Nastassia Samal/iStock through Getty Photos

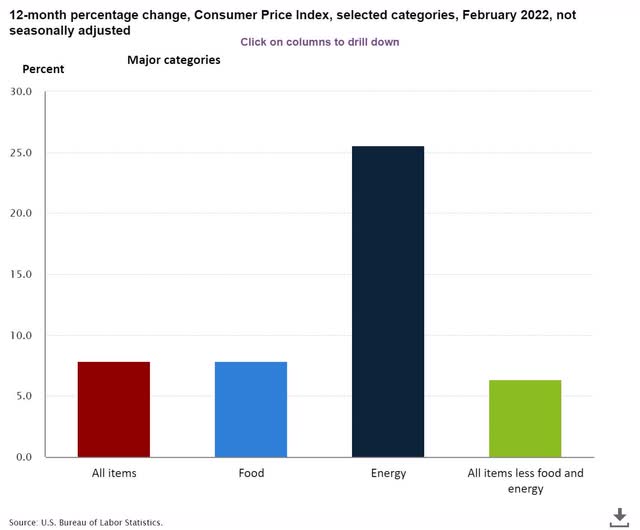

Investing in 2022 is not getting any simpler. With inflation constantly operating above 5% based on the patron worth index, many indexes such because the S&P 500 (SPY) at or close to report highs, and yields on funds and shares the bottom these payouts have been in a while, traders are having to work tougher than in earlier years.

Probably the most well-liked methods to speculate is thru alternate traded funds, or ETFs. Among the hottest alternate traded funds are dividend and income-based funds, one such fund is the Vanguard Dividend Appreciation Fund (NYSEARCA:VIG).

This fund has practically $64 billion below administration and seeks to match the efficiency of the Nasdaq US Dividend Achievers Choose Index. The fund focuses on large-cap corporations. The fund is well-diversified with 270 holdings, the biggest 5 holdings are Microsoft (MSFT), JPMorgan (JPM), Johnson & Johnson (JNJ), UnitedHealth Group (UNH), and Procter & Gamble (PG). The fund’s holdings are 17% financials, 16% industrials, 15% expertise, 15% shopper defensive, 15% well being care, 10% shopper cyclical, 5% fundamental supplies, 3% utilities, and a couple of% communications.

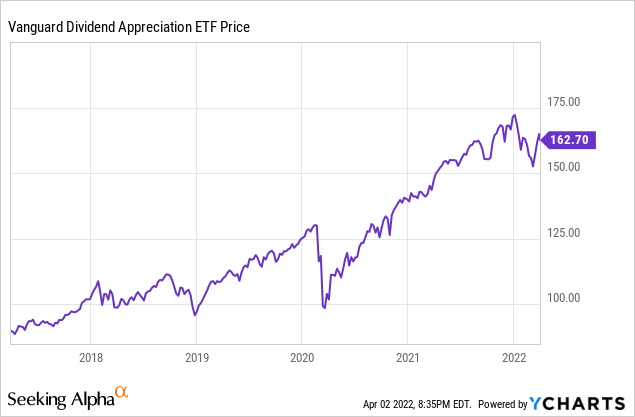

The fund has carried out fairly properly over the past 5 years in comparison with different dividend funds and the S&P 500, providing traders stable revenue and complete returns.

The common dividend progress charge of the fund over the past 10 years has been 9.26%, common dividend progress over the past 5 years has been 9%. The present yield is simply 1.75%, and the dividend is paid out quarterly. The fund’s expense ratio is nice at .06%

This fund has carried out fairly properly in comparison with different funds and benchmarks, although different dividend-based alternate traded funds such because the Schwab U.S. Dividend Fairness ETF (SCHD) have carried out higher, and this fund has additionally underperformed the S&P 500 as properly. The Schwab dividend fund has outperformed the Vanguard fund by 10% over the past 3 years. When you think about each revenue and complete returns, the Schwab fund is up 65% whereas the Vanguard fund is up 55%. This Vanguard fund has additionally underperformed different funds this yr which might be extra obese inflation, such because the WisdomTree U.S. Excessive Dividend Fund (DHS), and the Virtus Actual Asset Revenue ETF (VRAI). The WisdomTree fund presently yields 2.78%, and the Virtus Actual Asset Revenue fund, an actual property fund, presently yields 3.39%.

Investing is concerning the future, not the previous, and this Vanguard fund is more likely to underperform different alternate traded funds that supply extra safety such because the Vanguard Excessive Dividend Yield ETF (VYM), a fund that’s extra closely obese the monetary and vitality sectors. The Vanguard Excessive Dividend Yield fund has 22% of its holdings within the monetary sector and 13% in vitality and fundamental supplies.

Inflation has constantly been at 5% or larger for over a yr now as measured by the patron worth index. With wages rising, provide chain points persevering with, and geopolitical tensions excessive, excessive costs in lots of sectors are possible right here to remain.

Inflation Knowledge (US GOV)

Inflation has been operating over 5% for over a yr, and there’s no cause to assume inflation charges will drop considerably anytime quickly. Inflation has been at over 6% for a lot of this yr, and this fund has underperformed most main dividend funds this yr, returning unfavorable 4.9%.

The Vanguard Dividend Appreciation Fund is obese the monetary sector, an business clearly more likely to outperform in an inflationary atmosphere as charges rise, however this fund has no publicity to vitality shares, and really minimal publicity to commodities as an entire, since solely 5% of the fund’s holdings are in fundamental supplies. This fund does have favorable publicity to a weak greenback as a result of the fund is completely large-cap holdings, so there may be loads of worldwide leverage, however that is nonetheless an funding that’s more likely to considerably underperform different dividend funds extra obese vitality and fundamental materials shares. This fund will not be more likely to carry out properly in an inflationary atmosphere such because the one we’re in, and the Vanguard fund has additionally been risky for an funding automobile closely obese defensive sectors resembling well being care and shopper defensives, with a beta of .88.

With charges nonetheless low and more likely to stay low for a while, many traders are being pressured to be extra artistic to get the identical returns these people have gotten in earlier years as indexes and funds hit report highs. Despite the fact that this Vanguard fund has carried out properly over the past 5 years, traders looking for steady revenue and stable returns in an inflationary atmosphere usually tend to be higher positioned to get inflation-adjusted returns by selecting funding funds which might be extra closely obese commodities and fundamental supplies than this funding automobile. Funds such because the WisdomTree U.S. Excessive Dividend Fund supply higher present yields and are higher positioned to supply inflation-adjusted returns within the present financial and investing atmosphere.