Gold is on a sizzling streak, up greater than 50% to-date regardless of retreating from October’s report highs of $4,380 per troy ounce.

Driving world demand is the combination of geopolitical tensions, a weaker U.S. greenback, and sticky inflation. In Q3 2025, central financial institution purchases had been up 28% over the quarter, whereas inflows of gold-backed ETFs hit $26 billion.

This graphic, by way of Visible Capitalist’s Dorothy Neufeld, breaks down the entire world provide of gold, each above and beneath floor, primarily based on information from the World Gold Council.

All the World’s Above and Beneath-Floor Gold

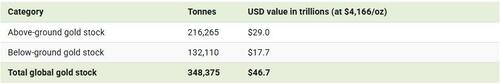

As of year-end 2024, the entire above-ground inventory of gold was 216,265 tonnes. Primarily based on a gold value of $4,166 per troy ounce, all the world’s mined gold is valued at $29 trillion.

When together with recognized underground gold, the entire reaches 348,375 tonnes. All the world’s gold collectively in a sphere could be about 107 ft tall, matching the approximate top of the White Home from the south facet’s garden to the highest of its flagpole.

The information desk beneath breaks down all the world’s above and below-ground gold and its worth.

The world’s below-ground inventory (gold that hasn’t been mined but) is an estimated 132,110 tonnes, masking reserves and assets. Gold reserves are the a part of underground gold assets (recognized deposits) which might be economically viable to extract at present costs.

Sources aren’t but confirmed to be economically viable to mine and course of.

How A lot Gold is Left to Mine?

With a lot of the world’s gold already having been mined, solely about 38% of the identified gold provide stays underground, recognized as reserves and assets.

At 2024’s tempo of roughly 3,661 tonnes of gold manufacturing a 12 months, that below-ground inventory equates to only below 4 many years of extra output, assuming costs or technological developments make assets economically possible to mine sooner or later.

For buyers, that blend of finite bodily provide, ongoing central-bank purchases, and rising funding demand helps clarify why this 107-foot sphere of gold now represents greater than $47 trillion in mixed above- and below-ground worth at present costs.

To study extra about the place the world’s gold is mined, try this graphic which breaks down world gold manufacturing by area and nation.