Drazen_/E+ through Getty Photographs

Pricey readers/followers,

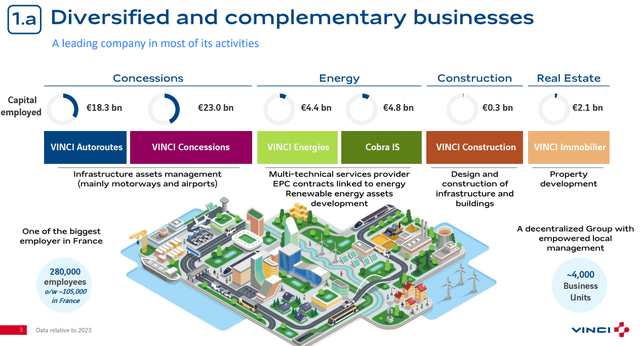

On this article, I will check out French firm Vinci SA (OTCPK:VCISY). It is a French concessions and development enterprise, that was initially a part of one of many French multinational banks over 120 years in the past. For a while now, it has been one of many largest development companies in France, with annual revenues of over €60B, of which it manages an over 10% working margin or EBIT.

On this article, we’ll have a look at what Vinci is, what it provides, why it has virtually doubled its annual gross sales quantity in round 10 years, and why investing on this enterprise might be a good suggestion for those who’re concerned with proudly owning development, vitality and automotive tolls, which is one other a part of the corporate’s operations.

This can be my first direct article on Vinci S.A. I do rather a lot of protection of European shares right here on SA – in actual fact, I might say I primarily attempt to give attention to European shares and provide the undervalued ones to your consideration with a private “BUY” score.

I additionally do not take a “BUY” score if I haven’t got pores and skin within the recreation – and on this firm, I will present you if I take into account it the best time to get some pores and skin within the recreation on Vinci, or if we must always wait.

Quite a bit to love about Vinci, development, and tolls – however what’s the worth?

Vinci does numerous issues, and as such, has numerous totally different rivals in numerous totally different fields. Vinci builds infrastructure – each small and huge – with competitors each nationally and internationally. The corporate additionally does airport infrastructure and economics, automotive tolls, Vinci Energies (vitality providers), and the corporate’s section often known as EUROVIA, which focuses on surfacing.

The corporate has over 45,000 workers, is without doubt one of the only a few A-rated development companies in the complete world, and provides you, the investor, a yield of at the least 4.3% with an upside in development, based mostly on a present payout of €4.3/share on a local share worth of €104.4. Wanting on the ADRs of corporations like this, the yield generally does not are inclined to translate all that nicely, however as that is an article on the ADR – the ADR yield is predicated on SA knowledge, $1.85 yearly, which presently comes to six.52% annualized with a bi-annual payout – however understand that the second biannual payout for this firm is not essentially the identical measurement as the primary, which was paid in Could 2024 for the ADR.

The corporate has very low total debt – underneath 45% long-term debt/cap- and a mixture of companies which are considerably atypical for the sector whereby they function.

What are the funding arguments for Vinci then, except for this?

