MicroStockHub/E+ through Getty Photos

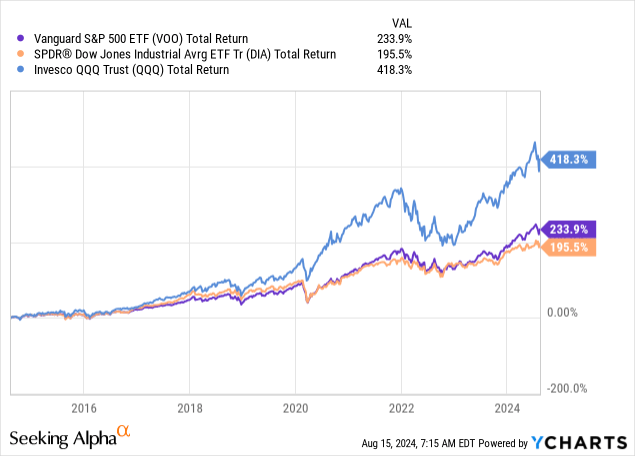

My followers know that I counsel them to construct a well-diversified portfolio and to carry it by the market’s up-n-down cycles. In addition they know that I consider they need to construct such a portfolio on the muse of the S&P 500. Right this moment, I’ll evaluation lots of the causes supporting this recommendation and clarify why a wonderful selection for the muse of your portfolio is the Vanguard S&P 500 ETF (NYSEARCA:VOO). I am going to begin with a easy chart evaluating the 10-year whole returns of the three broad market averages over the previous decade: the DJIA, the S&P 500, and the Nasdaq-100 as represented by the DIA, VOO, and QQQ funds, respectively:

As you possibly can see by the graphic, the S&P 500 has greater than doubled over the past 10-years and has out-performed the DJIA by nearly 40%. The Nasdaq-100 is the know-how laden and rather more unstable index and is the clear winner of the three, which is why a well-diversified portfolio also needs to embody sturdy publicity to the know-how sector.

Funding Thesis

In my previous articles on portfolio administration, I’ve suggested traders to undertake a top-down allocation technique to assemble a portfolio that meets their very own private concerns similar to age, working/retired, targets, threat tolerance, well being, and so forth. Such a technique usually ends in a portfolio containing quite a lot of funding classes during which the investor determines how a lot capital he/she desires to allocate capital. For instance, and easily for the sake of debate (acknowledging that every investor’s allocation selections will differ primarily based on the beforehand talked about elements …), such a well-diversified portfolio may look one thing like this:

| CATEGORY | ALLOCATION |

| S&P 500 | 40% |

| Revenue/Dividend Progress | 10% |

| Progress/Expertise | 25% |

| Sector-Particular ETFs | 5% |

| Speculative Progress | 5% |

| Treasured Metals | 5% |

| Money | 10% |

The explanations to have the S&P 500 as the muse (i.e. the most important allocation) of this portfolio are many and embody:

- Analysis reveals that over the long run, the overwhelming majority of abnormal traders – and even nearly all of skilled cash managers – don’t obtain the typical annual returns of the S&P 500.

- The S&P 500 holds the most important and most dynamic corporations on the planet, whereas additionally being a diversified fund of 500 corporations.

- Usually, S&P 500 ETFs are very economical as a result of they’ve low expense charges (VOO’s expense charge is just 0.03%).

- As proven earlier, the S&P 500 is a confirmed option to construct wealth over the long-term (the typical 10-year annual return of the VOO ETF since inception in 2010 is 14.5%).

So, let’s take a more in-depth have a look at the VOO ETF. I am going to begin with the portfolio.

