AnthonyRosenberg

W. P. Carey Inc. (NYSE:WPC) recently said it will spin off its office real estate portfolio and the REIT has lowered its AFFO outlook for 2024 as a consequence.

W.P. Carey recently updated its dividend policy as well and plans to pay out 70% to 75% of its pro forma AFFO moving forward. W.P. Carey’s updated dividend policy and 2024 guidance implies a leading dividend yield of 6.0-6.5% compared to a 7.9% yield today.

The lower dividend, however, still translates into an attractive yield for passive income investors and WPC is cheap based on 2024 AFFO.

My Rating History

In W. P. Carey: Spin-Off Is A Game Changer I pointed to the benefits of the trust’s office portfolio spinoff. Benefits included an increase in the weighted-average lease rate and a de-risked real estate portfolio.

W.P. Carey now presented its preliminary forecast of 2024 AFFO, following the office spinoff, which allows us to calculate an ex-office dividend yield and valuation multiple.

I have held W.P. Carey for more than two years in my passive income portfolio and rated WPC consistently favorably, including when the trust’s stock traded above $80.

The high interest rate environment has been a headwind for the entire REIT market, including WPC, which explains at least to some degree the trust’s poor performance.

W.P. Carey’s ad-hoc announcement in September to spin off its office properties also did some damage to sentiment and created AFFO and dividend uncertainty in the short term.

From a dividend coverage perspective, however, I think that W.P. Carey remains a promising choice for passive income investors.

Streamlined Property Portfolio Following Office Spinoff

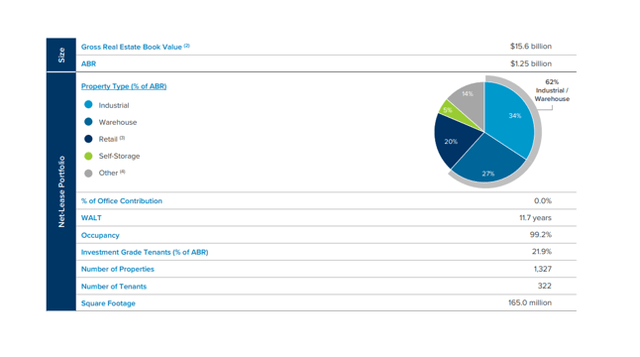

With the exclusion of office properties and challenges in the sector, W.P. Carey has rationalized its real estate portfolio. The trust is now more concentrated in its core business strategy industrial and warehouses which together account for 62% of W.P. Carey’s annualized base rent.

Though the REIT still owns a considerable number of other assets in its net lease portfolio, including retail and self-storage assets, I think the more refined portfolio positioning makes WPC a less risky investment, particularly for passive income investors that are concerned with collecting stable dividend income from the trust’s properties.

Portfolio Overview (W.P. Carey)

The trust has spun off its office properties into a new entity called Net Lease Office Properties (NLOP) which has begun trading recently.

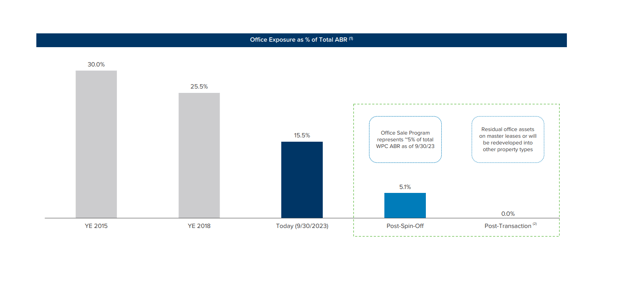

W.P. Carey’s office exposure fell to just 15.5% in 3Q-23, down from 30% in 2015, and the elimination of office properties, like I said, is a prudent move on the part of management to move risk off of it balance sheet.

Office Exposure (W.P. Carey)

AFFO Outlook for 2023 and 2024, New Announced AFFO Pay-Out Policy

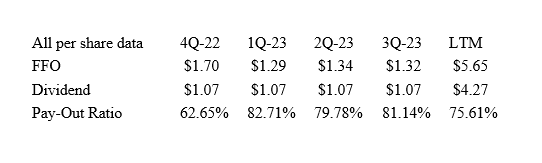

W.P. Carey’s dividend coverage in the third quarter looked as good as ever. The trust produced $1.32 in FFO while paying out $1.071 per share, reflecting an FFO-based pay-out ratio of 81%. Though the pay-out ratio deteriorated 1 percentage point QoQ, the dividend remained very well-covered.

AFFO (Author Created Table Using Trust Information)

More interesting for passive income investors, however, is the outlook for AFFO and the future dividend yield that they can expect once W.P. Carey’s spinoff-related dividend cut goes into effect.

Following the completion of the office spin-off, W.P. Carey is seeing AFFO between $5.17 and $5.23 per diluted share in 2023. The trust’s prior guidance called for $5.32 and $5.38 per diluted share in AFFO.

The lowered AFFO guidance implies $1.3 billion and $1.5 billion in acquisitions compared to an expected investment volume of $1.75 billion and $2.25 billion prior to that.

With office properties no longer being part of W.P. Carey’s core strategy, the trust also projected a decline in AFFO to $4.60 and $4.80 per diluted share in 2024 which reflects a decrease of 10% YoY.

Moving forward, this range, $4.60-4.80 per diluted share should be the new baseline for W.P. Carey in terms of FFO and I would expect low single digit growth in AFFO in the years after that.

W.P. Carey also clarified that its new dividend pay-out policy implies that the trust will pay out 70% to 75% of its pro-forma AFFO in the future. For 2024, this implies a dividend pay-out of $3.22 to $3.60 per diluted share which is a fairly wide range.

Based on the middle of the range, passive income investors can expect $3.29 to $3.53 per diluted share in dividends for 2024. This means, based on W.P. Carey’s preliminary 2024 AFFO guidance, an investment in WPC is set to yield between 6.1-6.5%.

W.P. Carey Is Still Cheap

With $5.20 per share in AFFO (middle of the range) expected for 2023, W.P. Carey’s stock is selling at an AFFO multiple of 10.5x.

Before the spinoff, W.P. Carey was selling at an AFFO multiple of 12x and the multiple before that was even higher. Based on the preliminary guidance for next year, $4.60-4.80 per diluted share, the trust’s stock is selling at 11.3-11.8x AFFO, so even when taking into account the office spinoff, the trust is selling at quite an attractive valuation multiple.

Why W.P. Carey Could See A Higher/Lower Valuation Multiple

W.P. Carey’s valuation multiple is still depressed, primarily because investors need more time to envision the ‘new’ W.P. Carey without its office portfolio footprint.

Uncertainty about expected AFFO, ex-office, has also been a headwind for W.P. Carey’s stock price, but with the trust now clarifying its AFFO expectations for 2024, I think that the valuation remains compelling for passive income investors. My previous comments about the de-risking of W.P. Carey’s portfolio are still valid as well.

My Conclusion

W.P. Carey is emerging as a REIT with a rationalized portfolio and a core-focus on industrial and warehouse facilities.

The trust just presented its expectations for 2024 AFFO, following the spinoff of its office property portfolio, and though W.P. Carey is expected to see a drop in AFFO, the valuation multiple based on AFFO looks attractive to me.

W.P. Carey is still set to offer passive income investors a dividend yield of more than 6% and I think that the cash flow guidance for 2024 was actually not that bad, implying only a 10% YoY drop in AFFO.

With a risk-reduced real estate portfolio and clarity provided in terms of AFFO potential, I think that WFC remains a buy for passive income investors.