article I put forth and display that it’s factually INCORRECT – I’ll REMOVE it.

Better of Luck to Everybody!