Victor Golmer/iStock Editorial via Getty Images

Synopsis

Visteon Corporation (NASDAQ:VC) is an automotive technology company that supplies automotive electronics parts to automakers worldwide. VC’s historical financial results have shown strong recovery growth since the impact of COVID-19. Additionally, margins have steadily expanded as well. Furthermore, its debt level has been gradually decreasing. Looking ahead, global demand for vehicles is anticipated to remain strong, which will provide VC with the tailwind needed to achieve its 2026 sales target. Moreover, VC is continuing with its new product launches, an initiative that will further bolster its future growth. With double-digit upside potential, I recommend a buy rating for VC stock.

Historical Financial Analysis

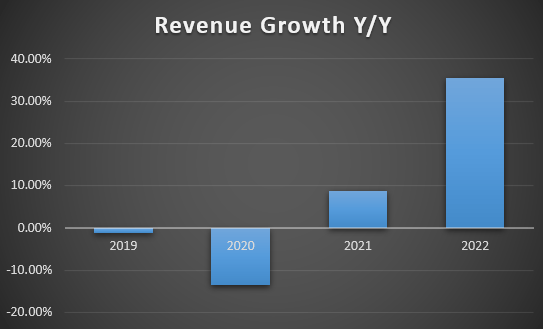

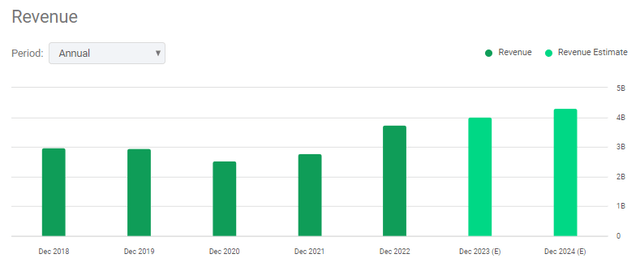

Over the last four years, VC’s revenue growth has demonstrated strong growth and recovery. In 2020, it reported a decline of negative 13.48% due to the impact of COVID-19. In 2021, revenue started to recover and grew by 8.83%. In 2022, it reported year-over-year revenue growth of 35.45%.

Author’s Chart

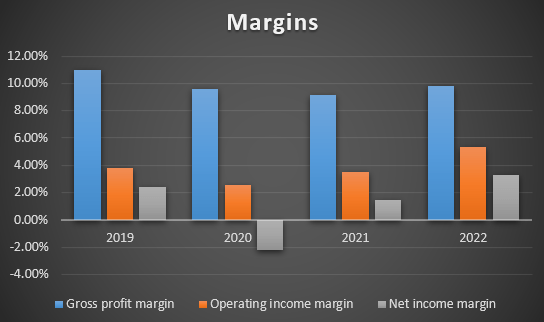

Moving onto its margins, VC has demonstrated robust performance over the last four years. After the impact of COVID-19 in 2020, VC’s margins have been gradually expanding. In 2020, the gross profit margin was reported at 9.62%, but by 2022, it had reached 9.80%. The operating income margin in 2020 was 2.59%, and by 2022, it had increased to 5.32%. Lastly, the net income margin in 2020 was a negative 2.20%, but by 2022, it improved to 3.30%. In 2020, the net loss was due to higher restructuring expenses of ~$72 million and also a decrease in gross margin.

Author’s Chart

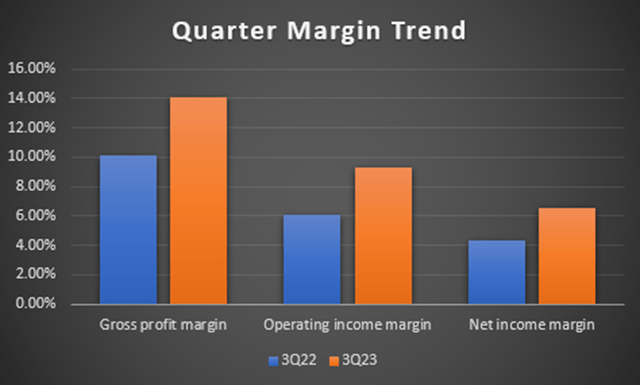

When looking at its most recent 3Q23 margins, all of them show a clear expansion trend year-over-year when compared to 3Q22. Its gross margin for 3Q23 increased to 14.10%, up from the previous period’s 10.14%. In terms of operating income margin, it expanded from 6.04% to 9.27%. Lastly, the net income margin expanded from 4.29% to 6.51%.

Author’s Chart

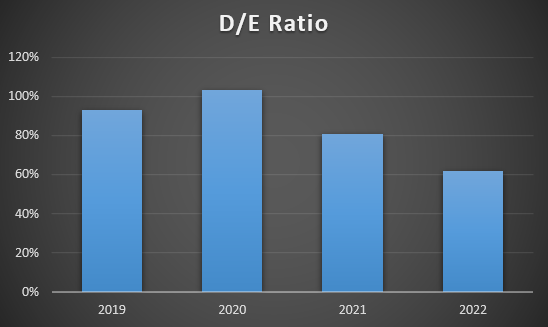

Lastly, VC’s debt-to-equity [D/E] ratio over the last four years has been gradually decreasing, which is welcome as lower debt reduces both interest expense and insolvency risk. In 2020, the D/E ratio reached 103%, but by 2022, it had been reduced to 62%, marking an improvement of 41%.

