bjdlzx

Very important Power (NYSE:VTLE) introduced an acquisition within the Delaware Basin. That is constructing upon earlier acquisitions to probably create a extra marketable and extra worthwhile holding. Probably the most notable success was the Howard County acreage some years again that was constructed over a number of acquisitions. A second success within the Permian would clearly add to future profitability.

The final article famous that the operators of earlier acquisitions had been typically excessive or larger price operators. Due to this fact, the primary order of enterprise was to carry down prices. Acquisitions made in the identical space typically assist decrease prices resulting from economies of scale, along with utilizing essentially the most present practices to decrease the nicely breakeven prices. Proper now, it will seem that administration is constructing a good sized place both in or close to Reeves County (which is among the most prolific and low-cost elements of the Permian).

The Acquisitions Made Final 12 months

Final yr, administration introduced a sequence of (all inventory) acquisitions that occurred in the direction of yearend utilizing all-stock. This shortly delevered the stability sheet whereas permitting administration to refinance some debt to avoid wasting curiosity prices.

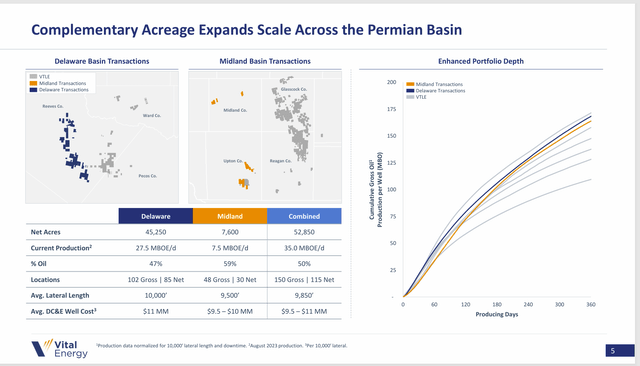

Very important Power 2023 Acquisitions To Delever The Stability Sheet (Very important Power Acquisition Presentation September 2023)

This transaction sequence, when mixed with a largely unused financial institution line, has put the corporate ready to go “purchasing” for some better-quality acquisitions. Usually, there may be hardly a greater location than Reeves County or, in some circumstances, close to Reeves County, Texas.

A number of these smaller operators have breakeven prices above $50 WTI (and typically at $60 WTI or above). Normally, the “shopper” negotiates based mostly upon what exists after which plans to do higher.

Bringing Down Prices

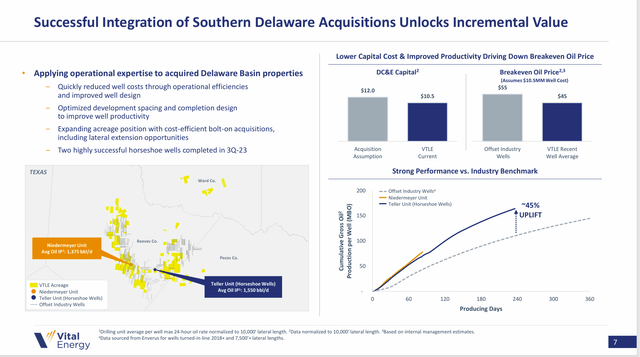

Now allow us to transfer ahead to the primary quarter presentation the place administration was busy presenting that price progress.

Very important Power Delaware Acquisition Price Enchancment Progress (Very important Power Earnings Convention Name Slides)

Administration (“on the primary attempt”) has already introduced down prices considerably. Now, as administration learns in regards to the acreage, they’re naturally going to search for acquisitions the place they’ve essentially the most success and are very snug with the acreage. In fact, that space additionally wants a large group of small operators that may be persuaded to promote at an affordable value to make the entire technique work. Evidently, administration has discovered that space and the stability sheet (and accompanying funds) was prepared for the deal.

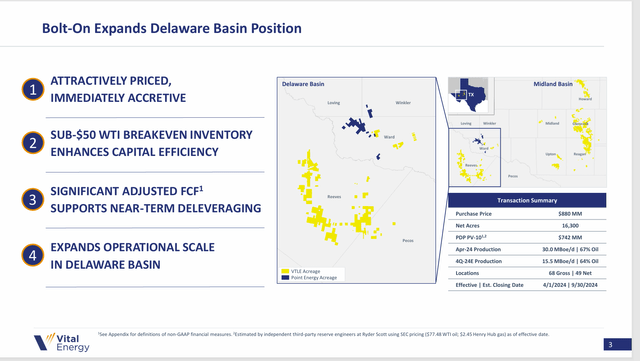

The Newest Deal

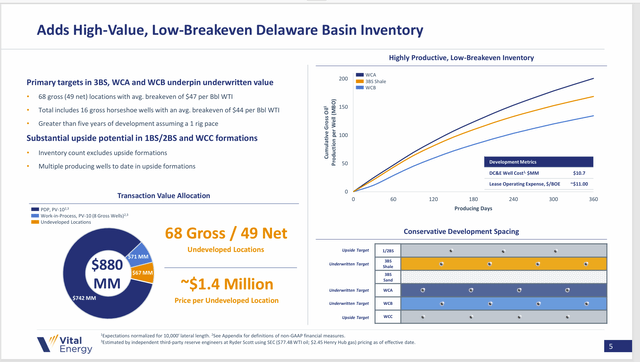

An all-cash value of roughly $880 million (earlier than changes) goes to fund this deal. Observe that the construction utilizing all inventory on the earlier deal made this one doable.

