PM Pictures

VIOO

Per Vanguard’s web site, “Vanguard S&P Small-Cap 600 ETF (NYSEARCA:VIOO) seeks to trace the funding efficiency of the S&P SmallCap 600 Index, an unmanaged benchmark representing small U.S. firms. Utilizing full replication, the portfolio holds all shares in the identical capitalization weighting as the index.”

I believe VIOO is a strong alternative for these wanting so as to add a small-cap tilt to their portfolio. In an setting surrounding large tech and overvalued markets, this ETF may very well be flying underneath the radar. VIOO is extraordinarily diversified, has a traditionally good risk-adjusted return, a low expense ratio, and a rising dividend yield to prime it off. Traditionally, the dividend yield is on the upper finish together with prime holdings representing decrease PE ratios, which might imply one is shopping for VIOO at a worth premium. I might suppose these are all nice causes to carry in a well-diversified account.

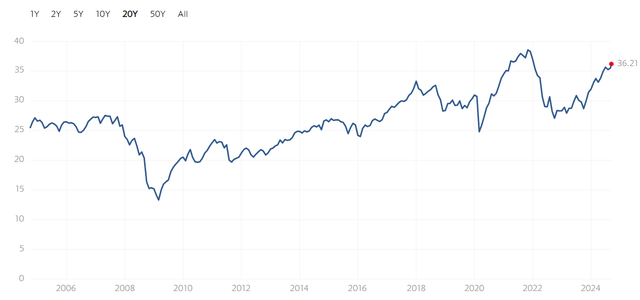

Shiller PE

One factor that’s regarding with the present state of the market is the whole index is flooded by giant cap tech, leading to an inflated “Worth-to-Earnings” a number of. This may be seen by wanting on the present Shiller PE Ratio Chart.

Shiller PE A number of (Multpl)

It at present sits at 36.21 which is about 30-40% above the typical of round 27. Though this might imply the market anticipating affiliated development, the anticipated earnings are decrease throughout markets with larger PE ratios. Fortunately, VIOO holds many small caps that assist convey the whole composite fee for earnings a bit decrease.

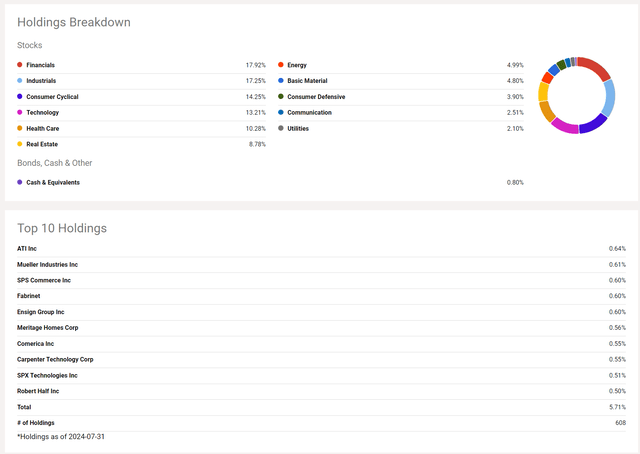

Holdings

VIOO is extraordinarily diversified. Based on In search of Alpha’s holdings breakdown, they’re unfold throughout eleven completely different sectors, not together with a small place in money & equivalents. Their prime 10 holdings do not make up greater than 6% of the whole portfolio. This implies they aren’t top-heavy like many market-cap weighted indexes, including one other stage to diversification.

VIOO Holdings (In search of Alpha)

Relating to earnings fee for these firms, among the prime holdings TTM PE are decrease than the whole index. For instance, (MLI) sits at 14-15 PE and (ATI) sits round 23. A end result of decrease PE holdings means VIOO dividend yield sits at an inexpensive stage in comparison with historic values.

VIOO Dividend Yield (In search of Alpha)

Clearly, 1.38% is not the best it is skilled (which might point out worth buy), it’s on the upper finish traditionally. This might imply VIOO is just not solely an ideal index play, but additionally a worth play at its present stage.

