We have been writing about the ESG scam on this site since it caught fire years ago, taking with it trillions of dollars of investment capital. And just as though there was big money in ESG for a couple of years, it now looks like there’s big money in “anti-ESG”.

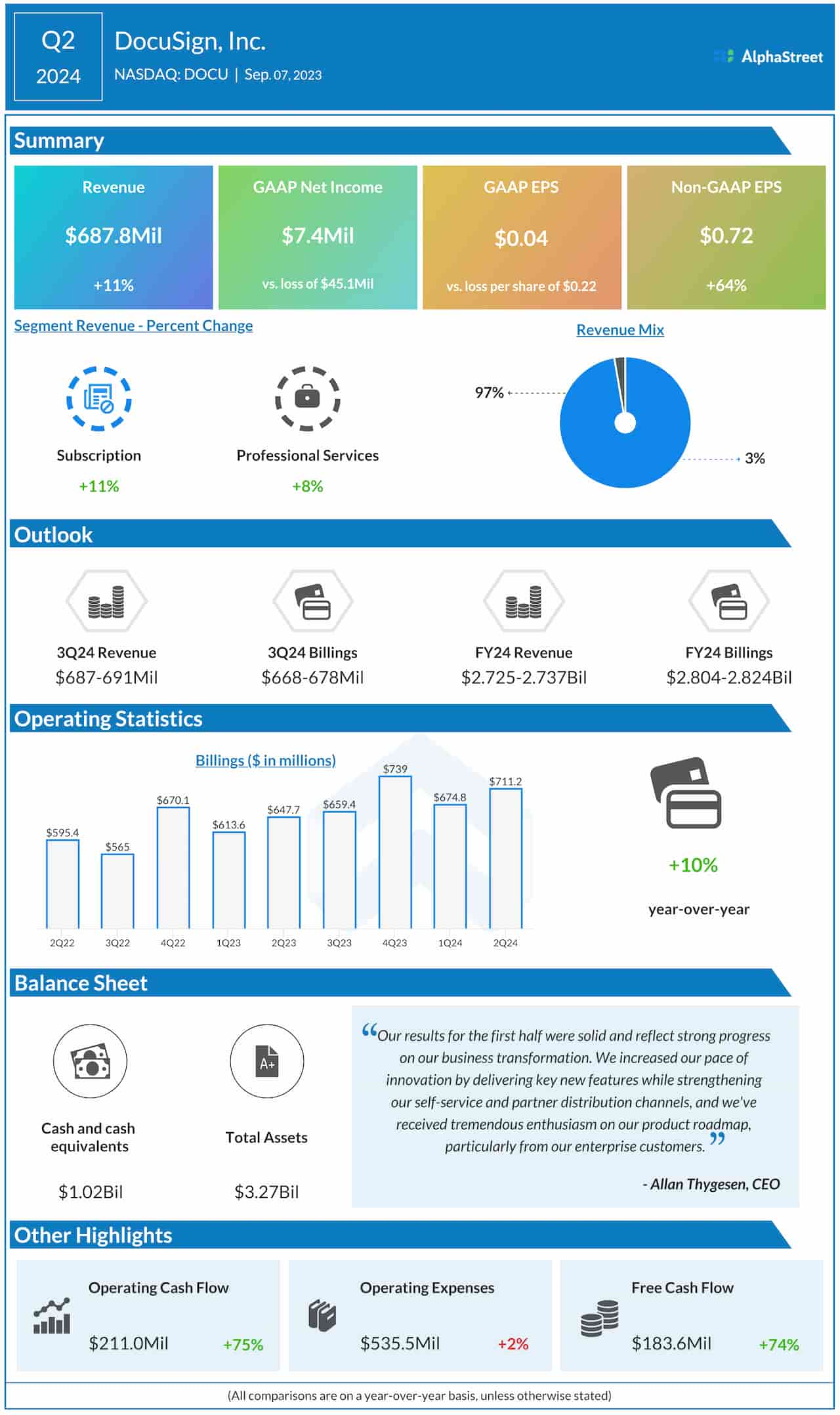

Republican presidential hopeful Vivek Ramaswamy is co-founder of Strive Asset Management, an anti-activism fund company. They have recently seen their assets under management crossing $1 billion. The firm has 11 exchange-traded funds and launched in 2022.

The firm says it wants companies to “focus on excellence” rather than ESG mandates, Bloomberg reported. It is likely being helped along by Ramaswamy’s run for president shining a public eye on him and his firm.

Bloomberg Intelligence senior ETF analyst Eric Balchunas commented: “It is a rare feat for any indie issuer to hit $1 billion in first year, let alone one that is largely a pushback to ESG as many of those ETFs have flopped.”

“Ramaswamy’s wealthy backers helped a lot and running for president probably can’t hurt either. That is some unchartered territory when it comes to ETF marketing,” he continued.

Some of the firm’s ETFs, according to Bloomberg, include:

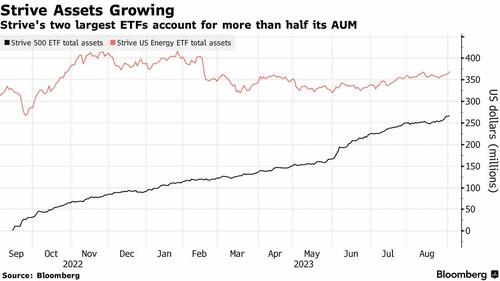

- $369 million Strive US Energy ETF (ticker DRLL) which encourages companies to “drill more and frack more”

- $267 million Strive 500 ETF (STRV), the largest and oldest ETF

- $153 million Strive Emerging Markets Ex-China ETF (STXE)

“Big, passive companies like BlackRock and Vanguard are beginning to democratize the voting and letting the end investor decide, which defuses some of the argument that they are voting everyone’s shares in an ESG way,” Balchunas added.

There has also been the addition of the GWGB ETF this week, with Tuttle (who runs SARK) filing for the “Get Woke Go Broke” ETF.

We also wrote about the latest chapter in the ESG ruse this summer, where tobacco companies – yes tobacco companies – were blowing away EV-maker Tesla in their ESG ratings.

We wrote earlier this summer that S&P Global assigned Tesla “a lower environmental, social, and governance score than Philip Morris International, the maker of Marlboro cigarettes.”

Tesla earned just 37 points on their ESG scorecard while Philip Morris posted a score of 84. Similarly, the report notes, the London Stock Exchange has given British American Tobacco a score of 94.

Jonathan Berry, who sued NASDAQ last year over its diversity requirements for corporate boards, told the Free Beacon: “ESG company ratings often measure abstract woke goals that have no rational connection to companies’ actual businesses. Companies score ‘points’ mainly by demonstrating their compliance with the latest dogmas issued by the DEI complex.”

Nowadays, trillions of dollars of capital moves according to how companies fare with their ESG scores. Despite Tesla’s crowning acheivement of nearly singlehandedly ushering in the era of electric vehicles, this still puts them at a disadvantage.

Perhaps this is why the anti-ESG movement is gaining such steam…