koto_feja/E+ by way of Getty Pictures

Thesis

Voyager Therapeutics, Inc. (NASDAQ:VYGR) is a biotechnology firm within the medical stage, which is concentrated on creating novel therapies, principally gene-based therapies, for the remedy of circumstances that alter the nervous system comparable to Alzheimer’s illness (AD), amyotrophic lateral sclerosis (ALS), Friedreich’s Ataxia, Huntington’s illness (HD), Parkinson’s illness (PD), amongst others.

Just a few months in the past, I took an in-depth look into Voyager’s expertise, its pipeline and financials primarily based on their FY 2023 10K report. Again then, the share value was standing round $9. Since then, the inventory has continued to indicate excessive volatility, sliding to round $7.50 and bouncing again to its present $8.51. In my earlier article, I rated the inventory as a “Purchase” primarily based on the sturdy partnerships with corporations comparable to Novartis AG (NVS), Neurocrine Biosciences, Inc. (NBIX) and AstraZeneca PLC (AZN), the nice potential of VYGR’s TRACER capsids, which may ship therapeutic molecules to the mind by way of an intravenous injection, and its sturdy steadiness sheet.

Lately, the corporate launched its Q1 2024 monetary report, which depicts the monetary stability of the corporate, holding related quantities of money than its present market cap. Extra importantly, VYGR has been offering updates in its totally different pipeline packages, which embody the beginning of its first medical trial related to VY-TAU01. Curiously, final month the corporate participated within the American Society of Cell & Gene Remedy (ASCGT), the place they delivered an oral presentation showcasing the event of the subsequent era of TRACER capsids, which have confirmed to have a better capability to focus on mind cells than the primary era.

Thus, contemplating all of the constructive advances, for my part, Voyager Therapeutics is now a “Robust Purchase”.

Overview

In my earlier article, I described the reliance on the TRACER patents as a possible threat, regardless of the seemingly sturdy TRACER IP. The primary rationale was that the majority of Voyager’s pipeline and multi-million partnerships are depending on this expertise. Nevertheless, the TRACER capsids have not been examined in people, which brings two layers of dangers.

The primary one is that regardless of the excellent preclinical outcomes, testing the expertise in people is the one technique to positively display if the TRACER capsids are environment friendly in crossing the blood-brain-barrier (BBB), delivering the therapeutic molecules to mind cells and spare harm to different tissues such because the liver. That is nonetheless pending to be examined.

The second layer of concern is expounded to the likelihood that the expertise is deemed unsafe or out of date. The longer that Voyager takes on acquiring regulatory approval for his or her product candidates, the upper the prospect that another biotechnology firm develops one thing with the potential to have an effect on the worth of the TRACER expertise. With this in thoughts, discovering out that Voyager is already engaged on the next-generation capsids, is one other vital signal of forward-looking progress. For my part, the truth that the corporate is already creating a safer and extra environment friendly model of the TRACER capsids will allow VYGR to deal with doubtlessly disappointing information from the medical trials.

Moreover, the beginning of the Section 1a medical trial which goals to check the security and pharmacological dynamics of VY-TAU01, the one product candidate that doesn’t use the TRACER capsids, in wholesome contributors forward of schedule is a superb signal of progress. For my part, if VY-TAU01 reveals promise in medical trials, it would turn into Voyager’s first industrial product earlier than its money runway ends (2027).

Taking these two main constructive indicators of progress, along with a couple of extra updates that I might be describing on this article, I give a price improve to Voyager Therapeutics, contemplating them as “Robust Purchase” for long-term traders because of its high-risk/high-reward potential.

Pipeline Q1 2024 Updates

VY-TAU01

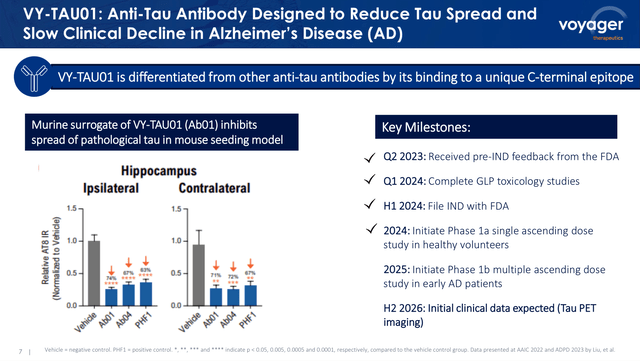

VY-TAU-01 is among the wholly-owned Voyager’s product candidates and the one product candidate that does not depend on the TRACER capsids. The therapeutic molecule is an antibody developed by Voyager which binds to the C-terminal of pathological TAU (see picture beneath), which is a protein related to Alzheimer’s illness progress. Due to this fact, VY-TAU01 is predicted to decelerate the progress of AD by lowering the unfold of pathological TAU within the mind.

