RichLegg/E+ by way of Getty Pictures

Funding Thesis

I’ve beforehand discovered that Wabash Nationwide Company (NYSE:WNC) is an excellent firm with rising working margins, capital efficiencies, and returns over the previous few years. There may be nothing to counsel that this has modified. An up to date valuation triangulating with 3 completely different worth approaches exhibits that the inventory is reasonable. That is now an funding alternative.

Background

After I final coated WNC in Might 2024, it was buying and selling at USD 23 per share. I had concluded that whereas it was an exquisite firm, there was not sufficient margin of security.

The market value has since declined to USD 18 per share and I needed to re-visit my valuation to see whether or not there’s now a ample margin of security. For this evaluation, I cowl the interval from 2017 to 2024.

- I used the Jun 2024 LTM outcomes as the 2024 values.

- I begin from 2017 to be in step with my Might 2024 evaluation.

I’m a long-term worth investor holding onto corporations for five to six years. As such I take a look at long-term developments when analysing valuing corporations. On this context, I’ll argue that the enterprise fundamentals of the corporate haven’t modified considerably since my Might article.

To recap:

- WNC is a number one producer of trailers and liquid transportation methods that has re-positioned itself as a “chief of linked options for the transportation, logistics, and distribution industries.”

- This can be a cyclical firm and from 2017 to 2024, income grew at 3.8% CAGR. It’s not a high-growth firm. In my earlier article, I quoted 2 market analysis experiences displaying that the sector is predicted to develop at a low single-digit progress fee.

- I had beforehand assessed the corporate to be financially sound. I keep this place trying on the present solvency and liquidity positions.

- Beforehand, I concluded that there was a great observe file of bettering working and capital efficiencies. However on this replace, I’ll present that not all metrics level to the identical path.

- Returns have been higher than the respective value of funds indicating that it created shareholders’ worth.

I had concluded that WNC was an exquisite firm and I’ve not seen something to counsel in any other case.

Valuation narrative

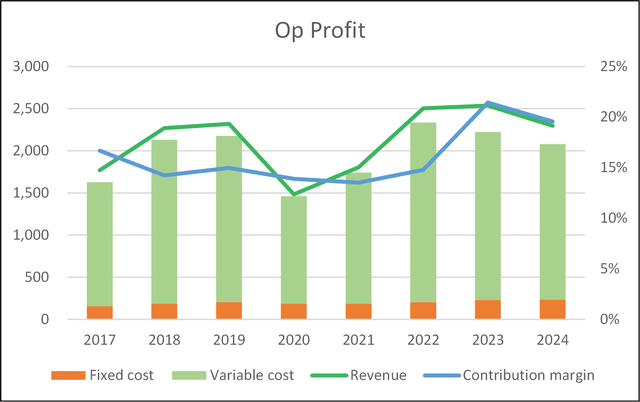

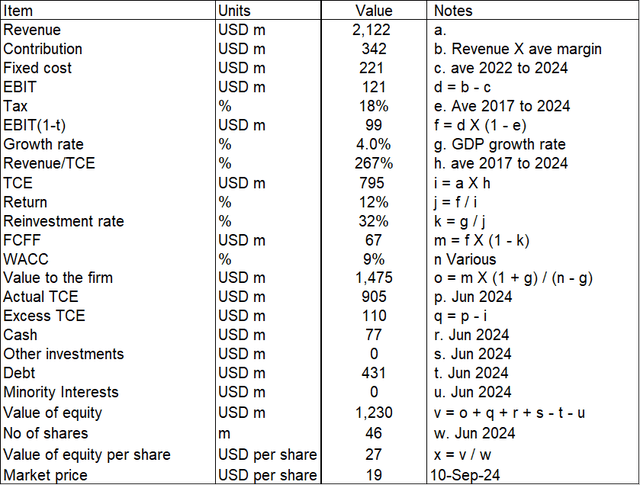

I valued WNC primarily based on the working mannequin illustrated in Chart 1.

Chart 1: Working Revenue (Writer)

Observe to Op Revenue Profile. I broke down the working earnings into fastened prices and variable prices.

- Fastened value = SGA, Depreciation & Amortization and Others.

- Variable value = Price of Gross sales – Depreciation & Amortization.

- Contribution = Income – Variable Price.

- Contribution margin = Contribution/Income.

There are 3 key parameters in my valuation mannequin.

- Income.

- Contribution margin to signify working effectivity.

- Capital turnover (income/whole capital employed) to signify capital effectivity.

Income

Based on Damodaran, projecting the efficiency of cyclical corporations primarily based on the present efficiency can result in deceptive valuations. Quite it’s extra applicable to base the valuation on the efficiency over the cycle.