Prime-10 Holdings

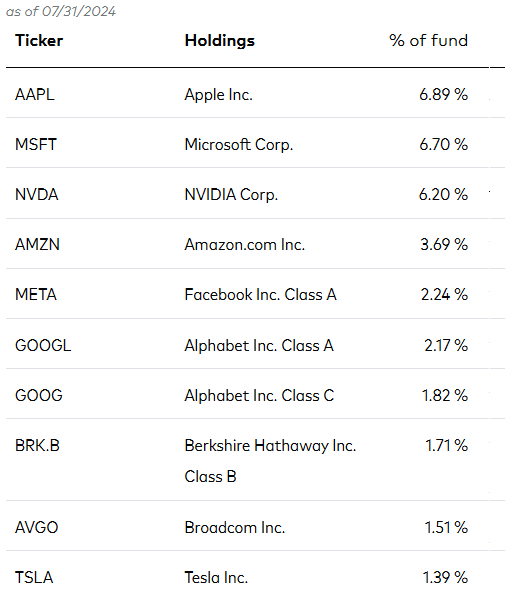

The highest-10 holdings within the VOO ETF are proven under and had been taken straight from the Vanguard VOO ETF webpage, the place you possibly can study extra detailed details about the fund:

Vanguard

As you possibly can see by glancing at these holdings, the top-10 holdings within the S&P 500 give traders sturdy publicity to the know-how sector and to what’s arguably the most important funding theme of our time: AI.

Apple (AAPL) is the #1 holding with a 6.9% weight. As , Apple has a really sturdy international model and operates quite a lot of client platforms (iPhones, iPads, Macs, Companies, and so forth.) that every have an enormous put in buyer base. That being the case, Apple can simply leverage that put in base to roll out new AI-enhanced merchandise. Whereas Apple’s development fee has arguably slowed over the previous few years, the corporate persistently generates sturdy free-cash-flow, is well-positioned for the longer term, and ended its most up-to-date quarter with $33.9 billion in money & money equivalents.

Word, the S&P 500 can also be well-represented by the hyperscalers: the top-3 corporations that dominate cloud-computing. Microsoft (MSFT) is the #2 holding in VOO with a 6.7% weight and operates the #2 cloud platform (Azure). Amazon (AMZN), which operates AWS – the main cloud platform – is the #5 holding with a 3.7% weight. I say #5 as a result of, in combination, Alphabet’s two courses of Google (GOOG) inventory equate to 4% of the VOO ETF, which makes it the true #4 holding. Google operates the #3 cloud platform (GCP) and in Q2 generated $10 billion+ in income (+28% yoy) and over $1 billion in working revenue from its cloud section. It was the first-time Google exceeded these income and revenue thresholds for its cloud-segment.

These hyperscalers all have widespread attributes:

- They function the main cloud platforms on the planet.

- They’ll leverage AI throughout their cloud-platforms.

- They produce other tangential companies during which they will leverage their cloud choices to roll out and, extra importantly, monetize AI functions.

Now, all three of those hyperscalers have been criticized for “over-spending” on AI. Nonetheless, as I identified in my latest article on The Expertise Choose Sector SPDR Fund ETF (XLK), these corporations proceed to develop their operations and generate sturdy free-cash-flow (see XLK: If You Are Underweight Tech Shares, This Is The ETF For You). The underside line is that these corporations are spending closely to build-out AI information facilities as a result of they will simply afford to take action. And, they know the danger of not doing so is falling behind. In spite of everything, AI is nothing with out the compute energy and high-speed networking required to run AI algorithms on giant language fashions (LLMs). All three of the hyperscalers shall be leaders in AI for a few years to come back.

Talking of compute energy, be aware the VOO ETFs #3 holding is Nvidia (NVDA) with a 6.2% weight. Whereas Nvidia is continuously seen as solely a chip-design outfit. Nonetheless, I consider its CUDA AI software program is a important part of its success as a result of it permits builders to extra simply use its high-performance GPUs as cloud-based compute home equipment throughout a broad variety of thrilling trade functions.

And, talking of high-speed networking, Broadcom (AVGO) is considered one of my favourite know-how shares and is the #9 holding with a 1.5% weight. Broadcom operates what’s arguably one of the best high-speed networking growth platform on the planet (i.e. each {hardware} & software program) and, consequently, at all times seems to be a technology (or two …) forward of the competitors. Broadcom’s networking options allow highly effective data-hungry AI compute-engines to be fed with the high-bandwidth, low-latency information they require to achieve their full computing potential.