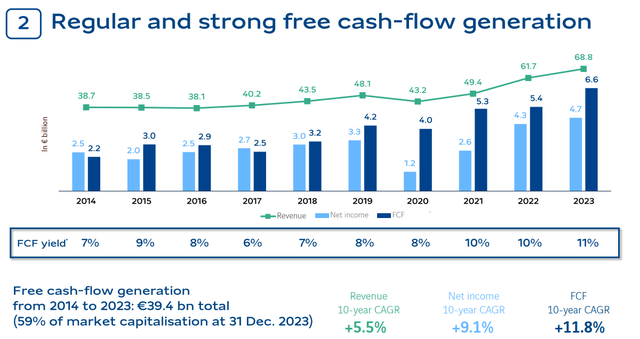

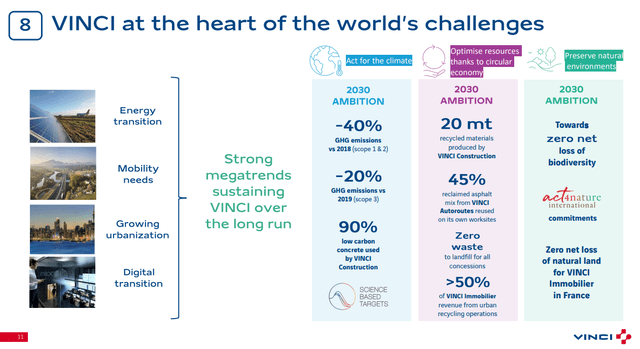

The corporate argues {that a} resilient enterprise mannequin with common and robust FCF, good capital allocation methods with confirmed outcomes, M&A observe information, shareholder base that is shareholder-friendly, however not dictated by yield, and a liquid inventory that is, as the corporate itself would argue, is central to the world’s challenges. This argument is sensible, because it’s in keeping with what’s being thought-about globally, and the place it is already set to vary by 2030 not merely based mostly on what corporations like Vinci are doing, however by insurance policies.

Vinci IR (Vinci IR)

Some would say that Vinci is principally a French firm. Whereas that is technically true on the premise of a income combine, the corporate has almost 57% of its revenues exterior of France, which is a rise of just about 80% in lower than 10 years time. Vinci has had a objective to diversify its revenues – and it has. It now has operations and tasks in additional than 120 nations, a lot of that are in Europe, with a small Asia publicity, and solely a slight NA publicity. It is subsequently primarily a European participant, with each the negatives and positives that include this.

The place Vinci S.A differs from its development friends comparable to Skanska is that it generates non-trivial money circulation from recurring operations that are not RE-based.

Vinci IR (Vinci IR)

As an alternative of the usually risky RE-based dwelling and property-selling arms, you will have secure and technology-neutral automotive toll assortment and related segments, which provide a really good cushioning by way of money circulation. it does not insulate the corporate, as you may see in 2020 throughout COVID-19, however it provides superb upside nonetheless.

The corporate’s maturities and repayments are very conservative. It has an NFD/EBITDA of 1.3x, absolutely reflecting the robust A-/A3 rankings that it has, and has liquidity of over €13B at across the time of writing this text.

For the capital it generates, Vinci has a sound allocation and dealing technique that features a 50% FCF payout ratio, M&A’s the place wanted, and share buybacks to offset any M&A dilution that is available in -while utilizing the corporate’s remaining money to de-lever.

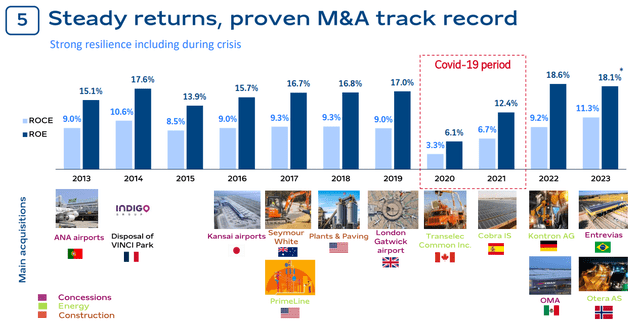

It’s in actual fact, the most effective M&A’ers on the market on this sector, and may show this.

Vinci S:A (Vinci S:A)

Some traders ask me why I like French corporations a lot. My reply is after they work, they actually work – and by that, I imply that French corporations, in comparison with some German and Scandinavian ones, are typically extra apt at non-European M&As, which we show with the combination we see above.

Over time, Vinci has averaged a TSR of 12% per 12 months, or virtually 200% since 2014. That is higher than Stoxx600, higher than CAC40 and higher than many indices on the market.

Vinci’s present operations and tasks are additional on the coronary heart of what’s making the world “tick” as we speak and what’s bringing upcoming change. We don’t have to take administration’s phrase for this. The vitality transition specifically is one thing that many argue have to be remodeled utterly.

Vinci is actually not distinctive in having attraction in these megatrends – Siemens (OTCPK:SIEGY) and different industrials are on the coronary heart of it as nicely, however it’s in a beautiful place given its multinational, 120+ nation publicity, and with its concession enterprise has a beautiful “security internet” by way of recurring earnings.

Vinci IR (Vinci IR)

A number of the attention-grabbing, non-typical segments are as follows.

Vinci Autoroutes manages 4,400+ km price of automotive infrastructure underneath concessions, which involves virtually 50% of the conceded French toll roads. Briefly, for those who drive in France, you are possible in some unspecified time in the future driving on a Vinci highway.