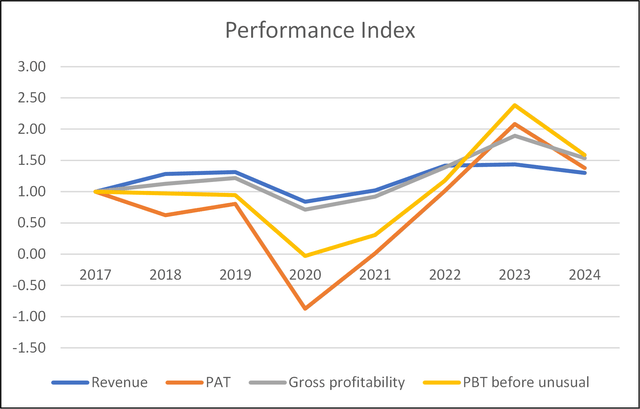

On this context, 2017 to 2024 seems to cowl at the least one peak-to-peak cycle. Seek advice from Chart 2.

In projecting the income for my valuation, I assumed that the common 2017 to 2024 income represents the bottom income. I additionally assumed that income would develop at 4% CAGR in perpetuity.

Chart 2: Efficiency Index (Writer)

Trying on the 2024 efficiency, you could be fearful that it is a signal of declining fundamentals. I might counter by pointing to its cyclical nature. Moreover whereas the 2024 outcomes could also be decrease than these in 2023, they’re nonetheless a lot better than these in 2017.

Moreover, in my Might article, I had proven that in 2022/23 there was a leap within the Producer Value Index. This led to a rise within the common unit promoting value in 2023 for WNC. The Producer Value Index in 2024 is decrease than that in 2023. As such you shouldn’t be stunned to see decrease income in 2024.

My rivalry is that WNC remains to be an exquisite firm. This narrative is in step with the opposite findings under.

Efficiencies

Whereas the corporate had a observe file of bettering working and capital efficiencies, I assumed that the 2017 to 2024 common contribution margin and capital turnover in my present valuation.

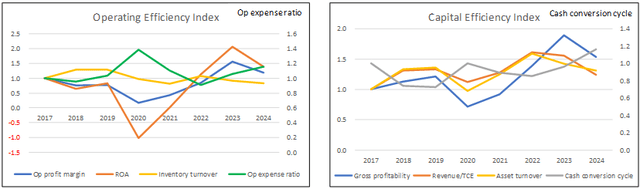

I didn’t construct in any enhancements as a result of there have been combined outcomes after I checked out different measurements of working and capital efficiencies.

- Working efficiencies. You may see from the left a part of Chart 3 that there have been enhancements within the working revenue margin and ROA. However stock turnover declined and the working expense ratio received worse.

- Capital efficiencies. Seek advice from the precise a part of Chart 3. There have been bettering developments in gross profitability, capital turnover, and asset turnover. Nevertheless, the money conversion cycle deteriorated.

From a 2017 to 2024 perspective, there are extra bettering developments than deteriorating ones.

Chart 3: Working and Capital Efficiencies (Writer)

Progress

Progress must be funded and one metric for that is the Reinvestment fee outlined as Reinvestment/NOPAT.

Primarily based on the basic progress equation, now we have:

Progress = Return X Reinvestment fee.

From 2017 to 2024, the common ROIC was 14.6 %. Income grew at 3.8 % from 2017 to 2024.

The derived Reinvestment fee = 3.8 / 14.6 = 26.0 %

However you may also derive the precise Reinvestment fee from the primary rules. I outlined Reinvestment = CAPEX + Acquisitions – Depreciation & Amortization + improve in Internet Working Capital.

Primarily based on this, the corporate had a mean Reinvestment fee of 40.2% from 2017 to 2024

You may see that there’s a distinction between the precise Reinvestment fee and that derived from the basic progress equation.

I might deduce that the corporate was not that environment friendly when Reinvesting. Within the context of my valuation,

- I exploit the basic progress equation.

- For the chance evaluation, I might assume that the corporate would begin with the historic Reinvestment fee and attain the basic fee on the terminal stage.

Valuation

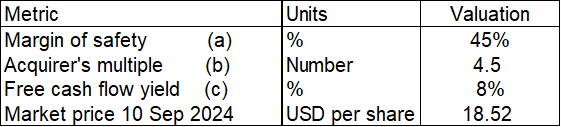

I take a look at 3 valuation strategies to find out whether or not the corporate is reasonable.

- Intrinsic worth. That is primarily based on the single-stage Free Money Circulate to the Agency (FCFF) mannequin. I obtained an Earnings Worth of USD 27 per share. The margin of security was derived by evaluating the intrinsic worth with the market value of USD 19 per share.

- Acquirer’s A number of. This was primarily based on EV / (previous 3 years common EBITDA). Based on Tobias Carlisle who favoured this metric, a price of lower than 6 is taken into account low-cost.

- Free money stream yield. That is primarily based on the historic 2017 to 2024 common Free money stream to the agency dividend by the present market value. I goal a fee higher than double the risk-free fee.

The outcomes are summarized in Desk 1. You may see that every one 3 metrics level to WNC being low-cost.

