jetcityimage

W.W. Grainger (NYSE:GWW) has done phenomenally well since my first article in October 2022, delivering 67% total returns versus 31% for the S&P 500. Let’s review what happened since then, what drove the growth, and whether the stock has remained attractively valued after the runup.

The investment thesis recap

Grainger is an industrial distributor with the majority of its business in the USA divided into:

- High-tough Solutions (HTS): Focused on mid to large customers with highly complex operations and processes

- Endless Assortment (EA): An easy buying experience for smaller and less complex businesses

- MonotaRO: Part of the Endless Assortment segment, but operating in Japan

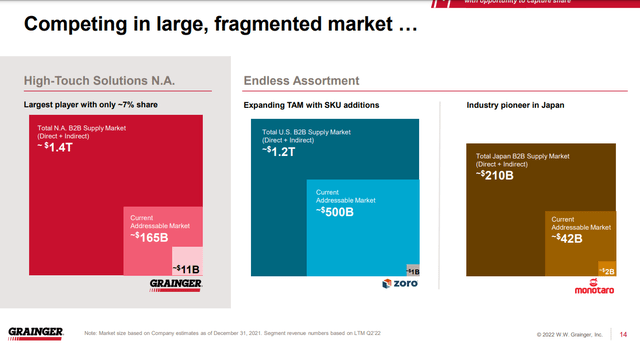

We can see that Grainger only has a 7% share in its largest segment (HTS), with the current addressable market only around 12% of the total B2B supply market in the USA. This leaves much room for organic growth by taking market share and expanding into new segments.

Total addressable market (GWW Investor Day)

Grainger has an edge over its competition due to its large scale and focus on value-added customer solutions. Scale is vital for distributors because a large and dense network of branches means faster and cheaper shipment, improving the customer experience and operating margins for Grainger. It also makes consolidation interesting because acquired branches enhance the network and bring new customer relationships and often new SKUs (stock-keeping units) into the mix.

Customer solutions are digital offerings like an inventory management system, digital procurement support or specialist consulting. This enhances the customer experience, makes Grainger a more significant part of the complex processes of the customer and locks them in.

Operating results

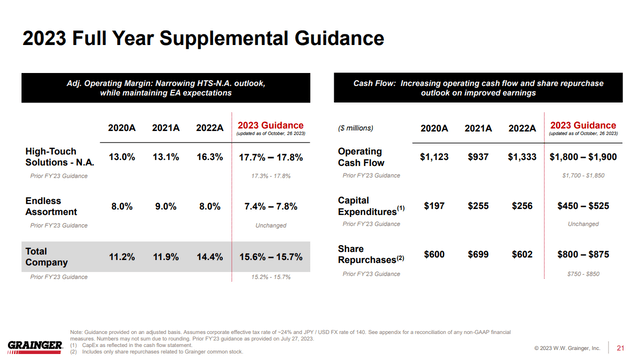

While revenue had no surprises in the last year (all five earnings since my previous coverage saw ~1% difference to analyst expectations), EPS surprised each quarter with 2-14%, showing the strong operating leverage Grainger managed to deliver and with that earnings growth. The company continues to spend much of its cash flow on share repurchases and has significantly increased capital expenditures to grow and support its business. I estimate that the business spends $150 million on growth capex, based on the difference between its capital expenditures and D&A expenses (a decent proxy for growth capex).

GWW FY 23 guidance (Q3 earnings)

E&R Industrial divestment

In December, Grainger divested its subsidiary E&R Industrial to Paradigm Equity Partners, an LA-based PE firm. While the company did not disclose many details about the transaction, according to several sources like Datanyze, E&R Industrial had generated over $350 million in sales, representing around 2% of the company’s sales. I’d assume the paid multiple was lower than the GWW Price/sales of 2, and I’d guess the price paid to be somewhere around $500 million. Overall, the divestment is not material to the investment case. Grainger has a history of divesting parts of its businesses.

Valuation

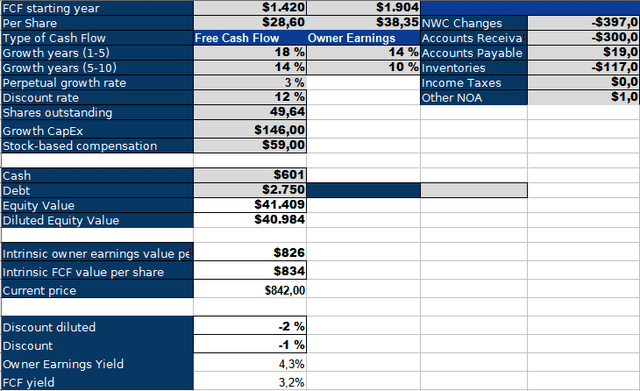

To value Grainger, I again use an inverse DCF model. Since my initial coverage, I made several changes to my inverse DCF model:

- I calculate FCF and Owner Earnings (FCF + growth CapEx – SBC +/- changes in NWC) and rely primarily on the result from Owner Earnings.

- I removed the shares count reduction from the calculation because it double counts buybacks (the FCF used for buybacks is already included in the FCF number).

- I increased the discount rate for cyclical business from 10% to 12-15% to account for the risk. As an industrial distributor Grainger relies on the economy and is cyclical, hence I use a 12% discount rate.

GWW Inverse DCF Model (Authors Model)

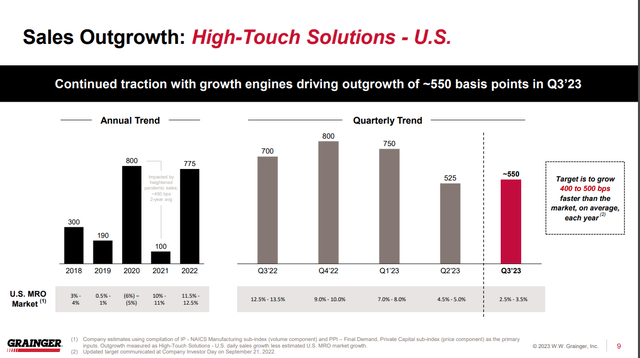

Based on the current results, Grainger would be required to grow by 14% for the next five years, followed by 10% for the following five years. I find these growth rates to be too high. Over the last five years, Grainger grew revenue by 8% annually and EPS by 23%. I believe revenue will continue to grow around 6-9% due to incremental market share gains, the market growth in line with inflation and network expansion through capex and acquisitions. Grainger made it a target to outgrow the overall market by 400 to 500 bps a year. I believe they can achieve this goal due to the previously mentioned factors. Grainger managed to almost double its net income margin over the last five years and retired over 10% of the shares outstanding. Profit margins are now at historically high levels, significantly above levels pre-pandemic, so I doubt that we will see significant further improvements. As a distribution business, you can only grow margins to a certain extent. The speed of buybacks has also slowed as the company saw a lot of multiple expansion from 10 times EBITDA to 15 times. This makes future buybacks less effective and lowers the impact on EPS.

Sales outgrowth against the market (Q3 Earnings)

Analysts share my concerns and expect the company to grow EPS in the mid to high single digits over the next three years, with sales growing at 6% annually. Grainger looks expensive at the current level, and I have to downgrade to a hold. We need to remember that I use a higher discount rate for my model compared to the previous analysis, so investors with a higher risk tolerance might still find Grainger attractive at these levels.