Hear beneath or on the go on Apple Podcasts and Spotify

Trudeau says Canada prepared with counter-tariffs if Trump begins commerce warfare. (00:24) Europe’s largest pension fund sells Tesla (TSLA) stake over Musk’s pay package deal: report. (01:42) White Home delays order for Nippon Metal to finish takeover bid for US Metal (X). (02:42)

Oleksii Liskonih

That is an abridged transcript.

Canadian Prime Minister Justin Trudeau stated Canada will reply with counter-tariffs if the President-elect follows by means of on his menace to impose tariffs on all Canadian imports.

In an interview on MSNBC’s Inside With Jen Psaki, the outgoing chief stated that although his authorities did not need a commerce struggle with the incoming Trump administration, it should retaliate if the tariffs materialize.

Trudeau confirmed that Trump floated the thought of creating Canada the 51st U.S. state throughout their assembly at Mar-a-Lago, labelling it a distraction from extra urgent points.

Trump, who’s getting ready to imagine workplace for a second time, has stated that he would slap a 25% tariff on imports from Canada and Mexico till the international locations crack down on unlawful immigration and drug smuggling.

In response to a Congressional report, the U.S. and Canada have one of many largest bilateral business relationships on the earth, together with a extremely built-in power and automotive market.

U.S. Commerce Division export information reveals that Canada buys extra U.S.-made items than every other nation, with America exporting items price about $322 billion to its northern neighbor within the first 11 months of final 12 months.

Dutch civil service pension fund ABP offered its complete stake in Tesla (NASDAQ:TSLA) over dissatisfaction with the CEO’s pay package deal.

In response to a Dutch newspaper, Het Financieele Dagblad, Europe’s largest pension fund divested its 2.8 million shares in Tesla as a result of it was sad with Elon Musk’s $56 billion remuneration package deal and poor working situations on the firm.

The report added that ABP emphasised that the choice was not politically motivated. Musk is about to go the deliberate Division of Authorities Effectivity below the incoming administration of President-elect Donald Trump.

Final month, a Delaware choose rejected the multi-billion greenback pay package deal for a second time. Musk’s attorneys tried to reverse the unique resolution after shareholders permitted the determine in June 2024.

Decide Kathaleen McCormick declined to revive Musk’s $56 billion compensation. In her resolution, McCormick stated the approval course of lacked transparency, and that the Tesla (TSLA) board was “beholden” to Musk.

The Biden administration has delayed its order for Nippon Metal (OTCPK:NPSCY)(OTCPK:NISTF) to drop its $14.9B takeover deal of United States Metal (NYSE:X) till mid-June, the businesses stated in a joint assertion late Saturday.

President Joe Biden on January 3 blocked the proposed transaction on nationwide safety grounds after the Committee on International Funding in america failed to succeed in a consensus on the mixture.

“We’re happy that CFIUS has granted an extension to June 18, 2025 of the requirement in President Biden’s Govt Order that the events completely abandon the transaction,” the businesses stated. “We look ahead to finishing the transaction, which secures the very best future for the American metal business and all our stakeholders.”

Neither the White Home nor the United Steelworkers union, which opposed the deal, instantly responded to requests for remark by Searching for Alpha.

Each Biden and President-elect Donald Trump stated they opposed the deal.

The businesses filed a lawsuit looking for to overturn the order final week, alleging that Biden’s opposition to the deal denied them a good overview.

What’s Trending on Searching for Alpha:

Apple plans iPhone revamp, push into good house, catching up with AI: report

Amid a world selloff, the correct transfer is likely to be to purchase extra bonds

TikTok ban: Supreme Courtroom skeptical of free speech arguments

Catalyst watch:

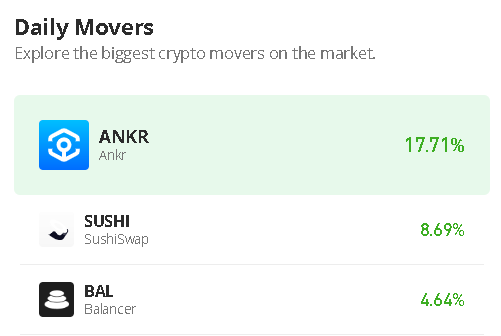

Now let’s check out the markets forward of the opening bell. Dow, S&P and Nasdaq futures are within the pink. Crude oil is up 1.8% at $78/barrel. Bitcoin is down 2.4% at $91,000.

On this planet markets, the FTSE 100 is down 0.3% and the DAX is down 0.8%. Markets in Japan had been closed for a vacation.

The most important movers for the day premarket: Intra-Mobile Therapies (NASDAQ:ITCI) shares surged as a lot as 21% on stories that Johnson & Johnson (JNJ) is in talks to amass the biotech firm, which has a market cap of roughly $10B.

Editor’s Notice: This text discusses a number of securities that don’t commerce on a significant U.S. change. Please pay attention to the dangers related to these shares.