When taking a look at Desk 1, word that the margin of security was primarily based on projecting the longer term efficiency. Nevertheless, the Acquirer’s A number of and Free money stream yield was primarily based on historic efficiency.

Desk 1: Valuation Abstract (Writer)

Notes to Desk 1:

a) Earnings Worth c/w market value.

b) Enterprise Worth / (common 3 years EBITDA).

c) (Common 2017 to 2024 Free money stream to the agency) / market value

Valuation mannequin – intrinsic worth

The valuation mannequin is illustrated in Desk 2. It was primarily based on the next Free Money Circulate to the Agency (FCFF) equation:

Worth to the Agency = FCFF X (1 + g) / (WACC – g)

FCFF = EBIT(1- t) X (1 – Reinvestment fee).

EBIT(1-t) was estimated primarily based on the working revenue profile as proven in Chart 1.

The Reinvestment fee was primarily based on the basic progress equation.

I modelled this as a cyclical firm utilizing 2017 to 2024 normalized values for the income, contribution margin, and capital effectivity (Income/TCE).

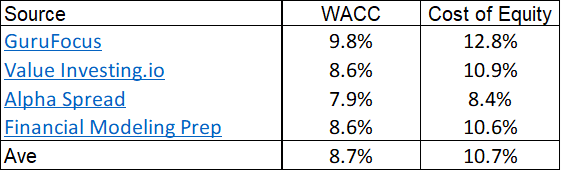

The WACC was primarily based on a Google seek for “Wabash Nationwide Company WACC” as per Desk 3.

Desk 2: Pattern calculation (Writer)

Desk 3: Estimating the price of funds (Numerous)

Dangers and limitations

The Acquirer’s A number of and Free money stream yield was primarily based on historic averages. However I might argue that for cyclical corporations, the efficiency sample repeats. As such, they’re in all probability extra dependable than these for corporations on the start-up or progress stage.

Secondly, in my valuation mannequin, I relied on the basic progress equation to derive the Reinvestment fee. I’ve earlier identified that the historic Reinvestment fee was a lot increased than that derived from the basic progress equation.

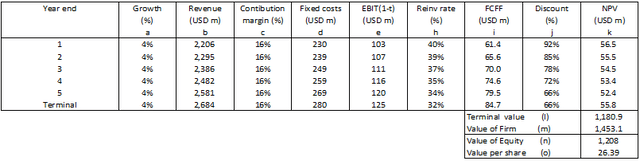

To see the affect of this, I used a multi-stage mannequin, the place I decreased the Reinvestment fee from the 40% historic fee to the basic fee on the terminal stage.

That is illustrated in Desk 4. The result’s that the intrinsic worth was decreased from USD 27 per share to USD 26 per share. It was not vital.

Desk 4: Calculating intrinsic worth with decreasing Reinvestment fee (Writer)

I might add that in Might 2024 I had valued WNC at USD 26 per share. Thus, the present margin of security is due extra to the decline out there value from USD 23 per share in Might 2024 to at the moment USD 18 per share. That is an a few 24% decline.

The important thing problem is whether or not you consider that the enterprise prospects of WNC had declined by 24% since Might 2024. That is particularly when the 2024 efficiency appears decrease than these in 2023.

Once you take a look at my evaluation and valuation, it’s primarily based on a long-term cum cyclical perspective. As such, I’m not fearful in regards to the projected 2024 declining income. It has all being factored in when trying on the cyclical efficiency.

Moreover, in my Might article, I had proven that in 2023 there was a leap within the Producer Value Index in 2022/23. This led to a rise within the common unit promoting value in 2023 for WNC. The Producer Value Index in 2024 is decrease than that in 2023. As such, you shouldn’t be stunned to see decrease income in 2024.

From 2017 to 2024, ROIC and ROE averaged 15% and 16%. The present WACC and price of fairness are 9% and 11%. You may see that the returns are higher than the respective value of funds, suggesting that shareholders’ worth was created. These are usually not indicators of deteriorating fundamentals.

Conclusion

I nonetheless take into account WNC an exquisite firm primarily based on the next:

- Whereas income in 2024 was decrease than that in 2023, I see this as a part of the cyclical efficiency.

- From 2017 to 2024 there have been extra metrics with bettering developments than these with deteriorating ones.

- There was no vital change within the numerous solvency and liquidity metrics.

The problem was figuring out the “honest value”.

I used a single-stage FCFF valuation mannequin to find out that the intrinsic worth was USD 27 per share, thereby offering greater than a 30% margin of security.

Recall that this intrinsic worth was primarily based on assuming the common 2017 to 2024 values for the important thing parameters. These averages have been decrease than the present values. A margin of security primarily based on these low averages is a conservative method.

On the similar time, the Acquirer’s A number of and Free money stream yield additionally factors to the corporate being low-cost.

Primarily based on these, I might take into account WNC an funding alternative.