halbergman

Introduction

VICI Properties (NYSE:VICI) is a REIT that has dissatisfied many readers and traders right here on Searching for Alpha. For the higher a part of two years the share worth has spent an excessive amount of time in a variety of $27 – $29.

Nonetheless, there have been quite a few purchase articles praising the inventory, and for my part, for good purpose. The REIT owns iconic properties and is basically sound whereas providing an excellent dividend yield at present.

And regardless of the current share worth appreciation on account of anticipated decrease rates of interest in September, VICI stays among the best REITs your cash can at present purchase.

On this article I talk about the corporate’s current quarterly earnings, fundamentals, and why revenue traders are nonetheless getting this inventory at an excellent worth.

Earlier Purchase Score

VICI Properties has lengthy been certainly one of my favourite REITs and I’ve printed a number of articles overlaying them, with the newest again in Could.

I perceive traders frustration with VICI, and that is why I titled it: Upside Could Require Persistence, However Acquire A 6% Yield Whereas You Wait. Since, the inventory is up over 8.73% and delivered a complete return of double-digits compared to the S&P who’s up practically 4%.

Searching for Alpha

I mentioned the REIT’s Q1 earnings that noticed income, FFO, and AFFO all ship strong development from the prior yr. Income and FFO each grew double-digits, up 10.3% and 13.41% respectively whereas AFFO additionally delivered strong development, up 8.4%.

So, regardless of their lagging share worth efficiency, VICI confirmed why they’re among the best REITs your cash should purchase. Moreover, even with the current share worth appreciation, I feel VICI continues to be an excellent cut price for long-term traders.

I mentioned the current mortgage the REIT offered to certainly one of their tenants, The Venetian, to conduct intensive upgrades to their property. I additionally touched on their dividend that was well-covered with a payout ratio of 74%.

Newest Quarter

VICI lately reported their Q2 earnings and delivered one other sturdy quarter with FFO of $0.71 and income of $957 million. In addition they managed to beat analysts’ estimates on each its prime & backside traces with estimates of $953.7 million and FFO of $0.66.

This was a a lot better report than anticipated as VICI was anticipated to disappoint on earnings as a consequence of capital commitments and pressures from the macro surroundings.

As an alternative, VICI did the other and delivered one other sturdy quarter which they’ve been doing for the higher a part of six years since their IPO.

Some name the inventory overhyped, an beneath performer, and many others. However for my part, shopping for a inventory at an inexpensive worth that continuously delivers strong earnings, and pays you a dividend that is well-covered is a no brainer for my part.

When you have a short-term funding horizon, then VICI might not be the inventory for you. Nonetheless, if in case you have a long-term funding horizon, then try to be rejoicing for the possibility to purchase at present ranges.

Within the chart beneath, you possibly can see the expansion VICI noticed year-over-year. That is why I discussed how they’re some of the basically sound REITs immediately. Income grew 6.55% whereas FFO & AFFO grew 7.33% and 9.63% respectively. Adjusted EBITDA additionally grew impressively by 7.26% over the identical interval.

Q1’24 | Q1’23 | |

Income | $957M | $898.2M |

FFO | $741.3M | $690.7M |

AFFO | $592.4M | $540.4M |

Adjusted EBITDA | $775.9M | $723.4M |

VICI additionally dedicated capital to their companions. Within the second quarter they offered $950 million to The Venetian and some of their Nice Wolf Lodge Resorts.

As beforehand talked about, VICI offered a $750 million mezzanine mortgage to The Venetian through the first quarter. Some traders noticed this as very Medical Properties Belief (MPW) like, offering capital to their struggling tenants.

And will view this as monetary hassle from VICI’s tenants on account of the excessive rate of interest surroundings. Nonetheless, VICI offered capital because of the reputation of The Sphere (SPHR), which continues to attract in guests from everywhere in the world.

And The Venetian is making the most of this by conducting intensive upgrades to its property. These investments are anticipated to be accretive and generate a blended yield of seven.9%.

In Could, worldwide visitation elevated by double-digits year-over-year to 23%. And on account of the recognition of the town, officers are anticipating including a second airport as famous by VICI’s CFO throughout Q2 earnings. So, it is secure to say Las Vegas will proceed to develop and profit from an rising inhabitants and tourism for the foreseeable future.

Raised Steering

On account of VICI’s sturdy efficiency and development, this allowed administration to boost steerage for 2024. They now anticipate AFFO in a variety of $2.24 – $2.26, up from $2.22 – $2.25 prior.

This represents a development fee of 4.7% from the prior yr. I additionally would not be shocked if the REIT raised steerage within the again half of the yr because the macro environmental image turns extra favorable with rates of interest anticipated to say no in September with a attainable second minimize in December.

