EyeEm Cell GmbH

Pay attention beneath or on the go on Apple Podcasts and Spotify

Espresso to get pricier as firms move on prices to customers. (00:22) CoreWeave (CRWV) units IPO itemizing worth at $40, lower than its earlier midpoint estimate of $51. (02:02) Levi Strauss (LEVI) in talks to promote Dockers model to Marquee – report. (03:26)

That is an abridged transcript.

You’ve heard quite a bit concerning the improve within the worth of eggs in current months however what concerning the juice that retains you going each morning. No, not OJ, a cup of joe.

Reuters reported that you could be quickly need to pay as much as 25% extra for espresso, as firms reminiscent of Lavazza, Nestle (OTCPK:NSRGY), and JDE Peet’s (OTCPK:JDEPF) are reportedly in talks with retailers to boost costs to move on the prices from surging arabica costs to customers.

In accordance with the Meals and Agriculture Group, world espresso costs jumped to a multi-year excessive in 2024.

Manufacturing has been impacted by extended dry climate and drought in Brazil and Vietnam, in addition to heavy rains in Indonesia. Brazil and Vietnam collectively account for practically 50% of the world’s espresso manufacturing.

World costs for the upper high quality arabica, favored within the roast and floor espresso market, soared 70% final 12 months and gained one other 20% to date in 2025.

Reg Watson, director of fairness analysis at ING, instructed Reuters that retail costs might rise 15%-25%.

Dutch agency JDE Peet’s (OTCPK:JDEPF) stated it might hike costs to soak up the prices from espresso inflation. Brazilian roaster 3 Coracoes reportedly raised roast and floor costs by 14.3% in March, after hikes of 11% in January and 10% in December.

Folgers espresso maker J.M. Smucker (NYSE:SJM), which raised costs final June and October, stated it expects one other hike within the first half of the subsequent fiscal 12 months.

CoreWeave (CRWV) set its preliminary public providing worth at $40, lower than its earlier estimate, promoting 37.5M shares for $1.5B, on Thursday evening.

The providing contains 36.59M shares of Class A standard inventory to be bought by the agency and 910K shares to be bought by present stockholders.

As well as, the corporate has granted the underwriters a 30-day over-allotment choice to buy as much as an extra 5,625,000 shares.

The inventory goes stay on the Nasdaq this morning underneath the ticker CRWV. The providing is anticipated to shut on March 31, 2025, topic to the satisfaction of customary closing circumstances.

The unreal intelligence hyperscaler anticipated a midpoint of $51 per share, in response to a submitting final week with the U.S. Securities and Trade Fee. With the corporate planning to promote 47M shares, it might have generated $2.4B on the midpoint.