Preclinical information related to VY-TAU01 and its key milestones (Voyager’s Q1 2024 Earnings name presentation)

Voyager’s administration, as described in its FY 2023 10K, was aiming to submit the investigational new drug (IND) software for VY-TAU01 in H1 2024. Nevertheless, they determined to go forward of schedule, and never solely have they submitted the IND software to the U.S. FDA in Q1 2024, but in addition they’ve acquired the FDA clearance and began dosing the primary contributors in April 2024, which was initially anticipated by H2 2024.

The beginning of the VY-TAU01 single-dose medical trial, properly forward of schedule, is a significant achievement for Voyager and for individuals affected by Alzheimer’s illness, which for my part the market has not factored in but. Given the time alignment, I believe the brand new Chief Medical Officer (CMO) Toby Ferguson M.D., Ph.D., who was appointed by mid-March could possibly be held accountable for the IND submission success. Therefore, it needs to be an excellent signal for future submissions to regulatory businesses.

This single ascending dose (SAD) Section 1a medical trial is a randomized, double-blind SAD trial the place 48 wholesome volunteers might be dosed with VY-TAU01 or a placebo, which is going down in the USA. The target of this research is to evaluate the security and the pharmacological interactions of VY-TAU01 in people. In different phrases, the thought is to evaluate for the primary time in people if the VY-TAU01 causes no harm to the mind or different organs whereas additionally assessing the organic distribution of VY-TAU01, and contributors’ responses to the ascending doses. Outcomes from this trial will inform the dose choice of the upcoming Section 1b multiple-ascending dose (MAD) trial in individuals with early AD, which is predicted to begin in H1 2025 and supply conclusive outcomes by H2 2026.

One of many FDA-approved antibody-based therapies which have been confirmed to decelerate the progress of AD is Leqembi, which is licensed by Biogen Inc. (BIIB) and Eisai Co., Ltd. (OTCPK:ESAIY) reported gross sales income amounting to JPY 4.3 billion for Q1 2024, as reported in Eisai’s 10-Q report. Leqembi obtained FDA approval in 2023, and it’s forecasted to achieve gross sales of roughly $3.5 billion by 2030.

If Leqembi’s gross sales and estimations are to be comparatively relevant to VY-TAU01, as soon as it obtains regulatory approval, the income alternative could be very transformative to Voyager Therapeutics. Thus, traders ought to keep watch over the event of this product candidate because it goes via medical trials.

Neurocrine’s collaborations

Voyager has two collaborative packages with Neurocrine. The primary program is aimed on the remedy of Friedreich’s ataxia, which is a neurodegenerative situation affecting the coordination of legs and arms. The therapeutic method is aimed to be a gene remedy resolution that delivers a wholesome model of the FXN gene, which is normally altered in individuals with FA.

NBIX and VYGR have introduced, in its Q1 10-Q, that they’ve chosen the payload of their TRACER capsids in February, and expect to submit the IND and begin the primary medical trials in people in 2025. The choice of the product candidate for this program already yielded a $5 million milestone cost to VYGR, which was realized within the Q1 2024 report.

The second collaborative program is the GBA1 gene alternative, which is aimed on the remedy of Parkinson’s Illness. On this event, the businesses are aiming to make the most of the TRACER capsids to ship a wholesome model of GBA1, which is normally altered in individuals with PD. On this sense, throughout the Q1 2024 report, VYGR introduced that along with NBIX they’ve chosen the therapeutic candidate related to this program, and count on to file the IND by 2025. It’s to focus on that the product candidate choice is a milestone, which entails a partnership cost from NBIX to VYGR of $3 million, that’s anticipated to be mirrored in Q2 2024 monetary report.