Broadcom additionally designs AI pc chips for a choose group of hyperscalers and is on its sixth technology of silicon for Google (as compared, Microsoft lately took supply of its first AI-specific silicon). As well as, Broadcom’s latest acquisition of VMWare has considerably elevated its high-margin Enterprise Software program Section’s income. And, as I’ve identified in my Looking for Alpha articles, many traders could have over-looked the truth that Broadcom has a strategic partnership with Nvidia to allow VMWare’s virtualization software program full-stack assist to run Nvidia’s GPU choices. The purpose right here is that VMWare’s prospects can run both Nvidia GPUs or Broadcom’s personal in-house designed AI compute engines. See Broadcom Q1 Earnings: CEO Hock Tan At His Greatest (Wheelin’ & Dealin’).

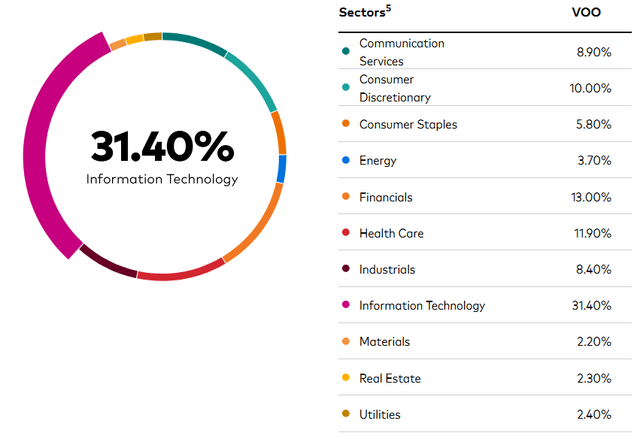

From an general perspective, VOO’s portfolio is – not surprisingly – most extremely uncovered to the Info Expertise sector, with a 31.4% weight:

Vanguard

For my part, that’s precisely what traders ought to need, given my opinion that the Expertise Sector is the place to be for the twenty first Century. That is as a result of, as I’ve written repeatedly on Looking for Alpha, we’re within the early innings of what’s a long-term secular bull-market in Tech that may final for a few years to come back (maybe for many years).

That stated, the VOO ETF can also be well-represented by the Monetary Sector (13%), the Well being Care Sector (12%), and Client Discretionary (10%). As you possibly can see from the record, VOO is a comparatively well-diversified portfolio.

Efficiency

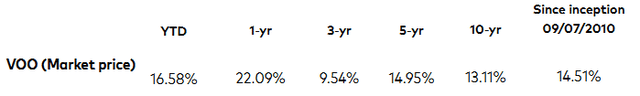

As talked about earlier, the VOO has a wonderful long-term efficiency monitor document:

Vanguard

As you possibly can see from the graphic, the fund has an 10-year common annual whole return of 13.1%. For my part, that is one purpose to construct your portfolio on the muse of the S&P 500. In spite of everything, for my part, you can’t “beat the market” till you first obtain the whole returns of the S&P 500.

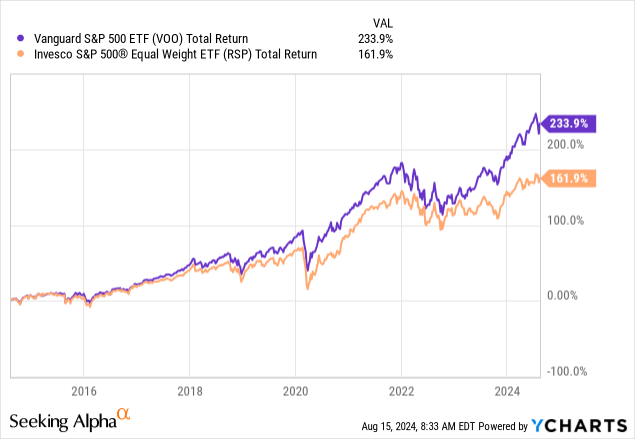

Now, there may be a number of speak in regards to the S&P 500 being too closely over-weighted in a handful of know-how shares and lots of the analysts making this (moderately apparent …) commentary pound the desk recommending an equal-weight fund, maybe just like the Invesco S&P 500 Equal Weight ETF (RSP). The next chart compares the whole returns of the 2 funds over the previous 10-years, and I’ll allow you to make the (once more, moderately apparent …) conclusion:

Valuation

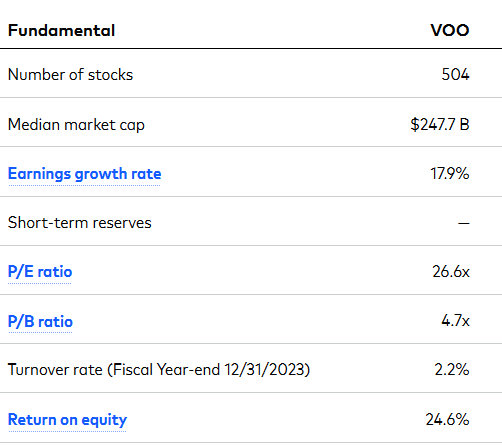

The S&P 500 is the broadest of main market indexes, and its valuation metrics are proven under:

Vanguard

Funding valuation metrics are usually in contrast towards the S&P 500, however right here we merely have the S&P 500. In comparison with the Nasdaq-100’s P/E = 40x, the S&P 500 is a relative worth. Nonetheless, on a price-to-book foundation, it’s the Nasdaq-100’s P/B = 3.6x that’s the higher discount as in comparison with the S&P 500.

Word the wonderful earnings development fee (17.9%) and spectacular ROE (24.6%) of the S&P 500.

The present yield of the VOO ETF is 1.26%. That being the case, the long-term funding thesis for the S&P 500 is capital appreciation, not revenue.

Dangers

The VOO ETF is clearly uncovered to all of the dangers and ups-n-downs of the worldwide macroeconomic surroundings (rates of interest, recessions, wars, and so forth.) and related political dangers – just like the upcoming U.S. presidential election. My view is that it will be very bearish for the U.S. and international economies (and thus the S&P 500) if ex-president Trump wins in November and truly follows by together with his vows to impose 60-100% tariffs on China, to deport tens of millions of migrants, and to take over the Federal Reserve’s job to set rates of interest. That is one purpose traders ought to at all times maintain a major money place throughout the portfolio. That manner, you possibly can make the most of large market sell-offs and add to your place.

Presently, there are a plethora of funding dangers, together with geopolitical (wars in Ukraine/Russia and the Center East), political (the upcoming U.S. presidential election), inflation, and China slow-down. Counteracting these destructive dangers are a seamless comparatively sturdy U.S. financial system and wonderful profitability throughout the S&P 500: regardless of seemingly unending recession fears, FactSet reviews that S&P 500 Q2 earnings thus far are +10.8% yoy with 78% of corporations reporting upside EPS surprises. Meantime, the prospects for imminent rate of interest cuts by the Federal Reserve are a really optimistic catalyst going ahead.

To scale back the danger of market timing, I strongly counsel traders attain their class capital allocation targets (together with within the S&P 500) over a time frame by scaling into these investments comparatively slowly… over a interval of weeks and months and, maybe years (for instance, it took me three years to determine a full-position within the QQQ fund). That manner, you will not kick your self for going “all in” on the prime of a market cycle earlier than an enormous sell-off, and will not kick your self for “lacking” out of a bull-run both.

A phrase about “timing the market”: analysis reveals that abnormal traders ({and professional} cash managers) are horrible at timing the market. In spite of everything, it’s a must to be appropriate twice: when to get out, and when to get again in. This has given rise to a phrase during which I subscribe to: moderately than timing the market, it is all about time IN the market.

Abstract & Conclusion

The VOO ETF is a superb S&P 500 fund to construct your well-diversified portfolio round. It’s extremely reasonably priced given its very low 0.03% expense charge and has a wonderful long-term efficiency monitor document. The fund is chock-full of the most important, greatest, and most dynamic U.S. corporations – all of which have sturdy international manufacturers, are extremely worthwhile, and generate sturdy free-cash-flow. I at all times have a Purchase score on the S&P 500 as a result of my private technique is to continuously make the most of market volatility so as to add to my present place.