Author’s Chart

Continuing Strong Global Vehicle Demand

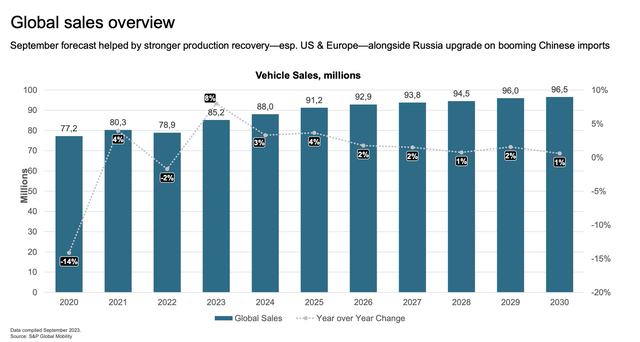

For 2023, global vehicle sales are expected to reach ~85.2 million units, which represents ~8% year-over-year when compared to 2022’s level. This high single-digit growth is mainly driven by increased production output and the replenishment of vehicle inventories as the industry overcomes previous supply chain disruptions and moves towards a more stable and efficient supply chain operation.

For 2024, global vehicle sales are expected to continue growing, but at a slower pace of just 3% year-over-year to ~88 million units. The lower growth forecast is driven by concerns about how factors like high vehicle prices and tougher financing conditions could impact the market’s recovery.

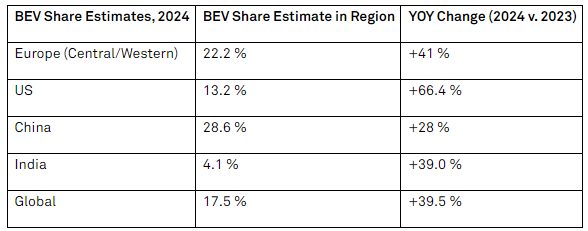

However, on the electric vehicle [EV] side, EV growth is expected to be strong in 2024. On a global scale, it is anticipated to grow ~39.5% year-over-year in 2024, and it will account for ~17.5% of the total automotive market.

S&P Global Mobility

By 2030, total global vehicle sales are expected to reach ~96.5 million units. Therefore, from 2022 to 2030, the CAGR of global vehicle sales is estimated to be ~2.55%. This growing vehicle sales market will provide VC with the tailwind needed to bolster its growth outlook.

S&P Global Mobility

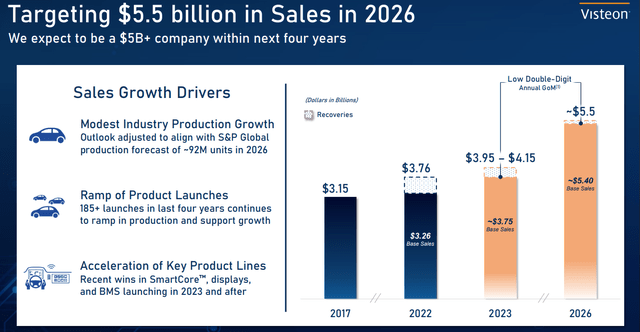

Achieving $5.5 Billion Sales in 2026

Based on VC’s presentation, management has set a target to achieve total revenue of $5.5 billion by 2026. I believe this estimate is justified as management has adjusted the outlook to align with S&P global production forecasts. One of the strategies employed to capture growth is the ramping up of product launches.

Visteon’s Investor Day

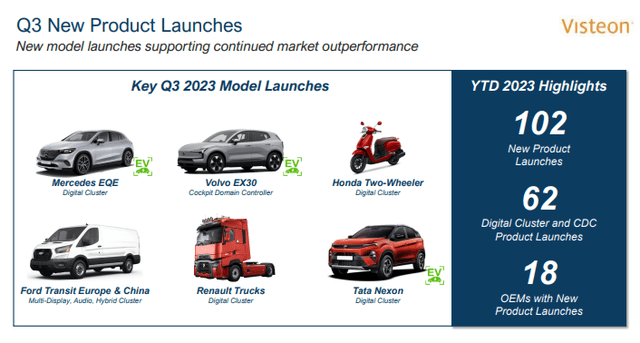

As you can see from its 3Q23 results, VC continues to uphold its promise of launching new products. VC has launched its products in 33 vehicle models. Year to date, it has already launched 102 new products. These new product launches will support their long-term growth. As mentioned by management, India is one of the fastest-growing markets this year, and VC is gaining momentum with carmakers in India. During the quarter, it launched its 7-inch digital cluster with Tata Motors, including Tata’s Nexon, which is one of the best-selling EVs in India.

