Tim Robberts

The stunning detrimental m/o/m CPI studying in america on Thursday, July 11 startled traders and economists. Buyers, after all, had been hoping to see one other slowdown in client inflation within the hopes that it could lastly lead the Federal Open Market Committee (FOMC) to decide to a foreseeable rate of interest (Fed Funds Charge) reduce. Those that had been following FOMC chairman Jerome Powell’s commentaries over latest weeks will know that Powell remained uncommitted to a near-term charge reduce till extra good inflation information happened.

Then we have had a bump in inflation within the first quarter, and now we have had one good and one superb inflation studying. We’d like extra good information in order that we could be assured that what we’re seeing is basically that inflation goes again down towards 2%.

– Jerome Powell, FOMC Chairman (July 10, 2024).

The S&P 500 rose practically 1% on Wednesday, July 10, with traders assured {that a} subsequent ‘good’ inflation studying was on its method and would lastly trigger Powell and co. to take motion.

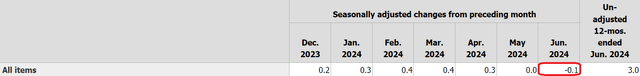

Thursday CPI Studying

Buyers acquired what they hoped for on Thursday, or in order that they thought. Their cupcake got here with an additional layer of icing as month-to-month CPI dropped for the primary time since 2020!

U.S. Bureau of Labor Statistics

Inventory Futures rose instantly upon the shock CPI launch – practically one other 1%. The U.S. Greenback tumbled on near-term expectations of decrease charges. Cue the victory music?!

Not so quick. Typically, it is doable to get an excessive amount of of a superb factor. Buyers following all elements of the story will know that Powell lately admitted that there have been two-sided dangers current, each dangers to persistent inflation and dangers to economic system.

Economics and plenty of traders (I am assuming the extra skilled selection) paused to rethink the information. By noon Thursday, U.S. markets had been within the crimson, and comparatively considerably. The S&P 500 closed decrease by practically 1%, practically a 2% reversal from the pre-market highs.

Out of the blue, low inflation readings turned the enemy.

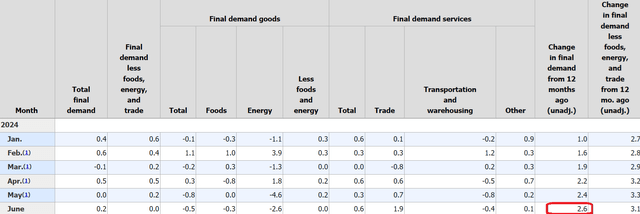

Enter PPI

This morning, the Producer Pricing Index studying delivered one other shock, rising greater than anticipated on each a m/o/m (+0.2% versus +0.1% forecast) and y/o/y (+2.6% versus +2.3% forecast) foundation.

Bureau of Labour Statistics

How rapidly the world has turned the other way up. All the things that was once dangerous is now good. Buyers, who’ve been cheering slowing inflation for the previous yr, had been out of the blue relieved to see a better inflation report after the CPI scare. By 11 AM Friday, markets had recovered virtually all their losses from Thursday.

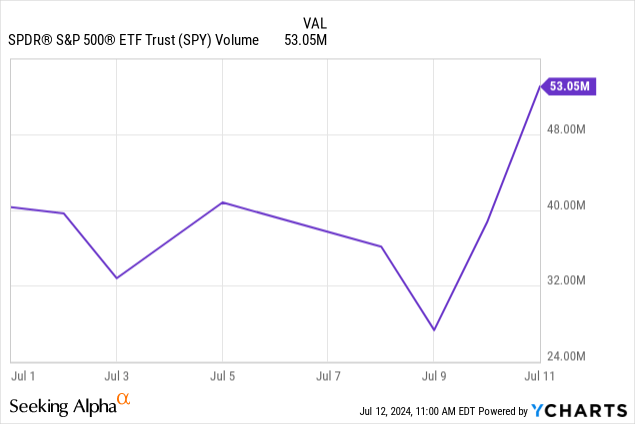

Looking for Alpha

Worrying Indicators and the Doable Affect on Company Earnings

With all due respect to traders who’re shopping for again the fairness positions they offered yesterday, I believe the ‘good cash’ is sitting this one out and seeing the place retail traders take this. Friday’s buying and selling quantity seems low, and if I’ve discovered something in my years of investing, it is to concentrate to the course of buying and selling when volumes spike, as they did on Thursday.