Very important Power 2024 Delaware Basin Acquisition Abstract (Very important Power Delaware Basin Acquisition July 28, 2024)

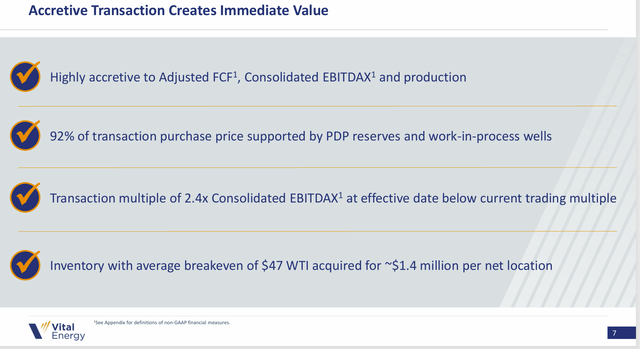

On condition that the financial institution line has a really low charge of curiosity, the deal as structured will nearly definitely be accretive. Most likely extra telling is that administration expects Free Money Circulate (a non-GAAP accounting time period) to extend greater than 30%. Ignored of this was how administration would deal with the debt “down the street” to get the corporate prepared for one more acquisition. It’s getting actually apparent that administration shouldn’t be accomplished remaking the corporate.

Nevertheless, there may be additionally the probably enchancment proven within the prior transaction that can be utilized for this acreage as nicely. In actual fact, administration could also be relying on comparable advantages as a part of the acquisition.

Very important Power Description Of Acquisition Upside (Very important Power Delaware Basin Acquisition July 28, 2024)

The vital concept is that the graph on the higher right-hand aspect is barely higher than the earlier one proven earlier. Now this may very well be resulting from higher acreage, or it may very well be resulting from a greater understanding by administration as to what’s wanted for higher returns.

Principally, the massive majority of the value paid is for reserves as said within the reserve report. Solely a small half is for different issues. This accounts for a far lower cost per remaining location than was the case not too way back, the place some acquirers paid as a lot as $3 million and even barely extra per nicely location.

The upside potential comes largely at no cost.

Debt

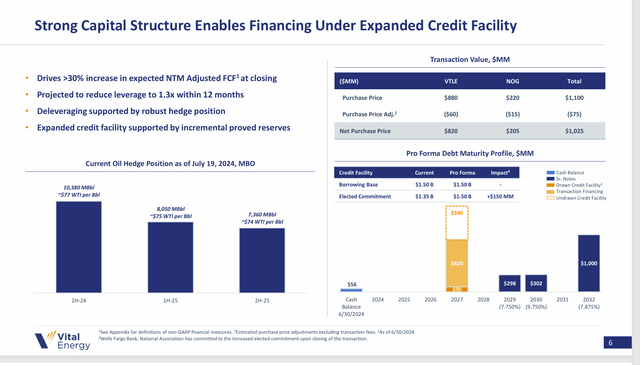

The debt ratio will certainly climb on the outset of this deal. But it surely ought to keep throughout the higher restrict of acceptable vary.

Very important Power Monetary Construction After Acquisition Closes (Very important Power Delaware Basin Acquisition July 28, 2024)

Clearly, even with the hedging, some cooperation from commodity costs is required. As soon as the debt ratio will get to that 1.3 quantity, issues loosen up a bit, despite the fact that the market nonetheless needs progress in the direction of a decrease stage.

The open query is: how rather more free money circulation can we get from this acquisition by operating it higher than the final operator? That is the place persevering with expertise enhancements typically make extra intervals price aggressive whereas growing the profitability of present intervals.

Administration did present some upside potential already with this acquisition. However there might simply be extra sooner or later.

Abstract

Administration seems to be efficiently constructing a big lease place in one of many extra profitable areas of the Permian Basin. The final article mentioned how the “bar was raised” for future acquisitions. This seems to be an instance (with probably extra to return).

Very important Power Abstract Of Acquisition Advantages (Very important Power Delaware Basin Acquisition July 28, 2024)

Administration has been remodeling this firm via a sequence of acquisitions into one with constructive money circulation. Now administration is constructing upon that constructive money circulation.

The work accomplished final yr created a number of areas for administration to construct a big presence in profitable areas of the Permian by buying smaller holdings and piecing them collectively.

This parallels what administration first did in Howard County years in the past. In that case, administration began with far smaller parcels as a result of the corporate was far smaller as nicely. If one thing that measurement had been to seem on the radar, administration may nicely make the most of it as a result of they acquired some darn good reductions again then.

What lies forward is tough to inform. As administration famous within the final convention name, it nonetheless seems to be a patrons’ market, as there are much more sellers than patrons. I think the reason being that the 2015-2020 interval actually killed quite a lot of concepts about making a killing by promoting a small holding for an enormous revenue.

Buy costs nonetheless seem like low cost in comparison with what they as soon as had been. Due to this fact, administration has a strategy to shortly rework this firm into one thing way more worthwhile than it as soon as was.

Nevertheless, ought to the offers dry up tomorrow, it’s clear that the acreage acquired thus far would help a slower transition to extra profitability.

This inventory stays a robust purchase as administration continues to execute the plan to construct a robust competitor within the present surroundings. It’s now a really completely different firm from the one again in 2016 as a result of circumstances within the business have dramatically modified.

Dangers

Any upstream firm is topic to the volatility and uncertainty of commodity costs sooner or later. The debt ratio will likely be a bit larger after the transaction. Due to this fact, some commodity value cooperation is required. Administration could possibly hedge out additional into the longer term and in a extra complete trend to cowl additional cash circulation. Nevertheless, that dangers lacking a rising commodity value market. Commodity costs are literally pretty sturdy proper now. However there isn’t any assure how lengthy that surroundings will final.

A number of the periodic expertise advances that sweep the business make these offers look even higher sooner or later. Nevertheless, the expertise advances can cease at any time for a protracted interval. Any acquisition can fail to fulfill the expectations of administration. At that time, an absence of expertise advances might expose a poor deal.

A lack of key personnel might set the corporate again materially.