Subsequent-generation TRACER capsids

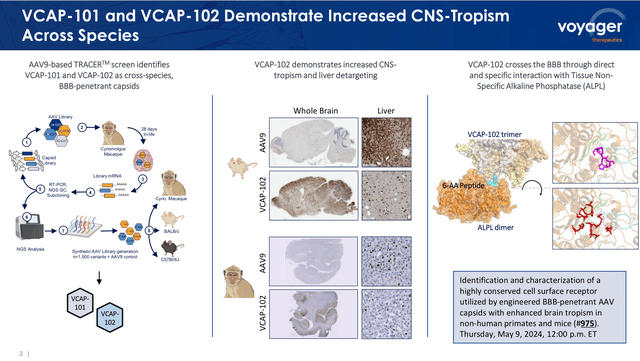

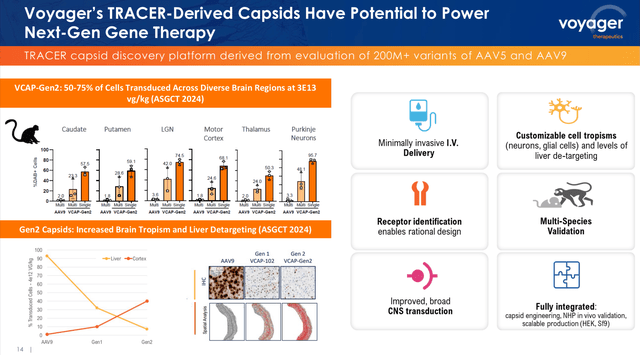

Voyager Therapeutics participated on the ASCGT 2024 convention, the place it showcased the invention of the second-generation of TRACER capsids with an enhanced capability to cross the BBB and ship genetic cargoes to neurons and astrocytes (i.e., mind cells), whereas having an excellent decrease tendency to focus on different organs, such because the liver, than the primary era (see picture beneath).

TRACER capsids second-generation leads to two animal fashions (ASCGT 2024 presentation, Might 2024)

The corporate has in depth preclinical information, in numerous animal fashions, exhibiting the excellent outcomes of the second-generation TRACER capsids, exhibiting the likelihood to customise the cell concentrating on (i.e., a direct goal of neurone or glial cells), enabling the popularity of particular cell markers, whereas exhibiting negligible concentrating on of liver or coronary heart.

In abstract, I imagine that the brand new era of TRACER capsids with an excellent increased potential to ship therapeutic genetic cargoes in a protected and particular method will increase Voyager’s prospects of success within the growth of neurogenetic therapeutic merchandise.

TRACER capsids first-generation vs. second-generation (Voyager’s Q1 2024 earnings presentation)

Financials

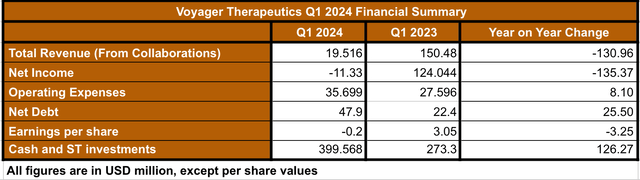

The Q1 2024 monetary outcomes are comparatively sturdy contemplating that Voyager would not have any industrial merchandise but (see desk beneath).

Q1 2024 Monetary Abstract (Information collected by the creator from Q1 2024 monetary report)

By way of Q1 2024 income, which comes from partnerships, a complete of $18 million is coming from the Neurocrine packages. Compared with Q1 2023, Q1 2024’s revenues are $130 million decrease. The lower is as a result of realization of huge milestone funds from NVS ($79 million) and NBIX ($71.5 million) in Q1 2023.

However, as a result of ramp-up in the direction of medical trials related to the main product candidates, the working bills have elevated by $8 million when evaluating Q1 2024 vs. Q1 2023. This isn’t solely anticipated, however for my part, a welcomed improve given the required progress of the main candidates into medical trials.

Moreover, given Voyager’s sturdy money place totaling almost $400 million, and comparatively low gathered deficit of $272.5 million, as reported within the Q1 10-Q, I feel Voyager is in a really steady place by way of its steadiness sheet. On this sense, Voyager’s administration said of their Q1 report the next:

As of March 31, 2024, we had money, money equivalents, and marketable securities of $400.5 million. Based mostly upon our present working plans, we count on that our present money, money equivalents, and marketable securities on March 31, 2024, together with quantities anticipated to be acquired as reimbursement for growth prices below our collaboration and licence agreements with Neurocrine and Novartis, sure near-term milestones, and curiosity earnings, to be ample to fulfill our deliberate working bills and capital expenditure necessities into 2027.

On this sense, to calculate the money runway of Voyager, I’ve thought-about the corporate’s money readily available ($400 million), and estimated the quarterly money burn to extend farther from the $35.7 million reported in Q1 2024 to roughly $40 million, given the anticipated begin of extra medical trials. Due to this fact, the corporate has sufficient money readily available to cowl their present working bills and the event of the anticipated medical trials for as much as 3 years from now. As well as, it is very important spotlight that the corporate would possibly have the ability to obtain milestone funds that may lengthen even additional the money runway.