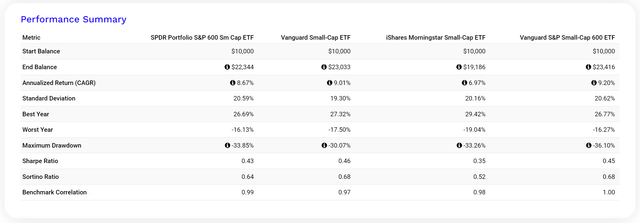

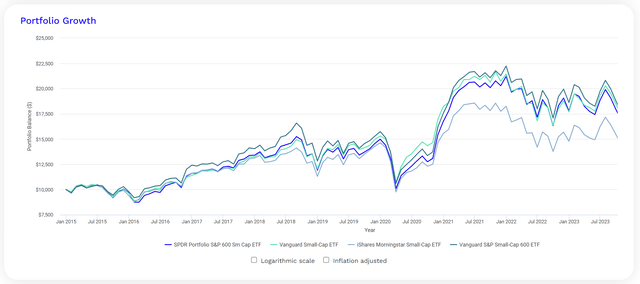

Evaluation

To research VSS, I in contrast backtesting outcomes of assorted different small cap targeted ETFs. These had been the SPDR® Portfolio S&P 600™ Small Cap ETF (SPSM), Vanguard Small-Cap Index Fund ETF Shares (VB), iShares Morningstar Small-Cap ETF (ISCB).

VIOO Efficiency (Portfolio Visualizer Utilizing Writer Inputs)

Since 2015, The outcomes point out VIOO had a CAGR 9.20% which is the best within the group. Nevertheless, this got here with a normal deviation of 20.62% which can be the best. So it is clear VIOO did return extra, however got here with barely extra volatility. The chance reward is measured by the Sharpe Ratio, which stands at 0.45. This occurs to be the second greatest, simply behind VB, with a Sharpe of 0.46. The draw back to this ETF is it had the worst Most Drawdown measurement of 36.10%. That is round 3% decrease than the following ETF in line.

VIOO Efficiency Graph ( Portfolio Visualizer Utilizing Writer Inputs)

VIOO resulted within the highest finish worth of $23,416 on a $10k funding since 2015. It is fairly clear from the backtesting, VIOO is the high-risk excessive reward model of the small-cap ETF comparable.

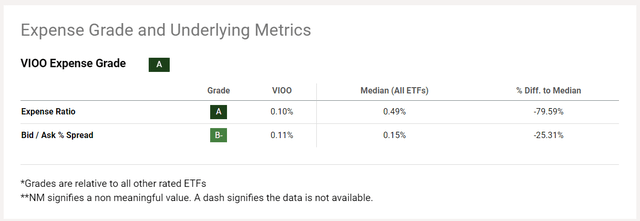

Expense Ratio

The expense ratio is low for VIOO. It has a 0.10% and receives an “A” Grading from In search of Alpha. That is in fact relative to different comparable ETFs. That is barely excessive in comparison with the main index monitoring ETFs, however nonetheless an inexpensive expense ratio.

VIOO Expense Ratio (In search of Alpha)

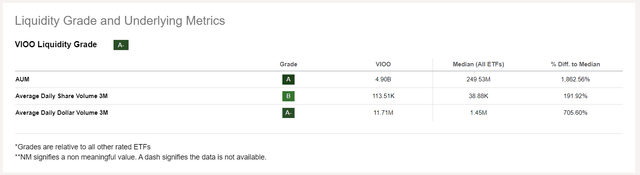

Liquidity

I believe liquidity is commonly seemed over relating to ETFs. Having the ability to transfer property does have a worth premium to some extent, and VIOO receives an excellent grade for this in response to In search of Alpha’s dividend scorecard. Almost $5bn in property underneath administration (“AUM”) makes this one of many largest and extra liquid ETFs on this class.

VIOO Liquidity (In search of Alpha)

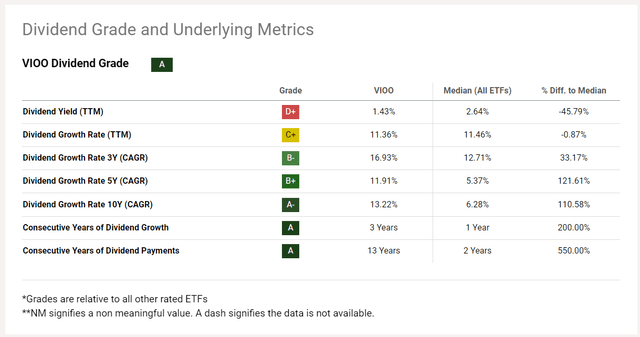

Dividends

Whereas having an excellent risk-adjusted return, expense ratio, and liquidity, VIOO pays an annual dividend yielding 1.43% with a 10-year compound annual development charge (“CAGR”) of 13.22%. That is ok to obtain a “A” dividend grading from In search of Alpha’s scorecard.

VIOO Dividend Scorecard (In search of Alpha)

Conclusion

Total, VIOO is among the extra “excessive threat/reward” small-cap ETFs, however solely by a small margin. I imagine traditionally good risk-adjusted return, low expense ratio, and a rising dividend yield are causes to personal this ETF in a well-diversified basket. The holding’s PE and dividend yield may additionally point out the investor is shopping for at a worth premium.