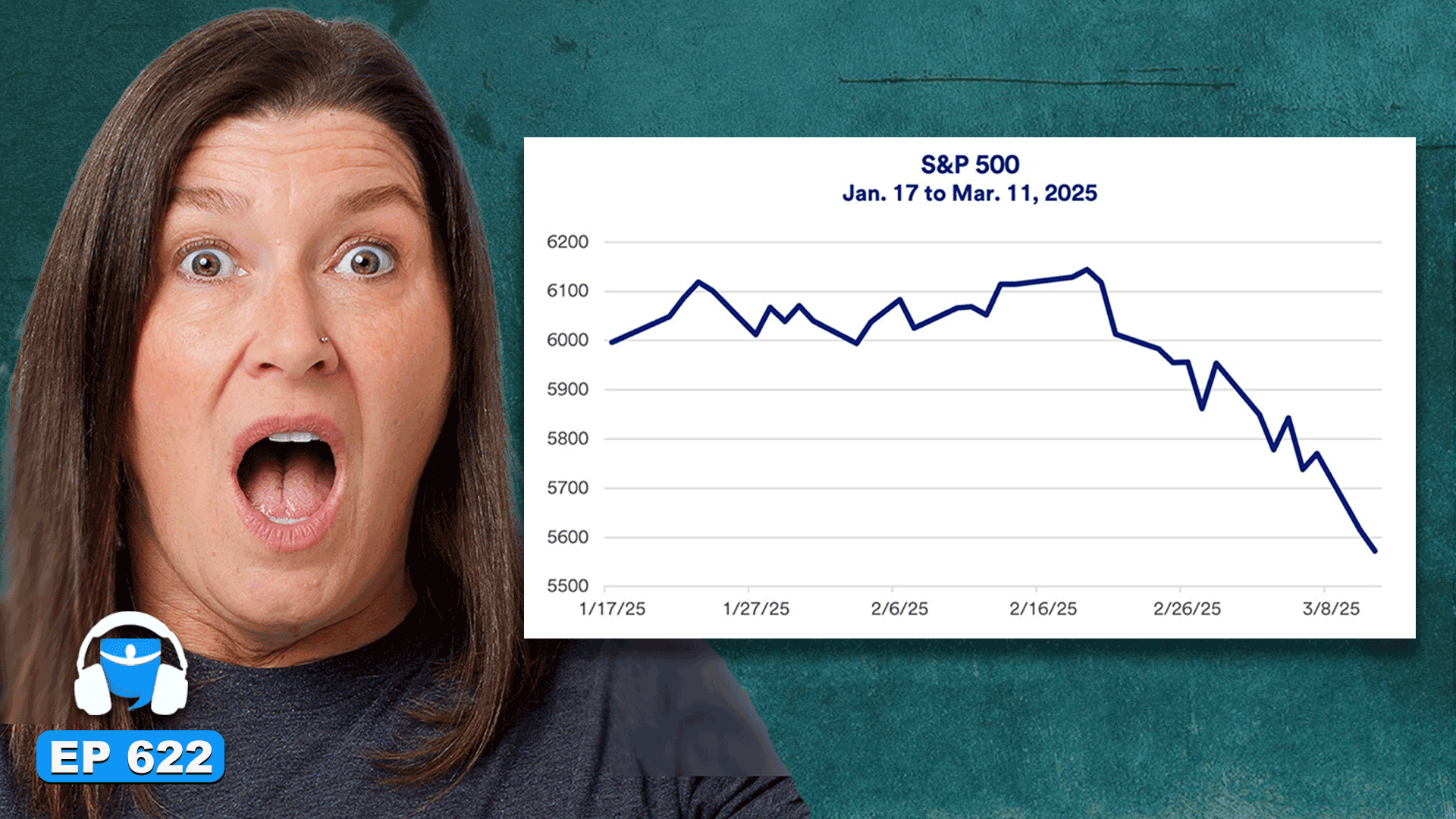

Nevertheless, the corporate downsized to incentivize traders. The discount in share quantity and worth was additionally associated to current inventory market volatility, in response to Bloomberg. This provides it a valuation round $20B.

Searching for Alpha reached out to CoreWeave for remark.

Nvidia (NASDAQ:NVDA), a backer of CoreWeave, was anticipated to purchase $250M price of shares at $40 every, in response to varied stories. Nvidia owned about 6% of the corporate earlier than this reported haul.

Marquee Manufacturers is in unique discussions with Levi Strauss (NYSE:LEVI) to buy the Dockers model.

If a transaction with Marquee would not occur, there are different consumers, together with Genuine Manufacturers, which might are available in and do a deal for the Dockers model, in response to a Ladies’s Put on Each day report on Thursday, which cited unidentified sources. The timing of a possible deal wasn’t clear, although Levi Strauss (NYSE:LEVI) is scheduled to report its Q1 outcomes on April 7.

Marquee could not be reached for remark by Ladies’s Put on Each day and Levi’s declined to remark Thursday.

The report comes after Levi Strauss (LEVI) introduced in October that it was contemplating strategic alternate options for its Dockers model, which might end in a sale.

What’s Trending on Searching for Alpha:

Auto tariffs: TSLA, RIVN, LCID produce their autos in U.S., F higher positioned than GM

Trump administration seeks management over future investments in Ukraine’s infrastructure, minerals – report

Europe gross sales decline is momentary, revamped Mannequin Y can assist Tesla – Analysts

HSBC terminated funding bankers on bonus day, did not pay bonuses: report

Catalyst watch:

Now let’s check out the markets forward of the opening bell. Dow, S&P and Nasdaq futures are within the crimson. Crude oil is flat at $69/barrel. Bitcoin is down 2.5% at $85,000.

On the planet markets, the FTSE 100 is down 0.1% and the DAX is down 0.5%.

The most important movers for the day premarket: Lululemon Athletica (NASDAQ:LULU) -11% – Shares fell regardless of a powerful This autumn, as disappointing steering and weaker-than-expected same-store gross sales overshadowed earnings.

On at present’s financial calendar:

8:30 am Private Revenue and Outlays

10:00 am Client Sentiment

12:15 pm Federal Reserve Board Governor Michael Barr will take part in a “Banking Coverage” dialogue earlier than the 2025 Banking Institute occasion hosted by the College of North Carolina Regulation Faculty.

3:45 pm Atlanta Federal Reserve Financial institution President Raphael Bostic will average”U.S. Housing Finance Coverage” panel earlier than the Third Annual Georgia Tech-Atlanta Fed Family Finance Convention.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a serious U.S. change. Please concentrate on the dangers related to these shares.