This section, which is tremendous, generates revenues of €6.3B with an EBITDA margin of 74% as of the newest operations.

Second, Vinci Airports, as a result of there’s important worth right here. Vinci now operates over 70 airports throughout 13 nations, with important revenues. Right here additionally, the corporate posts margins of over 63%. The EBITDA margins for these concessions are insane, and for this firm, a single 12 months quantities to over €7B in EBITDA from Concessions alone. And that is not taking different concessions under consideration, which Vinci has within the type of over 3,100 km motorways in 10 nations, and over 30 tasks managed within the type of stadiums, railways, and the like.

As such, it is a firm with, as I see it, a really attention-grabbing mixture of enterprise that’s fairly atypical in comparison.

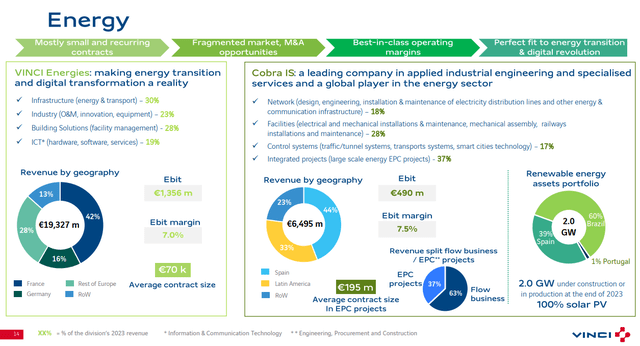

And that is even with out going into the corporate’s vitality section – which helps the continued vitality transition.

Vinci IR (Vinci IR)

One of many main considerations held by some traders is French politics – so earlier than we go into valuation for this enterprise, let’s take a more in-depth have a look at what potential dangers and upsides we might see for this enterprise.

Upsides and Dangers for Vinci

These positives about Vinci, like me, would level to the interesting firm mixture of diversified concession property which act as a chance to personal irreplaceable infrastructure throughout a number of fields. This, greater than the development section, is why I put money into Vinci. The returns for these property are supported by the truth that a few of these contracts are extraordinarily long-term. That is added to by the corporate’s enticing airport enterprise, which is more likely to additional enhance earnings and outcomes, which can enable additional room for payouts, and for the corporate to maneuver ahead with plans.

Total, from a company-specific perspective, I do not see many dangers – as a substitute, macro supplies the largest draw back right here, as a result of Vinci has a stable order ebook with good tasks. It allows Vinci, like my different builders comparable to Skanska and NCC, to be very selective about tasks, which has grow to be the norm within the sector for the previous 10 years.

However, nothing optimistic with out damaging. For those who consider {that a} considerably socialist-oriented nation like France goes to simply accept 60-70% toll and concession margins from an organization with no dialogue, you want to learn extra about France. These returns within the concession section have already been underneath scrutiny, and taxation is probably going.

That is one disadvantage. Secondly, these concessions are granted politically, which does introduce political dangers.

Other than the French political and regulatory dangers, each different potential draw back is “macro” to this firm – as I see it.

This supplies us with a reasonably good visibility going ahead.

Vinci – The corporate has fairly a little bit of upside on the proper worth

Estimating a good worth for Vinci is predicated on the continued stability and development of its FCF, and the newest consequence helps optimistic assumptions right here. Vinci continues to see record-high EBIT margins in most segments, and I additional forecast that the corporate can handle to maintain its elevated 12% working margin over time for the group. This is a rise from my earlier working assumption of about 10.5-11%. When combining this with the corporate’s leverage, you begin to see a really attention-grabbing upside contemplating present income development.

I do not count on historic income development to proceed – extra to 4-5% because of the restoration in passengers and quantity being extra muted versus post-COVID-19 – however I consider that is made up for by the corporate’s glorious and well-filled order ebook.