Valuation

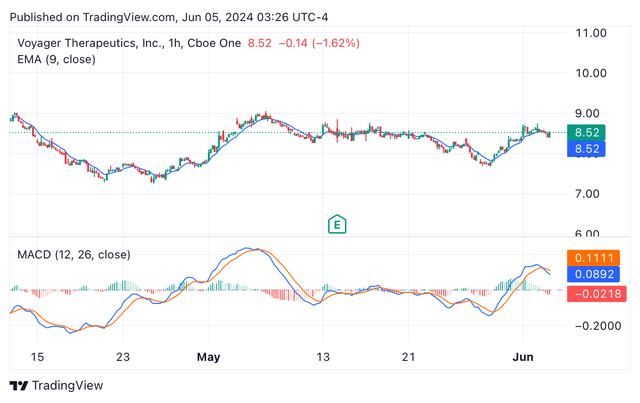

Voyager’s shares are buying and selling at $8.51, with a market cap of $462.89 million, which is barely marginally increased than the money, money equivalents, and marketable securities held by the corporate by the tip of Q1 2024. Within the final three months, the inventory has continued to face excessive volatility, as it may be appreciated from the candle chart beneath, and the MACD strains crossing a number of instances (see picture beneath). Nevertheless, the evaluation of the EMA and MACD indicators helps a bullish case for VYGR.

3 months VYGR’s candle value chart depicting EMA and MACD (TradingView)

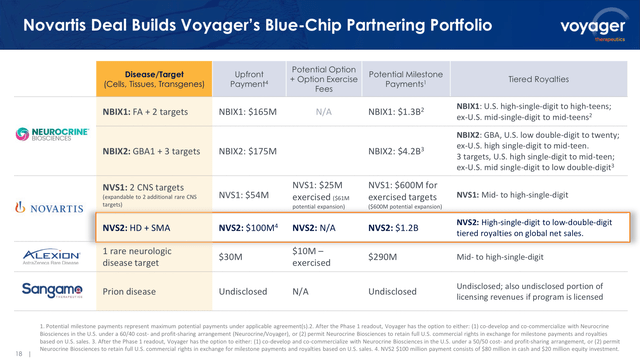

As well as, the corporate is holding multi-billion greenback income potential primarily based on collaboration partnerships (see picture beneath), that are producing milestone funds in favor of Voyager in addition to masking the price of the analysis & growth related to these packages.

Voyager’s collaborations-driven income potential (Voyager’s Q1 2024 earnings presentation)

By way of the Novartis partnership, it is very important spotlight that NVS has already exercised the buy-out of $25 million in VYGR shares, which could be expanded as much as $86 million. However, contemplating that bigger pharmaceutical corporations comparable to NVS and NBIX agreed with VYGR milestones funds that may complete as much as $6.7 billion plus royalties, I might imagine the present $462.89 million market cap could be very removed from Voyager’s price. On this sense, I’m wondering if NVS is contemplating an M&A transaction, which at this level could be less expensive than the milestone cost related to their partnership packages.

One other proof of income potential is the beginning of medical trials forward of schedule, which can speed up the progress of VY-TAU01 right into a industrial product, with multibillion greenback potential if/when regulatory approval is achieved.

Contemplating the dialogue earlier than and the intrinsic worth calculated in my earlier article, a $10.96 goal share value, I contemplate that Voyager Therapeutics is a “Robust Purchase” on the present share value.

Dangers

The biggest threat that traders have to contemplate is that Voyager’s product candidates lack conclusive efficacy and security information in people. On this sense, the corporate has, lastly, began its first medical trial related to VY-TAU01, and it’s anticipated to begin medical trials related to 3 different packages (FA, GAB1, and ALS) in 2025. Thus, for my part, traders needs to be conscious that regardless of the sturdy preclinical information and the help of huge pharmaceutical corporations, there’s a risk of failure when the therapeutic candidates are examined in people. Nonetheless, if the medical trials yield constructive outcomes, I might count on the share value and the milestones-driven income to react positively.

Moreover, provided that the medical trials will begin yielding preliminary outcomes by H2 2025 and early 2026, I might count on the share value to proceed experiencing excessive volatility within the close to time period.

Conclusion

In abstract, I imagine, Voyager Therapeutics, Inc. has supplied sufficient progress of their pipeline to justify the score improve. Not solely have they submitted the VY-TAU01’s IND forward of schedule, but in addition the FDA has granted clearance quickly, which I contemplate a superb signal. The beginning of the medical trials is a stage that traders, together with me, have been ready for. So, I’m more than happy to see that it took lower than one month from receiving FDA clearance to the beginning of the trial.

Likewise, the announcement of the next-generation TRACER capsids with a bigger capability to particularly goal nervous system cells and a decrease tendency to focus on undesired organs (e.g., liver) after being injected intravenously can be a significant milestone for Voyager. For my part, this demonstrates Voyager’s forward-looking considering, and it reveals its useful know-how on the event of genetic carriers with the capability to cross the BBB.

Lastly, the sturdy partnership agreements, along with Voyager’s advances of their wholly-owned packages and the sturdy money place, recommend that the enterprise worth of Voyager is far increased than the present $462.98 million market cap. Nevertheless, the inventory is more likely to observe excessive volatility within the quick time period, given the dearth of conclusive information in people.