Tippapatt

The healthcare business is a crucial a part of the financial system, and one which has constantly demonstrated each progress and resilience within the face of broad financial downturns. Now, many elements seem to profit persevering with progress inside healthcare, together with developments in medical expertise and the ageing of child boomers. Additional, many younger people look like requiring take care of critical points, together with most cancers and coronary heart illness, which creates additional demand. For these causes, long-term investing inside healthcare seems smart, and the Vanguard Well being Care Index Fund ETF (NYSEARCA:VHT), is a extremely affordable methodology of gaining broad publicity to healthcare suppliers and insurers.

VHT tracks the MSCI US Investable Market Well being Care 25/50 Index, and gives a diversified portfolio of healthcare corporations. VHT invests in healthcare sectors that embrace prescribed drugs, biotechnology, healthcare providers, and medical gadgets. VHT additionally has an inexpensive 0.10% expense ratio, making it one of many inexpensive healthcare ETFs inside the market.

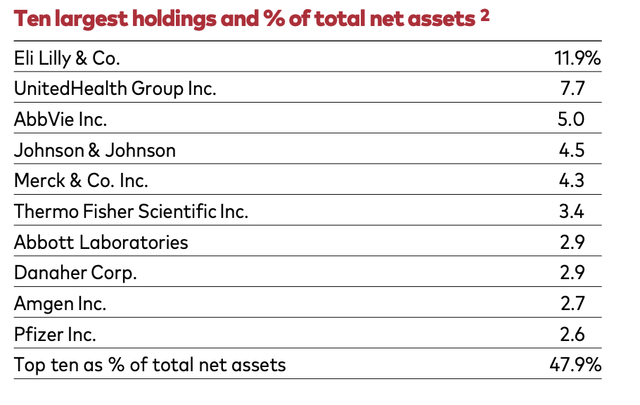

With roughly 423 holdings, VHT is very diversified inside the healthcare, however it’s a little top-heavy. VHT is market weighted, and the extra vital market capitalizations of its largest constituents make them dominate the index and ETF. Because of this, the highest ten holdings make up almost half of the ETF, and Eli Lilly (LLY) is now roughly 12% of VHT, and UnitedHealth Group (UNH) is sort of eight p.c. Roughly 73% of VHT consists of enormous cap shares, whereas the rest is made from small and medium-sized corporations.

VHT prime ten holdings (Vanguard’s VHT Reality Sheet)

A major a part of why its largest constituents are so dominant inside the index is because of their market share and inventory outperformance, and these elements could proceed. Because of this, VHT permits buyers to allocate into these giant gamers who’ve carried out so properly prior to now, and which can proceed to outperform into the longer term, whereas concurrently diversifying into equities which may be lagging and presently undervalued, and which can hedge threat related to market reversals.

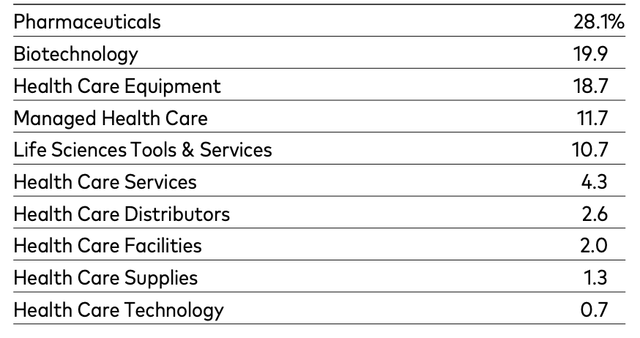

One other optimistic attribute of VHT is that with its sizable holdings comes broad publicity to biotechnology, together with potential future market darlings and acquisition targets. These increased threat investments are balanced out by the ETF’s extra vital publicity to giant cap Pharma, in addition to the insurance coverage and instruments & providers subindustries that are likely to commerce at decrease valuations.

VHT’s subindustry weighting (Vanguard’s VHT truth sheet)

VHT has carried out exceptionally properly during the last a number of weeks, and not too long ago broke out of its buying and selling vary. Shares had been rising in a reasonably slim channel since earlier this 12 months, with the occasional take a look at of each help and resistance. VHT seemed to be testing provide on almost a month-to-month foundation, and final did so across the begin of August when market volatility spiked. After that take a look at of help, VHT carried out exceedingly properly, making a clear break by means of upward resistance, which was at round $280. Since then, it has solely continued to understand, in what seems to be a clear breakout which will have room to run additional up the charts.

VHT day by day candlestick chart (Finviz.com)

This obvious breakout doesn’t merely take VHT by means of latest resistance, however truly out of a longer-term buying and selling vary the place the ETF has remained caught since 2022. This can be construed as a long run basing interval that would now be adopted by an prolonged breakout and appreciation.

VHT weekly candlestick chart (Finviz.com with crimson strains by Zvi Bar)

It’s usually the case that healthcare shares expertise a interval of weak point prematurely of presidential elections, because the business is a frequent scapegoat because of its ever rising prices. Whereas it could find yourself occurring this cycle too, it presently seems that the market is much less involved with such dangers to healthcare than is commonly the case. This can be because of the latest change in nomination, and the chance that neither candidate seems to current a higher future menace than the present administration.

Nonetheless, it’s totally potential that this circumstance will change between now and November. If that happens, one may think that VHT may retest prior resistance at $280 and hopefully affirm it as help. Given present momentum and market expectations, it seems totally potential that no such retest will happen within the close to time period, and that the extra probably prevalence is sustained appreciation.

One robust motive why VHT and healthcare normally could carry out properly within the coming weeks, months, and quarters is because of the forthcoming charge minimize cycle. By lowering the risk-free charge of return obtainable by means of short-term Treasuries, equities which have a properly coated dividend are more likely to change into extra beneficial. That is particularly the case for corporations which have the potential to extend their payouts sooner or later, which is a function lots of the bigger Pharma and insurance coverage corporations seem to have.

Dangers

The healthcare sector is commonly risky and influenced by elements comparable to regulatory adjustments, medical trial outcomes, and exterior financial situations that complicate the capability to pay for care. Given we’re presently dashing in direction of a nationwide election, it’s totally potential and fairly probably that both giant cap Pharma or healthcare insurers may bear elevated political focusing on.

It is a frequent concern, and subsequently one which may be priced into nearly all of equities, however such isn’t any certainty. Due to this fact, there’s the chance that healthcare may change into extra risky through the quarter and as we method the election. Equally, the big entities on this business may bear higher political scrutiny after the election, and be focused because of their pricing and/or profitability.

One other potential concern is that of innovation, which may render present worthwhile companies out of date. For instance, the latest success of GLP-1 drugs may curtail anticipated progress available in the market for diabetes medication and gadgets like steady glucose screens. To the extent such happens, the success of 1 index constituent may come on the expense of one other, and probably end in a zero-sum sport.

Conclusion

The healthcare business seems to be breaking out of a multi-year base because of the power of its market leaders, in addition to the chance of high-quality dividend payers being valued increased. Due to this, VHT has carried out exceedingly properly not too long ago, and that development seems more likely to proceed within the close to time period. This development could acquire momentum because the Federal Reserve initiates the forthcoming charge minimize cycle, and in addition speed up after the election.