I sense an air of concern within the markets. And allow us to not overlook in regards to the economics, which is able to finally carry the day.

In a time when even the Federal Reserve Chairman is publicly expressing issues a couple of presumably slowing economic system, rising PPI together with declining CPI offers me the jitters as an investor in firm shares.

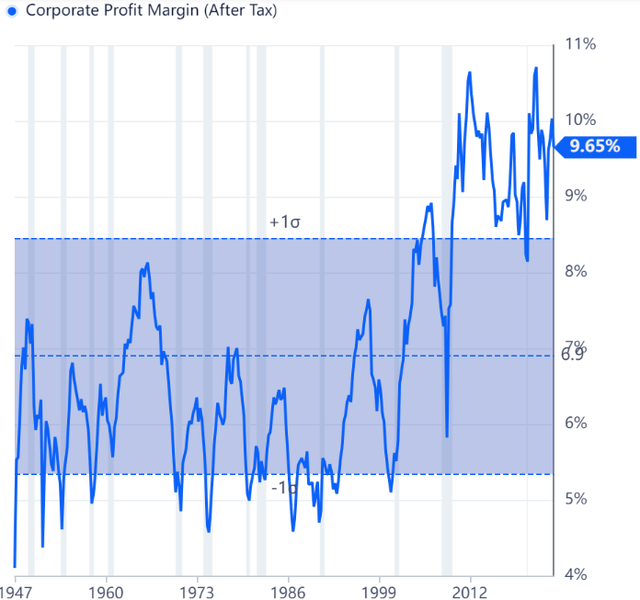

U.S. Company Revenue Margins stay inside 1% of all-time highs, and in the long term of issues, it stays to be seen whether or not the productiveness features corporations have seen over the previous decade are sustainable.

Gurufocus.com

America continues to be a closely consumer-driven economic system, and a slowdown in customers means or willingness to pay more and more increased costs (there are already early indicators that the job market has been slowing) is one thing to be aware of, particularly in an surroundings the place producers could also be persevering with to see enter value inflation.

Market Valuation & Outlook

Those that have been following my articles will observe that I am a bit skittish in regards to the markets, particularly because the much-fretted November election (for each camps) appears certain to lead to nice uncertainty, trepidation, and worry. At low volatility, I have been persevering with to purchase portfolio safety by Put Choices.

However this week’s collection of financial releases and market reactions have given me a brand new purpose to fret in regards to the draw back in U.S. market indices, which most traders are uncovered to by index ETFs just like the Vanguard S&P 500 ETF (NYSEARCA:VOO).

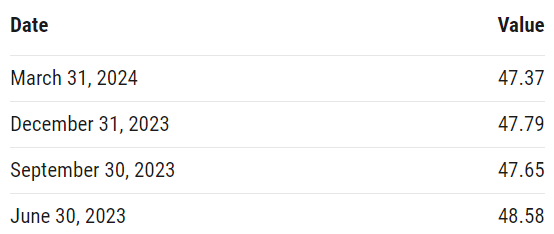

S&P 500 earnings stand at 191.39 over the previous 4 quarters, which means the index is already buying and selling at a TTM P/E of 29.4x. The Shiller P/E, which I concede would not have the very best observe document of predicting quick/medium-term market actions, stands increased than 36x.

YCharts

Abstract and Advice

I view the mixture of this week’s stunning inflation readings coupled with the market’s seeming reverse reactions to inflation numbers, together with Chairman Powell’s feedback, as substantial causes for traders to query the established order development. There’s quite a bit to soak up right here. Whereas markets could also be recovering their Thursday, July 11 losses, I am anticipating far more cautious/detrimental buying and selling within the weeks to return. Even passive traders in index funds like VOO might want to take into account reserving some earnings.

Buyers also needs to bear in mind the mantra “purchase the rumor and promote the information”. After a lot anticipation already, it is exhausting to think about traders driving inventory costs increased even when the Fed does reduce charges.

Buyers trying to stay invested in equities would possibly take into account transnational firms who’re based mostly in america. Each charge cuts and a possible slowdown within the U.S. Economic system would virtually actually drive U.S. Greenback (DXY) (UUP) weak spot, making it simpler for corporations with substantial worldwide operations to keep up revenue ranges.