RudyBalasko

VICI Properties (NYSE:VICI) has something, not too many other REITs have – a wide moat. Its current portfolio of assets is of such high quality, even if VICI stopped expanding and just kept on holding to existing assets it would probably be able to provide investors with a decent return.

The resiliency of the gaming industry and the shining lights of Las Vegas aren’t showing any sign of fading away, and VICI’s future appears just as strong.

After another quarter with 100% occupancy rates, 100% rent collection, and an 11.9% increase in AFFO, I reiterate VICI as a must-have in a dividend investor’s portfolio.

Background

At the beginning of July, I wrote an article about VICI, claiming ‘Not Many REITs Have Such A Wide Moat’. I urge you to read that article, where I delved into the company’s business model, competitive advantages, and amazing management, as well as analyzed its growth model.

I found that the Ed Pitoniak-led REIT owns non-commoditized, iconic assets like Caesars Palace, The Venetian, The Mirage, Mandalay Bay, and MGM Grand. These are assets that are not only extremely difficult to build, they are located in the most attractive locations in the world, and most of them are right on the Vegas Strip.

While I do understand that other REITs might provide a higher upside than VICI at opportune times, I believe that not too many REITs can provide investors with such a steady and reliable cash stream, and 99% of the credit should go to VICI’s unique portfolio.

H1-23 Financial Review

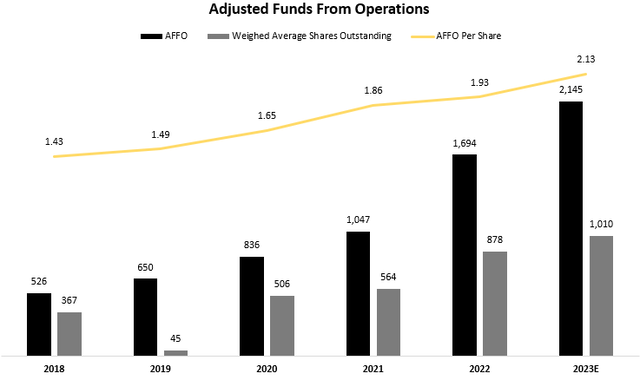

Created and calculated by the author using data from VICI financial reports and presentations.

Although shareholders were again diluted in Q2, AFFO per share continued to increase at a double-digit pace, reaching $0.54 in the quarter. The company upgraded its guidance to 10.1% AFFO per share growth for the full year, up from 9.6%, reflecting additional accretive rent.

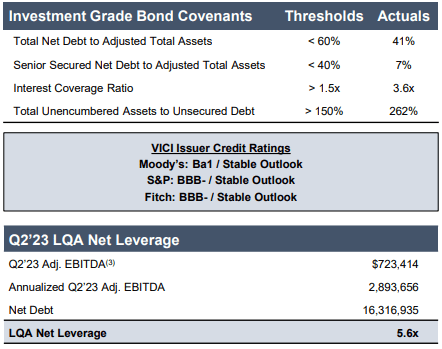

VICI 2Q’23 Financial Supplement

VICI’s balance sheet remained strong, and far above the company’s covenant thresholds, with 41% debt to total assets and a 3.6x interest coverage ratio.

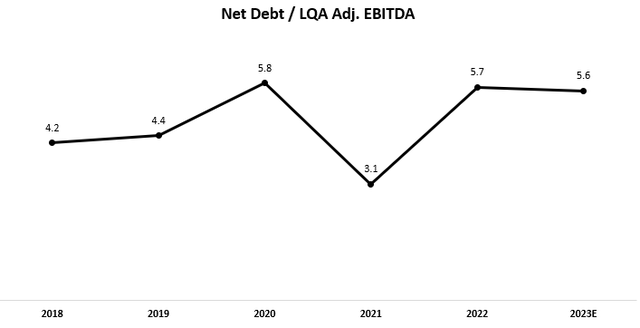

Created and calculated by the author using data from VICI financial reports and presentations.

Another important metric to look at is Net Debt / LQA Adj. EBITDA, which is defined as Total Debt less Cash, Cash Equivalents & Short-Term Investments divided by the last quarter’s annualized Adjusted EBITDA.

As we can see, the leverage ratio is at the high end of VICI’s range since its IPO, but that is due to a temporary debt spike as a result of the MGM Properties acquisition. I expect that VICI will return to the mid-range shortly, and we’re already seeing a slight decrease.

Growth Prospects Update

For a company that owns so many assets in the world’s most attractive locations, it could be argued that VICI has limited room for additional high-quality growth. However, I find VICI’s growth prospects extremely attractive.

VICI categorizes its growth avenues under six pillars. Let’s see what’s new.

VICI Properties 2023 Investor Presentation

First, the Embedded Growth Pipeline, this pillar refers to contracted put or call options VICI possesses to increase or reduce its stake in different assets. As of Q2-23, this pipeline includes the right to call Harrah’s Hoosier Park, Horseshoe Indianapolis, and Caesars Forum Convention Center at a 13.0x multiple (7.7% cap rate); Rights of first refusals regarding Horseshoe Casino Baltimore, 2 assets near the Vegas Strip, and a land in Virginia; The right to call the real estate assets associated with any BigShots Golf facility; The right to call the real estate assets of Canyon Ranch Austin; and other not as material options. Definitely not a short list.

Just yesterday, VICI and Canyon Ranch closed a preferred equity investment deal, valued at up to $150M.

Second, in Gaming Opportunities (Geographic Expansion), VICI announced the acquisition of Rocky Gap Casino Resort just two days before writing this article. The deal is priced at $203.9M and was valued based on a 7.6% cap rate. In addition, VICI acquired four Canadian casinos from Century Casinos, for an aggregate price of approximately $164.7N, based on a 7.8% cap rate.

Valuation

Based on management’s guidance, VICI currently trades at a forward P/AFFO of 15.4x, which is above Gaming and Leisure Properties (GLPI), in line with other considerably high-quality REITs like Realty Income (O), and below Iron Mountain (IRM). Before 2022, a year in which VICI significantly outperformed the market, it traded at 15.6x.

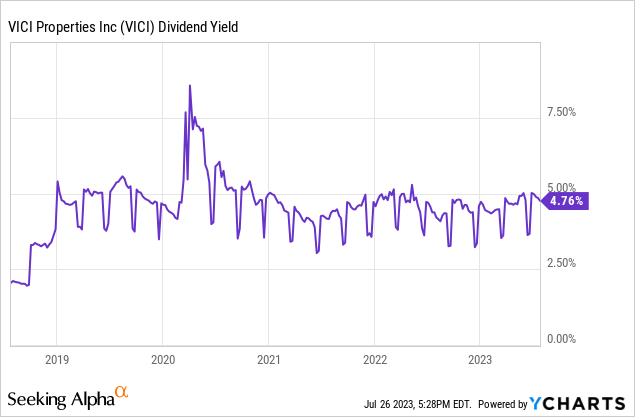

Looking at VICI’s yield, it’s clear that right around the 5.0% threshold is where it usually trades. Thus, I find VICI to be at the higher end of its valuation range.

Conclusion

Not many REITs have a moat as wide as VICI’s. With the strength of its portfolio, even if we assume no multiple expansion, no renegotiated rent agreements, and no new acquisitions, VICI should provide at least a 7% annual return through a combination of dividends and legally-binding rent increases.

And as VICI deleverages, I certainly expect a multiple expansion as well. I view VICI as an attractive investment as long as it trades in the 14-16 P/FFO range. Thus, I reiterate a Buy.