Visteon’s 3Q23 Earnings

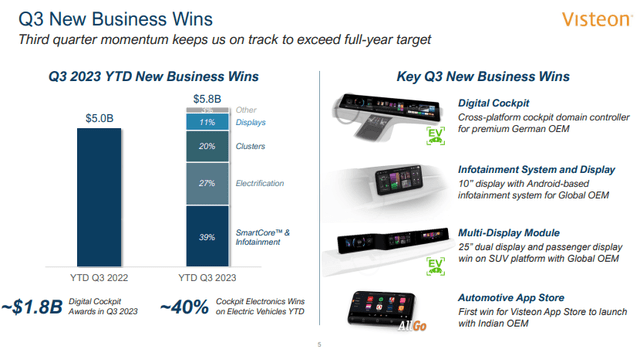

Apart from product launches, VC’s 2023 YTD new business win of $5.8 billion has already far exceeded its 2022 YTD of $5 billion. This represents an increase of ~16%. Given its strong product launches and new business wins, management is very certain that it is well on track to exceed its FY2023 target.

Visteon’s 3Q23 Earnings

Comparable Valuation Model

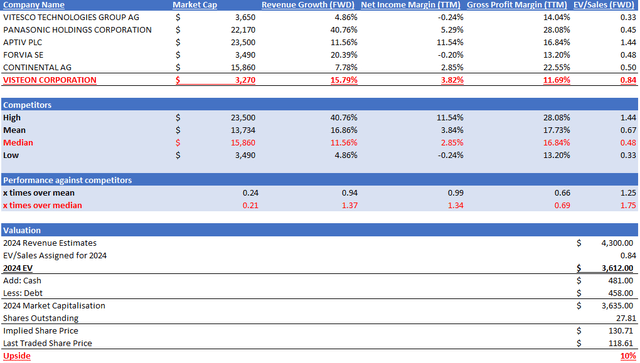

VC’s size is significantly smaller compared to its competitors, which I have listed below in my comparable model. VC’s market capitalization is $3.27 billion vs. its competitor’s median of $15.86 billion. This means VC is only ~0.21x the size of the median of its competitors.

Despite its smaller size, VC outperformed its competitors listed in my model below in both growth outlook and net income margin. VC has a forward revenue growth outlook of 15.79% vs. its competitors’ median of 11.56%.

In terms of net income margin TTM, VC reported 3.82% vs. its competitors’ median of 2.85%, despite having a lower gross profit margin TTM of 11.69% compared to its competitors’ median of 16.84%.

Currently, VC’s forward EV/Sales ratio is 0.84x, trading above its competitors’ median of 0.48x. Given VC’s outperformance in both growth outlook and profitability margin, I argue that it deserves to trade at a premium. In addition, VC’s current EV/Sales ratio is trading below its 5-year average, which stands at 1.04x.

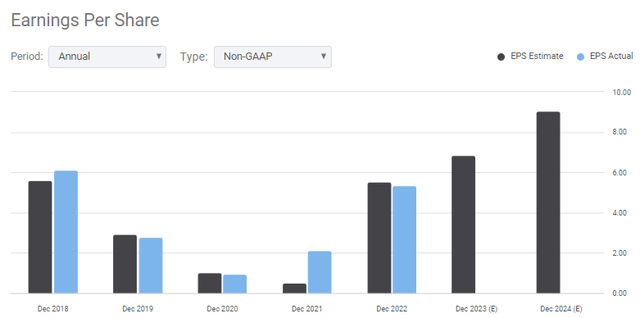

The market revenue estimate for VC is expected to reach $4.01 billion in 2023 and $4.30 billion in 2024. The market’s estimate for VC’s 2023 EPS is $6.86, and for 2024, it is $9.06. Based on my discussion regarding VC’s financial performance and growth catalysts, these estimates seem well supported. By applying its current EV/Sales ratio to the 2024 revenue estimate, my price target for 2024 is $130.17, representing an upside potential of 10%. Therefore, I recommend a buy rating for VC.

Author’s Valuation Model Seeking Alpha Seeking Alpha

Risk

One downside risk associated with VC relates to inflation. Given that VC’s business is tied to the automotive industry, its revenue heavily depends on automotive demand, which can be influenced by inflation since automobiles are considered a significant purchase. Should inflation rise more than expected, it could dampen automotive demand. Consequently, this has the potential to impact VC’s 2026 sales targets. Failure to meet these targets could weaken market expectations for VC, possibly leading to a downward adjustment of its premium multiple.

Conclusion

In conclusion, VC’s historical financial performance, strategic initiatives, and optimistic outlook for the global automotive market all contribute to a positive outlook for the company. Over the last four years, VC has shown strong revenue growth and margin expansion following the COVID-19 pandemic, along with a gradual reduction in its debt levels.

The anticipated increase in global automotive demand up to 2030 provides a strong tailwind for VC to achieve its $5.5 billion sales target by 2026. VC’s ongoing product launches and consistent new business wins demonstrate its commitment to capturing market share and driving long-term growth, particularly in fast-growing markets like India.

Despite being smaller in size compared to its competitors, VC boasts a better growth outlook and net income margin. Moreover, my model indicates double-digit upside potential. Given VC’s positive growth outlook, I am recommending a buy rating.