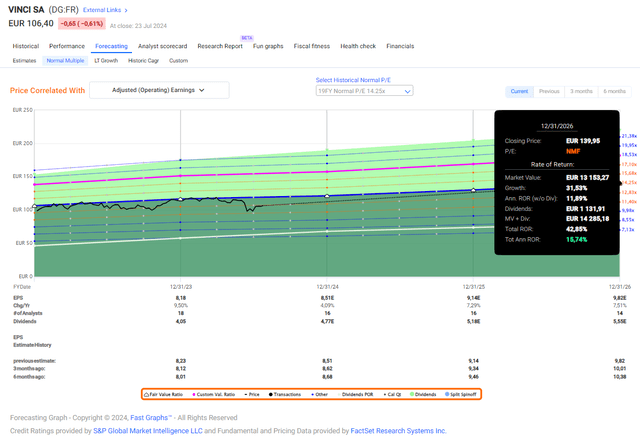

Vinci S.A. is way extra secure than you’d usually count on from a development firm. This lends me the boldness to place excessive credibility to the 20-year P/E common as a goal for the corporate. (Supply: Paywalled F.A.S.T Graphs hyperlink)

Vinci is presently buying and selling at about 12.52x for the VCISY ADR ticker. This isn’t an excessively low-cost valuation for the corporate, and it does not make it the “finest different round”, however Vinci additionally hardly ever crashes down arduous. I consider the most suitable choice for this firm is to slowly add shares, bearing in mind that the corporate could drop extra, however conscious of the truth that it already is interesting. On the present valuation, when averaging round a 20-year P/E common with a 15% annualized upside, there’s attraction right here.

F.A.S.T graphs Vinci Upside (F.A.S.T graphs Vinci Upside)

I might give the corporate a “low-cost” description at a double-digit native share worth near €90/share for the native – now it is merely attractively priced for an FV estimate of roughly €140/share, which can also be the place I put my introductory worth goal for Vinci. When wanting on the ADR VCISY, which is a 0.25x ADR to the native, this interprets to a good worth of $37.99 at as we speak’s worth, round $38/share for VCISY, and turning into low-cost at round $24/share.

On the 5-year common, Vinci has a far increased premium of 16-17x, which opens the potential for 20%+ annualized RoR, however I consider the extra conservative assumption is the one to go together with right here.

My stance is that Vinci provides an interesting technique to make 15%+ annualized at the moment, from a conservative perspective, and this makes the corporate a “BUY” at as we speak’s worth. The one method the corporate is price long-term lower than $34-$38/share is that if it doesn’t develop – and I do not see this as being legitimate.

Right here is my present thesis for Vinci.

Thesis

- Vinci has some of the attention-grabbing enterprise mixes and income mixes in all of Europe for a development firm. The toll and concession segments provide, as I consider it, some of the attention-grabbing and advantageous upsides on this whole sector on the proper worth, and an outstanding cushion for the volatility usually inherent to a lot of these companies.

- With a wholesome 4% dividend yield supported by robust capital allocation, superb margins and order ebook visibility, dangers for Vinci are what I might take into account restricted. At most, they’re relegated to taxation and regulatory scrutiny, except for macro.

- Due to this, I might take into account this firm to be a “BUY” right here, with a conservative PT of $38 for the VCISY ADR, with round €140/share for the native ticker.

- I’ve lately added a place because of the firm’s moaty concessions enterprise coupled with the basic attraction of its development and vitality companies.

Bear in mind, I am all about:

Shopping for undervalued – even when that undervaluation is slight and never mind-numbingly huge – corporations at a reduction, permitting them to normalize over time and harvesting capital features and dividends within the meantime.

If the corporate goes nicely past normalization and goes into overvaluation, I harvest features and rotate my place into different undervalued shares, repeating #1.

If the corporate does not go into overvaluation however hovers inside a good worth, or goes again all the way down to undervaluation, I purchase extra as time permits.

I reinvest proceeds from dividends, financial savings from work, or different money inflows as laid out in #1.

Listed here are my standards and the way the corporate fulfills them (italicized).

This firm is total qualitative.

This firm is basically secure/conservative & well-run.

This firm pays a well-covered dividend.

This firm is presently low-cost.

This firm has a sensible upside based mostly on earnings development or a number of growth/reversion.

The one concern right here is that the corporate is not actually “low-cost” – except for this, there’s a lot to love about Vinci right here, and I say “BUY”.

Editor’s Be aware: This text discusses a number of securities that don’t commerce on a significant U.S. trade. Please pay attention to the dangers related to these shares.