JLGutierrez

The Vanguard Short-Term Inflation-Protected Securities ETF (NASDAQ:VTIP) is a fund that invests in TIPS, or US Treasury Inflation-Protected Securities, and in this article I will delve into both the structure of the ETF, and the dynamics and the factors that influence its price. Finally, I will give my perspectives on the current macroeconomic scenario, thus trying to explain whether the ETF can be a good opportunity at the moment.

The ETF Structure

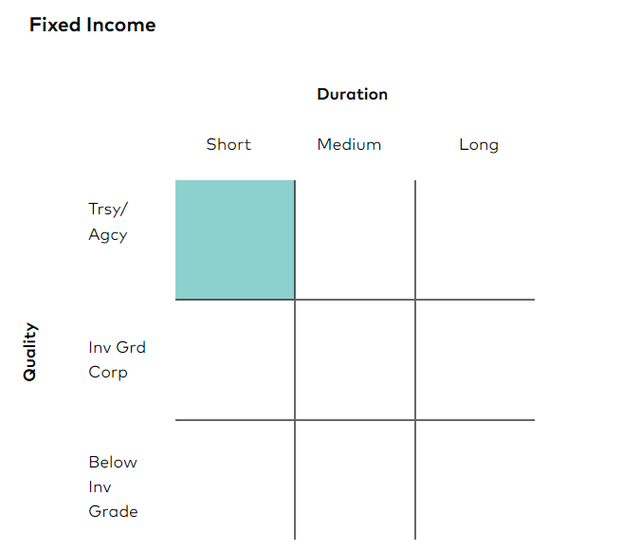

The structure of VTIP is relatively simple: as mentioned before, the ETF invests in TIPS, considered risk-free as they are issued by the US Treasury, and with a duration between 0 and 5 years.

VTIP Stylebox (Vanguard)

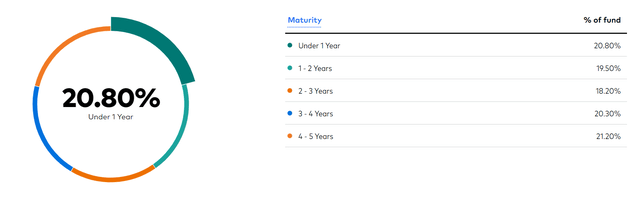

Maturities are split almost evenly, with roughly 20% of the fund’s assets in each duration range.

VTIP Maturities (Vanguard)

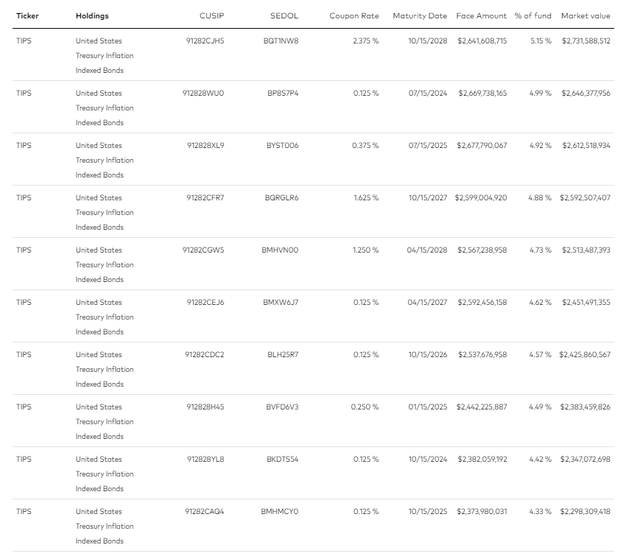

As for the top 10 holdings, here too, it is easy to predict their typology.

Top 10 holdings (Vanguard)

Going instead to metrics regarding the overall efficiency of the ETF, I believe that VTIP ranks among the best in the category. As regards the expense ratio of 0.04%, a very important characteristic from my point of view regarding this type of investment, the value is extremely good compared to its competitors. According to Vanguard, the average value for this category is, in fact, around the value of 0.63%.

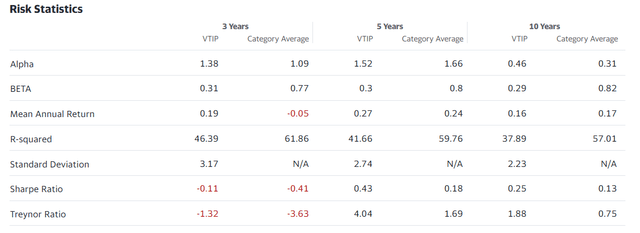

Regarding other metrics such as Alpha, Sharpe Ratio and Treynor Ratio, you can see in the image below how VTIP has always been, in all time frames analyzed, above the other ETFs in the category.

VTIP Risk Statistics (Yahoo Finance)

As regards liquidity and volumes, also in this case from my point of view, there are absolutely no problems: VTIP has a total of $51.6 billion dollars in assets (updated as of 01/31/2024), while as regards volumes, the value is above 760 thousand.