Robust Liquidity Positions VICI For Progress

VICI has additionally been bolstering its liquidity this yr. In Q1, the REIT bought shares and entered into swap agreements for its debt that was due this previous Could. This allowed them to defer till 2025, positioning them to capitalize on development alternatives. VICI bought 4 million shares for internet proceeds of $115 million.

In addition they had a complete of $3.2 billion in liquidity and $347 million in money & money equivalents. In addition they have an accordion choice permitting them to request a further $1 billion in capital and had a internet debt to EBITDA of 5.4x, inside their goal vary of 5x – 5.5x.

That is compared to experiential REIT, EPR Properties’ (EPR) 5.2x and Gaming And Leisure Properties’ (GLPI) 4.5x. Administration can also be targeted on decreasing this within the coming quarters. VICI’s whole debt stood at $17.1 billion with roughly $2 billion in debt due in 2025. 99% of this was additionally fixed-rate with a weighted-average rate of interest of 4.36%.

Dividend

With AFFO of $0.57 this offers VICI a well-covered dividend with a payout ratio of 72.8%. Their FFO payout ratio is far decrease at 58.4%. For comparability functions, Gaming And Leisure Properties’ FFO payout ratio was 80.8% throughout their newest quarter.

Moreover, traders can anticipate a dividend improve this upcoming October if historical past repeats itself. I anticipate a dividend improve within the vary of $0.43 – $0.435. Analysts’ anticipate a 3.6% improve to $0.43, giving VICI an annual dividend of $1.69.

Utilizing their midpoint of steerage, this offers VICI a conservative payout ratio proper at administration’s goal vary of 75%. Their dividend yield can also be nonetheless engaging regardless of their current share worth appreciation sitting at 5.2%.

Valuation

On the time of writing VICI has a ahead P/AFFO a number of of 14x. Though their share worth has appreciated over the previous month, that is nonetheless barely beneath the sector common of 14.91x.

That is additionally 6.25% beneath my worth goal of $34 that I had for the REIT again in Could. Though I feel the primary fee minimize is priced in already, if we get a December minimize like some anticipate, I feel VICI’s share worth will see $33 – $35, or probably increased by the top of the yr.

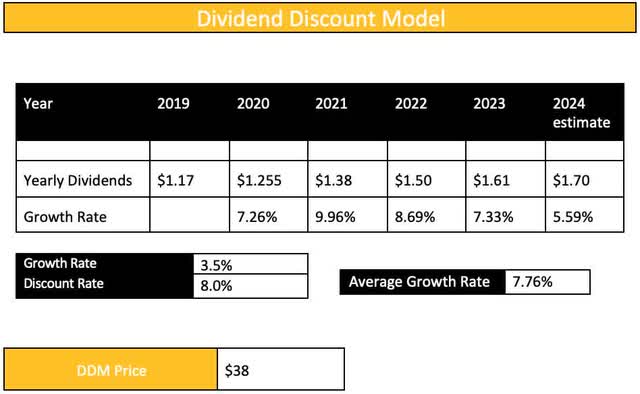

That is in-line with Wall Avenue’s worth goal of $35.12. Utilizing the Dividend Low cost Mannequin I’ve a worth goal of $38, barely beneath their common worth goal of $39. Regardless of the current share worth appreciation this nonetheless provides traders double-digit upside of practically 19%.

Creator DDM

Dangers & Conclusion

Rates of interest are anticipated to say no this yr, particularly after the current FED assembly. Nonetheless, unemployment has been rising, lately climbing to 4.3%. This was increased than the 4.1% anticipated, signaling that the economic system is starting to sluggish.

Furthermore, if we fall right into a recession, Las Vegas will doubtless see a decelerate, thus lowering foot visitors. This might additionally trigger a slowdown at their different properties like Canyon Ranch.

This might additionally negatively affect VICI’s prime two tenants Caesar’s Leisure (CZR) & MGM Resorts (MGM), who make up 39% and 35% of VICI’s annualized base lease.

Though I think each tenants could be wonderful together with VICI if we did see a recession, that is nonetheless a danger to think about when investing. However with rates of interest more likely to decline quickly, I feel VICI Properties will proceed to carry out exceptionally, probably elevating steerage within the again half of the yr.

Their sturdy development year-over-year additional solidifies why they’re among the best REITs your cash should purchase at present. At a ahead P/AFFO a number of nonetheless beneath the sector common, VICI’s share worth hasn’t appeared to have caught as much as their fundamentals.

And, if you happen to’re a long-term investor, VICI continues to be buying and selling at a very good worth even after the current rally within the sector, with the potential for double-digit upside. On account of this and their well-covered and rising dividend, I proceed to fee VICI Properties a purchase.