Finally, the last metric to consider is the ETF’s yield, currently at 2.86%. From my point of view, this is the flaw of VTIP, in fact, as I will explain in more detail later, at the moment there are much more profitable forms of investment in terms of dividends, leaving VTIP as an alternative, only if you believe in a sudden increase in inflation.

The Drivers of VTIP

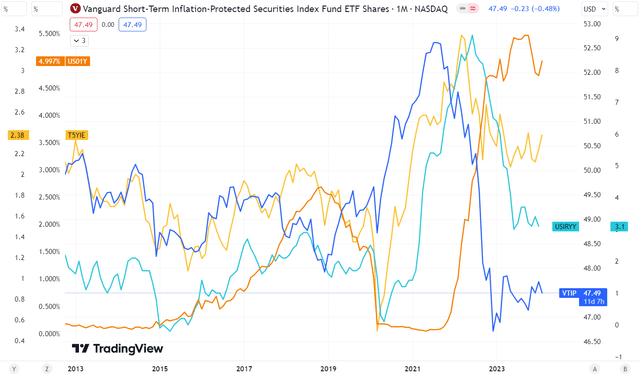

Before analyzing the current economic context to interpret the possible trend of VTIP, it is necessary to understand what are the drivers that move the price of the ETF. TIPS in particular are driven by 3 factors: interest rates, duration and inflation. Below I have compared these 3 factors with the VTIP graph (in blue), in particular the 1-year bond yield in orange, the US CPI in light blue, and the 5-year breakeven inflation rates in yellow.

VTIP and Drivers (TradingView)

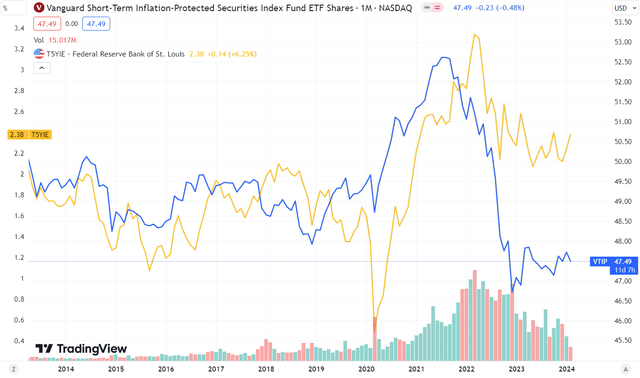

Analyzing the main correlations, the trend of VTIP (but it can be said in general of thematic ETFs that invest in TIPS) is correlated to the trend of breakeven inflation rates, as this ideally represents the expectation of inflation.

VTIP and Breakeven Inflation Rate (TradingView)

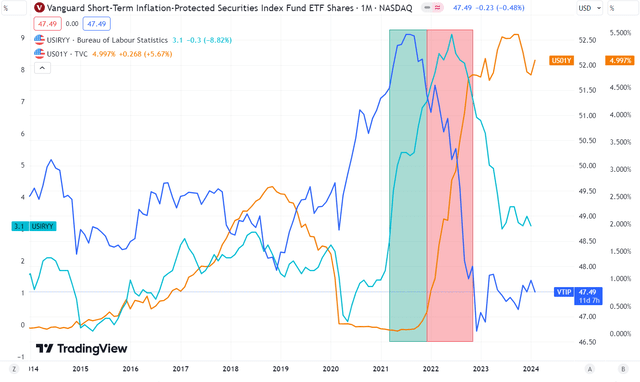

Looking instead at the trend of the interest rate, TIPS being bonds are negatively affected by the rates: an increase in interest rates causes a decrease in the price. Precisely for this reason, the best period to buy an ETF like VTIP is when inflation is rising, but interest rates are still low (as highlighted by the green rectangle), while when inflation is falling, but rates are still high, it is the worst time to hold this type of investment (red rectangle).

VTIP and Interest Rate (TradingView)

What to Expect

From my point of view, an investment of this type only makes sense if an increase in inflation is expected. Otherwise, it makes more sense to look at some other type of financial instrument. In fact, the 2.86% dividend is not very attractive, especially considering that there are high yield ETFs out there that offer much more and have more room for price growth. Secondly, at the moment even an investment in short-term Treasuries offers higher returns of at least 2 percentage points.

The point is, although the latest inflation print at 3.1% is not encouraging, even looking at the CORE CPI at 3.8%, a sudden increase in inflation remains very unlikely in my view. The Fed estimates that the 2% inflation target could be reached in 2025, and given that the number one priority remains to contain inflation, I doubt that there will be any rash moves that could undermine the progress made.

The only risk I see at the moment concerns a broader concept of structural inflation given by the deglobalization process due to rising geopolitical tensions. Indeed, some analysts believe that inflation could, in fact, remain at levels structurally above 2% for many years as a result of this process. However, despite supporting this idea even from a more optimistic perspective, I believe that current policies will be able to contain this problem and that a considerable increase in inflation should be discarded as a probable hypothesis.

For this reason, I think that this is not the right time for an investment in VTIP, although I take this ETF into consideration for the future as one of the best in the category.